Vt Unemployment Insurance Rate

All Vermont employers who have to pay Unemployment Insurance UI on their employees MUST file a quarterly wage and contribution report. Unemployment Insurance has been in existence since 1939.

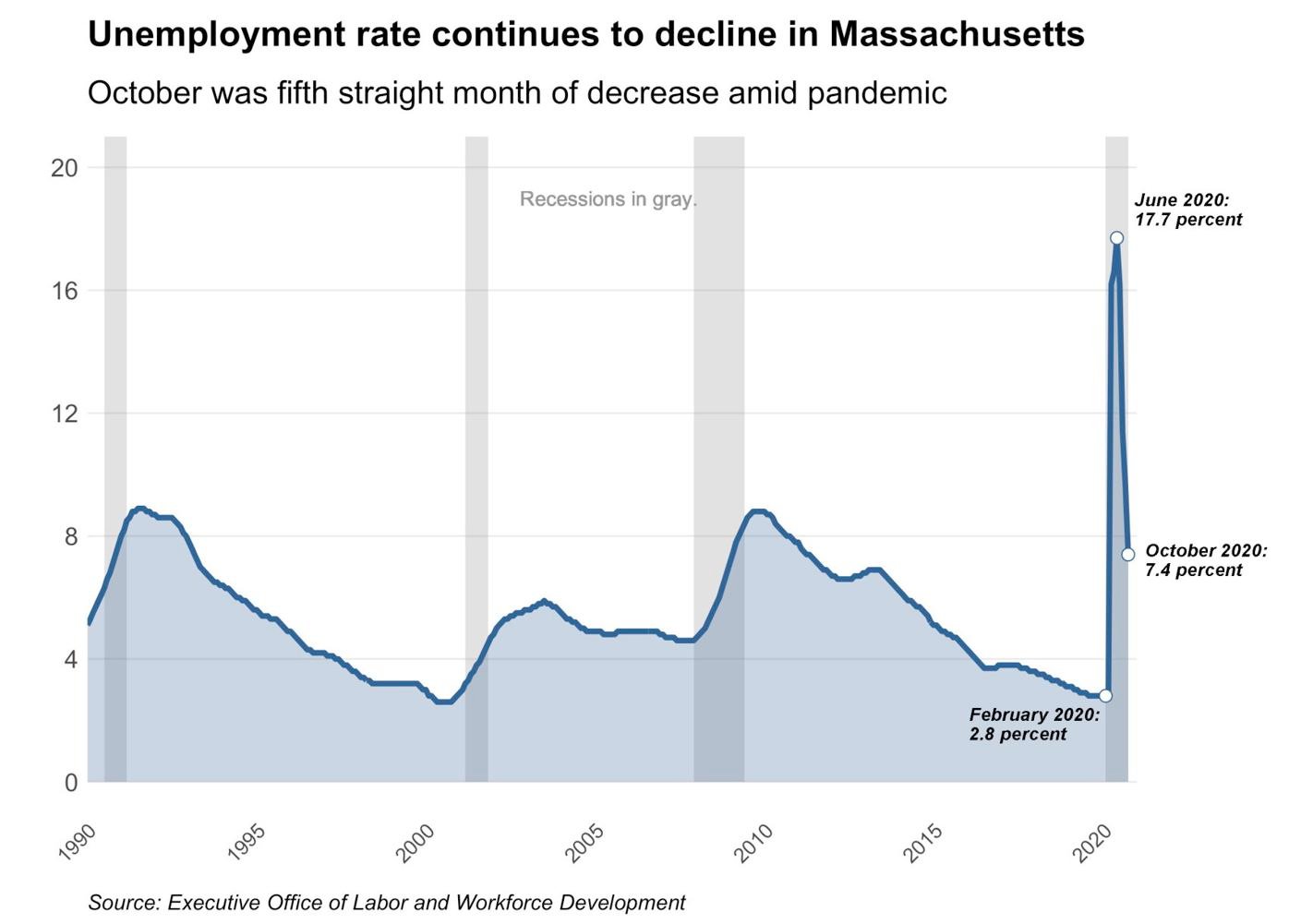

Jobless Rate Falls To 7 4 Percent In Massachusetts But Gains Slowing State Berkshireeagle Com

Jobless Rate Falls To 7 4 Percent In Massachusetts But Gains Slowing State Berkshireeagle Com

The Vermont Department of Labor administers the Unemployment Insurance program from a central office and a telephone claim center both of which are located in Montpelier.

Vt unemployment insurance rate. Effective July 1 2011 all new benefit years established will be subject to a variable duration that will be impacted by two factors. June 23 2020 Montpelier Vt. The Vermont qualifications for unemployment insurance claims must be understood before you apply for unemployment benefits.

Without exception the tax rate of an employer that has had three calendar years of benefit liability will be based on experience during the last three years. This increase is effective beginning the first full week of July. In addition to this tax rate change the maximum weekly benefit amount paid to unemployed Vermonters will increase from 513 to 531.

Here is a list of the non-construction new employer tax. The gross wages paid. Limited Service positions are established for specially funded projects or programs.

The balance of the Unemployment Insurance Trust Fund on June 30 and December 31 determines which of six Premium Rate Charts shall be used to determine Premium Rates for the following six month period. The amount due is based on. Box 488 Montpelier 05601-0488.

This increase is effective beginning the first full week of July. Labor Force Unemployment Rate The Local Area Unemployment Statistics LAUS program provides the most recent resident Vermont Labor Force Unemployment estimates. This determination by the US Department of Labor follows the recent announcement of Vermonts unemployment rate decreasing from 83 in July to 48 in August.

The tax rate that has been assigned to the employer. In addition to this tax rate change the maximum weekly benefit amount paid to unemployed Vermonters will increase from 513 to 531. However its always possible that rate could change.

Eligibility for EDD benefits takes into account a few specific factors for each applicant. Historical data from 1976. Most recently it has been approaching 17000.

The premium rate charts and fund trigger dates are provided under TCA. 10 hours agoThe Vermont Department of Labor has announced that the state is set to trigger off of the High Extended Benefits program as of October 10 2020. The current taxable wage base and.

Vermont Department of Labor 5 Green Mountain Drive PO. This position Unemployment Insurance Program Administrator IV Job Requisition 7800 is open to all State employees and external applicantsIt is a Limited Service position which is non-tenured and authorized for a specific period of time. Department of Labor offices are currently closed due to COVID-19Please contact the Department by phone.

The employer unemployment tax program and Office of Program Integrity which are. View monthly estimates of labor force employment unemployment and unemployment rates for the state counties labor market areas LMAs and towns. Because tax rates are recalculated only on an annual basis most employers pay unemployment insurance taxes at the new employer rate for at least two years before getting an experience rating.

In Vermont the state UI tax rate for most new employers also known as the standard beginning tax rate has been fixed at 1 since 2004. Maximum duration will be 46 of the base period wages OR 26 times the WBA which ever amount is LESS. This increase is effective beginning the first full week of July.

The money for unemployment benefits is solely funded by employers by paying taxes into the unemployment insurance trust fund. Vermont has a mandatory electronic filing requirement for all employers. If a petitioner is unable to meet every one of these unemployment insurance eligibility requirements the claim will be denied and no funds will be available to him or her.

Employers with questions regarding the tax schedule changes should contact the Unemployment Insurance Employer Services line at 802-828-4344 or visit laborvermontgov for more information. The purpose of unemployment insurance benefits is to provide short term replacement of lost wages to individuals who lose their jobs through no fault of their own. 52 rows SUI tax rate by state.

Employers with questions regarding the tax schedule changes should contact the Unemployment Insurance Employer Services line at 802-828-4344 or visit laborvermontgov for more information. Governor Phil Scott and the Vermont Department of Labor today announced changes to the Unemployment Insurance UI program that will reduce employers UI tax rates and increase the maximum weekly benefit amount for UI claimants. Determination of Rate Table in Effect.

In addition to this tax rate change the maximum weekly benefit amount paid to unemployed Vermonters will increase from 513 to 531.

Additional And Extended Benefits Department Of Labor

Additional And Extended Benefits Department Of Labor

Weekly Unemployment Claims Hold At Over 1 800 Vermont Business Magazine

Weekly Unemployment Claims Hold At Over 1 800 Vermont Business Magazine

Unemployment Rate Among Veterans Masks High Unemployment Of Post 9 11 Veterans Veteran Owned Business Psa Veteran Owned Businesses News Vobeacon

Unemployment Rate Among Veterans Masks High Unemployment Of Post 9 11 Veterans Veteran Owned Business Psa Veteran Owned Businesses News Vobeacon

Weekly Unemployment Claims Continue To Slide Now Under 1000 Vermont Business Magazine

Weekly Unemployment Claims Continue To Slide Now Under 1000 Vermont Business Magazine

Unemployment Insurance Data Employment Training Administration Eta U S Department Of Labor

Unemployment Insurance Data Employment Training Administration Eta U S Department Of Labor

Weekly Unemployment Claims Continue To Rise Vermont Business Magazine

Weekly Unemployment Claims Continue To Rise Vermont Business Magazine

.png?width=600) How Do Education And Income Affect Employment Across Vermont Across Vermont Vt Patch

How Do Education And Income Affect Employment Across Vermont Across Vermont Vt Patch

Weekly Unemployment Claims Level Off Vermont Business Magazine

Weekly Unemployment Claims Level Off Vermont Business Magazine

Visualizing Unemployment By Metropolitan Area

Visualizing Unemployment By Metropolitan Area

Weekly Unemployment Claims Still Edging Up Vermont Business Magazine

Weekly Unemployment Claims Still Edging Up Vermont Business Magazine

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

Unemployment Insurance Data Employment Training Administration Eta U S Department Of Labor

Unemployment Insurance Data Employment Training Administration Eta U S Department Of Labor

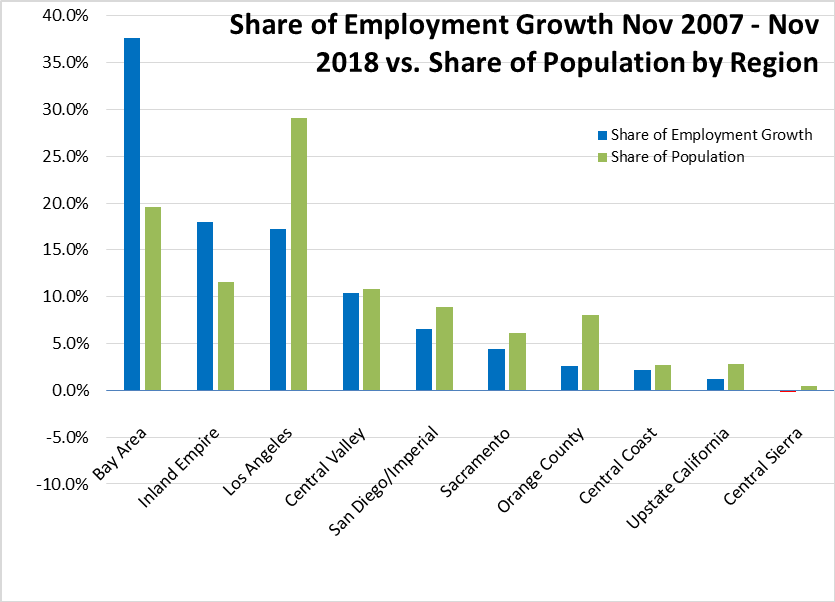

November 2018 Jobs Report Center For Jobs 50 States

November 2018 Jobs Report Center For Jobs 50 States

Unemployment States 2010 Blue 10 Orange 7 Gray 4 Primary Care Primary Care Physician States In Usa

Unemployment States 2010 Blue 10 Orange 7 Gray 4 Primary Care Primary Care Physician States In Usa

Unemployment Ethnic Diversities Of Argentina Wiki Fandom

Unemployment Ethnic Diversities Of Argentina Wiki Fandom

Weekly Unemployment Claims Keep Falling Still Over 2 100 Vermont Business Magazine

Weekly Unemployment Claims Keep Falling Still Over 2 100 Vermont Business Magazine

Weekly Unemployment Claims Edge Up Over 500 Vermont Business Magazine

Weekly Unemployment Claims Edge Up Over 500 Vermont Business Magazine

Post a Comment for "Vt Unemployment Insurance Rate"