Employer Unemployment Tax Rate Georgia

TAX RATES AND COVERED EMPLOYMENT. That rate generally remains in effect for at least 36 months.

Https Dol Georgia Gov Document Gdol Rules Gdol Rules Chapter 300 2 3 Tax Rates And Covered Employment Download

The Employer Portal is the preferred method for employers to manage their unemployment insurance UI tax accounts.

Employer unemployment tax rate georgia. As a reference for 2020 the new employer SUI state unemployment insurance rate was 270 percent on the first 9500 of wages for each employee. Here is a list of the non-construction new employer tax. If youre a new employer use the standard rate of 270.

The withholding tax rate is a graduated scale. Tax and wage reports may be filed using the preferred electronic filing methods available on the Employer Portal. Emergency Rule 300-2-3-020 containing Rule 300-2-3-020-05 Charges to Experience Rating Account 1 An employer shall be charged for all benefits paid as a consequence of the employers failure to provide a timely written response to a claim for unemployment insurance benefits regardless.

Uploading W2s 1099 or G-1003. 1 day agoThe solvency fund assessment one of several factors used to calculate a business owners unemployment insurance contribution rate jumped from 058 to 923 for 2021. Qualified employers may defer quarterly taxes of 500 or less until January 31st of the following year.

Rates range from 004 to 756. Employers must report all wages paid to employees. Import W2s and G-1003.

Georgia doesnt have state disability insurance but it does have unemployment insurance. The 2020 Annual UI Tax Rate Notices are now available on the Georgia Department of Labor GDOL Employer PortalIf you are not registered on the Employer Portal please register immediately to avoid delays in receiving this important information. In recent years the rate has been 27.

The release of Georgias 2021 Annual Unemployment Insurance Tax Rate Notices has been delayed and anticipated to be available on the Georgia Department of Labor Employer Portal in February 2021. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest. Contributory employers pay taxes at a specified rate on a quarterly basis.

If you are liable you will need to pay unemployment insurance taxes either quarterly or annually depending on your business type. In Georgia employers pay the entire cost of unemployment insurance benefits. 52 rows SUI tax rate by state.

The solvency assessment covers unemployment benefits that are not chargeable. You will pay 27 rate for the first 3 years you are in business. Difference Between Import and Upload.

2 if annual gross is less than 8000 3 if annual gross is between 8000 and 10000 4 if annual gross is between 10001 and 12000 5 is annual gross is between 12001 and 15000 575 if annual gross is 15000. Employers that fail to receive a Tax Rate Notice or have questions about a tax rate should contact the Rate Unit at 4042323300. After this grace period your rate will either increase or decrease depending upon the number of claims filed against your company.

Tax rate calculations consider the history of both unemploy - ment insurance contributions and benefits paid to former workers growth of an employers payroll and the overall unemployment conditions for the state. For withholding rates on bonuses and other compensation see the Employers Tax Guide. Submitting Year End W2s 1099s and G-1003 Annual Return.

New or newly covered employers are assigned a total tax rate of 270 percent until such time as they are eligible for a rate calculation based on their experience rating history. Employers may view employer account information eg. 12 hours agoBut that tax rate schedule is only one part of how an employers tax bill for unemployment insurance is calculated.

Sign Up For Our Withholding Email List. Established employers are subject to a lower or higher rate than new employers depending on an experience rating. The state UI tax rate for new employers also can change from one year to the next.

Tax rates account status and payment details file Quarterly Tax and Wage Reports submit payments update employer addresses file partial claims and email the Field Tax. With a wage base of 9500 unemployment insurance covers those unemployed through no fault of their own. Governmental and nonprofit organizations may elect the contributory method or may choose to reimburse the.

However taxes are due only on the first 9500 per employee per year. TABLE OF CONTENTS.

Why Did Employer Coverage Fall In Massachusetts After The Aca Potential Consequences Of A Changing Employer Mandate Health Affairs

Why Did Employer Coverage Fall In Massachusetts After The Aca Potential Consequences Of A Changing Employer Mandate Health Affairs

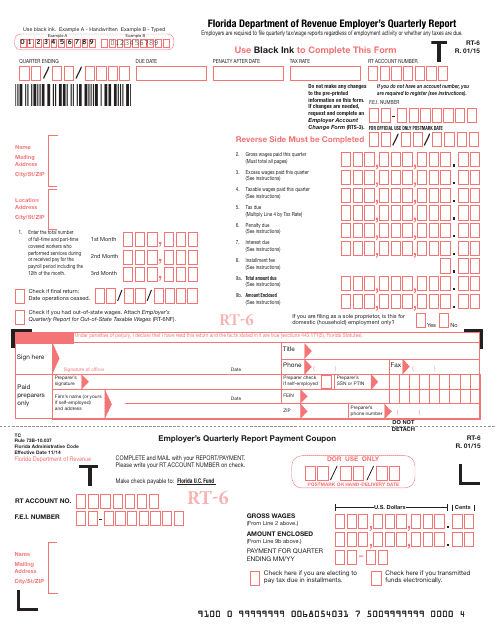

Form Rt 6 Download Printable Pdf Or Fill Online Employer S Quarterly Report Florida Templateroller

Form Rt 6 Download Printable Pdf Or Fill Online Employer S Quarterly Report Florida Templateroller

Are Relocation Expenses For Employees Taxable When Paid By An Employer

Are Relocation Expenses For Employees Taxable When Paid By An Employer

Pay Stub Requirements By State Overview Chart Infographic

Pay Stub Requirements By State Overview Chart Infographic

Employer Costs For Employee Compensation For The Regions December 2020 Southwest Information Office U S Bureau Of Labor Statistics

Employer Costs For Employee Compensation For The Regions December 2020 Southwest Information Office U S Bureau Of Labor Statistics

Georgia Employers Not Charged For Partial Ui Benefits Related To Covid 19 Partial Claims Antares Group Inc

Georgia Employers Not Charged For Partial Ui Benefits Related To Covid 19 Partial Claims Antares Group Inc

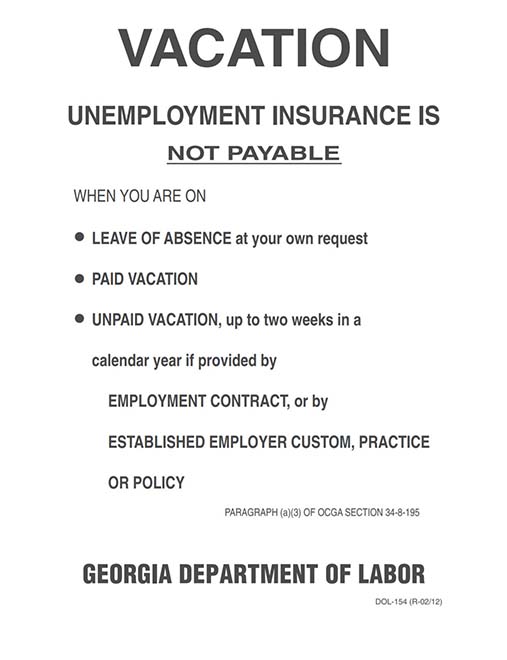

Georgia Labor Law Posters How To Start An Llc

Georgia Labor Law Posters How To Start An Llc

Payroll Services In Texas Payroll Taxes Gov Links Payroll Taxes Payroll Payroll Software

Payroll Services In Texas Payroll Taxes Gov Links Payroll Taxes Payroll Payroll Software

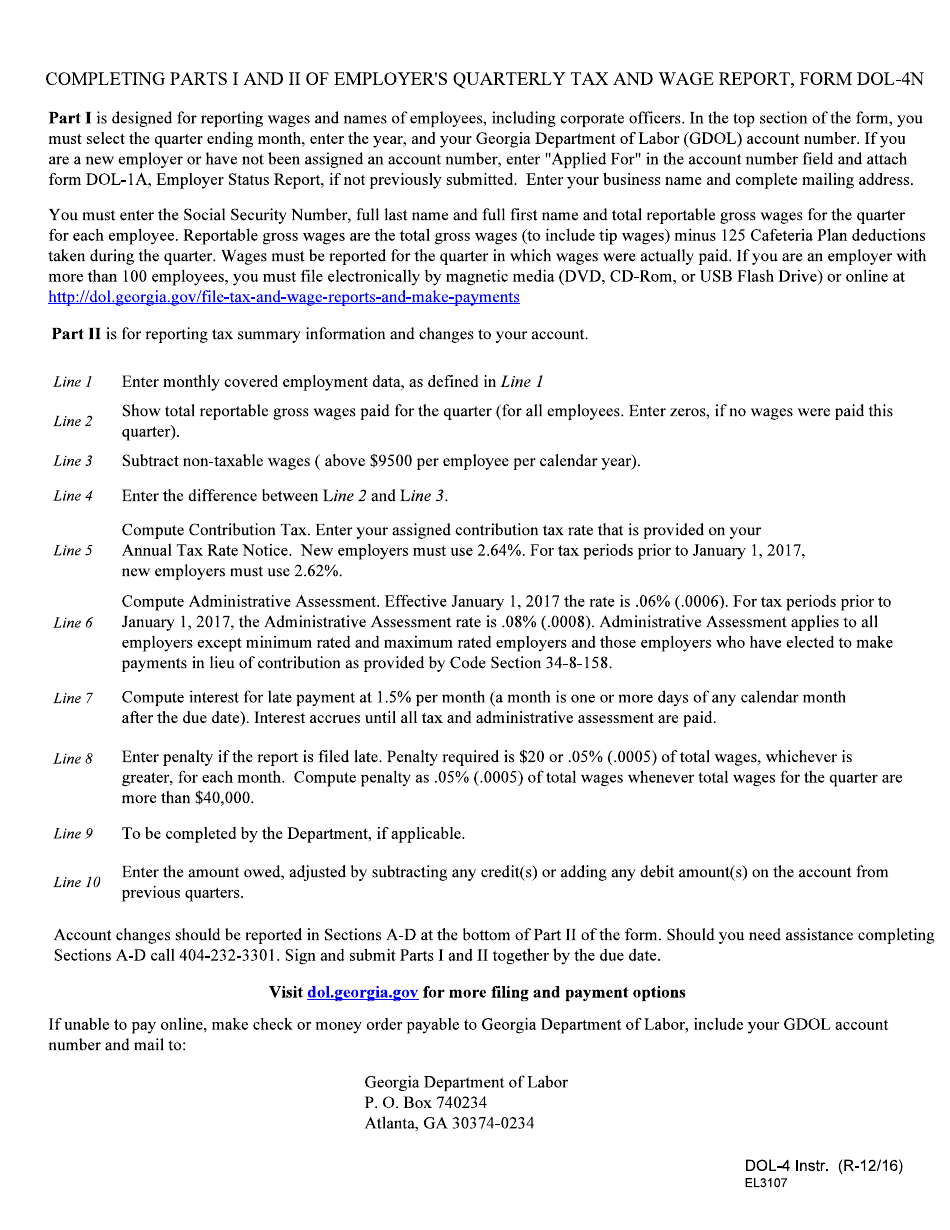

Form Dol 4n Download Fillable Pdf Or Fill Online Employer S Quarterly Tax And Wage Report Georgia United States Templateroller

Form Dol 4n Download Fillable Pdf Or Fill Online Employer S Quarterly Tax And Wage Report Georgia United States Templateroller

Are Employers Responsible For Paying Unemployment Taxes

Are Employers Responsible For Paying Unemployment Taxes

Are Employers Responsible For Paying Unemployment Taxes

Are Employers Responsible For Paying Unemployment Taxes

Georgia Labor Law Posters How To Start An Llc

Georgia Labor Law Posters How To Start An Llc

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

How To Be A Fair Employer During The Coronavirus Crisis California Toolkit Hand In Hand

How To Be A Fair Employer During The Coronavirus Crisis California Toolkit Hand In Hand

Pandemic Unemployment Assistance 20 Questions And Answers For Employers Ogletree Deakins

Pandemic Unemployment Assistance 20 Questions And Answers For Employers Ogletree Deakins

Blog Archive Common Tricks Used By Employers To Avoid Paying You Overtime Wages

Blog Archive Common Tricks Used By Employers To Avoid Paying You Overtime Wages

What Employers Need To Know About Unemployment Benefit Audits

What Employers Need To Know About Unemployment Benefit Audits

Https Dol Georgia Gov Document Unemployment Tax Employer News 2019 Download

Post a Comment for "Employer Unemployment Tax Rate Georgia"