How To Find State Unemployment Id Number

Its a simple form. Apply for an EIN with the IRS assistance tool.

Your Application cannot be processed if you do not record your Federal Employer Identification Number EIN in.

How to find state unemployment id number. Select option 5 for questions about 1099-G forms. 800 247-4984 Illinois Job Link questions. Some states may use the Employers State ID Number located on the W-2 between boxes 15 and 16.

Register at Employers and Agents. MyTax IllinoisEmployer Hotline questions. The Unemployment Insurance UI Program issues identification numbers that are different from those issued by the Minnesota Department of Revenue and the Internal Revenue Service.

Do I use the same Payers Identification number for Federal and State tax forms. Contact your state agency to find out which number they require. Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year.

Look on line 15 of the W-2 form you receive by the end of January each year. Department of Economic Security Special Programs Unit PO. Individual workers wages are recorded on the DES wage record files and retained for five quarters to be used for determining monetary benefit entitlement should a worker file a claim for unemployment.

Will take five minutes. What is the Payers Federal Identification number. The EIN is a core identification number similar to your social security number just for your business.

So it is good advice to handle it as such. Employers that are liable for Missouri unemployment tax contributions must provide the Division of Employment Security DES information on the wages of their covered employees each quarter. Please be sure to include your Social Security Number and remember to indicate which tax year you need in your request.

Important IDES Telephone Numbers at a Glance. Presviously assigned NC Unemployment Insurance Tax Account Number 7 digits. You will answer a series of questions about the ownership of the business and the number of locations operated.

The the Maryland Department of Labor Federal ID is. Employers must register with the Texas Workforce Commission TWC within 10 days of becoming subject to the Texas Unemployment Compensation ActTWC provides this quick free online service to make registering as easy as possible. You will need to contact the agency that issued you the Form 1099-G to obtain the state ID number.

Unemployment insurance claim questions. Employers may contact the Unemployment Insurance UI. Box 6123 - Mail Drop 589C Phoenix Arizona 85005.

Call your employers human resource or accounting department and ask a representative to look up the information for you. If you find fraud in your name keep that page open and go to the Employment Security Department Fraud site and report what you found. The information you provide to DES on this form will be used to determine whether or not you are liable to pay Arizona Unemployment Insurance UI taxes.

If you do NOT have a FEIN andor a NC Department of Revenue withholding ID you must complete an Employer Status Report PDF. If I have questions concerning information on my 1099G how do I contact someone within unemployment insurance. If you received unemployment benefits.

If you use TTYTDD call a relay operator first at 800 662-1220 and ask the operator to call the Telephone Claims Center at 888 783- 1370. This is also the number for our collections unit. Contact the Department of Revenue for the state in which you live.

If you are found ineligible to receive unemployment insurance benefits you will receive a determination explaining the reason. The amounts on this form are reported to the taxing agencies and matched with the amounts reported on your tax return. See the link below and select the applicable state to find out how to contact your particular state.

Note for reference purposes the State and Federal ID numbers are as follows. 800 244-5631 Complaintsallegations regarding unemployment insurance fraud. Click Employer Status Report button below print the PDF document and mail the completed form to the address on page 1.

If you disagree you may request a hearing within 30. It will guide you through questions and ask for your name social security number address and your Doing Business As DBA name. Department of Labor website.

Your nine-digit federal tax ID becomes available immediately upon verification. The EIN number is a nine-digit number that follows the format XX-XXXXXXX. FederalState Unemployment Insurance UI tax.

State ID 07-506284E Federal ID 86-0369595. If you are unsure about which number to use visit the US. Employment Authorization Form I-9 The form I-9 exists for the purpose of verifying the identity of you nanny and for employment authorization.

You wont have a letter ID so just use the information from this box. 800 814-0513 If you are a victim of fraud click here. View the list of state agencies to find contact information for your state unemployment agency.

Its best to claim weekly benefits or obtain benefit payment information online with your NYGov ID.

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Free Unemployment Verification Letter Sample With Benefits Plus In Proof Of Unemployment Letter Template Business Letter Template Lettering Letter Templates

Free Unemployment Verification Letter Sample With Benefits Plus In Proof Of Unemployment Letter Template Business Letter Template Lettering Letter Templates

Free Boat Deposit Receipt Template Word Pdf Eforms Free Fillable Forms Receipt Template Receipt Personal Financial Statement

Free Boat Deposit Receipt Template Word Pdf Eforms Free Fillable Forms Receipt Template Receipt Personal Financial Statement

Browse Our Image Of Direct Deposit Form Social Security Benefits For Free Separation Agreement Template Social Security Benefits Contract Template

Browse Our Image Of Direct Deposit Form Social Security Benefits For Free Separation Agreement Template Social Security Benefits Contract Template

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Appeal Letter Sample Proposal Sample For Proof Of Unemployment Letter Template In 2021 Letter Template Word Letter Templates Letter Sample

Unemployment Appeal Letter Sample Proposal Sample For Proof Of Unemployment Letter Template In 2021 Letter Template Word Letter Templates Letter Sample

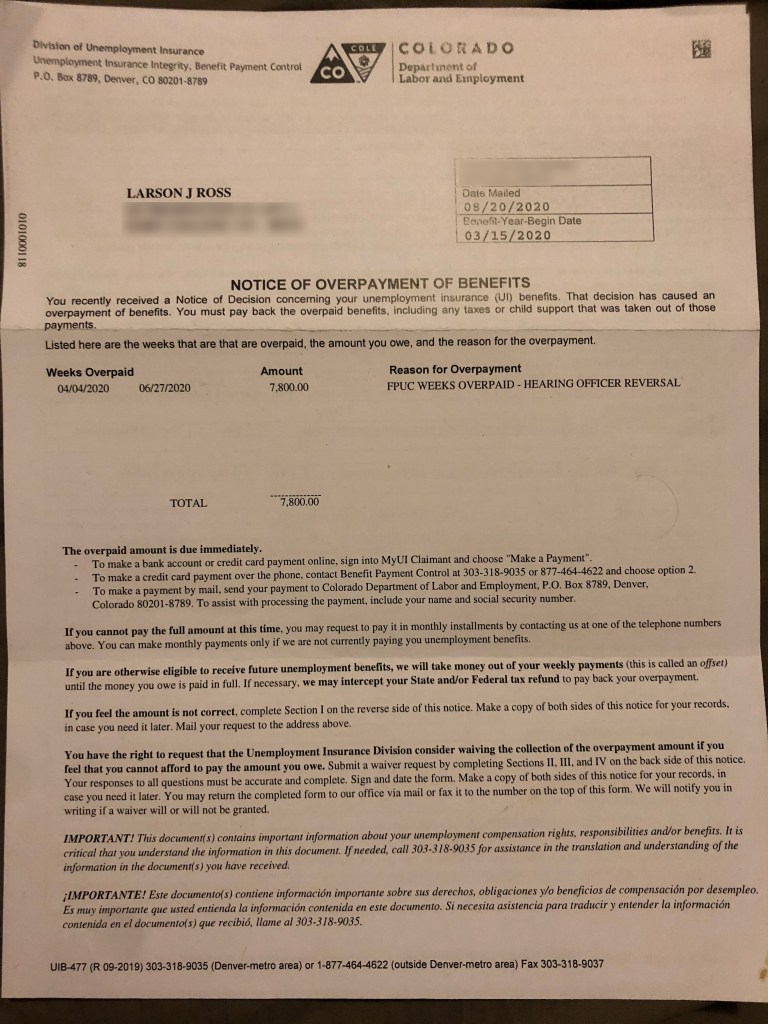

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

Handy Printable Tax Prep Checklist Tax Prep Checklist Business Tax Tax Prep

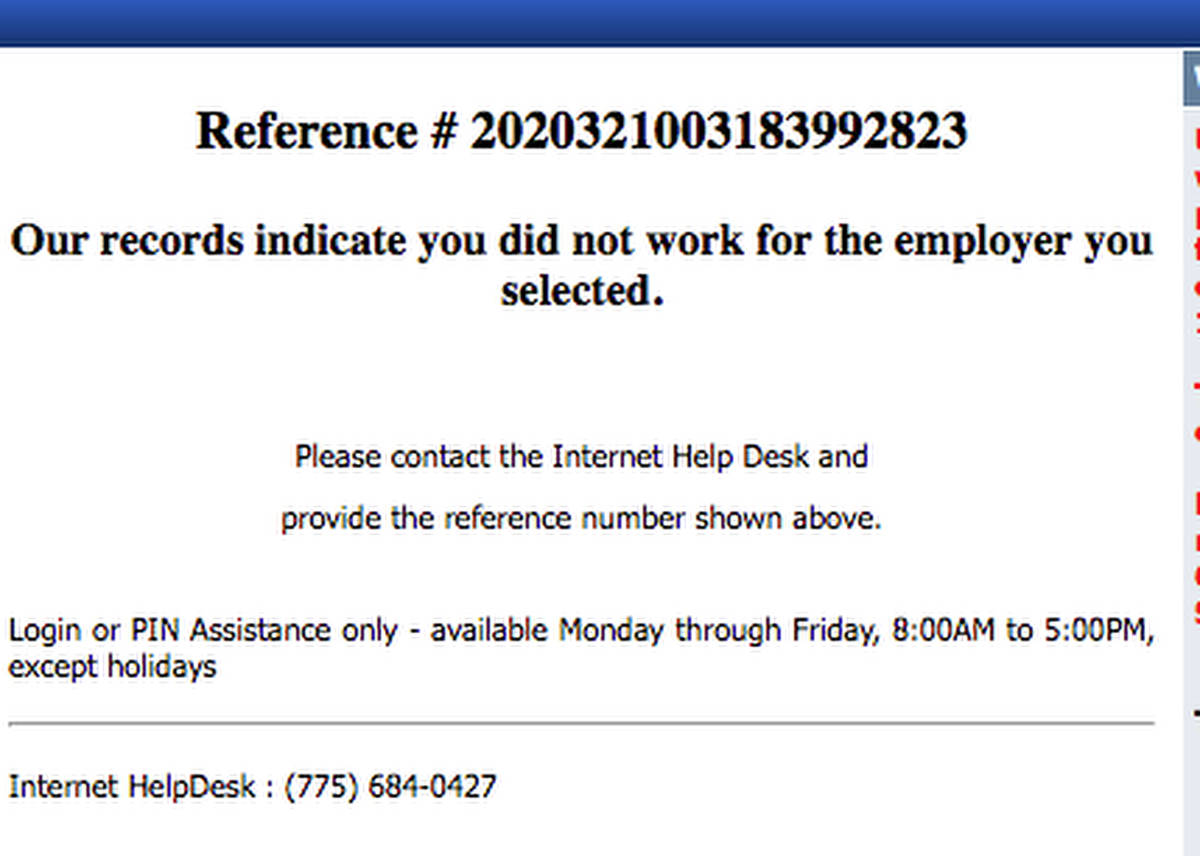

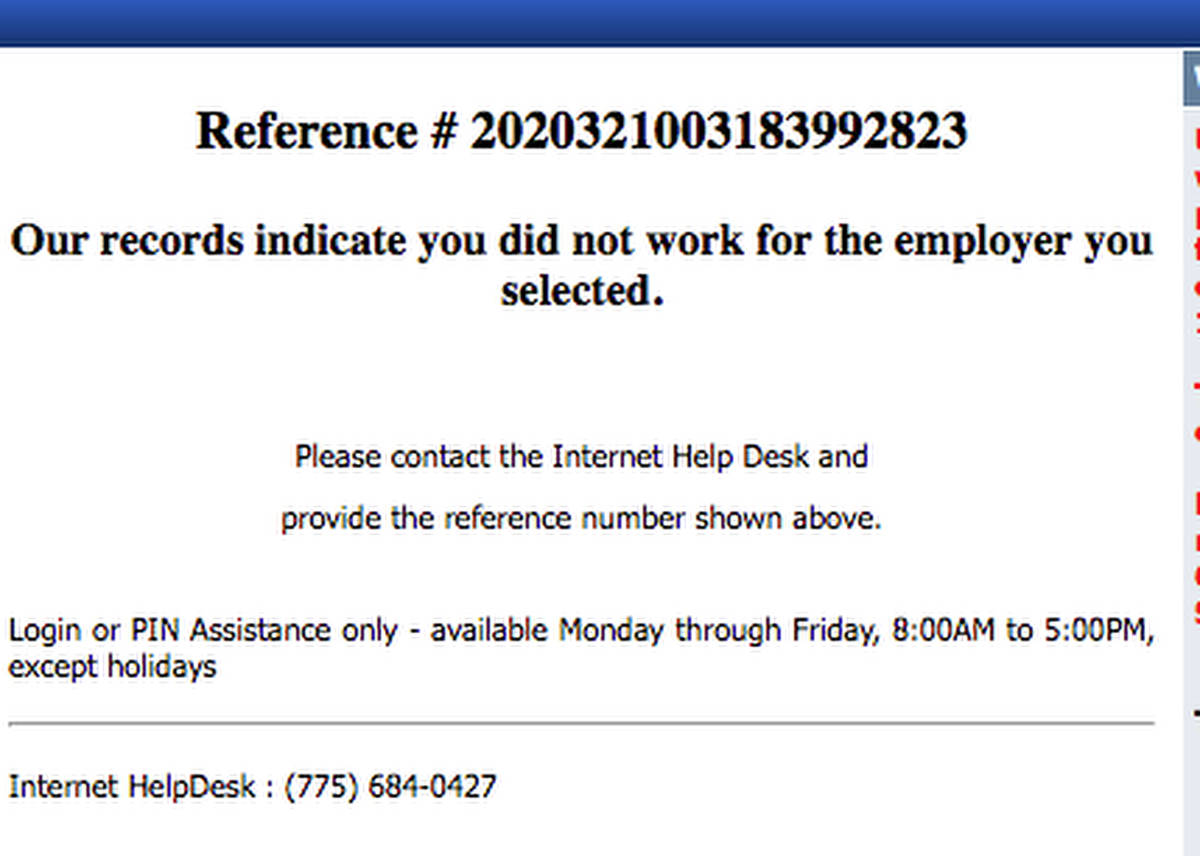

Nevada Unemployment Website Common Problems And What To Do About Them Las Vegas Review Journal

Nevada Unemployment Website Common Problems And What To Do About Them Las Vegas Review Journal

Unemployment Verification Letter Sample Awesome 9 10 Letter Unemployment Verification Dannybarrantes Lettering Letter Templates Professional Reference Letter

Unemployment Verification Letter Sample Awesome 9 10 Letter Unemployment Verification Dannybarrantes Lettering Letter Templates Professional Reference Letter

Benefit Rights Information For Claimants And Employers Unemployment Insurance

Benefit Rights Information For Claimants And Employers Unemployment Insurance

Post a Comment for "How To Find State Unemployment Id Number"