Unemployment W2 And Self Employed

The FFCRA provides two self-employed tax credits to help cover the cost of taking time off due to COVID-19. Benefits available for self-employed workers Unemployment benefits are available for Washingtonians who have lost work because of the COVID-19 crisisincluding freelancers independent contractors and other self-employed workers.

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

This money goes to fund state unemployment insurance which workers who lose their jobs may be eligible to receive.

Unemployment w2 and self employed. The IRS will receive a copy as well. How Taxes on Unemployment Benefits Work. During the application process when UBS asks non-traditional workers the reason for their job separation they should select reduced hours.

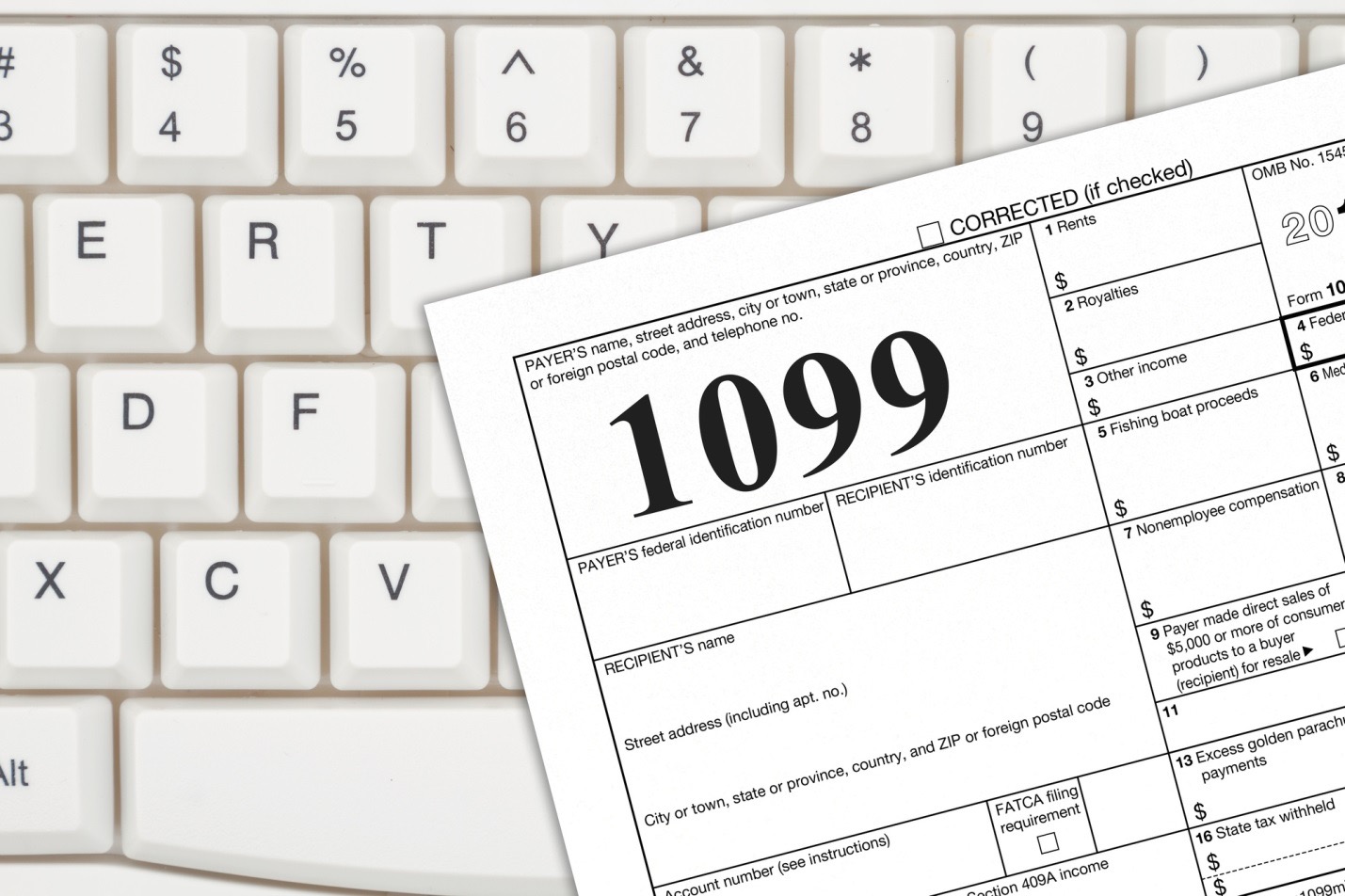

People who worked gig jobs or were other self-employed in 2020 will receive a 1099 instead of a W2. I am self employed and in Spring 2020 I applied for PUA unemployment in NJ due to reduced work from Covid. While most of the text in these laws apply to businesses with employees it also applies to self-employed individuals.

Were reviewing the tax provisions of the American Rescue Plan Act of 2021 signed into law on March 11 2021. The form is for folks who earned money but didnt pay taxes on those earnings. Unemployment benefits are income just like money you would have earned in a paycheck.

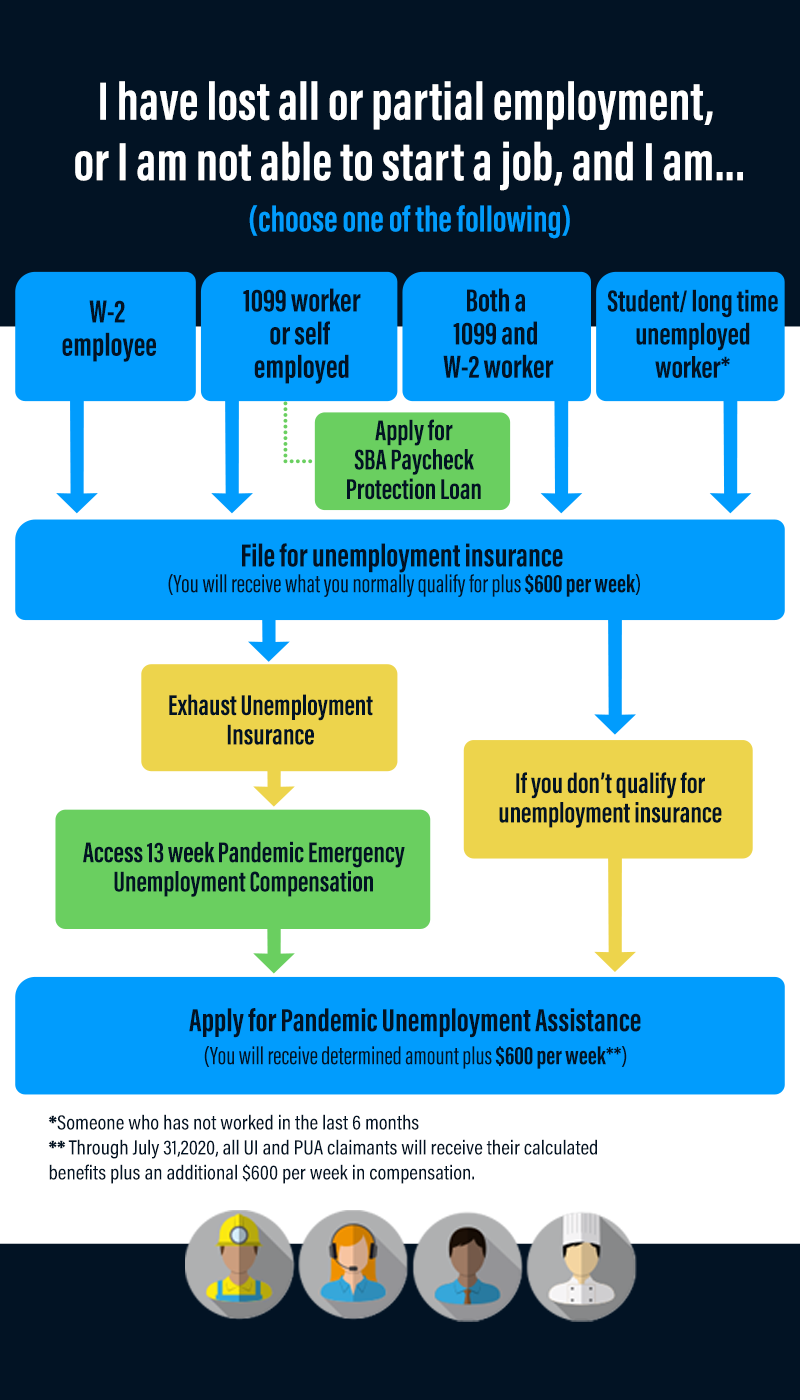

The coronavirus relief package passed in December 2020 also established a new program for self-employed workers who also earn income via traditional W-2. Being self-employed usually means you cant get unemployment benefits when your business income dips or dries up. Due to the recent coronavirus pandemic many businesses and individuals are facing challenging times including those that are self-employed.

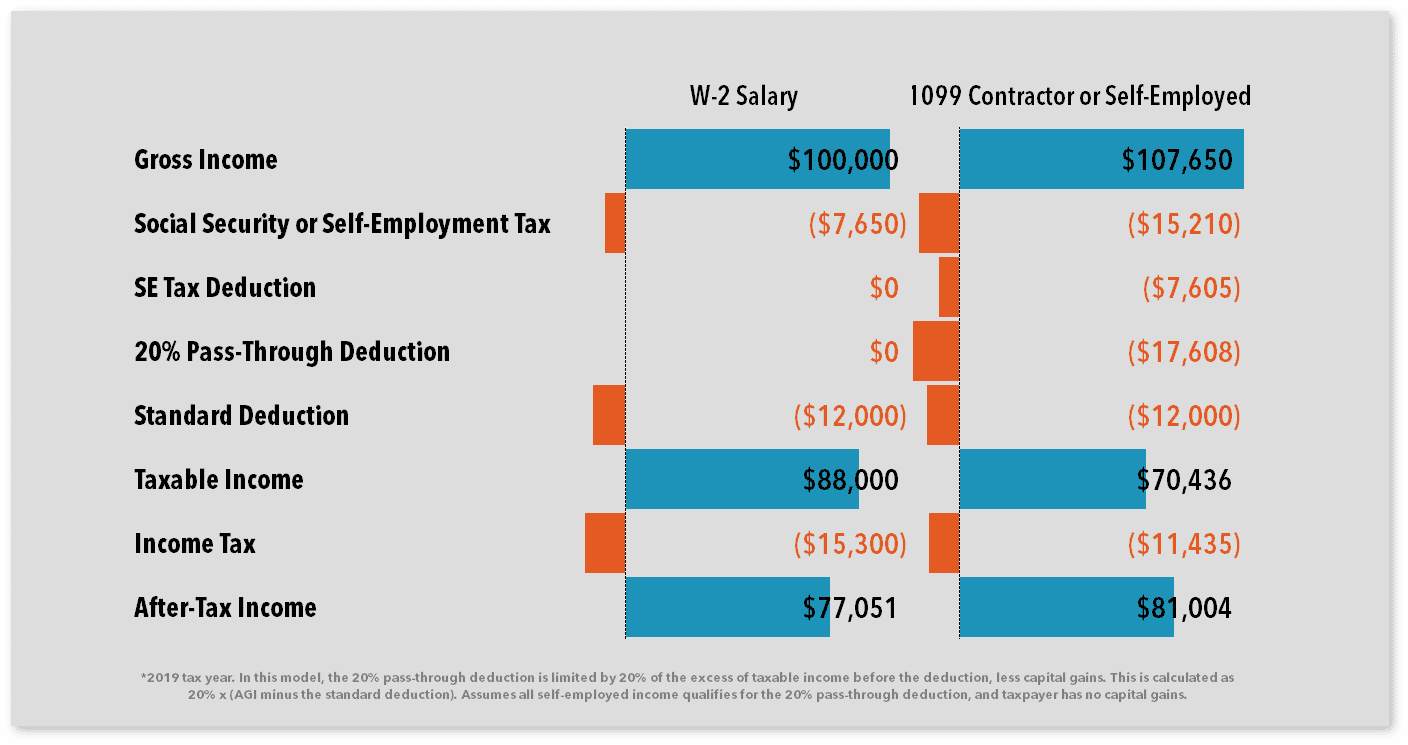

AUSTIN The Texas Workforce Commission TWC advises self-employed contract and gig workers who have lost work due to the COVID-19 pandemic to apply for Pandemic Unemployment Assistance PUA using Unemployment Benefits Services UBS. Youll receive a Form 1099-G after the end of the year reporting in Box 1 how much in the way of benefits you received. Except for federal unemployment benefits both self-employed individuals and employees pay the same taxes.

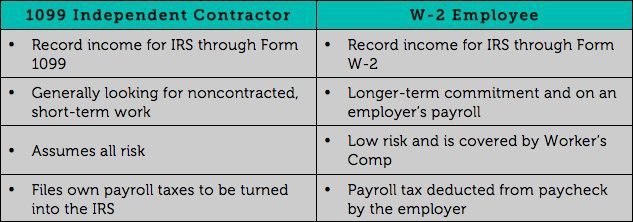

Self-employed individuals pay these taxes based on the income of their business while employees have these taxes withheld from their paychecks and pay on their individual income tax returns. Traditionally self-employed professionals are ineligible for unemployment benefits because they generally do not make contributions to the unemployment taxes that these benefits come from. With the recent introduction of new unemployment and relief benefits for self-employed professionals though your eligibility may change.

Federal income taxes and taxes for Social Security and Medicare. The federal government has made it possible for states to pay unemployment benefits to self-employed people whove seen their business suffer because of the COVID-19 pandemic. Pandemic Unemployment Assistance is a new federal program that is part of the Coronavirus Aid Relief and Economic Security CARES Act that provides extended eligibility for individuals who have traditionally been ineligible for Unemployment Insurance benefits.

How do i get a w-2 if i am self employed. But coronavirus legislation has changed that at least temporarily. The federal tax filing deadline for individuals has been extended to May 17 2021.

It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. A 1099 is a wage statement that your employer will give to you when you worked. For instance with new plans like disaster relief.

The Pandemic Unemployment Assistance PUA program was made to help workers who wouldnt otherwise qualify for unemployment insurance like self-employed and freelance workers. For the latest updates on coronavirus tax relief related to this page check IRSgovcoronavirus. The money partly replaces your lost earnings and helps you pay expenses while looking for new work.

I was approved although only was paid for 2 weeks when my income dipped below the threshold to allow me to receive benefits that week. Yes you can claim both credits however it may be limited. Self-employed individuals generally must pay self-employment tax SE tax as well as income tax.

Self-employed workers do not need to deduct state unemployment taxes from the money they earn making them ineligible for benefits. The government has issued unemployment insurance for self-employed individuals to help them manage their finances. The new federal CARES Act extensions make this possible.

The tax treatment of unemployment benefits you receive depends on the type of program. The benefits from taxes your former employers paid are not based on financial need. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

However employers who contract with self-employed workers do not make unemployment tax deductions. A W2 is a wage statement that your employer will give to you when you worked for them and they held out taxes for you. If you are self-employed an independent contractor or a farmer you may now be eligible and can file for benefits online.

Unemployment benefits provide you with temporary income when you lose your job through no fault of your own.

Hardship Letter Sample Letter Sample Lettering Financial Institutions

Hardship Letter Sample Letter Sample Lettering Financial Institutions

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

S Corporation Reminder Before You Finalize Your Year End Payroll Don T Forget To Include Shareholder Medical Insurance Premiums In W 2 Wages Wegner Cpas

S Corporation Reminder Before You Finalize Your Year End Payroll Don T Forget To Include Shareholder Medical Insurance Premiums In W 2 Wages Wegner Cpas

Independent Contractor Unemployment Online Accounting

Independent Contractor Unemployment Online Accounting

1099 Vs W2 Difference Between Independent Contractors Employees

1099 Vs W2 Difference Between Independent Contractors Employees

California Last Year I Had A W2 Job And A 1099 Job Self Employed I Made Way More Income With My 1099 But Edd Didn T Approve Me For Pua The Government Bill

California Last Year I Had A W2 Job And A 1099 Job Self Employed I Made Way More Income With My 1099 But Edd Didn T Approve Me For Pua The Government Bill

Unemployment Assistance Assembly Democratic Caucus

Unemployment Assistance Assembly Democratic Caucus

Petition Unemployment Relief For Independent Workers With Mixed Income Types Change Org

Petition Unemployment Relief For Independent Workers With Mixed Income Types Change Org

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

How W2 Employees Are Taxed Differently Than 1099 Contractors

How W2 Employees Are Taxed Differently Than 1099 Contractors

1099 Vs W2 Be Better At Business Podcast Eagle Employer Services

1099 Vs W2 Be Better At Business Podcast Eagle Employer Services

What Is The Difference Between A W2 Employee And A 1099 Employee Az Big Media

What Is The Difference Between A W2 Employee And A 1099 Employee Az Big Media

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Guide To Cares Act Unemployment For Self Employed Business Owners Kelli Loo Cpa

Guide To Cares Act Unemployment For Self Employed Business Owners Kelli Loo Cpa

1040 Statutory Employees Schedulec Schedulese W2

1040 Statutory Employees Schedulec Schedulese W2

Post a Comment for "Unemployment W2 And Self Employed"