Unemployment Tax Calculator Kansas

We make no promises that the sum you receive will be equal to what the calculator illustrates. ER pays these taxes.

Are Employers Responsible For Paying Unemployment Taxes

Are Employers Responsible For Paying Unemployment Taxes

Pandemic Unemployment Assistance PUA is a broad program that expands access to unemployment in addition to what state and federal law already pay.

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Unemployment tax calculator kansas. Independent Contractors Gig workers such as Uber and Lyft drivers. State Income Tax Range. Enter your employer account number 6 digit unemployment tax serial number.

Less than 45 percent up to 16 weeks available. Yes the Tax Reform Act of 1986 mandated that all unemployment insurance benefits are taxable. You will be taken through the steps to create a new unemployment tax account.

Kansas City 913 596-3500 Topeka 785 575-1460 Wichita 316 383-9947 Toll-Free 800 292-6333. The number to call is. Kansas State Employee Withholding Tax.

State Taxes on Unemployment Benefits. Business owners their accountants or a third-party administrator such as a payroll service may establish an unemployment tax account for an employer. This Kansas State Tax Calculator allows you to estimate the Withholding and Employer Unemployment tax for employee and employer taxes.

Kansas allows itemized deductions but only for taxpayers who claim itemized deductions on their federal tax returnOtherwise taxpayers can claim the Kansas standard deduction which is 3000 for single filers 7500 for joint filers 3750 for married persons filing separately and 5500 for. CST Monday through Friday. Unemployment benefits are considered regular income for tax purposes and so are subject to both federal and state income taxes.

Then select File a KCNS 010 Status Report to register your business for Unemployment Tax on the next page. Kansas taxes unemployment benefits. The good news is that up to 10200 of those benefits received in 2020 are tax-free thanks to the American Rescue Plan Act of 2021.

27 rows If youre single married and filing separately or a head of a household you will be taxed at 310. The most recent figures for Kansas show an unemployment rate of 47. You will need to complete your federal income tax return prior to completing your Kansas.

This was done to protect your personal information. This option is through a 1-800 number where you can make payments for any state of Kansas tax including your unemployment tax. KDOL Social Media Policy.

Additionally taxes on small business income have been reinstated after being eliminated in 2012. Unemployment Contact Center Kansas City 913 596-3500 Topeka 785 575-1460 Wichita 316 383-9947 Toll-Free 800 292-6333. What is the Average Kansas Rate.

The seasonally adjusted three-month average unemployment rate in Kansas at the time your claim is effective. That amount known as the taxable wage base was stable in Kansas for many years at 8000. Kansas Unemployment Taxes Employer ER pays State Unemployment Taxes SUTA.

Are my unemployment benefits taxable. This includes those who traditionally are not able to get unemployment such as. This calculator uses the average weekly state benefit amount reported by the Department of Labor from January 2020 to November 2020 to calculate total unemployment compensation and.

EE pays these taxes. Kansas income tax conforms to many provisions of the Internal Revenue Service. UI tax is paid on each employees wages up to a maximum annual amount.

For security reasons your connection to our system has been closed. Kansas residents and nonresidents of Kansas earning income from Kansas sources are required to annually file an income tax return K-40. That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns.

31 on taxable income from 2501 to 15000 for single filers and from 5001 to 30000. The amount continues to be. Today the Kansas Department of Labor KDOL announced that the agency launched an Employer Help Desk to assist businesses with a variety of labor-related issues.

Divide your total benefit amount by your weekly benefit amount to calculate the approximate number of weeks of unemployment benefits available to you. Kansas Employer Unemployment Tax. However in recent years it has increased first to 12000 and then to 14000.

To reach the KDOL Employer Help Desk call 888-396-3725. Dedicated operators will be available to assist employers during the hours of 8 am. Select option 2 pay state taxes Enter jurisdiction code 2611 followed by Select option 1 for unemployment tax.

This calculator is here to assist you in evaluating what you might obtain if you are entitled to receive benefits.

Employer Tax Rates Employers Kdol

Employer Tax Rates Employers Kdol

Kansas City Housing Market Statistics January 2017 Continental Title Company Housing Market Marketing Marketing Stats

Kansas City Housing Market Statistics January 2017 Continental Title Company Housing Market Marketing Marketing Stats

Futa Federal Unemployment Tax Act San Francisco California

Futa Federal Unemployment Tax Act San Francisco California

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

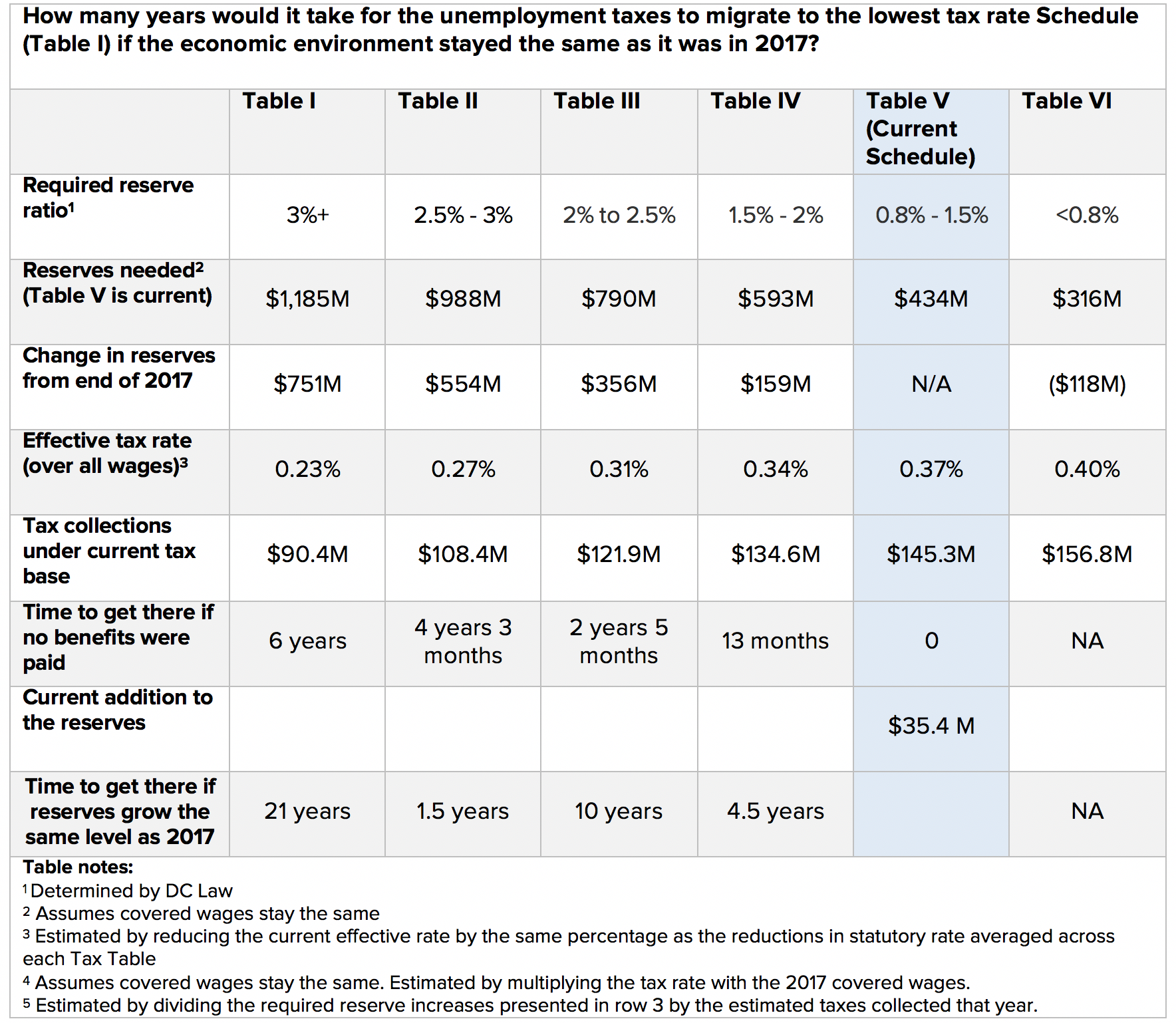

Rethinking The District S Unemployment Taxes D C Policy Center

Rethinking The District S Unemployment Taxes D C Policy Center

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

How High Are Your 2021 Unemployment Taxes

How High Are Your 2021 Unemployment Taxes

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Ranking Corporate Income Taxes On The 2020 State Business Tax Climate Index The Online Tax Guy Business Tax Income Tax Tax

Ranking Corporate Income Taxes On The 2020 State Business Tax Climate Index The Online Tax Guy Business Tax Income Tax Tax

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Citylab Bloomberg Geography Federal Income Tax Economy

Citylab Bloomberg Geography Federal Income Tax Economy

Uk City Bonuses Were Delayed To Get The Benefit Of The Lower Tax Rate Low Taxes Tax Bonus

Uk City Bonuses Were Delayed To Get The Benefit Of The Lower Tax Rate Low Taxes Tax Bonus

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

Post a Comment for "Unemployment Tax Calculator Kansas"