Ohio Unemployment Tax New Employer Rate

Ohios unemployment rate in February 2021 was 5 percent and the national rate was 62 percent. 1 day agoOhios unemployment rate in February 2021 was 5 percent and the national rate was 62 percent.

Https Www Michigan Gov Documents Uia Miwam Toolkit For Employers 473402 7 Pdf

Unemployment taxes contributions must be paid on the first 9000 of an employees wages per year.

Ohio unemployment tax new employer rate. This is a dramatic improvement from one year ago. Ohios unemployment rate drop in October to 56 percent set the three-month average below the definition of high unemployment period by the federal government which means some benefits will end. The Ohio new employer SUTA rate is 27 for 2021 for all non-construction industries.

For contributory employers that submit their first second third andor fourth quarter 2020 reports andor tax payments late the Ohio Department of Job and Family Services ODJFS will waive the late reporting penalty and interest once the reports are filed and taxes paid in full. If an individual works for two or more employers both employers are required to pay unemployment taxes on the first 9000 each employer pays to that individual. The new-employer tax rate is to be 270 for 2021 unchanged from 2020.

Employers state unemployment tax rates are based largely on their experience rating which is a measure of how much they have paid in taxes and been charged in benefits. This month Ohios tax revenues exceeded the monthly estimate by 41 million or 26 percent and remain 43 percent above the estimate for the fiscal year-to-date. The Ohio 2020 state unemployment insurance SUI tax rates will range from 03 to 94 up from the 2019 range of 03 to 92.

When completing the Quarterly Tax Return JFS-20125 please use a tentative contribution rate of 27. This month Ohios tax revenues exceeded the monthly estimate by 41 million or 26 percent and remain 43 percent above the estimate for the fiscal year-to-date. Employers with questions can call 614 466-2319.

The 2020 SUI taxable wage base reverts to 9000 down from 9500 for 2018 and 2019. If an employers account is not eligible for an experience rating it will be assigned a standard new employer rate of 27 percent. When a contribution rate is officially determined for your enterprise you will be notified by mail.

Backdated 3 weeks because Ohio didnt get everything together fast enough. Get Your SUTA Rate View Details. Payments for the first quarter of 2020 will be due April 30.

This is a dramatic improvement from one year ago. JFS-20100 Report to Determine Liability. This month Ohios tax revenues exceeded the monthly estimate by 41 million or 26 percent and remain 43 percent above the estimate for the fiscal year-to-date.

New construction employers use 58 for. This month Ohios tax revenues exceeded the monthly estimate by 41 million or 26 percent and remain 43 percent above the estimate for the fiscal year-to-date. This is a dramatic improvement from one year ago.

New Employer Rate If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the construction industry in which case the 2017 rate is 62 the 2018 rate is 60 the 2019 rate is 59 the 2020 rate is 58 and the 2021 rate is 58. Employers in Ohio will receive a new State Unemployment Tax Assessment SUTA rate every year. In recent years however it has been stable at 27.

1 day agoEliminating Ohios unemployment loan balance according to a statement from the Ohio Chamber of Commerce would stave off an employer tax increase in 2022 of more than 100 million and a subsequent 658 million in total tax increases over a. FOR BEST RESULTS PLEASE USE ADOBE VERSION 933 OR HIGHER. New employers in the construction industry are to be assessed a rate of 580 in 2021 also unchanged from 2020.

Should you need to file prior to receiving an employer account number please complete the Quarterly Tax Return JFS-20125 when due. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. New employers except for those in the construction industry will continue to pay at 27.

Except for new employers in the construction industry who are subject to a significantly higher beginning rate. 52 rows Many states give newly registered employers a standard new employer. Ohios unemployment taxable wage base will remain at 9000 for 2021.

Ohios unemployment rate in February 2021 was 5 percent and the national rate was 62 percent. Ohios unemployment rate in February 2021 was 5 percent and the national rate was 62 percent. For new employers registering their account online or existing employer to manage their account online please visit ericohiogov.

Used by employers to apply for an unemployment tax. The state UI tax rate for new employers also known as the standard beginning tax rate can change from one year to the next.

Employment Interview Questions Employment Rate Uk Employment Rights Act 1996 Section 98 Empl Employment News This Or That Questions Interview Questions

Employment Interview Questions Employment Rate Uk Employment Rights Act 1996 Section 98 Empl Employment News This Or That Questions Interview Questions

What Is Futa Tax 2021 Tax Rates And Information

What Is Futa Tax 2021 Tax Rates And Information

Https Www Michigan Gov Documents Uia Miwam Toolkit For Employers 473402 7 Pdf

Employer Costs For Employee Compensation For The Regions December 2020 Southwest Information Office U S Bureau Of Labor Statistics

Employer Costs For Employee Compensation For The Regions December 2020 Southwest Information Office U S Bureau Of Labor Statistics

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

Are Employers Responsible For Paying Unemployment Taxes

Are Employers Responsible For Paying Unemployment Taxes

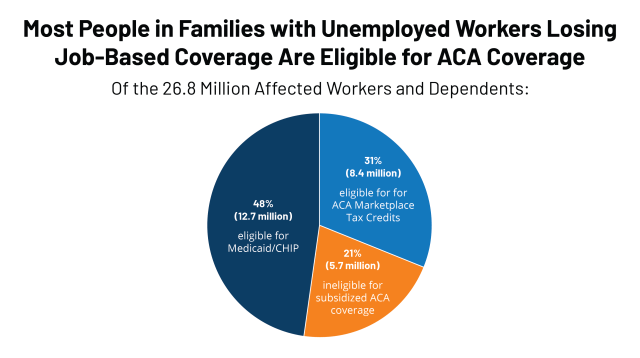

As Unemployment Skyrockets Kff Estimates More Than 20 Million People Losing Job Based Health Coverage Will Become Eligible For Aca Coverage Through Medicaid Or Marketplace Tax Credits Kff

As Unemployment Skyrockets Kff Estimates More Than 20 Million People Losing Job Based Health Coverage Will Become Eligible For Aca Coverage Through Medicaid Or Marketplace Tax Credits Kff

How Eliminating Certain Tax Deductions Will Affect Income Groups Tax Deductions Income Family Income

How Eliminating Certain Tax Deductions Will Affect Income Groups Tax Deductions Income Family Income

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

What Are Employee And Employer Payroll Taxes Ask Gusto

What Are Employee And Employer Payroll Taxes Ask Gusto

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Flexjobs Survey Roughly One Third Of Workers Have Left A Job Due To Lack Of Flexible Work Options Flexible Working Leaving A Job Flexibility

Flexjobs Survey Roughly One Third Of Workers Have Left A Job Due To Lack Of Flexible Work Options Flexible Working Leaving A Job Flexibility

Interest Only Mortgages Back In Favour Interest Only Mortgage Mortgage Interest Rates Fixed Rate Mortgage

Interest Only Mortgages Back In Favour Interest Only Mortgage Mortgage Interest Rates Fixed Rate Mortgage

Https Www Michigan Gov Documents Uia Miwam Toolkit For Employers 473402 7 Pdf

Post a Comment for "Ohio Unemployment Tax New Employer Rate"