How To Get W2 From Unemployment Michigan

The federal COVID-19 relief package which extends federal CARES Act unemployment benefit programs was signed into law. Include the information requested above and enter Duplicate W-2 as the subject line.

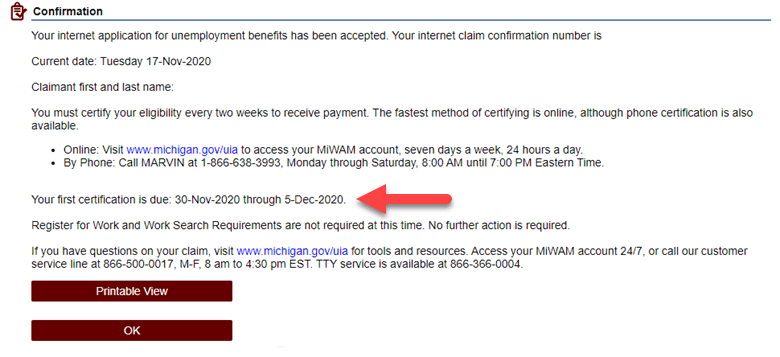

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

How Taxes on Unemployment Benefits Work.

How to get w2 from unemployment michigan. There are some employers who make W-2s available for import to TurboTax but not all do this. The IRS will receive a copy as well. Youll receive a Form 1099-G after the end of the year reporting in Box 1 how much in the way of benefits you received.

Unemployment benefits including Federal Pandemic Unemployment Compensation FPUC Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Lost Wages Assistance LWA and Extended Benefits EB are taxable income. You can also receive an allowance of 6 per week per dependent up to 30. We use cookies to give you the best possible experience on our website.

PPP is based on Schedule C profit which is not what the UI offices are looking at again in my state and its not income. However they only use the address you had as of. The state tax rate in Michigan is 425.

That will be the case if a new tax break on up to 10200 of unemployment benefits makes them newly eligible for income-dependent tax breaks like the earned income tax. You should be able to get an electronic copy if you log into CONNECT and go to My 1099-G and 49Ts in the main menu. Amount and Duration of Unemployment Benefits in Michigan.

You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers. If you were out of work for some or all of the previous year you arent off the hook with the IRS. A significant provision in federally funded pandemic unemployment programs is an extra 100 weekly payment to workers who had a significant cut to their income due to COVID and had both wage W2 income and self-employment 1099 income.

Please note that Unemployment Insurance is available to Hoosiers whose employment has been interrupted or ended due to COVID-19 you should file for UI and your claim will. The 1099s reflecting unemployment benefits paid in 2020 will be mailed to the last address on file no later than January 29 2021. Email alerts will be sent to the claimants that elected to receive electronic notifications advising that they can view and print their 1099G online.

Youll also need this form if you received payments as part of a governmental paid family leave program. Once your request has been received you may expect to receive your duplicate W-2 within 2 weeks. The most you can receive per week is currently 362.

If your modified AGI is 150000 or more you cant exclude any unemployment compensation. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to 10200. Mail the completed form to.

In most cases state UI is only paying benefits based on W-2 income what they do in my state or some type of average claim amount if youre 100 1099 what my friends in other states are getting. If you received unemployment your tax statement is called form 1099-G not form W-2. Contact the IRS at 800-829-1040 to request a copy of your wage and income information.

You may be able to locate the information online. To view and print your current or. There are three options.

You can download Form 4506-T at IRSgov or order it from 800-TAX-FORM. Cant find my unemployment w2 or havent gotten and need to know what to do. To enter it on your tax return go to FederalWages IncomeUnemployment Government benefits on Form 1099G.

If you are eligible to receive unemployment your weekly benefit in Michigan will be 41 of what you earned during the highest paid quarter of the base period. Submit your request to OFM at dtmb-payrollmichigangov. Unemployment and family leave.

Amounts over 10200 for each individual are still taxable. Unemployment income is reported on a 1099-G tax statement. Those who received unemployment benefits for some or all of the year will need a 1099-G form.

Some taxpayers who collected unemployment benefits in 2020 and filed their returns in the early days of tax season may have to file an amended return to get their maximum refund. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. Unemployment Insurance Benefits Update.

One bright note is that in the state of Michigan unemployment benefits are not subject to city tax said Harper. Usually you need to go to the states unemployment web site to get it and print it out. Federal Benefit Programs Extended.

Think of this as someone with a normal part-time salaried job who also has a reasonable side hustle or freelancing gig making money eg Etsy Contractors or. But you dont have to wait for your copy of the form to arrive in the mail. How can I get a copy of my Michigan unemployment W-2.

You have to get it yourself. I have a 1099-int form. Please use our Quick Links or access one of the images below for additional information.

Unemployment benefits are income just like money you would have earned in a paycheck. The Michigan Unemployment office MUST have ALL W-2s in the mail by January 31st. Federally with seven tax brackets.

Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year. Pandemic Unemployment Assistance PUA and Pandemic Emergency Unemployment Compensation PEUC will be extended through September 4 2021. You can also use Form 4506-T to request a copy of your previous years 1099-G.

Consider contacting your state unemployment agency to determine when that document will be sent to you. The 1099-G is a tax form for Certain Government PaymentsESD sends 1099-G forms for two main types of benefits.

Https Static Fmgsuite Com Media Documents D292c244 71e0 4c12 A0b2 A70165eba30a Pdf

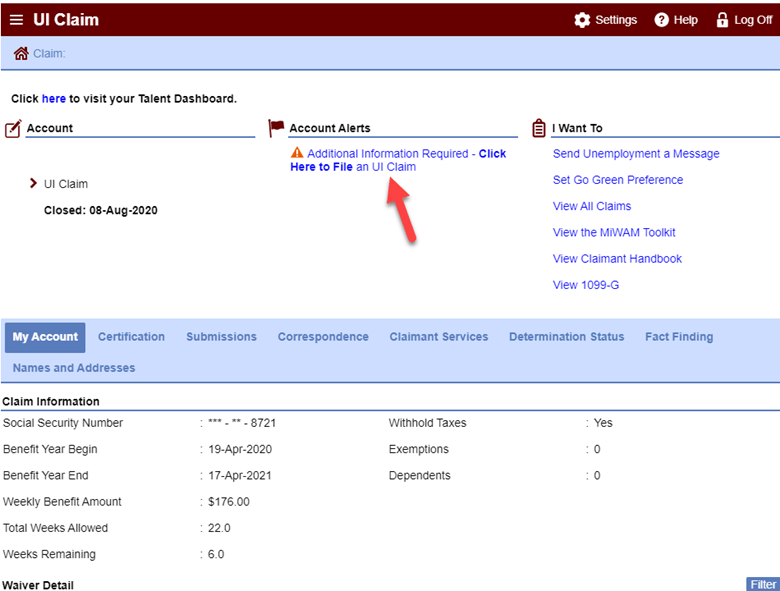

Labor And Economic Opportunity Steps To Restart Your Ui Claim

Labor And Economic Opportunity Steps To Restart Your Ui Claim

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Https Www Michigan Gov Documents Uia Miwam Toolkit For Employers 473402 7 Pdf

Unemployment Resources Aft Michigan

Unemployment Resources Aft Michigan

Michiganders Eligible For Federal Pandemic Unemployment Assistance Keweenaw Report

Get Our Image Of Independent Contractor Commission Agreement Template Independent Contractor Contractors Agreement

Get Our Image Of Independent Contractor Commission Agreement Template Independent Contractor Contractors Agreement

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Business Tax Bookkeeping Business Small Business Bookkeeping

This Annual Tax Reference Guide Is For Any Business That Has Employee S And Contractors Or That Ha Business Tax Bookkeeping Business Small Business Bookkeeping

Labor And Economic Opportunity Steps To Restart Your Ui Claim

Labor And Economic Opportunity Steps To Restart Your Ui Claim

How Rick Snyder Made Collecting Unemployment Benefits Harder Opinion

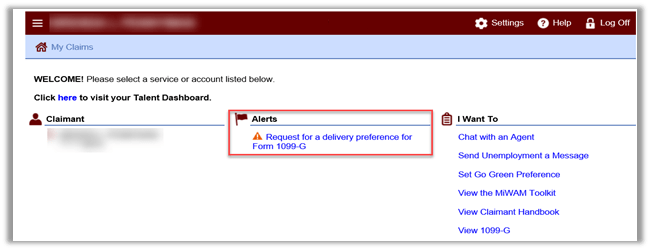

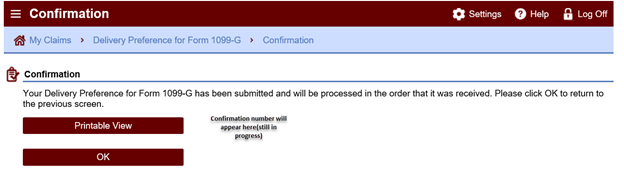

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

Https Static Fmgsuite Com Media Documents D292c244 71e0 4c12 A0b2 A70165eba30a Pdf

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

Post a Comment for "How To Get W2 From Unemployment Michigan"