Can U Collect Unemployment If You Are Self Employed

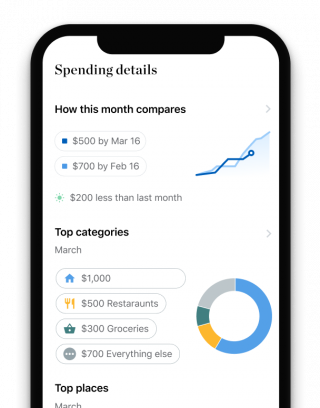

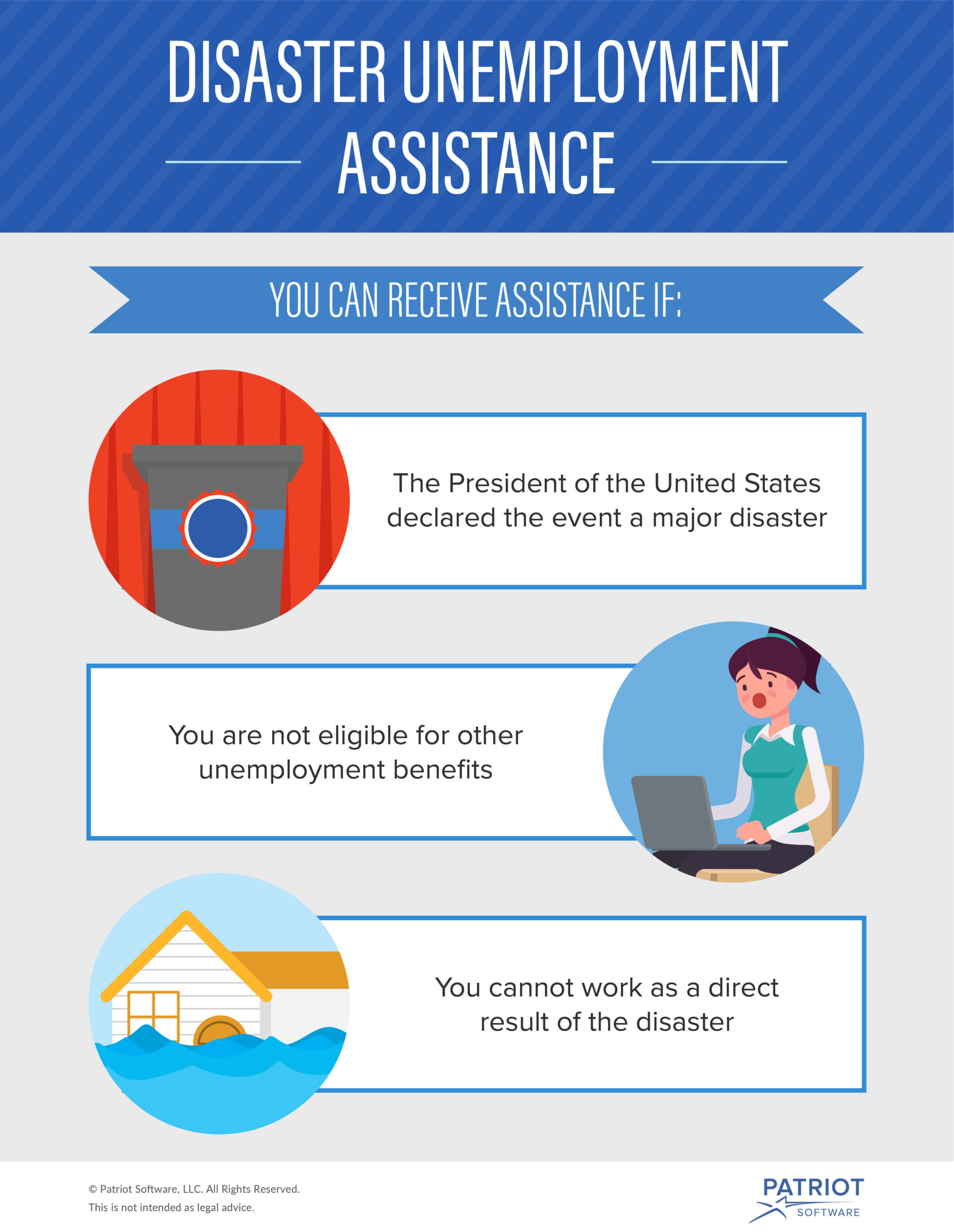

Being self-employed usually means you cant get unemployment benefits when your business income dips or dries up. People who are self-employed including independent contractors and gig workers and dont qualify for regular unemployment insurance can receive benefits if.

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Help For Self Employed Coronavirus Relief For Self Employed Individuals

However for self-employed individuals without employees whose typical profit and business expenses combined are less than 950 per week the simplest option is.

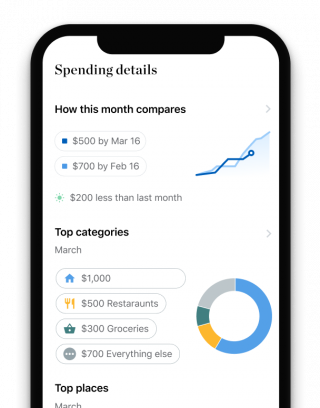

Can u collect unemployment if you are self employed. If you are self-employed an independent contractor or a farmer you may now be eligible and can file for benefits online. The minimum benefit rate is 50 of the average weekly benefit amount available in your state. The amount you recieve is based on your previous income and may vary based on where you live and your benefit guidelines.

If you are self-employed or a 1099 then you likely cannot use your PPP funds to pay yourself and continue to collect unemploymentbecause the payment you make to yourself counts as income which in most cases will disqualify you from continuing to receive unemployment. You may be ineligible for benefits if you are self-employed setting up a business or have ownership interest in a business. With new unemployment and relief benefits for self-employed professionals under the CARES Act you may be eligible to apply for unemployment benefitsIn this article we cover the types of self-employment you may identify as along with several available financial support programs for collecting unemployment when youre self-employed.

Under most regular unemployment insurance regulations independent contractors and self-employed workers cant collect unemployment benefits. You Can Collect Unemployment If Youre Self-Employed Paul Saitowitz April 4 2016 The thrills you experience as a self-employed entrepreneur such as the freedom to. Weekly Unemployment Insurance benefits while participating in self-employment activities.

How self-employed can file for unemployment insurance benefits This video tutorial shows how self-employed individuals can apply for unemployment insurance benefits under the CARES Act COVID-19. Counseling and technical assistance on developing a market feasibility study and a business plan. Self-employed people and independent contractors are currently eligible for unemployment under the Pandemic Unemployment Assistance PUA program but as many business owners prepare to apply for the Paycheck Protection Program PPP which is opening for many lenders on Tuesday you may be wondering whether unemployment and the PPP can be combined.

This Pandemic Unemployment Assistance or PUA provides up to 39 weeks of benefits to qualifying individuals who are unable to work due to COVID-19. Pandemic Unemployment Assistance is a new federal program that is part of the Coronavirus Aid Relief and Economic Security CARES Act that provides extended eligibility for individuals who have traditionally been ineligible for Unemployment Insurance benefits eg self. Waiver of the actively seeking work requirement while participating in the program.

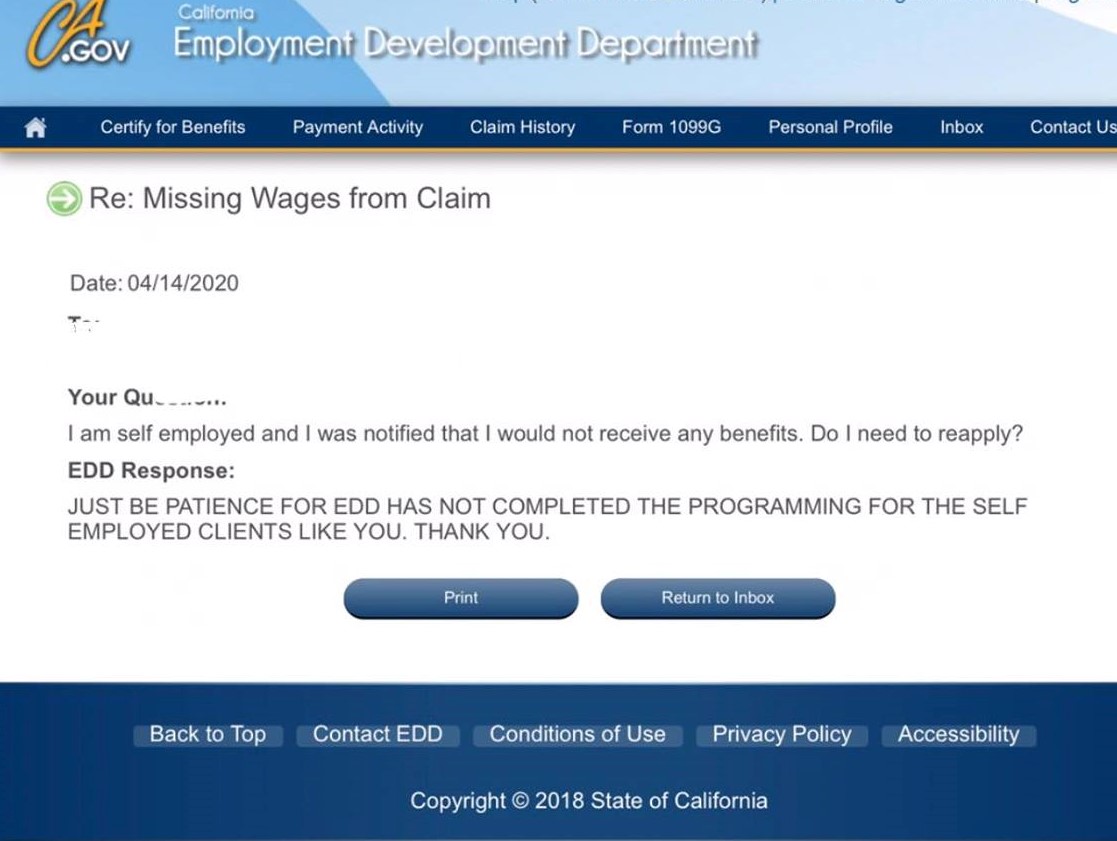

But coronavirus legislation has changed that at least temporarily. For more information and an application guide for self-employed workers see myunemploymentnjgovpua and apply online at myunemploymentnjgov. Self-Employment During the Base Year Services performed in self-employment do not qualify as base year employment and will not be used to establish financial eligibility for benefits.

Under the 2 trillion Coronavirus Aid Relief and Economic Security or CARES Act self-employed workers now qualify for 600 in weekly Pandemic Unemployment Assistance PUA. Provide unemployment benefits to self-employed workers who dont traditionally qualify. If you have no work or lost hours due to the COVID-19 pandemic you are likely eligible for help through federal Pandemic Unemployment Assistance PUA.

The federal government has made it possible for states to pay unemployment benefits to self-employed people whove seen their business suffer because of the COVID-19 pandemic.

Pandemic Unemployment Assistance Now Available To Self Employed Gig Workers And Independent Contractors Kreis Enderle

Pandemic Unemployment Assistance Now Available To Self Employed Gig Workers And Independent Contractors Kreis Enderle

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Pandemic Unemployment Assistance Pua Benefits Checklist

Pandemic Unemployment Assistance Pua Benefits Checklist

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Self Employed Unemployment Insurance Can Business Owners File

Self Employed Unemployment Insurance Can Business Owners File

Unemployed Worker Benefits Pine Tree Legal Assistance

Unemployed Worker Benefits Pine Tree Legal Assistance

Self Employed How To Claim 600 Week Unemployment Youtube

Self Employed How To Claim 600 Week Unemployment Youtube

Filing For Unemployment When Self Employed Or An Independent Contractor In Florida Unbehagen Advisors

Filing For Unemployment When Self Employed Or An Independent Contractor In Florida Unbehagen Advisors

Coronavirus Unemployment Getting Answers For The Self Employed Cbs Sacramento

Coronavirus Unemployment Getting Answers For The Self Employed Cbs Sacramento

Illinois Unemployment Ides Pua Benefits Payments Now Available For Self Employed Workers To Apply Problems Reported Abc7 Chicago

Illinois Unemployment Ides Pua Benefits Payments Now Available For Self Employed Workers To Apply Problems Reported Abc7 Chicago

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Https Www Iowaworkforcedevelopment Gov Sites Search Iowaworkforcedevelopment Gov Files Content Files Webinar 20q 26a 20 20april 2016 Pdf

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Can I Get Unemployment If I M Self Employed Credit Karma

Can I Get Unemployment If I M Self Employed Credit Karma

Https Www Louisianaworks Net Hire Admin Gsipub Htmlarea Uploads Pandemic Unemployment Assistance Pua Portal Claimants Guide Pdf

Post a Comment for "Can U Collect Unemployment If You Are Self Employed"