Unemployment Tax Break Kentucky

You can take the tax break if you have an adjusted gross income of less than 150000. This will reduce your FUTA contribution rate to 060 600 - 540.

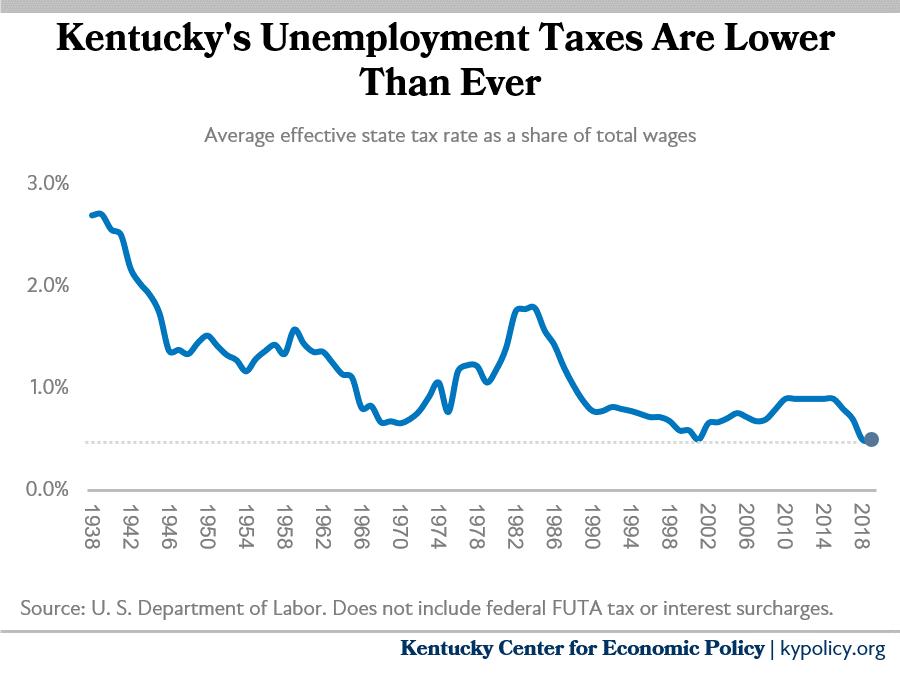

Kentucky S Inadequate And Outdated Unemployment Insurance Taxes Need To Be Modernized Kentucky Center For Economic Policy

Kentucky S Inadequate And Outdated Unemployment Insurance Taxes Need To Be Modernized Kentucky Center For Economic Policy

Its great that Americans wont have to pay taxes on 10200 of unemployment income.

Unemployment tax break kentucky. That tax break will put a lot of extra cash into peoples bank accounts. Will the Kentucky Division of Unemployment Insurance be able to generate and issue revised 2021 tax rate notices for all employer prior to the first quarter 2021 filing and payment deadline of April 30 2021. You will be taxed at the regular rate for any federal unemployment benefits above 10200.

Its also important to keep in mind that not everyone will get a federal tax break on 10200 in unemployment income. The 19 trillion Covid relief measure limits that break to individuals and couples whose. Not all states have extended the same 10200 unemployment tax break as the federal government which means that some residents may face higher state taxes than they were expecting.

Additionally HB 413 will decrease the 2021 unemployment taxable wage base from 11100 to 10800. Colorado Georgia Hawaii Idaho Kentucky Massachusetts Minnesota Mississippi North Carolina New York Rhode Island South Carolina and West Virginia. The state has not adopted the federal exemption for up to 10200 of unemployment compensation.

State Taxes on Unemployment Benefits. What the American Rescue Plan does is exempt the first 10200 of federal unemployment benefits from your taxable income. The latest stimulus includes a federal tax exemption for up to 10200 in unemployment benefits received in 2020.

The IRS will start with taxpayers who had up to 10200 in exempt unemployment income first then look to. A provision in the 19 trillion American Rescue Plan could save jobless Americans between 1000 and. Heres how the 10200 unemployment tax break in bidens covid relief plan works About 40 million people collected jobless aid last year according to.

You will be taxed at the regular rate for any federal unemployment benefits above 10200. Is your state saying no to the 10200 unemployment tax breakBetween March and April 2020 unemployment soared to 148. You can take the tax break if you have an adjusted gross income of less than 150000.

Some of those states may still decide to adopt the tax break before the May 17 tax filing deadline. Kentucky employers are eligible to claim the full FUTA credit of 540 when filing your 2020 IRS 940 forms in January 2021. Americans who received jobless benefits last year can expect a tax break thanks to the new 19 trillion coronavirus relief package which waives federal taxes on up to 10200 of jobless.

You will be taxed at the regular rate for any federal unemployment benefits above 10200. 2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break. The FUTA taxable wage base remains at 7000 per worker.

The American Rescue Plan waived federal tax on up to 10200 of jobless aid per person collected in 2020. That provision only applies to tax-filers whose income. These will start going out in May and continue into the summer.

You might want to do more than just wait Last Updated. The IRS announced it will automatically issue refunds for the unemployment tax break. Hundreds of unemployed Kentucky residents in June waiting for help with unemployment claims.

Unemployment benefits are generally treated as income for tax purposes. Heres how to claim it even if youve already filed your 2020 tax return. You can take the tax break if you have an adjusted gross.

Unemployment compensation is fully taxable in Kentucky. The 13 states that are still taxing federal unemployment benefits are. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits.

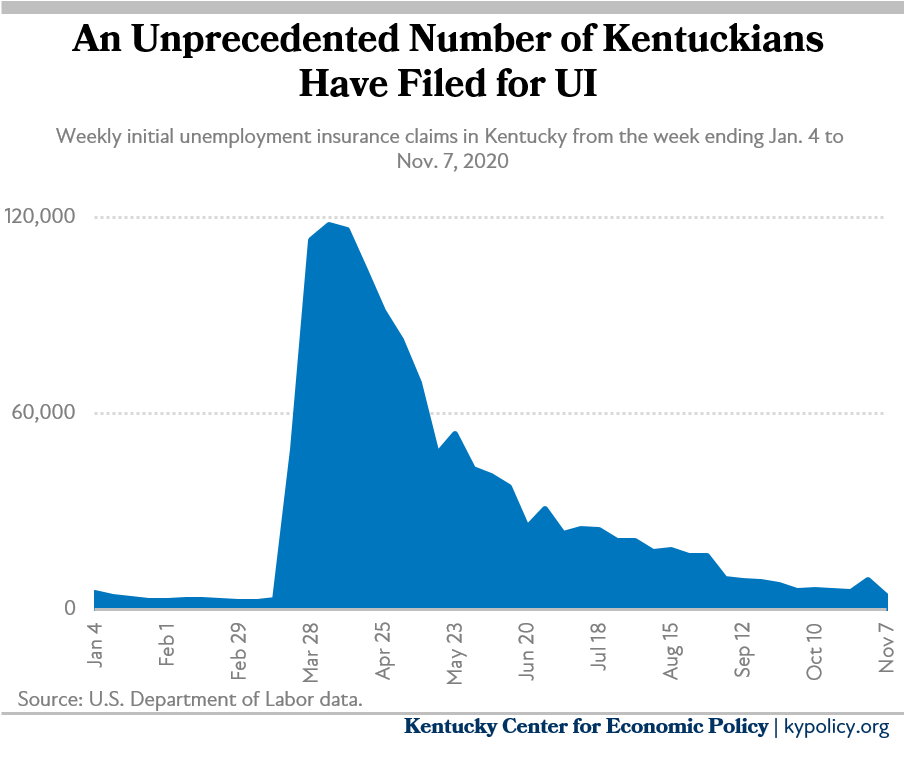

Covid 19 Crisis Demonstrates Need For State Improvements To Unemployment Insurance In Kentucky Kentucky Center For Economic Policy

Covid 19 Crisis Demonstrates Need For State Improvements To Unemployment Insurance In Kentucky Kentucky Center For Economic Policy

What Is Local Income Tax Income Tax Income Tax

What Is Local Income Tax Income Tax Income Tax

Tax Break For At Home Workers Is An Extraordinarily Expensive Windfall Kentucky Center For Economic Policy

Tax Break For At Home Workers Is An Extraordinarily Expensive Windfall Kentucky Center For Economic Policy

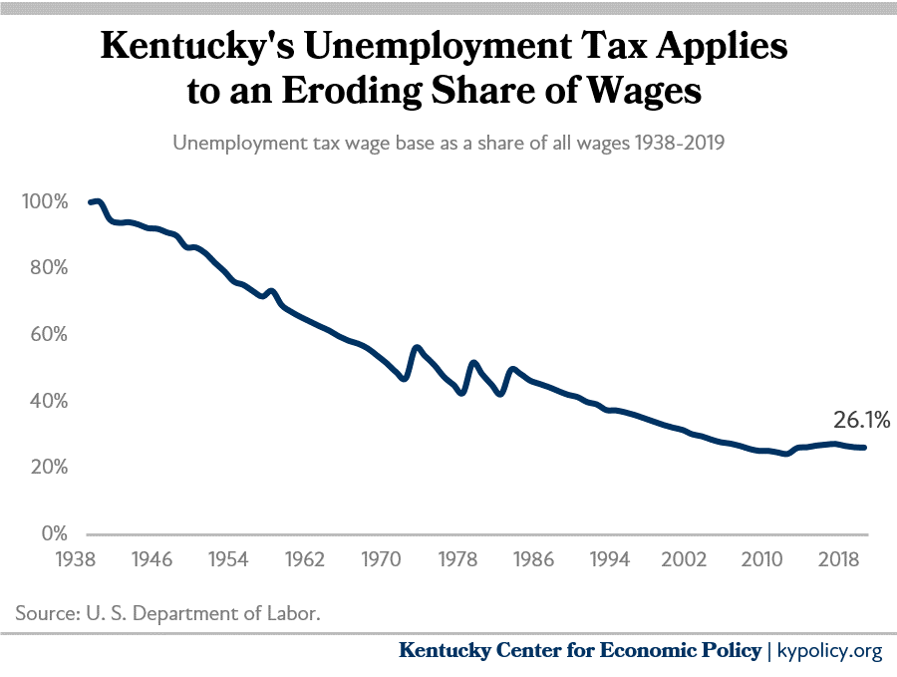

Hb 413 Provides Poorly Targeted Tax Break That Will Add Costs Later And Stress Unemployment System Kentucky Center For Economic Policy

Hb 413 Provides Poorly Targeted Tax Break That Will Add Costs Later And Stress Unemployment System Kentucky Center For Economic Policy

Kentucky State Income Tax Kentucky Retirement Systems

Kentucky State Income Tax Kentucky Retirement Systems

Covid 19 Federal And State Updates Northern Kentucky Chamber Of Commerce

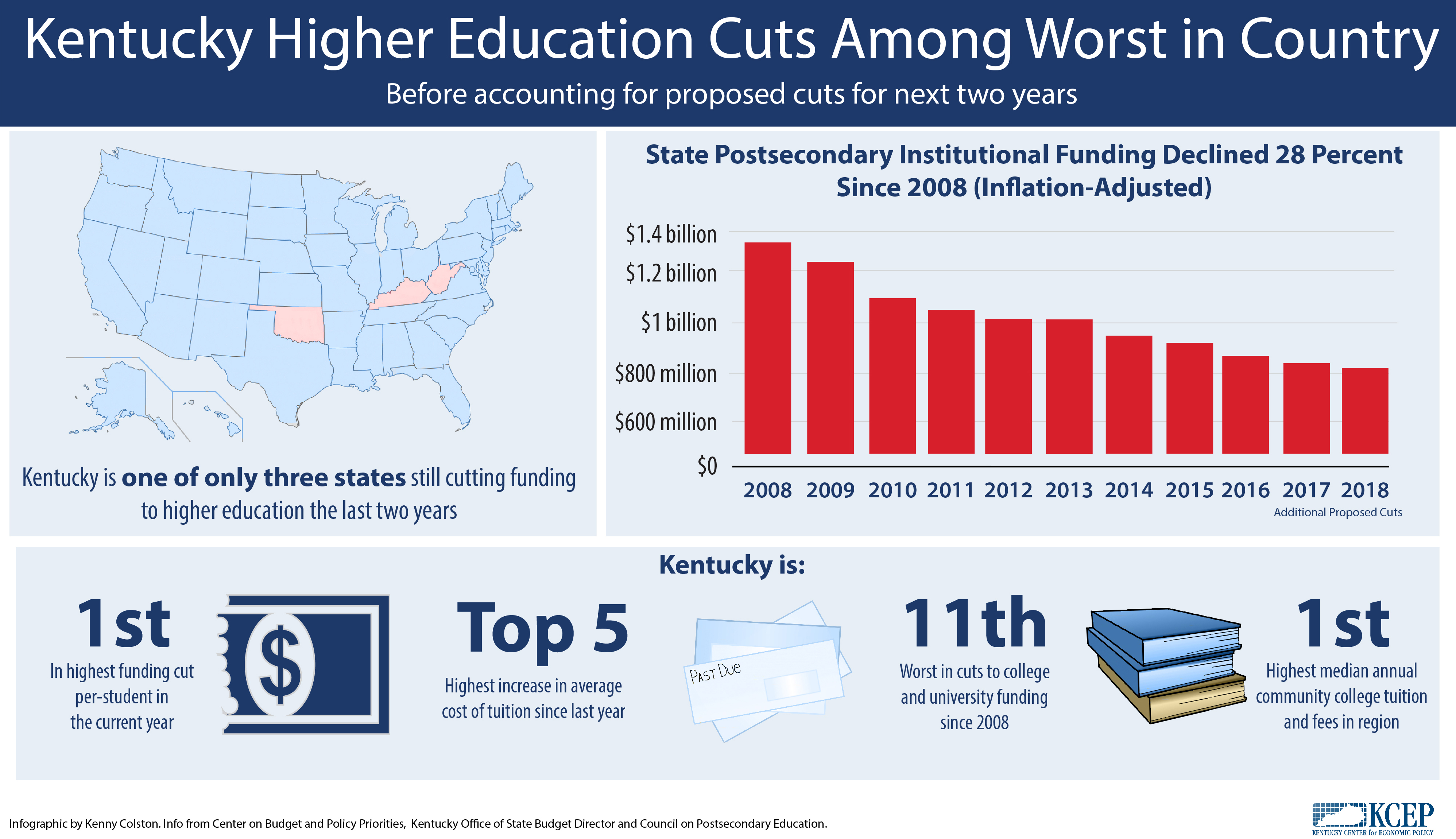

Infographic Kentucky Higher Education Cuts Among Worst In Country Kentucky Center For Economic Policy

Infographic Kentucky Higher Education Cuts Among Worst In Country Kentucky Center For Economic Policy

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

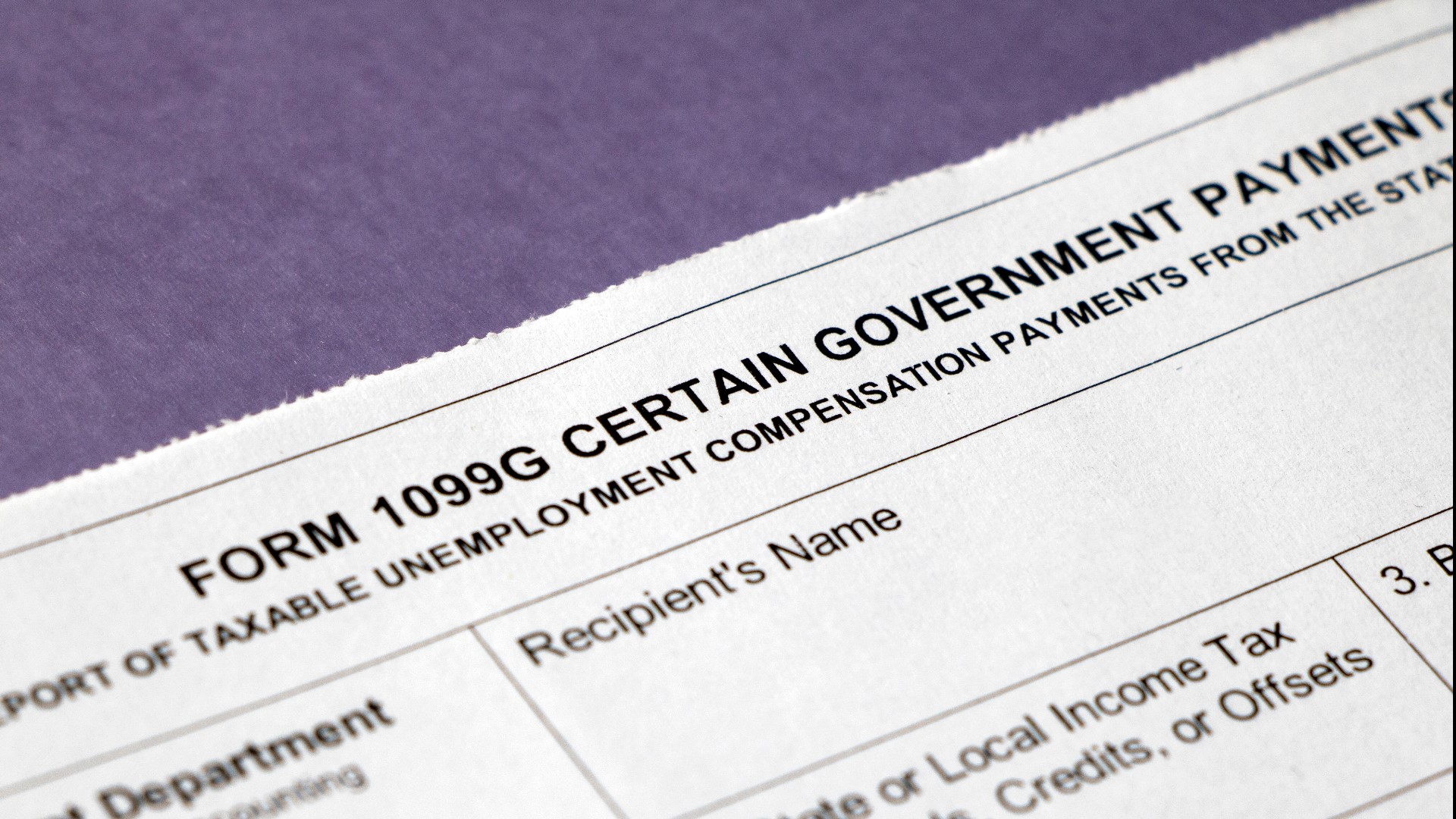

1099 G Tax Form Causing Confusion For Some In Kentucky Wbir Com

1099 G Tax Form Causing Confusion For Some In Kentucky Wbir Com

Beshear Orders Individual Tax Deadline Extended In Kentucky

Beshear Orders Individual Tax Deadline Extended In Kentucky

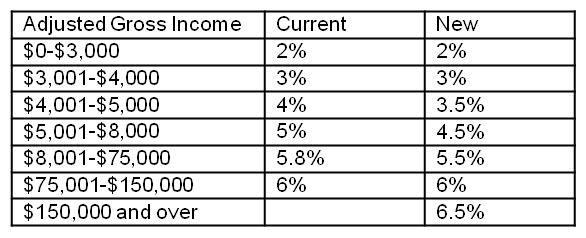

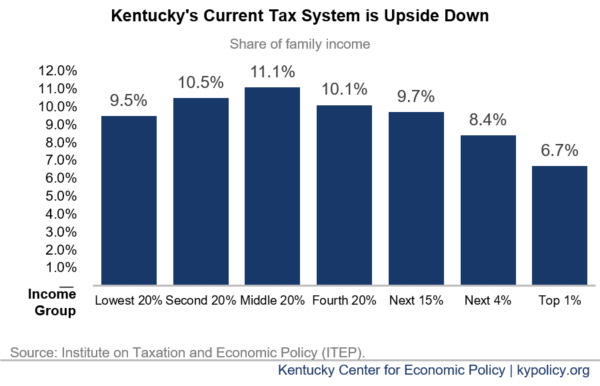

What Good Tax Reform Looks Like Kentucky Center For Economic Policy

What Good Tax Reform Looks Like Kentucky Center For Economic Policy

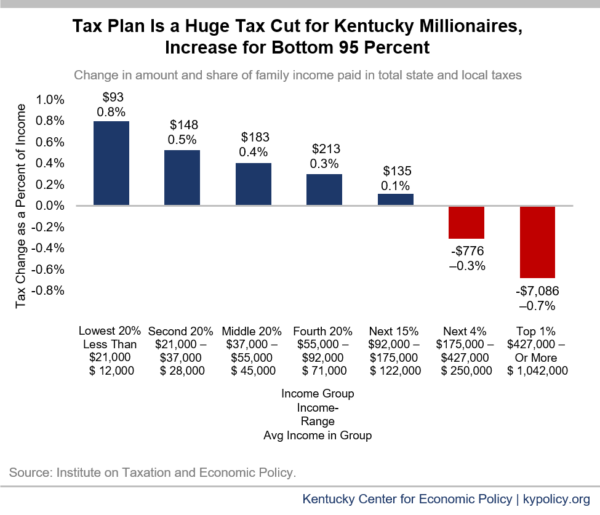

New Analysis Shows Kentucky S New Tax Plan Is A Millionaire Tax Cut Kentucky Center For Economic Policy

New Analysis Shows Kentucky S New Tax Plan Is A Millionaire Tax Cut Kentucky Center For Economic Policy

Unemployment Benefits Fully Taxable On Kentucky Returns Department Of Revenue

Unemployment Benefits Fully Taxable On Kentucky Returns Department Of Revenue

Officials Outline Steps For Kentucky Residents Who Believe They Re Being Taxed Incorrectly On Unemployment Community Wdrb Com

Officials Outline Steps For Kentucky Residents Who Believe They Re Being Taxed Incorrectly On Unemployment Community Wdrb Com

Tax Plan Would Fix Kentucky S Budget Challenges By Addressing Upside Down Tax Code Kentucky Center For Economic Policy

Tax Plan Would Fix Kentucky S Budget Challenges By Addressing Upside Down Tax Code Kentucky Center For Economic Policy

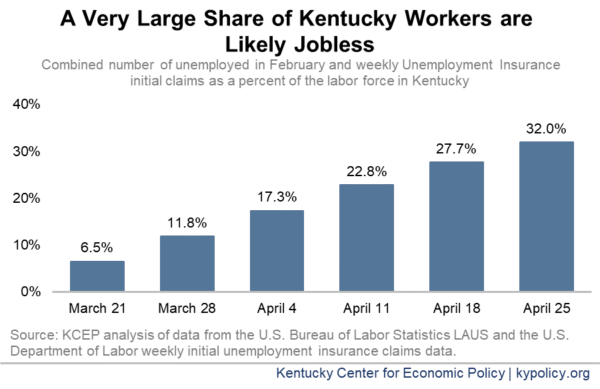

Nearly One In Three Kentucky Workers May Be Out Of A Job Kentucky Center For Economic Policy

Nearly One In Three Kentucky Workers May Be Out Of A Job Kentucky Center For Economic Policy

Recovery Ready Communities Bill Headed To Governor Business Tax Break Clears House Abc 36 News

Recovery Ready Communities Bill Headed To Governor Business Tax Break Clears House Abc 36 News

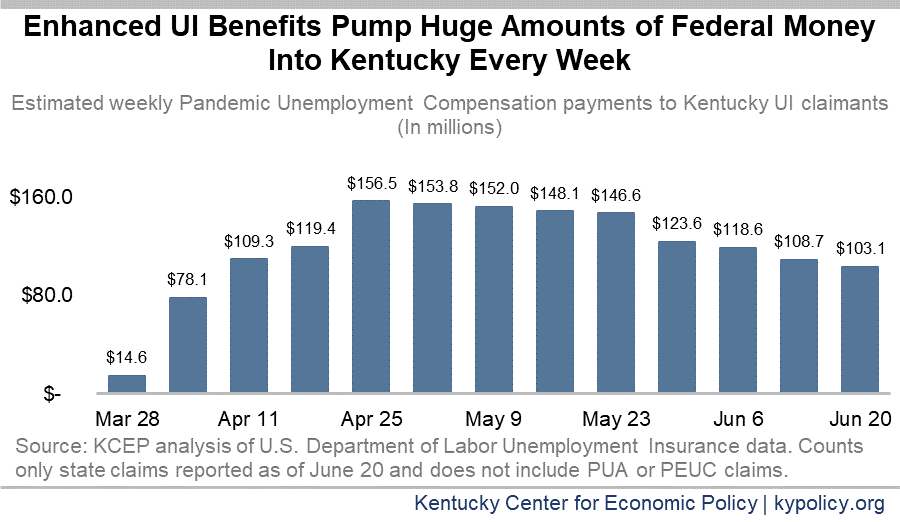

Letting Enhanced Unemployment Insurance Benefits Expire In A Month Would Harm Families And Weaken Kentucky S Economy Kentucky Center For Economic Policy

Letting Enhanced Unemployment Insurance Benefits Expire In A Month Would Harm Families And Weaken Kentucky S Economy Kentucky Center For Economic Policy

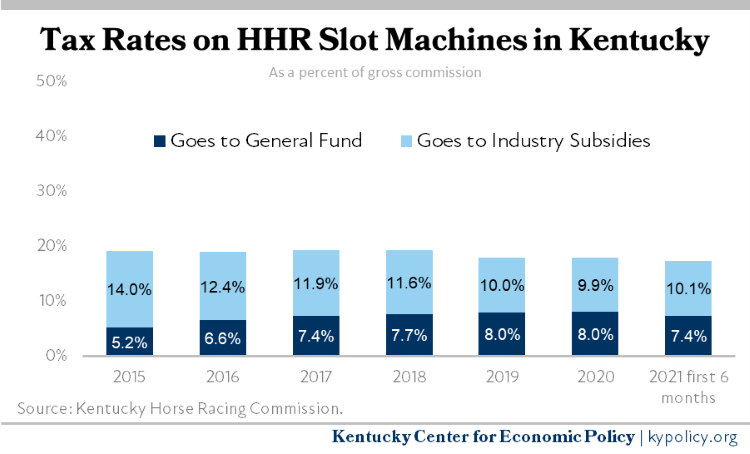

Letter To The Kentucky House Of Representatives On Raising The Inadequate Tax Rate On Hhr Slot Machines Kentucky Center For Economic Policy

Letter To The Kentucky House Of Representatives On Raising The Inadequate Tax Rate On Hhr Slot Machines Kentucky Center For Economic Policy

Post a Comment for "Unemployment Tax Break Kentucky"