When Will Self Employed Get Unemployment In Kansas

We en coura ge you to apply. Yes all severance pay must be reported to the Kansas Department of Labor when filing an application and weekly claims for unemployment benefits.

Bls Unemployment Rates Stable In 42 States In September Unemployment Rate Unemployment Finance Blog

Bls Unemployment Rates Stable In 42 States In September Unemployment Rate Unemployment Finance Blog

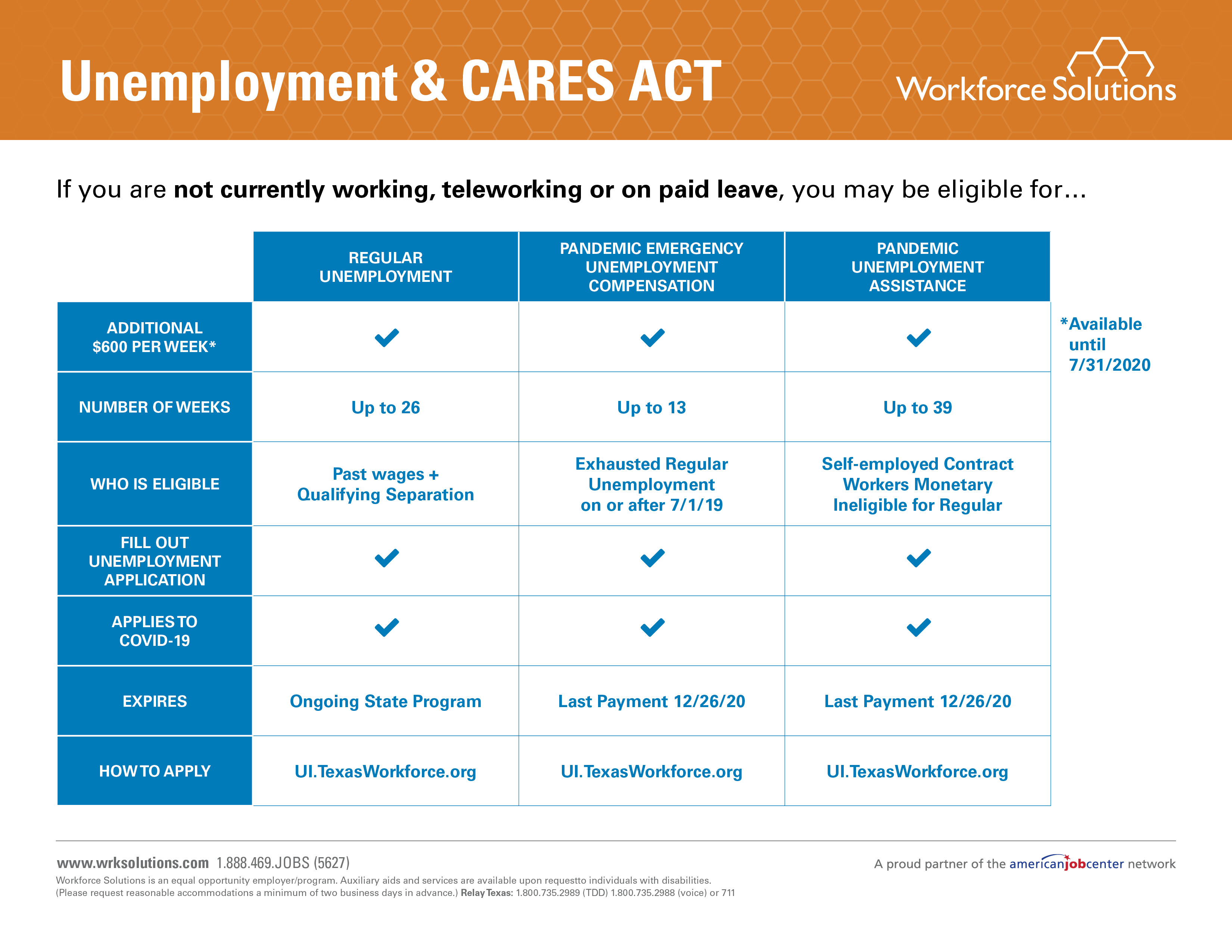

Pandemic Unemployment Assistance PUA is a broad program that expands access to unemployment in addition to what state and federal law already pay.

When will self employed get unemployment in kansas. Kansas also recently extended its unemployment benefits from 16 to 26 weeks joining the majority of states which offer benefits for half a year. When will you file for Unemployment Benefits. KANSAS DEPARTMENT OF LABOR wwwdolksgov.

Included with the letter will be a form regarding your severance from employment. KANSAS UNEMPLOYMENT CONTACT CENTER. January February March April May June July August September October November December.

You will need to complete and return the form before your scheduled call. The Kansas Department of Labor. Payments to begin May 25.

Garcia said the state is still in the process of building the Pandemic Unemployment Assistance Program which would pay out 600 to those who are self-employed or. Self-employed and gig workers in Kansas will have to wait at least three more weeks before they receive an extra 600 in unemployment benefits. After accepting applications the Kansas Department of Labor next week begins issuing Pandemic Unemployment Assistance PUA payments to more Kansas workers impacted by.

By Audri Smith Mar 16 2020. If you are not working or working reduced hours due to COVID-19 you may be eligible for Unemployment Insurance UI benefits. If you are married and your spouse also received unemployment both of you can exclude 10200.

This includes those who traditionally are not able to get unemployment such as. Pandemic Unemployment Assistance PUA Program Individuals filing for Pandemic Unemployment Assistance PUA PUA is a broad program that expands access to unemployment in addition to what state and federal law already pay. K-BEN 3120-A Web Rev.

PUA Overview PUA is a temporary federal program that provides up to 79 weeks of unemployment benefits to individuals who are not eligible for regular Unemployment Insurance UI such as. In addition to employees who have traditionally been eligible to collect unemployment insurance compensation the CARES Act extends benefits to workers who have not qualified for unemployment benefits in the past including independent contractors self-employed and gig workers and the long-term unemployed who have exhausted their benefits. Applications for 600 per week start May 12.

Self-employed workers get update on unemployment system in Kansas. Independent Contractors Gig workers such as Uber and Lyft drivers. Box 3539 Topeka KS 66601-3539 FAX.

Gig Workers are considered self- employed in Kansas. Please try again later. Wednesday May 20 2020.

10-17 Page 1 of 2. Do I have to report my severance pay when applying for unemployment benefits. You will receive a letter approximately seven 7 days after you file your application for unemployment giving you the date and time of your phone interview.

The American Rescue Plan signed into law on March 11 2021 includes a provision that makes the first 10200 of unemployment nontaxable for each taxpayer who made less than 150000 in 2020. Self-employed Kansans can begin filing for unemployment. The UI program was established as a means to protect those who are involuntarily unemployed from the financial burdens and dangers that come with being unemployed.

Our staff will determin e wh eth er or n ot you have suff icient insured earnin gs to suppor t a claim for un employm ent ben ef its. 11 2020 at 621 PM PDT. However you are eligible for 600 in unemployment benefits.

This includes those who traditionally are not able to get unemployment such as. Individuals who are self-employed. Published on Apr 30 2020.

If you have worked for an employer wh o pays un employm ent taxes in th e last 18 m onths you may be eligible. Unemployment Contact Center PO. You are not eligible for unemployment benefits through the state if you are self-employed.

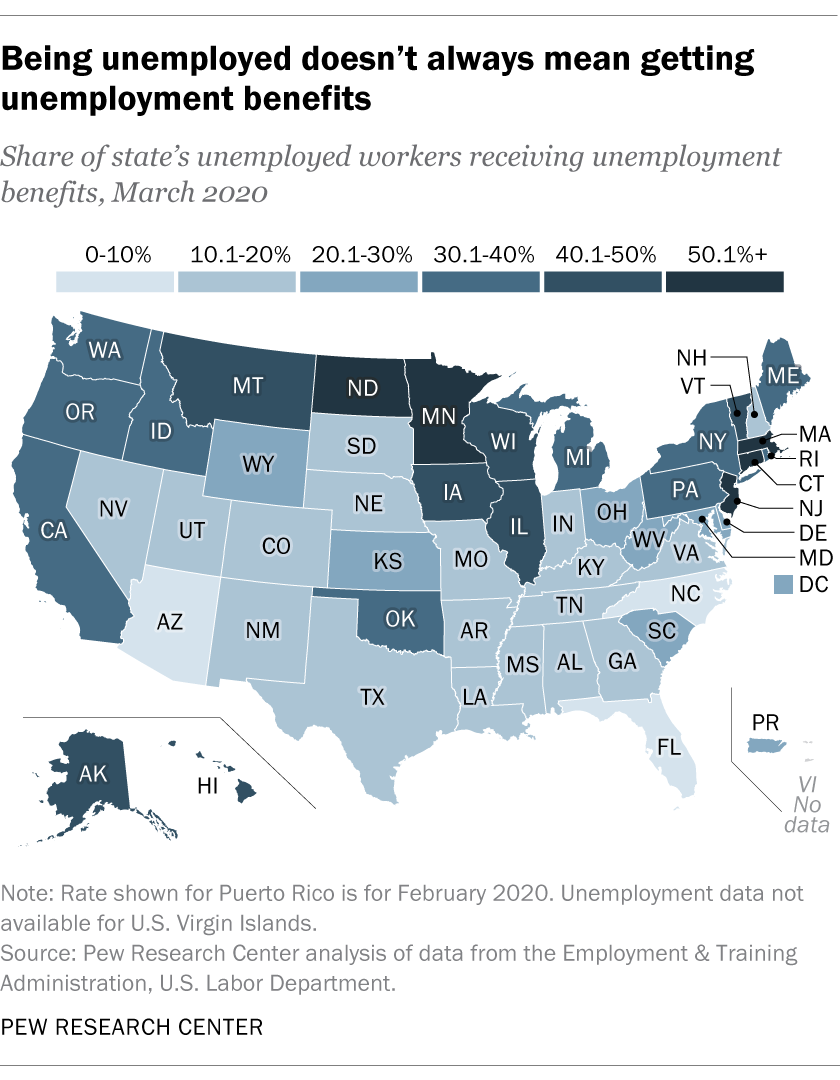

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

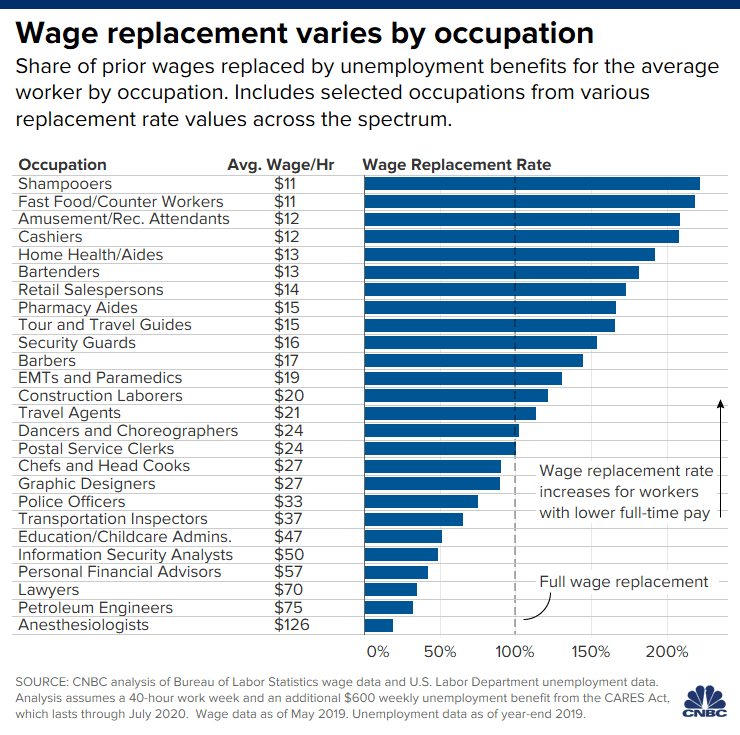

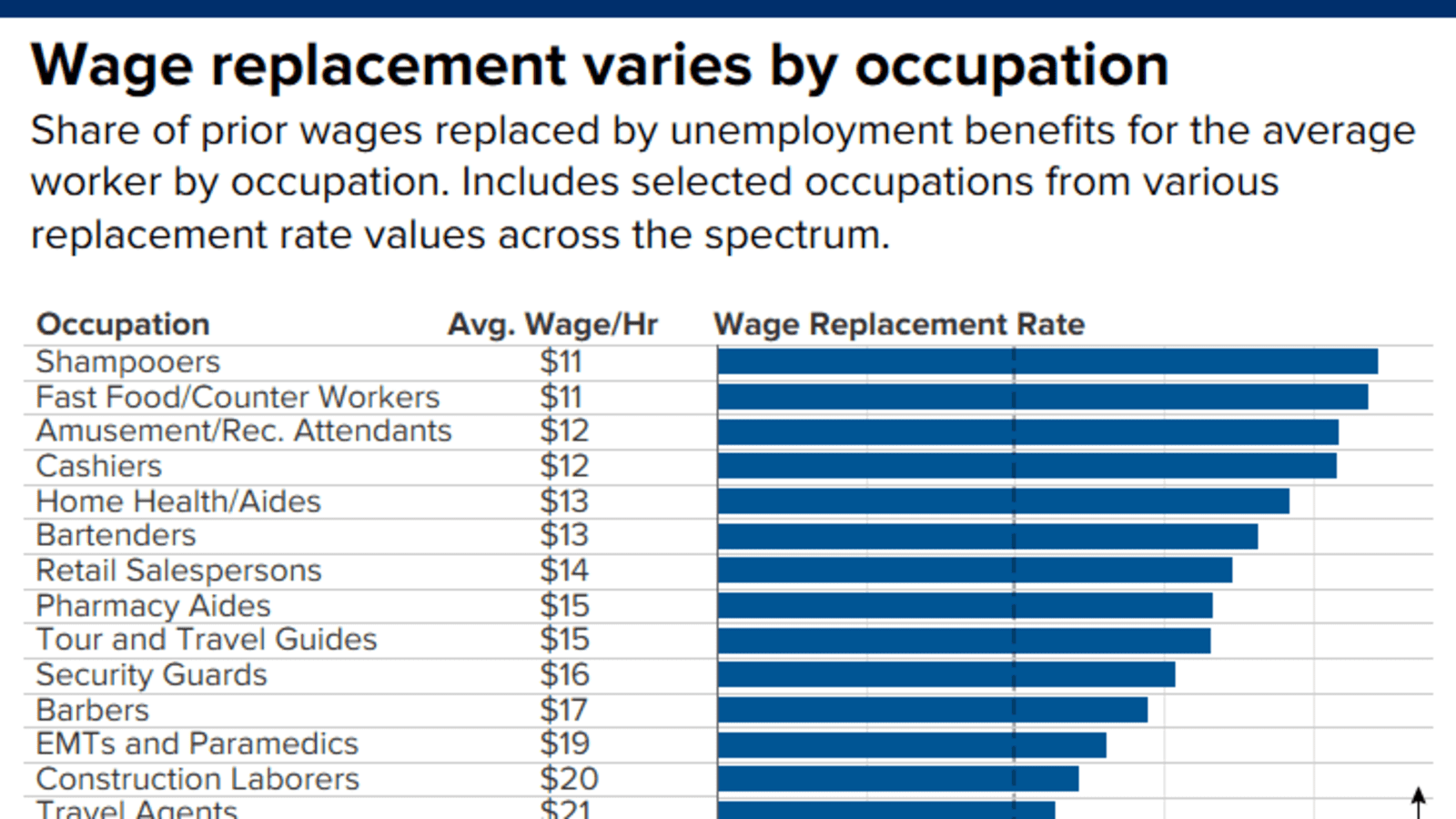

It Pays To Stay Unemployed That Might Be A Good Thing

It Pays To Stay Unemployed That Might Be A Good Thing

Unemployment In California This Is The Best Time To Make Claims Call And Other Questions Answered About Edd Peuc And Job Opportunities Abc7 San Francisco

Unemployment In California This Is The Best Time To Make Claims Call And Other Questions Answered About Edd Peuc And Job Opportunities Abc7 San Francisco

How To File For Unemployment Benefits If You Re Self Employed Youtube

How To File For Unemployment Benefits If You Re Self Employed Youtube

States With The Happiest And Unhappiest Workers Infographic Happy At Work Learning For Life Finding A New Job

States With The Happiest And Unhappiest Workers Infographic Happy At Work Learning For Life Finding A New Job

The Radial Map Policyviz Map State Abbreviations Graphing

The Radial Map Policyviz Map State Abbreviations Graphing

Self Employed Unemployment Insurance Can Business Owners File

Self Employed Unemployment Insurance Can Business Owners File

The Winging It Podcast S1 Ep 1 From Unemployed To Self Employed My Business Journey Podcas Identity Design Logo Timeless Logo Design Instagram New Feature

The Winging It Podcast S1 Ep 1 From Unemployed To Self Employed My Business Journey Podcas Identity Design Logo Timeless Logo Design Instagram New Feature

It Pays To Stay Unemployed That Might Be A Good Thing

It Pays To Stay Unemployed That Might Be A Good Thing

Gig Workers Self Employed Can Sign Up For Notification When Unemployment Benefits Can Be Filed Kfor Com Oklahoma City

Gig Workers Self Employed Can Sign Up For Notification When Unemployment Benefits Can Be Filed Kfor Com Oklahoma City

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Https Www Lkm Org Resource Resmgr Education Covid 19 Unemployment Faqs 4 10 20 Pdf

2014 S Best Worst Cities For People With Disabilities Disability Ms Awareness Illness Disease

2014 S Best Worst Cities For People With Disabilities Disability Ms Awareness Illness Disease

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Unemployment Benefits Workforce Solutions

Unemployment Benefits Workforce Solutions

A Fact Sheet I Did About The Informal Sector In The Philippines For Our Economics Class Fact Sheet Goods And Services Economics

A Fact Sheet I Did About The Informal Sector In The Philippines For Our Economics Class Fact Sheet Goods And Services Economics

Post a Comment for "When Will Self Employed Get Unemployment In Kansas"