What Is A Base Year For Unemployment In Pa

So if you applied in March the base year would start on Oct. In a state with varied duration it is probable that the benefit year may include less than 26 payable weeks.

Pa Unemployment Benefits Can Be Backdated Up To 52 Weeks

Pa Unemployment Benefits Can Be Backdated Up To 52 Weeks

This is because the denial is based on your eligibility for state unemployment benefits which are tied to earnings or wages earned over the prior quarters Wage Base Period.

What is a base year for unemployment in pa. For claims filed April through June the base period is. If you worked 18 weeks you can get 26 weeks of UC benefits. The first four calendar quarters of the.

You may file claims for waiting week credit and for UC benefits for weeks of unemployment occurring within your benefit year. The benefit year is a period of 52 consecutive weeks beginning with the AB date. Usually most states permit an individual to obtain unemployment for a maximum of 26 weeks or half the benefit the benefit year.

However you must have at least 18 credit weeks to qualify for benefits. Your MBA is your weekly benefit rate WBR multiplied by the number of credit weeks in your base year. Regular Base Year January through March April through June July through September and October through December represent calendar unemployment quarters.

The base period is a period of one year and does not include the most recent quarter most recent three months. In Pennsylvania as in most states the base period is the earliest four of the five complete calendar quarters before you filed your benefits claim. In the majority of the states the base period is 12 months consisting of the first four of the last five quarters of the calendar year before filing the claim.

Its the first four of the last five completed calendar quarters immediately before when you apply for benefits. A few states have standardized benefit duration while most have different durations depending upon the worker. For instance if your High Quarter was 1688 you.

The amount of qualifying wages needed is determined by the amount of wages in the High Quarter. With respect to benefit year commencing on or after July 11995 if an individual does not have sufficient qualifying weeks or wages in his base year to qualify for benefits the individual shall have the option of designating that his base year shall be the alternative base year which means the last four. Under the Pennsylvania UC Law a base year is the first four of the last five completed calendar quarters prior to the quarter in which the claim was filed.

Typically the base period or base year is the period of employment before losing the job. Tion of severance pay for purposes of computing claimant base year wages. Unemployment Compen-sation Board of Review 512 A2d 1169 Pa.

The base year is generally the first four of the last five completed calendar quarters prior to the AB date. When a former employee files an application for benefits the base year employers receives Form UC-44F3 Notice of Financial Determination. If you file your unemployment claim in January through March your base period is January through September of the previous year as well as October through December of the year prior to that.

The more money that you made in your base period the larger the amount that you will recieve every week for unemployment. Other states may have slightly different necessities. This section assigning wages to usual pay date rather than actual date of receipt pertains to employers report-.

The Pennsylvania UC Law provides that when a claimant is paid benefits charges will be billed to the reimbursable employers for whom the claimant worked during the claimants base period. If you are laid off file. If it is determined you do not have enough earnings that would qualify you for a new benefits year youll be put right back on the enhanced unemployment extensions.

For example if you filed your claim in October of 2021 the base period would be from June 1 2020 through May 31 2021. 1 2018 and go through the. Your benefit year expires one year 52 weeks after your application for benefits AB date.

For example if a claim is filed in April May or June the base year period is the four calendar quarters which comprise the. Note A calendar year is divided into four quarters known as the calendar quarters. In Pennsylvania you must have been employed for at least 16 weeks in the base year in order to get 16 weeks of joblessness.

Base Period Calculator Determine Your Base Period For Ui Benefits

Base Period Calculator Determine Your Base Period For Ui Benefits

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Pennsylvania How Unemployment Payments Are Considered

Pennsylvania How Unemployment Payments Are Considered

Pennsylvania How Unemployment Payments Are Considered

Pennsylvania How Unemployment Payments Are Considered

Pennsylvania How Unemployment Payments Are Considered

Pennsylvania How Unemployment Payments Are Considered

Pennsylvania How Unemployment Payments Are Considered

Pennsylvania How Unemployment Payments Are Considered

Base Period Calculator Determine Your Base Period For Ui Benefits

Base Period Calculator Determine Your Base Period For Ui Benefits

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

Toby Run Falls Clarion Pa Places To Go Beautiful Mountains Clarion

Toby Run Falls Clarion Pa Places To Go Beautiful Mountains Clarion

Martha Stewart Secor Accent Ottoman Metal Base Soft Fabric Small Luxe Stool Vanity Chair Modern Foam Pa Footstool Living Rooms Modern Chairs Accent Ottoman

Martha Stewart Secor Accent Ottoman Metal Base Soft Fabric Small Luxe Stool Vanity Chair Modern Foam Pa Footstool Living Rooms Modern Chairs Accent Ottoman

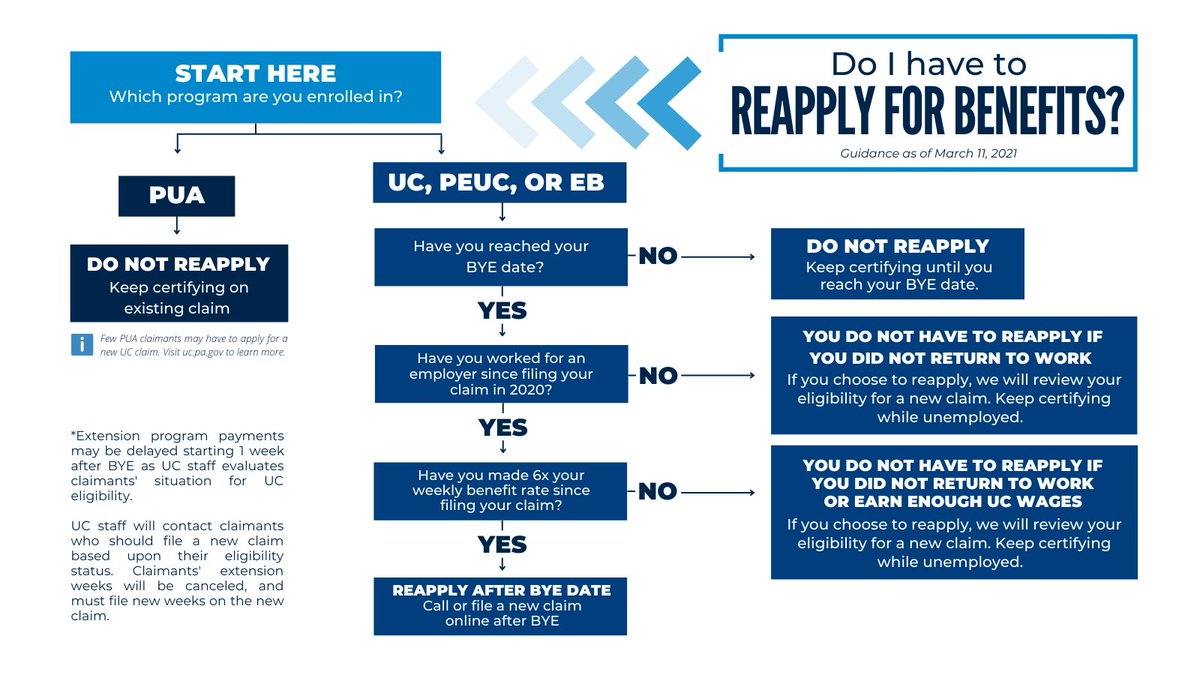

Pa Department Of Labor Industry On Twitter As A Reminder When You Reach Your Benefit Year End Bye Date The Next Steps Depend On 1 Which Program You Are Enrolled In And

Pa Department Of Labor Industry On Twitter As A Reminder When You Reach Your Benefit Year End Bye Date The Next Steps Depend On 1 Which Program You Are Enrolled In And

Http Www Uc Pa Gov Documents Ucp 20forms Ucp 1 Pdf

County Median Home Prices House Prices County Real Estate Marketing

County Median Home Prices House Prices County Real Estate Marketing

Post a Comment for "What Is A Base Year For Unemployment In Pa"