Unemployment W2 2020 Online

Youll also need this form if you received payments as part of a governmental paid family leave program. If you were out of work for some or all of the previous year you arent off the hook with the IRS.

1099 Form Fileunemployment Org

1099 Form Fileunemployment Org

The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

Unemployment w2 2020 online. If you do not have an online account with NYS DOL you may call 1-888-209-8124 to request 1099. To access this form please follow these instructions. The Department will begin mailing IRS Forms 1099-G for the calendar year 2020 no later than January 31 2021.

IRS Form W-2 - Wage and Tax Statement for each employee for a calendar year. Unemployment rate peaked in April 2020 to 148a level not seen since data collection began in 1948before declining to a still-high 67 in December to close out the year. We will post an update on this page when the forms are mailed out and when UI Benefit payment information for 2020 can be viewed online.

1099-G income tax statements for 2020 are available online. Bureau of Labor Statistics BLS and released by IDES. NOTE that pursuant to the IRS webpage the following now applies to your federal taxes.

The address shown below may be used to request forms for prior tax years. How to find form 1099-G on the New York Department of. If you do not have an online account with NYSDOL you may call.

Pays for administration of the national unemployment insurance program Send form to IRS by mail and transmit payment using IRS online system by 131 for the preceding year. The 1099-G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment Assistance payments during the calendar year January 1 to. Unemployment benefits including Federal Pandemic Unemployment Compensation FPUC Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Lost Wages Assistance LWA and Extended.

If you received unemployment your tax statement is called form 1099-G not form W-2. A customer service representative will contact you either by phone or from the uiclaimshelpiwdiowagov email address. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

Unemployment compensation is taxable income and must be reported each year even if you have repaid some or all of the benefits received. Please report your case of suspected fraud as soon as possible online or by calling our fraud hotline at 609-777-4304. If you receive a 1099-G but did not receive Unemployment Insurance compensation payments in 2020 you may be the victim of identity theft.

Unemployment Help Request Form. Contributory Employers - The Office of Unemployment Insurance has elected not to charge Contributory Employer Reserve Accounts for any unemployment benefits paid out during the 2nd 3rd and 4th quarters of 2020. IRS Form 940 - Employers Annual Federal Unemployment Tax Return.

Information for tax year 2020 is now available. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment. 866-832-2363 815am to 430pm Monday - Friday and 9am to 1pm on Saturday closed Sunday and state holidays For TTY Callers.

Eligibility and Requirements Should you become unemployed in Washington this guide will offer you a comprehensive explanation of the way in which you should go about filing your claim for unemployment benefits. But you dont have to wait for your copy of the form to arrive in the mail. First and foremost it is important to understand who is qualified to receive WA unemployment benefits.

A good rule of thumb is that those who are most likely to receive benefits. In 2020 an international crime ring used previously stolen personal information to fraudulently claim unemployment benefits in states across the country. The Illinois Department of Employment Security IDES announced today that the unemployment rate decreased -03 percentage point to 74 percent while nonfarm payrolls were up 21100 jobs in February based on preliminary data provided by the US.

How to Get Your 1099-G online. To access your form online log in to labornygovsignin click Unemployment Services select 2020 from the dropdown menu and click ViewPrint Your 1099-G. Workers receiving unemployment will get an extra 600 per week on top of their normal benefits and some gig workers independent contractors and others who may not qualify for standard unemployment will newly be.

You can submit an Unemployment Help Request Form for the fastest assistance. Virginia Relay call 711 or 800-828-1120. Expanded and enhanced unemployment benefits provided by the federal stimulus are set to go online in Washington state on April 18th.

If you claimed unemployment benefits in 2020 you will need it to correctly file your tax return this year. Those who received unemployment benefits for some or all of the year will need a 1099-G form. If you believe youre a fraud victim or if youve already reported fraud to us but received a 1099-G for fraudulently paid benefits please see the tax information for fraud victims page.

Submit quarterly tax reports over the Internet through either an on-screen form or a file upload option.

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Missouri Unemployment W2 Forms Vincegray2014

Missouri Unemployment W2 Forms Vincegray2014

Unemployment Guides Archives Fileunemployment Org

Unemployment Guides Archives Fileunemployment Org

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment W2 Form 2014 Vincegray2014

Unemployment W2 Form 2014 Vincegray2014

Unemployment W2 Forms Nj Vincegray2014

Unemployment W2 Forms Nj Vincegray2014

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Instant W2 Form Generator Create W2 Easily Form Pros

Instant W2 Form Generator Create W2 Easily Form Pros

Massachusetts Unemployment W2 Forms Vincegray2014

Massachusetts Unemployment W2 Forms Vincegray2014

Ky Unemployment W2 Forms Vincegray2014

Ky Unemployment W2 Forms Vincegray2014

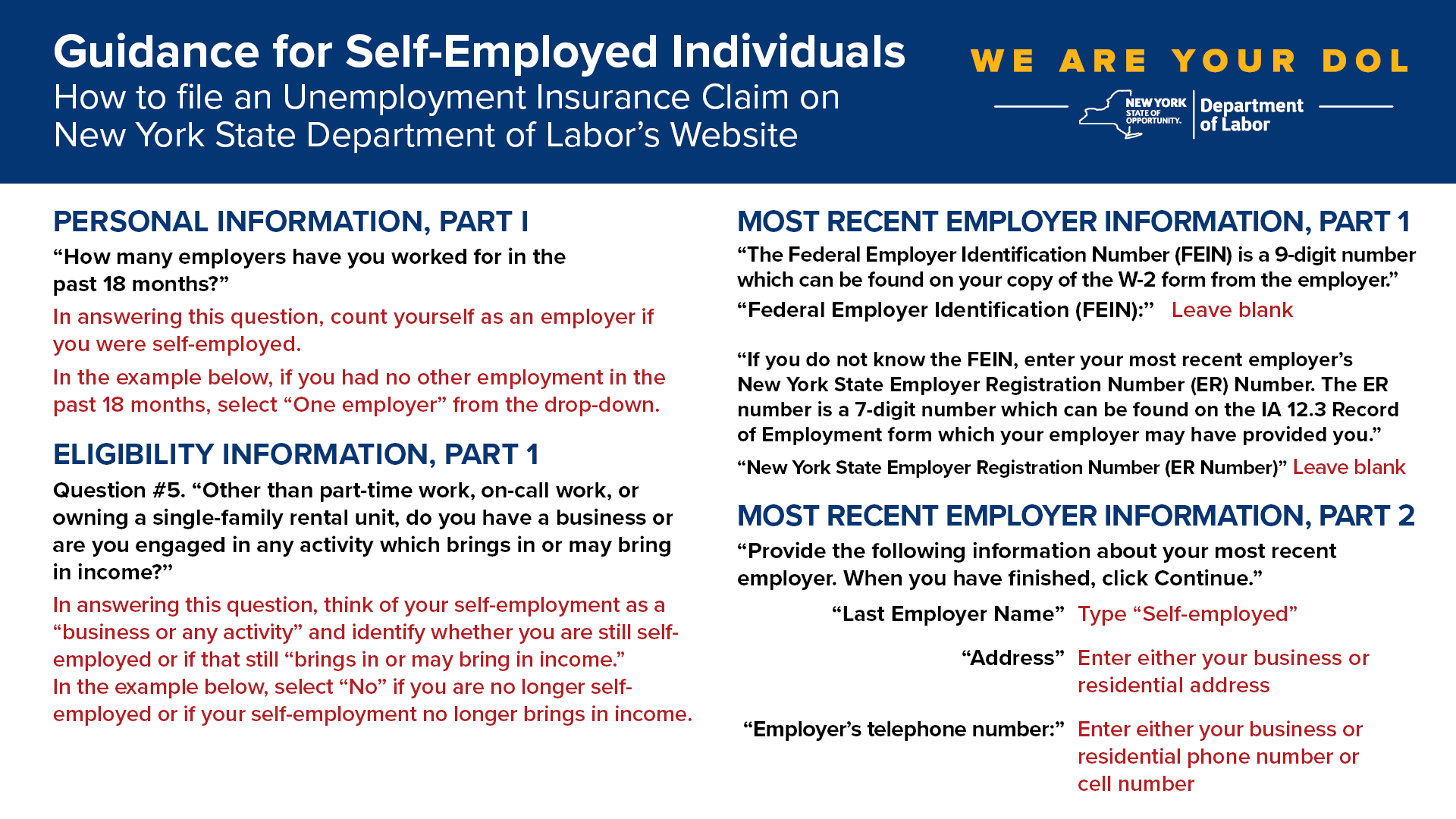

Nys Department Of Labor On Twitter If You Are Self Employed You Can Now Apply For Unemployment Insurance Benefits The Best Way To File Is Online At Https T Co T2tezsp2lf Please See Guidance Below On

Nys Department Of Labor On Twitter If You Are Self Employed You Can Now Apply For Unemployment Insurance Benefits The Best Way To File Is Online At Https T Co T2tezsp2lf Please See Guidance Below On

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Ky Unemployment W2 Forms Vincegray2014

Ky Unemployment W2 Forms Vincegray2014

How To Apply For Unemployment Assistance In Florida Without Having The Website Crash

How To Apply For Unemployment Assistance In Florida Without Having The Website Crash

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Indiana Unemployment W2 Forms Vincegray2014

Indiana Unemployment W2 Forms Vincegray2014

Post a Comment for "Unemployment W2 2020 Online"