Ny State Unemployment W2 2020

The form W-4 Employees Withholding Certificate for federal withholdings no longer has the option of allowances. FecEraI income tax withheld 631.

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

The Tax Department issues New York State Form 1099-G.

Ny state unemployment w2 2020. Recipients must report this information along with information from other income tax forms such as Form W-2 on their 2020 federal and New York income tax returns. If you need a copy of your 1099G you can view and print your 1099G for calendar year 2013 on the NYS Department of Labor website. The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein.

Any unemployment income that was excluded on a taxpayers federal return should be. Learn more about the W-4 form changes on the IRS website. The 1099-G will show the amount of unemployment benefits received during 2020.

If you disagree you may request a hearing within 30. Incomplete or inaccurate information on your return may cause a delay in processing. If you are found ineligible to receive unemployment insurance benefits you will receive a determination explaining the reason.

If you received unemployment compensation in 2020 including any income taxes withheld visit the New York State Department of Labors website for Form 1099-G. Perform a quick Paycheck Checkup using the IRS. To access your form online log in to labornygovsignin click Unemployment Services select 2020 from the dropdown menu and click ViewPrint Your 1099-G.

Log in to your NYGov ID account. 2020 Enhanced Form IT-2 Summary of W-2 Statements Enhanced paper filing with a fill-in form. You can do a search for the forms andor publications you need below.

Learn how to clear your browser cache if you experience issues logging in with your NYgov username and password. You can also certify for weekly benefits with our automated phone system by calling 833-324-0366 for PUA or 888-581-5812 for UI. If you collected unemployment insurance last year you will need the 1099-G form from IDES to complete your federal and state tax returns.

Electronic filing is the fastest safest way to filebut if you must file a paper Summary of W-2 Statements use our enhanced fill-in Form IT-2 with 2D barcodes. 1545-0120 Statement for Rectpents of Certain Government Payments 2020 Form 1099-G 1220 4. No more handwritingtype your entries directly into our form.

External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites. If you do not have an online account with NYS DOL you may call 1-888-209-8124 to request 1099-G form through our automated phone service. Log in with your NYGOV ID then click on Unemployment Services and ViewPrint your 1099GYou can also request a copy by completing and mailing the Request for 1099G form.

This form does not include unemployment compensation. The Statement for Recipients of Certain Government Payments 1099-G tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020. Announcement January 19 2021.

New York State and the IRS recommend you contact your employer to request your W-2. Similarly if you were paid for 2020 weeks in 2021 those will not be on your 1099-G for 2020 they will appear on your 1099-G for 2021. The state has not adopted the federal exemption for up to 10200 of unemployment compensation received in 2020.

All individuals who received unemployment insurance UI benefits in 2020 will receive the 1099-G tax form. Hello cbhay99 For NYS unemployment you should have received a 1099G. The 1099-G form is available as of January 2021.

You should wait until mid-February to receive your W-2 before requesting a copy from your employer. No27-0293117 Phone 12345-6789 00 RECIPIENTS 1. This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020 as well as any adjustments or tax withholding made to your benefits.

If there is a form that youre looking for that you cant locate please email email protected and let us know. Meaning if you were paid in 2020 for weeks of unemployment benefits from 2019 those will appear on your 1099-G for 2020. Last year New York received more.

Visit the Department of Labors website. Employers have until January 31 to mail W-2s to their employees. NEW YORK STATE DEPARTMENT OF LABOR-UNEMPLOYMENT INSURANCE OMB NO.

The 2021 form IT-2104 Employees Withholding Allowance Certificate for state and city withholdings still provides for allowances. The challenges of the COVID-19 pandemic meant 2020 was the first time some Gen Z members and millennials entered the workforce and claimed unemployment benefits.

The 2020 W 4 Forging Into The Upcoming Year Journey Payroll Hr

The 2020 W 4 Forging Into The Upcoming Year Journey Payroll Hr

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Alabama Tax Forms And Instructions For 2020 Form 40

Alabama Tax Forms And Instructions For 2020 Form 40

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Irs Form 1099 R Box 7 Distribution Codes Ascensus

Minnesota Tax Forms 2020 Printable State Mn Form M1 And Mn Form M1 Instructions

Minnesota Tax Forms 2020 Printable State Mn Form M1 And Mn Form M1 Instructions

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

2020 W 2 See What Last Year S Changes Bring To The Form

2020 W 2 See What Last Year S Changes Bring To The Form

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

Kentucky Tax Forms 2020 Printable State Ky 740 Form And Ky 740 Instructions

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Instant W2 Form Generator Create W2 Easily Form Pros

Instant W2 Form Generator Create W2 Easily Form Pros

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

1099 G Tax Form Department Of Labor

1099 G Tax Form Department Of Labor

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

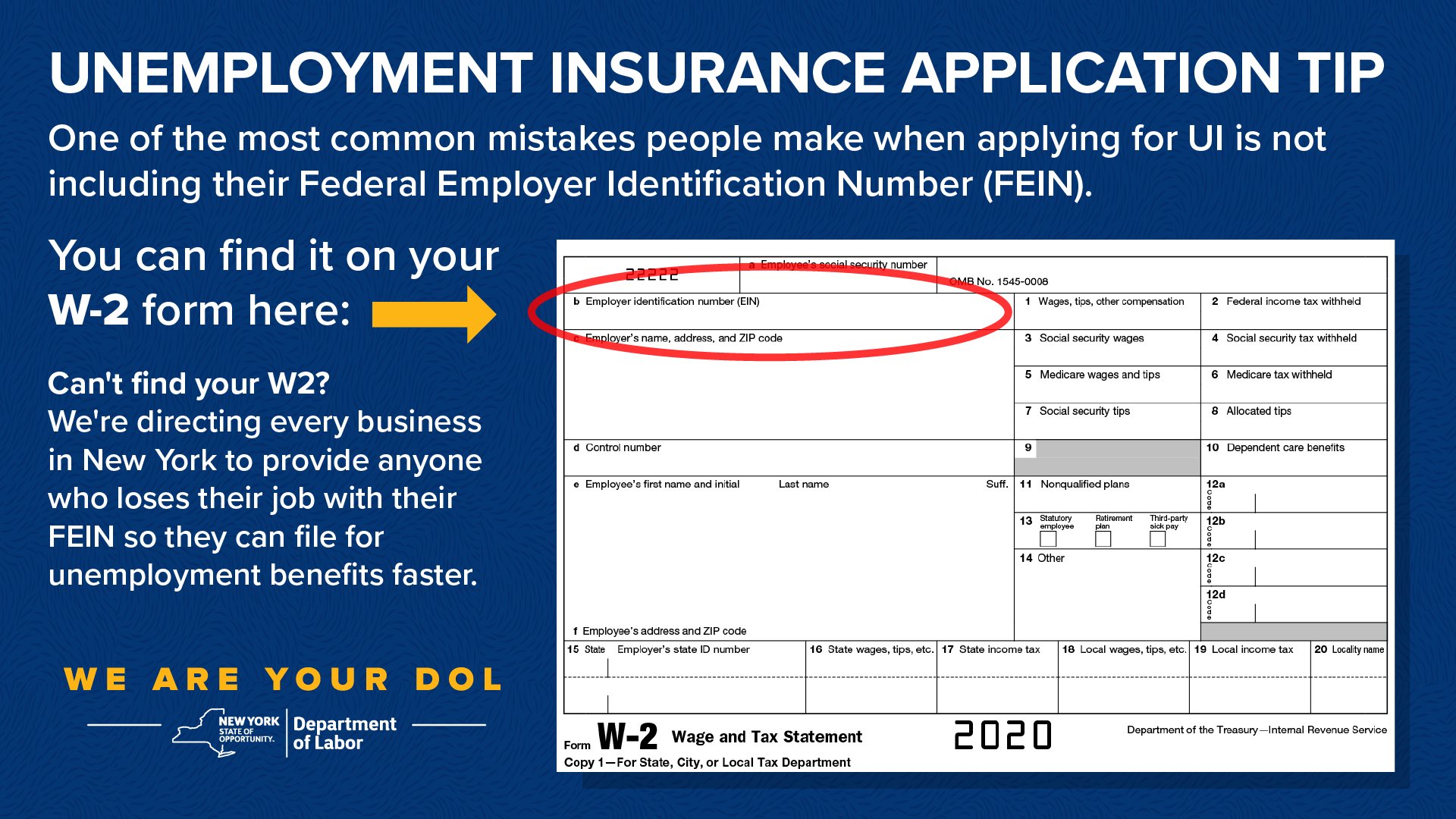

Nys Department Of Labor On Twitter Reminder The Number One Reason New Yorkers Applications Are Incomplete Is Because They Are Missing Federal Employer Identification Numbers Fein Here S Where You Can Find The

Nys Department Of Labor On Twitter Reminder The Number One Reason New Yorkers Applications Are Incomplete Is Because They Are Missing Federal Employer Identification Numbers Fein Here S Where You Can Find The

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Post a Comment for "Ny State Unemployment W2 2020"