What Is A Base Week For Nj Unemployment

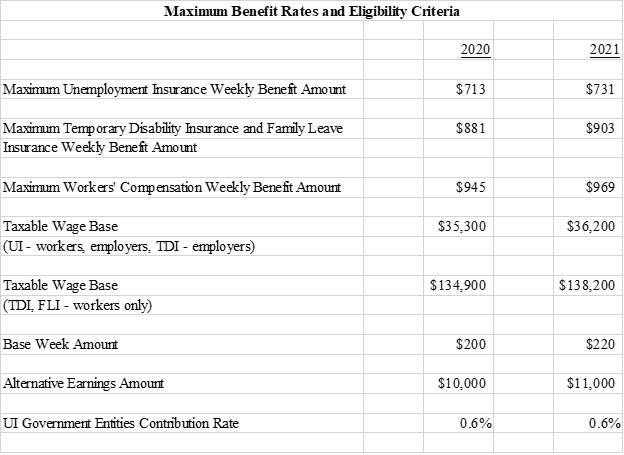

Base week A week in which you earn a minimum amount. A base week is any calendar week Sunday through Saturday in the reporting quarter during which the employee earned in employment remuneration equal to or more than 20 times the state hourly minimum wage 172 in 2019 and 200 in 2020.

New Jersey Unemployment Tips Hotel Trades Council En

New Jersey Unemployment Tips Hotel Trades Council En

The base week amount is 20 times the state hourly minimum wage 169 in 2018 and the alternate earnings test is 1000 times the state hourly minimum wage 8500 in 2018.

What is a base week for nj unemployment. Ernst Young LLP insights. The more money that you made in your base period the larger the amount that you will recieve every week for unemployment. Benefit eligibility is calculated based on the minimum wage on October 1 of the prior year.

BASE WEEK- a week with earnings not less than 20 times the state hourly minimum wage the current base week amount 172. The maximum New Jersey unemployment amount in 2020 is 713. For claims filed in 2020 a base week is one in which you earn at least 200.

July 1 2020 to June 30 2021. The law will apply to unemployed workers who have exhausted the base 26 weeks of benefits and additional 13 weeks of CARES Act benefits which runs through the end of the year. These include New York New Jersey Ohio North Carolina Washington Rhode Island Michigan Maine Vermont New Hampshire Massachusetts and Wisconsin.

You cant pick and choose which time periods you want to use to qualify. 725hr state minimum hourly wage. A base week is any calendar week Sunday through Saturday in the reporting quarter during which the employee earned in employment remuneration equal to or more than 20 times the state hourly minimum wage 16900 in 2018 and 17200 in 2019.

This number is then multiplied by the number of weeks that you worked during the base period up to a maximum of 26 weeks. Your base period is the period of time that you worked prior to losing your job in which you establish the amount of money that you will receive in unemployment. The base week is determined on the basis of earnings regardless of the actual payment date.

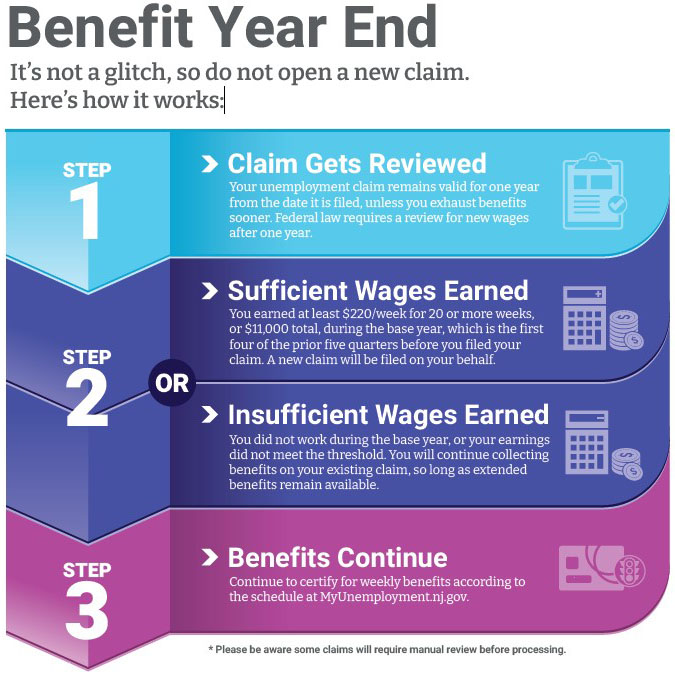

To make sure you qualify for benefits check out NJ unemployment eligibility section. For more information on unemployment taxes in New Jersey contact the Department at 1 609 633 6400 or see the Departments website. To be eligible for Unemployment Insurance benefits in 2021 you must have earned at least 220 per week a base week during 20 or more weeks in covered employment during the base year period or you must have earned at least 11000 in total covered employment during the base year period.

If you are eligible to receive unemployment your weekly benefit rate WBR will be 60 of your average weekly earnings during the base period up to a maximum of 713. Enter the number of base weeks you worked during the selected period enter between 1-52. Each state department of.

20 base weeks 20 of AWW or alternative. In your base period you must have 20 weeks where you earned gross wages totaling at least 10000. 1000 times the state minimum hourly wage.

The first four calendar quarters of the last five full quarters you worked prior to the week you file for unemployment benefits give you your base year. You may qualify for benefits if you worked at least 20 base weeks for claims filed in 2020 these are weeks during which you earned at least 200 or earned at least 10000 in any one-year period over the last 18 months. A base week is any calendar week Sunday through Saturday in the quarter during which the employee has earned a specific dollar amount or more in remuneration.

If you dont qualify for benefits using your base period wages you may be able to qualify using an alternate base period. The base period is a period of one year and does not include. A base week is defined as one where you earned at least 200.

New Jersey Unemployment Base Period. To be eligible for Unemployment Insurance benefits in 2020 you must have earned at least 200 per week during 20 or more weeks in covered employment during the base year period or you must have earned at least 10000 in total covered employment during the base year period. BASE YEAR- 52-week period on which a claim is based.

Base period The base period is the timeframe used to determine if you qualify for UI benefits and to calculate your benefit amount. The qualifying formula for wages and employment used by New Jersey is. To qualify for benefits in 2019 a person must either have earned at least 172 per week for 20 base weeks or have earned a total of at least 8600.

Example If a claim is filed anytime between January to March 2020 the base period will be 12 months from January 1 2019 to December 31 2019. The employer FY 2020 SUI tax rate notices were issued during the fourth week of July 2019. The 2020 taxable wage base of 35300 goes into effect as of the first quarter 2020.

If a week falls within two calendar quarters report it in the quarter in which four or more days fall. Base weeks are used to calculate the unemployment insurance benefit you are entitled to. The minimum wage in.

What do the terms remuneration in lieu of notice severance pay and continuation pay mean as they pertain to unemployment entitlement. The base week amount is equal to 20 times the state hourly minimum wage 172 in 2019.

2020 New Jersey Payroll Tax Rates Abacus Payroll

2020 New Jersey Payroll Tax Rates Abacus Payroll

Understanding Unemployment Benefits Nj 2 1 1

Pixeledme New Jersey State Police Minecraft Skin Minecraft Skin Minecraft Police

Pixeledme New Jersey State Police Minecraft Skin Minecraft Skin Minecraft Police

Lsnjlaw An Overview Of The Unemployment Appeals Process

Lsnjlaw An Overview Of The Unemployment Appeals Process

2021 New Jersey Payroll Tax Rates Abacus Payroll

2021 New Jersey Payroll Tax Rates Abacus Payroll

Lsnjlaw Unemployment Benefits Calculator

Lsnjlaw Unemployment Benefits Calculator

Division Of Unemployment Insurance Answers To Common Questions About Existing Claims

Division Of Unemployment Insurance Answers To Common Questions About Existing Claims

Nj Labor Department Njlabordept Twitter

Nj Labor Department Njlabordept Twitter

Coronavirus New Jersey Updates From May 2020 Abc7 New York

Coronavirus New Jersey Updates From May 2020 Abc7 New York

2019 New Jersey Payroll Tax Rates Abacus Payroll

2019 New Jersey Payroll Tax Rates Abacus Payroll

A Guide To The Extended Unemployment Benefits In New Jersey

A Guide To The Extended Unemployment Benefits In New Jersey

New Jersey Unemployment Benefits And Eligibility For 2020

New Jersey Unemployment Benefits And Eligibility For 2020

Contact For New Jersey Unemployment Benefits

Contact For New Jersey Unemployment Benefits

2018 New Jersey Payroll Tax Rates Abacus Payroll

2018 New Jersey Payroll Tax Rates Abacus Payroll

Nj Unemployment Claims Fall As 600 Federal Weekly Supplement About To End Latest Headlines Pressofatlanticcity Com

Nj Unemployment Claims Fall As 600 Federal Weekly Supplement About To End Latest Headlines Pressofatlanticcity Com

Nj Unemployment Benefit Rates Increase In Nj Started On January 1st

Nj Unemployment Benefit Rates Increase In Nj Started On January 1st

Nj Unemployment Benefit Rates Increase In Nj Started On January 1st

Nj Labor Department To Begin Making Pua Payments To Sole Proprietors And Independent Contractors Njbia New Jersey Business Industry Association

Nj Labor Department To Begin Making Pua Payments To Sole Proprietors And Independent Contractors Njbia New Jersey Business Industry Association

Post a Comment for "What Is A Base Week For Nj Unemployment"