Can A Business Owner Collect Unemployment In Ohio

Who is an Employee for purposes of UC. This means that a shareholder can be on the payroll and if he is the S corporation must pay unemployment insurance tax on his behalf.

As A Record Number Of Ohio Unemployment Applicants Express Frustration State Officials Say They Re Working On Solutions Scene And Heard Scene S News Blog

As A Record Number Of Ohio Unemployment Applicants Express Frustration State Officials Say They Re Working On Solutions Scene And Heard Scene S News Blog

Ohio taxpayers and the people who pay into unemployment.

Can a business owner collect unemployment in ohio. Any officer of a corporation Any worker who is an employee under the usual common law rules Any worker whose services are specifically covered by law An employee may perform. Criminals may be counting on business owners to set these claims aside in the hope of a quick return. With the exception of non-profit 501c3 organizations and public entities if you run a business you may become subject to Ohios unemployment law for one of these reasons.

Things to consider about collecting unemployment with a side business Under most regular unemployment insurance regulations independent contractors and self-employed workers cant. So can LLC owners collect unemployment. You have at least one employee in covered employment for some portion of a day in each of 20 different weeks within either the current or the preceding calendar year.

Your employees if you have any are entitled to file but the rules for you as a self-employed business owner are slightly different. If you own a business and are forced to close or think you may need to close in the future you may wonder if you have any right to file for unemployment insurance. This has always been a concern for small business owners but the coronavirus pandemic brought this reality into sharp focus.

An executive order issued by Governor DeWine expands flexibility for Ohioans to receive unemployment benefits during Ohios emergency declaration period. The reason for their unemployed status will be reviewed. A sole proprietor or an LLC does not pay wages but if you are paying yourself a salary through an S-Corp or a C-Corp you pay unemployment benefits and would qualify if you met the minimum time required for drawing.

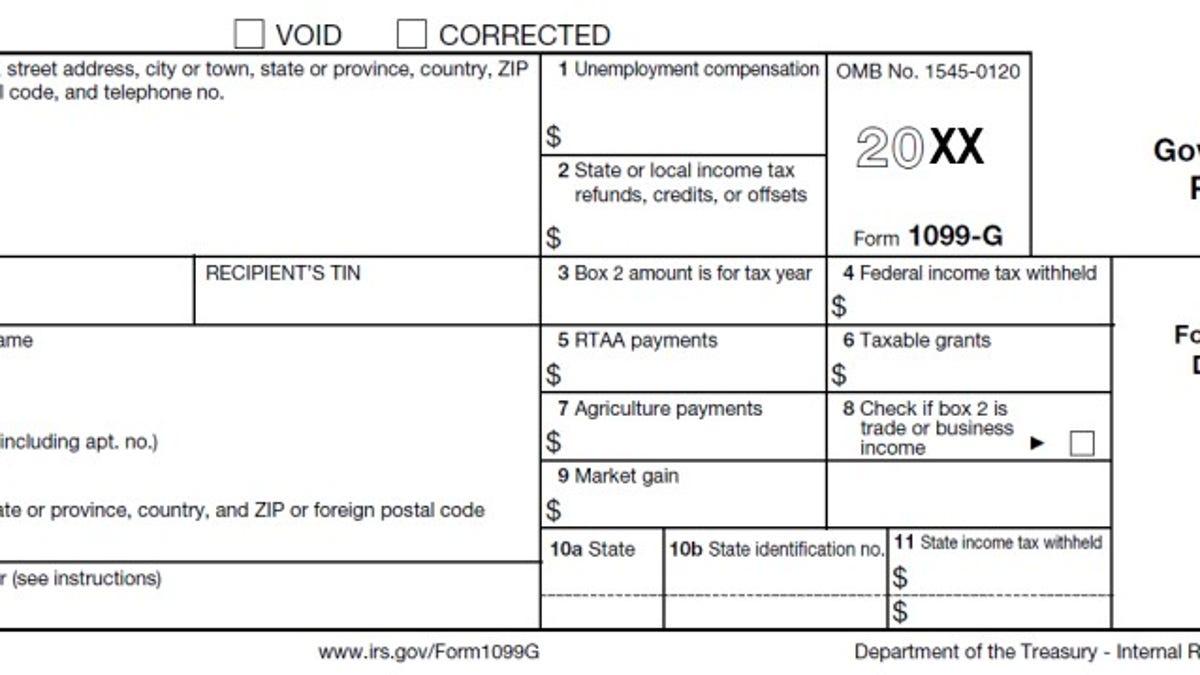

Your Unemployment Eligibility as a Business Owner. The Ohio Department of Job and Family Services doesnt yet know what documentation will be needed to apply for such extended benefits which are known as Pandemic Unemployment Assistance or PUA. However the coronavirus outbreak has us living in a time that is anything but normal and new policies have been created to provide more self-employed individuals with unemployment compensation.

Information about unemployment benefits for small business owners affected by COVID-19. Yes if the employees are otherwise eligible. If a person owns a business that is structured as a Corporation or as an S-Corporation has been drawing a salary and paying unemployment insurance and then goes out of business can the owner claim unemployment.

State unemployment insurance guidelines typically require individuals to actively seek work to receive unemployment benefits each week but there is flexibility on this factor under the CARES Act. As defined in the Ohio Revised Code an employee includes. 2020 forced many business owners to scramble to keep their business afloat and if that failed to seek LLC unemployment compensation.

Self-employed people and independent contractors are currently eligible for unemployment under the Pandemic Unemployment Assistance PUA program but as many business owners prepare to apply for the Paycheck Protection Program PPP which is opening for many lenders on Tuesday you may be wondering whether unemployment and the PPP can be combined. No Wage No Unemployment An LLC member is an owner of the company and under default rules of the IRS a member cannot receive a regular wage from the company. While many businesses in the US.

In normal times you would only be eligible for unemployment benefits if your small business 1 paid you a regular salary and 2 paid unemployment taxes on your salary. The IRS has officially stated that shareholders who work for S corporations even if the shareholder is the only owner or worker are considered employees for purposes of the Federal Unemployment Tax Act. Business owners will also get a break on unemployment benefits as the taxes they pay for them will be spread out over time.

If you are paying unemployment taxes and the business closes you could draw benefits but as an owner not drawing salary you cannot collect unemployment. Yes they can claim unemployment compensation. You may qualify for unemployment benefits as a business owner if you have lost income or are unable to work due to COVID-19.

According to the CARES Act self-employed people affected by the COVID-19 coronavirus pandemic are eligible for Pandemic Unemployment Assistance. And small businesses will get an additional boost. The IRS generally treats a multimember LLC as a partnership and a single-member LLC as a sole proprietorship with the companys entire profit attributed to the members.

Are feeling the effects of forced closures and coronavirus lockdown measures small business owners and independent contractors. So where does that money come from.

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

88 Failed Phone Calls Or Why Ohio S Unemployment System Still Can T Keep Up

88 Failed Phone Calls Or Why Ohio S Unemployment System Still Can T Keep Up

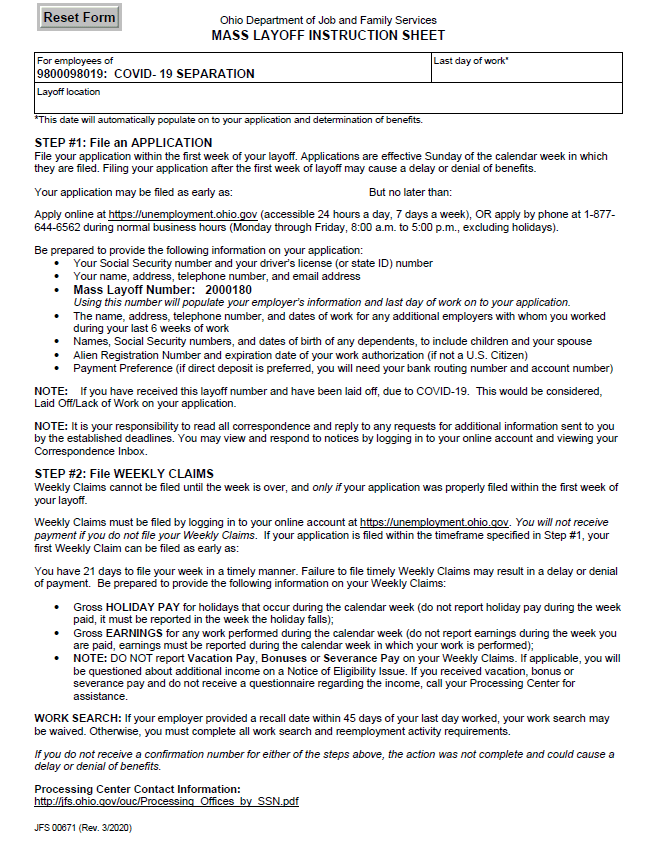

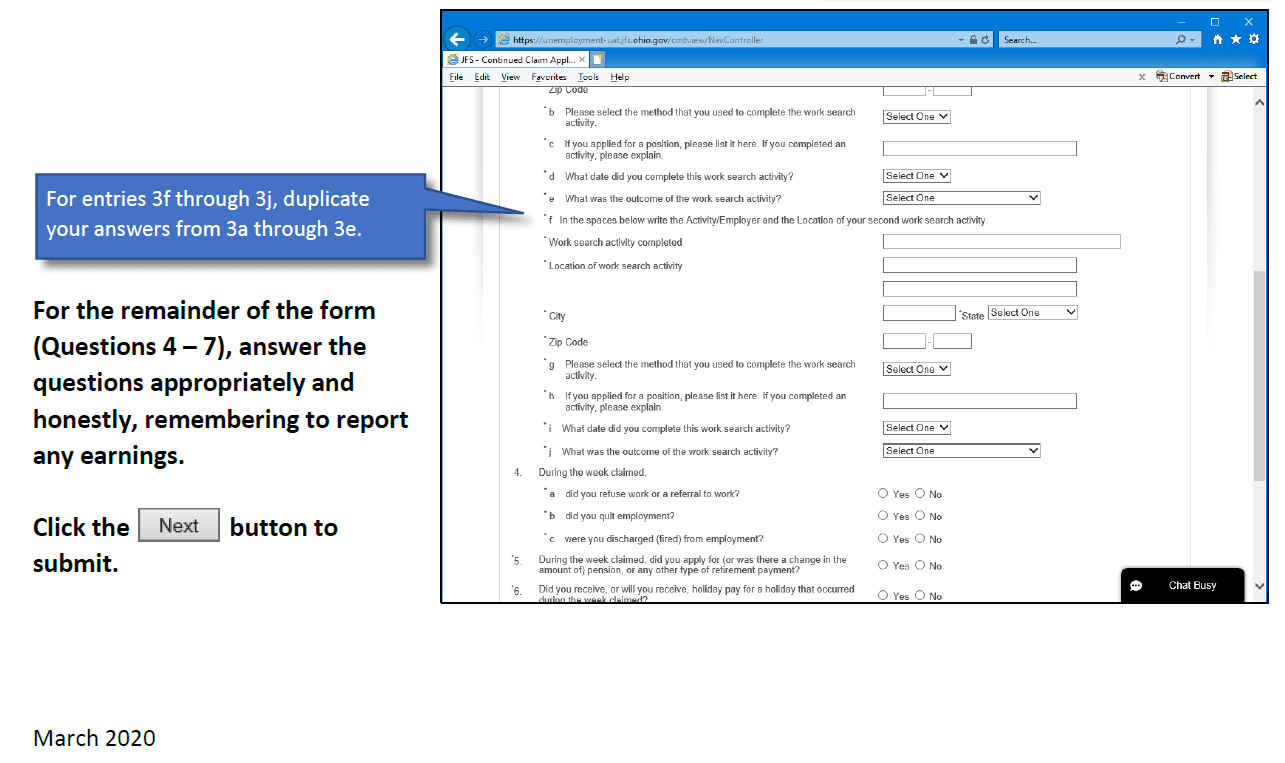

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Can Small Business Owners File For Unemployment Homebase

Can Small Business Owners File For Unemployment Homebase

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Amid Pandemic Unemployment Checks Can Take Longer To Arrive

Amid Pandemic Unemployment Checks Can Take Longer To Arrive

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Ppp Loans Vs Unemployment Benefits How To Choose Bench Accounting

Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids

Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Jfs Ohio Gov Ouio Pdf Pua Stepbystepapplicationinstructions Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Post a Comment for "Can A Business Owner Collect Unemployment In Ohio"