Unemployment Status Break In Claim

Yet another unemployment issue. I assumed it was for the 2 previous weeks.

Coronavirus Unemployment Q A How Long Does It Take To Process A Claim

Coronavirus Unemployment Q A How Long Does It Take To Process A Claim

Set Electronic payment method - debit carddirect deposit.

/claiming-adult-dependent-tax-rules-4129176_color3-29b00ca3129544f9b2dbc50675d04c90.gif)

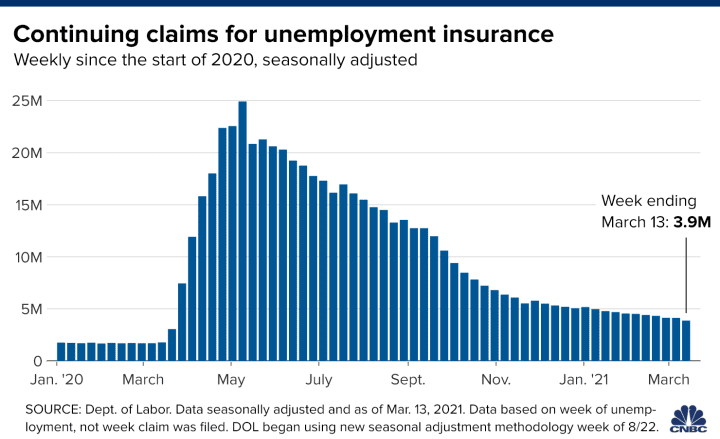

Unemployment status break in claim. Your state agency will assume you have found employment if you do not return your claim form by the specified deadline. What does my payment status mean paid paid 0 pending or break in claim. However taxpayers cant get the break if their modified adjusted gross income excluding unemployment benefits is 150000 or more.

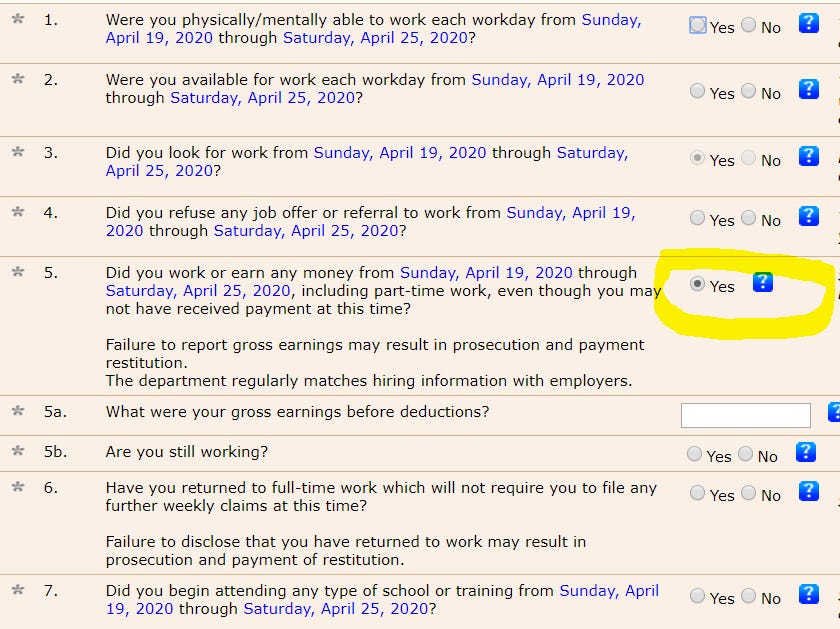

I filed on 412 and it is now saying pay held. 1 The claimant forgets to file for benefits one week or does not file by the deadline. If you stop filing your weekly claim form your unemployment claim becomes inactive.

Reopen an existing claim after a break has occurred in your weekly request for payments. If you received a confirmation number rest assured your claim is in process and you will receive the full amount to which you are entitled. Some taxpayers who collected unemployment benefits in 2020 and filed their returns in the early days of tax season may have to file an amended.

File a partial claim. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. How to claim the unemployment tax break for your state taxes For state taxes adoption of the new rule will vary.

If your payment shows as break in claim you need staff intervention. If your claim shows a determination of 0-0 while it is pending this means we are still processing your claim and there is nothing more you need to do. I filed unemployment and was emailed to file on 321 and again on 328.

I have filed every Sunday for the last three weeks on the dates it tells me Im required to do so. This unemployment income tax break however will apply to households with total incomes under 150000 Adjusted Gross Income AGI in 2020. Some states may follow the 10200 tax break on unemployment income other states may notor they may choose to provide an unemployment tax break in a different way.

2 days agoExpecting another refund after the IRS calculates the 10200 unemployment tax break. The next week my status said break in claim next file date 412. All states Amended return may be needed to get full refund on 10200 unemployment tax break IRS says In some cases where a filer may be eligible for the EITC an amended return may be required.

The Unemployment Claim Determination also may provide other information about your claim such as a message letting you know that you dont have a valid claim since you have less than 680 hours in your base year and that you may qualify for an alternate base year claim or information letting you know we are requesting wages and hours from. The American Rescue Plan a 19 trillion Covid relief bill waived. For married couples the 150000 limit still applies as it is a household maximum and not a straight filing status.

If your claim shows as denied. If your payment shows as paid and the amount is listed as 0 this means you should receive. 2 The claimant works a job that is temporary in nature for the week and therefore cant claim benefits.

The limit is the same regardless of filing status. You can reopen or restart your claim at any time during your benefit year which spans 12 months from the date of your first benefit check. Each time I check my claim status it says break in claim and I do not receive any unemployment benefits.

You might want to do more than just wait Last Updated. Breaks in claim can occur if you tried to reopen a claim but you earned more than your previous weekly benefit amount. A break in claim generally occurs for three reasons.

My unemployment was paid on 330 and again on 331. Call them or you will not get payed itmeaning your payment is being held due to filing back weeks or missing a week. And to help confused taxpayers the IRS plans to automatically adjust.

Please call 877 OHIO-JOB 1-877-644-6562 or TTY at 888 642-8203. File your continued weekly claim for benefits. File a new claim for unemployment benefits.

I was furloughed on 3192020 due to corona virus. It includes a tax break on up to 10200 of unemployment benefits earned in 2020. I answer all the questions correctly and when I initially filed I used the Covid number Dewine issued.

If your payment shows as paid and a date is listed this means you should receive payment in your account or on your debit card within 24 to 48 hours after that date.

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Here S How The 10 200 Unemployment Tax Break Works

Here S How The 10 200 Unemployment Tax Break Works

Turbotax H R Block Update Software For 10 200 Unemployment Tax Break

Turbotax H R Block Update Software For 10 200 Unemployment Tax Break

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Irs Releases Guidance On How To Collect Ui Tax Break Whec Com

Irs Releases Guidance On How To Collect Ui Tax Break Whec Com

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

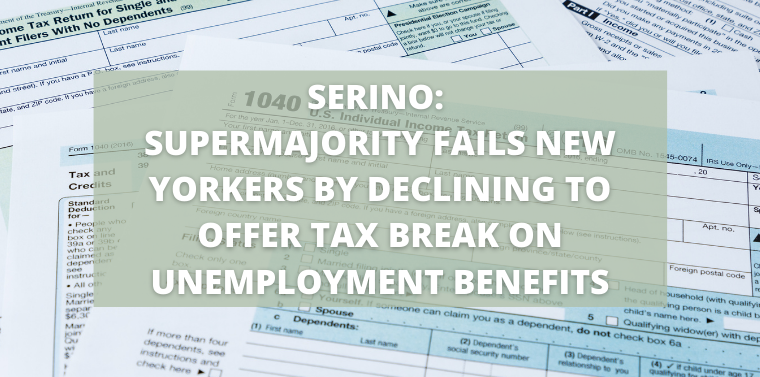

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Arizona Unemployment Claims Can Be Faxed If The Online Form Breaks

Arizona Unemployment Claims Can Be Faxed If The Online Form Breaks

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

/claiming-adult-dependent-tax-rules-4129176_color3-29b00ca3129544f9b2dbc50675d04c90.gif) Tax Rules For Claiming Adult Dependents

Tax Rules For Claiming Adult Dependents

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

My Unemployment Says I Have A Break In My Claim What Does That Mean In 2020 Meant To Be Serious Problem Sayings

My Unemployment Says I Have A Break In My Claim What Does That Mean In 2020 Meant To Be Serious Problem Sayings

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Post a Comment for "Unemployment Status Break In Claim"