What Are The Kiddie Tax Rules For 2018

While As example demonstrates that a childs kiddie tax may increase as a result of the TCJA C and Bs examples demonstrate the opposite. Under these rules children pay tax at their own income tax rate on unearned income they receive up to a threshold amount--for 2020 the threshold is 2200.

Free Printable Feelings Word List Mums At The Table Feeling Words List Feelings Words Emotion Words

Free Printable Feelings Word List Mums At The Table Feeling Words List Feelings Words Emotion Words

For tax years 2018 and 2019 the unearned income of certain children was taxed using the brackets and tax rates of estates and trusts.

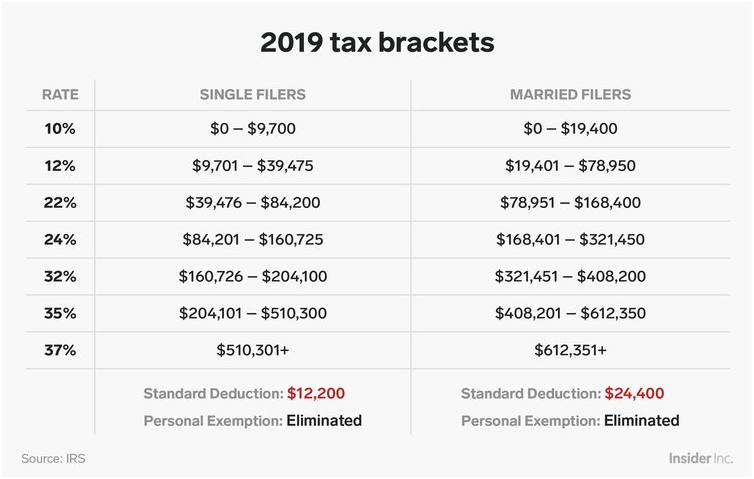

What are the kiddie tax rules for 2018. The unearned income threshold for 2018 is 2100. Under the Kiddie Tax rule the first 1100 of a childs unearned income qualifies for the standard deduction. The Tax Cuts and Jobs Act of 2017 temporarily changed the rules effective with the 2018 tax year substituting the tax rates that apply to trusts and estates for the parents tax rate making the Kiddie Tax much more expensive for some.

The next 1100 is taxed at the childs income tax rate. For 2018 a childs income that can be taxed at rates below 24 is limited to the sum of ETI plus 2550 the minimum taxable income for the 24 estatetrust tax bracket. The SECURE Act reinstated the kiddie tax as it was before 2018.

Heres the answer. Further income that can be taxed at rates below 35 is limited to the sum of ETI plus 9150 the minimum taxable income for the 35 estatetrust tax bracket. For 2018 through 2025 the TCJA revises the kiddie tax rules to tax a portion of a childs net unearned income at the rates paid by trusts and estates.

The kiddie tax applies to children who do not file a joint return have at least one living parent at the close of the tax year have more than 2200 of unearned income 2100 for 2018 and who are either 1 under age 18 or 2 are 18 or a full - time student ages 1923 and have earned income for the tax year equal to or less than one - half of their support. If the unearned income threshold is not exceeded the Kiddie Tax does not apply. It means that if your child has unearned income more than 2200 some of it will be taxed at estate and trust tax rates for tax years 2018 and 2019 or at the parents.

These rates can be as high as 37 for ordinary income or for long-term capital gains and qualified dividends as high as 20. A child or young adults unearned income beyond 2200 is taxed at the parents normal tax. For 2019 and 2020 the threshold is 2200.

For tax years after 2019 the unearned income above a certain amount is taxed at the parents rate. The rules on the first 2100 of unearned income remain unchanged. With the Tax Cuts and Jobs Act the Kiddie tax has been simplified and will stay in effect until 2025.

Whats new for 2018. Under the Kiddie Tax all unearned income above a certain threshold is taxed at the parents marginal income tax rate instead of the childs tax rate. These rates can be as high as 37 percent for ordinary income or for long-term capital gains and qualified dividends as high as 20 percent.

For 2018 through 2025 the TCJA revises the kiddie tax rules to tax a portion of a childs net unearned income at the rates paid by trusts and estates. TCJA changes to the kiddie tax and the increase in the basic standard deduction cause B s 2018 tax to be 797 lower than his 2017 liability a decrease of roughly 61. So the first 2100 of unearned income is not taxed.

Rather than using the parents tax rates on investment income above a certain threshold the kiddie. For 2018-2025 the Tax Cuts and Jobs Act TCJA revamps the Kiddie Tax rules to tax a portion of an affected childs or young adults unearned income at the rates paid by trusts and estates. Kiddie tax rules apply to unearned income that belongs to a child.

Starting with the 2018 tax year the kiddie tax rules changed from their original incarnation. As under prior law the kiddie tax applies to a childs net unearned income if the child is under age 19 or is a full-time student under age 24 has at least one living parent has unearned income above a threshold amount 2200 for 2020 and doesnt file a joint return with a spouse for the year. 5 rows Prior to the Tax Cuts and Jobs Act TCJA the kiddie tax required a childs unearned income over.

This change is mandatory for 2020 and later.

Top 12 Things You Must Know About The New Tax Laws 2018 Tax Reform Explained The Handy Tax Guy Social Media Detox Relationship What Is Love

Top 12 Things You Must Know About The New Tax Laws 2018 Tax Reform Explained The Handy Tax Guy Social Media Detox Relationship What Is Love

Avoid Penalty Increase By Filing Tax Return By Thursday Https Www Irstaxapp Com Avoid Penalty Increase By Filing Tax Filing Taxes Tax Return Tax Exemption

Avoid Penalty Increase By Filing Tax Return By Thursday Https Www Irstaxapp Com Avoid Penalty Increase By Filing Tax Filing Taxes Tax Return Tax Exemption

Use This Paycheck Card Set As An Engaging Group Activity Warm Up Or Writing Prompts For Cte Li Financial Literacy Lessons Writing Prompts Financial Literacy

Use This Paycheck Card Set As An Engaging Group Activity Warm Up Or Writing Prompts For Cte Li Financial Literacy Lessons Writing Prompts Financial Literacy

Huatrk Ipad 9 7 Inch 6th Generation Case Best Ipad Ipad 6 Ipad

Huatrk Ipad 9 7 Inch 6th Generation Case Best Ipad Ipad 6 Ipad

2020 Tax Information Standard Deduction Standard Deduction Irs Tax

2020 Tax Information Standard Deduction Standard Deduction Irs Tax

How The New Tax Law Changes Roth Ira Conversions Financial Planning Roth Ira Conversion Roth Ira Ira

How The New Tax Law Changes Roth Ira Conversions Financial Planning Roth Ira Conversion Roth Ira Ira

Abby Hatcher Cupcake Toppers Print Your Own Stickers And Cupcake Toppers Avery 22817 2 Print T Cupcake Toppers Glossy Labels Topper

Abby Hatcher Cupcake Toppers Print Your Own Stickers And Cupcake Toppers Avery 22817 2 Print T Cupcake Toppers Glossy Labels Topper

Photos River Rocks Landing Resort Venue River Rock River Resort

Photos River Rocks Landing Resort Venue River Rock River Resort

The Kiddie Tax Hurts Families More Than Ever Whalen Company Cpas

The Kiddie Tax Hurts Families More Than Ever Whalen Company Cpas

Depreciation Recapture When Selling A Rental Property Estate Tax Rental Property Tax Accountant

Depreciation Recapture When Selling A Rental Property Estate Tax Rental Property Tax Accountant

Tax Rules For Bitcoin Are Based On How It S Being Used As An Investment Capital Gains Mining Staking Investing Investment Advisor Investment Accounts

Tax Rules For Bitcoin Are Based On How It S Being Used As An Investment Capital Gains Mining Staking Investing Investment Advisor Investment Accounts

Pin On Fariyas Hotel Mumbai Specials

Pin On Fariyas Hotel Mumbai Specials

Lottery Winning Strategies Powerball Mega Millions California Lottery Florida Lottery Texas Lottery Winning Numbers Pi Lottery Strategy Lottery Florida Lottery

Lottery Winning Strategies Powerball Mega Millions California Lottery Florida Lottery Texas Lottery Winning Numbers Pi Lottery Strategy Lottery Florida Lottery

The New Kiddie Tax How It Might Change Gift Giving

The New Kiddie Tax How It Might Change Gift Giving

Tax Reform S Impact On Individual Taxpayers Warren Averett Asset Management

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining What Is Bitcoin Mining Bitcoin

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining What Is Bitcoin Mining Bitcoin

Seattle Tax Preparation Services Akopyan Company Cpa Video Tax Preparation Accounting Office Tax Preparation Services

Seattle Tax Preparation Services Akopyan Company Cpa Video Tax Preparation Accounting Office Tax Preparation Services

Post a Comment for "What Are The Kiddie Tax Rules For 2018"