What Is Meaning Of Unemployment Tax

Federal Income Taxes When you receive unemployment benefits theyre taxed at the federal level as ordinary income. They agreed to trim extended weekly jobless benefits to 300 from 400 but also to continue the federal boost through Sept.

10 200 Unemployment Tax Break Irs Makes More People Eligible

10 200 Unemployment Tax Break Irs Makes More People Eligible

Businesses also may have to pay state unemployment taxes which are coordinated with the federal unemployment tax.

What is meaning of unemployment tax. For a list of state unemployment tax agencies visit the US. Pandemic Unemployment Assistance PUA the federal program. Unemployment is measured by the unemployment rate which is the number of people who.

Unemployment benefits are income just like money you would have earned in a paycheck. All employers pay Federal Unemployment Tax FUTA to fund the unemployment account of the federal government which pays employees who leave a company involuntarily. Any unemployment benefits you receive over that threshold or any benefits youve received in 2021 will still be subject to income tax.

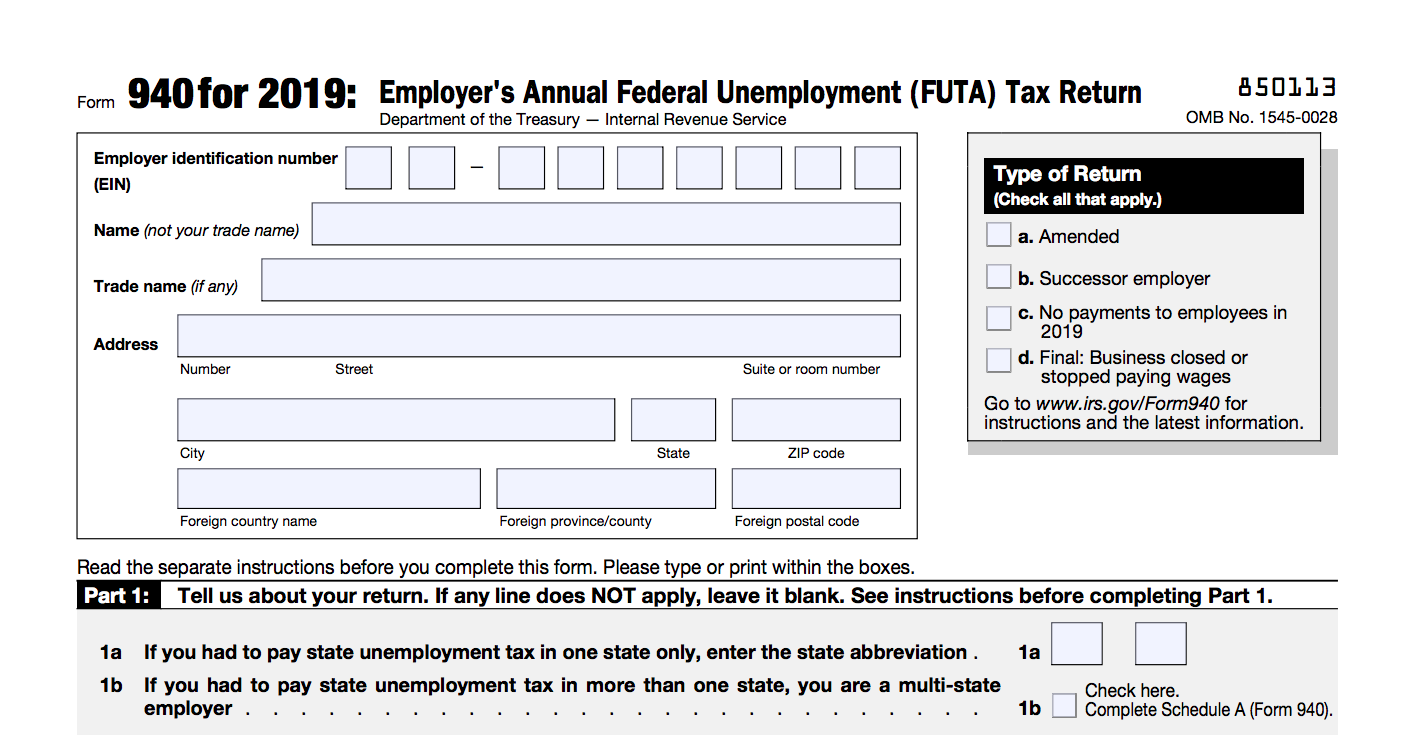

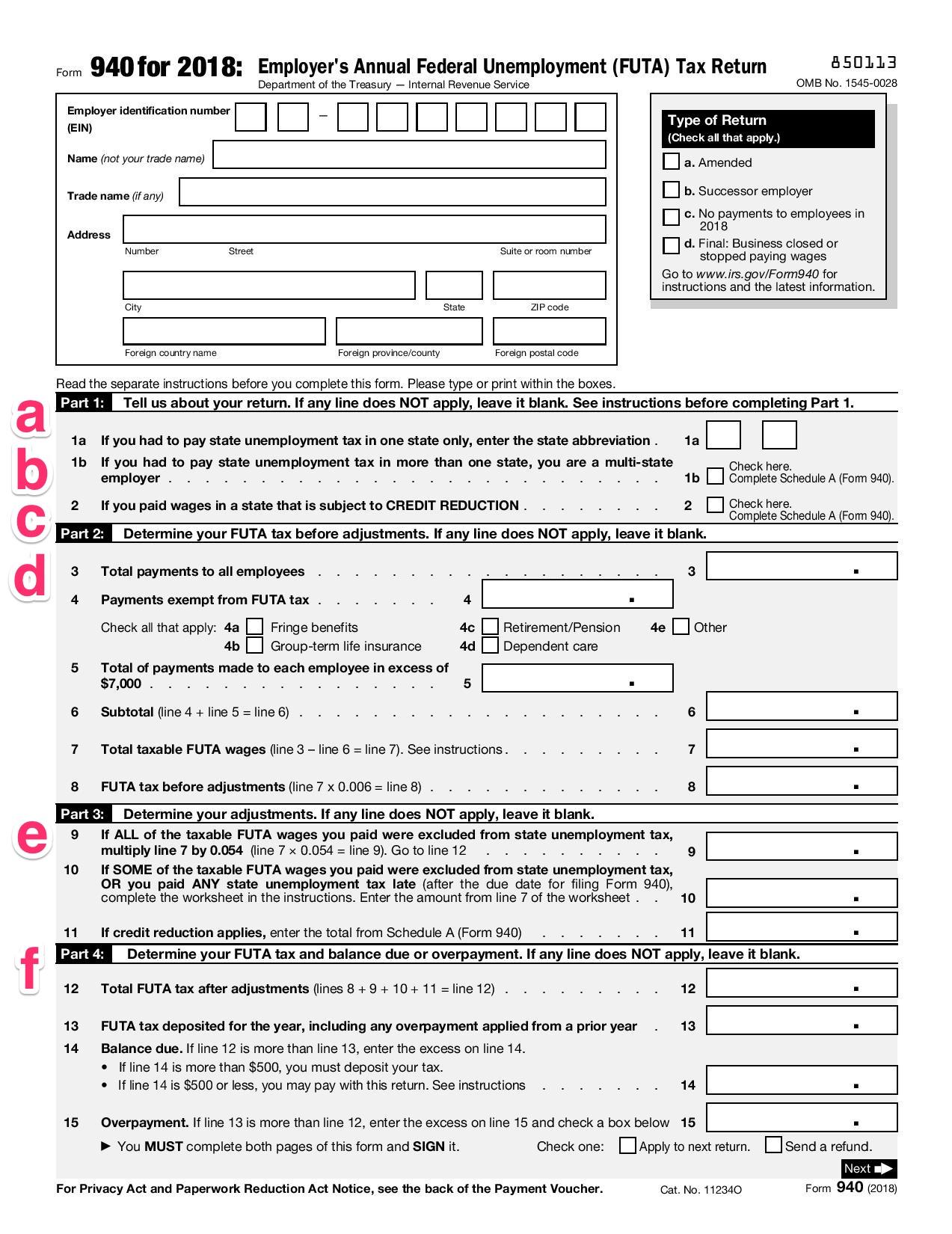

The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. If you are an employer one of the taxes you must pay is unemployment tax. Department of Labor monitors the system.

Unemployment benefits are usually taxable as income and are still subject to federal income taxes above the exclusion or if you earned more than 150000 in 2020. While the definition of unemployment is clear economists divide unemployment into many different categories. The IRS will receive a copy as well.

When filing taxes unemployment benefit recipients need to reference Form 1099-G a tax form that shows how much they received in benefits and any amounts that were withheld for tax purposes. The Federal Unemployment Tax Act FUTA is a piece of legislation that imposes a payroll tax on any business with employees. 52 rows Generally unemployment taxes are employer-only taxes meaning you do.

That means if you got 15000 from unemployment during a typical year it would be taxed in the same income tax brackets as it would if youd earned 15000 from a job. Unemployment umemployment rate 51 hai na kh 445 according to Awais according to the OECD Organisation for Economic Co-operation and Development is persons above a specified age usually 15 not being in paid employment or self-employment but currently available for work during the reference period. The revenue it generates is allocated to state unemployment insurance.

Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020 is exempt from. Making the first 10200 of unemployment insurance income tax free is aimed at keeping families from being hit with a surprise bill at a difficult time for many. Most employers pay both a Federal and a state unemployment tax.

The IRS plans to automatically process refunds for taxpayers who had unemployment income in 2020 and filed their tax returns before legislation passed that made those benefits tax-free. Youll receive a Form 1099-G after the end of the year reporting in Box 1 how much in the way of benefits you received. Department of Labors Contacts for State UI Tax Information and Assistance.

The two broadest categories of unemployment are voluntary and involuntary unemployment. Unemployment taxes are paid by employers and these taxes go into a state fund to aid workers who have lost their jobs. The unemployment income exemption is the result of a compromise between Democrats and Republicans to get the package passed.

Withholding Taxes From Unemployment Compensation. 6 and make the first 10200 of income tax free for those jobless Americans making under 150000.

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Pin On Personal Money Management

Pin On Personal Money Management

Types Of Tax And Their Definitions Personal Financial Literacy Financial Literacy Lessons Financial Literacy Anchor Chart Personal Financial Literacy

Types Of Tax And Their Definitions Personal Financial Literacy Financial Literacy Lessons Financial Literacy Anchor Chart Personal Financial Literacy

What Is The Futa Tax 2021 Tax Rates And Info Onpay

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

What Is Futa Tax 2021 Tax Rates And Information

What Is Futa Tax 2021 Tax Rates And Information

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Futa Tax Learn How To Calculate The Federal Futa Tax

Futa Tax Learn How To Calculate The Federal Futa Tax

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

What Is The Federal Unemployment Tax Futa Cleverism

What Is The Federal Unemployment Tax Futa Cleverism

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Post a Comment for "What Is Meaning Of Unemployment Tax"