Unemployment Tax Rate Oregon

009 00009 for 2nd quarter. Current Unemployment Insurance Tax in 2020 Imposed on taxable wage of subject employer Minimum rate 07 Maximum rate 54 Schedule II in 2020 Tax base rate 21 new employer rate Taxable wage base in 2020 is 42100 adjusted every year Statutorily listed deadline for filing q uarterly tax report and payment.

Aging Oregon Pt 1 Population Growth Oregon Office Of Economic Analysis Economic Analysis Comparative Advantage Aging

Aging Oregon Pt 1 Population Growth Oregon Office Of Economic Analysis Economic Analysis Comparative Advantage Aging

COVID-19 Interest and Penalty Relief Application.

Unemployment tax rate oregon. Despite facing the highest unemployment rate in Oregons history the 2021 payroll tax schedule is a modest shift from the 2020 tax schedule with an average rate of 226 percent on the first 43800 paid to each employee. Taxable base tax rate. New employers are assigned a base rate until they have had sufficient experience to qualify for an experience rate based tax rate.

Website Terms. The state UI tax rate for new employers also known as the standard beginning tax rate also changes from one year to the next either increasing or decreasingIn recent years it generally has been between 29 and 33Established employers are subject to a lower or higher rate than new employers depending on an experience ratingThis means among other things whether your business has. All employers are mailed their rate for the next calendar year by.

Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule four for the 2021 calendar year. The Oregon Employment Department and the Oregon Law Center announced they have submitted a proposed settlement in a class action lawsuit. 2021 Tax RatesFiling Due Dates.

15 on its website. This usually takes about three years. My Business Account Information.

The breakdown obtained through a. General Oregon payroll tax rate information. Despite facing the highest unemployment rate in Oregons history the 2021 payroll tax schedule is a modest shift from the 2020 tax schedule with an average rate of 226 percent on the first 43800 paid to each employee.

You can take the tax break if you have an adjusted gross income of less than 150000. Taxable payroll includes payroll for a maximum of. Online Payroll Reporting System.

012 00012 for 1st quarter. Unemployment tax rates are assigned in accordance with Oregon law. The suit filed by fourteen Oregonians who waited weeks or months for unemployment benefits sought to resolve issues related to timeliness challenges and language barriers faced by Oregonians filing for.

You will be taxed at the regular rate for any federal unemployment benefits above 10200. Anthony Smith the Oregon State Director for the National Federation of Independent Business spoke up for the roughly 16000 employers who actually saw their unemployment tax rates. Starting in 2021 Proposition 208 approved by.

45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers. For 2020 unemployment tax rates for experienced employers generally are to decrease because they are to be determined with Schedule 2 under which tax rates range from 07 to 54. UI Trust Fund and Payroll Taxes FAQ.

Unemployment Tax Rates are assigned in accor-dance with Oregon Law. Tax Forms. This usually takes about three years.

UI Trust Fund fact sheet. 26 new employer rate Special payroll tax offset. Employment Department Unemployment.

That signals House Bill 3389 is. Skip to the main content of the page. Next year 145200 Oregon businesses will see a jump in UI tax rates according to a breakdown by the Oregon Employment Department.

Contact the UI Tax Division. Paid Family and Medical Leave Insurance. 2021 UI Tax Relief fact sheet.

Oregons unemployment-taxable wage base is to be 42100 up from 40600 for 2019 the state Employment Department said Nov. New employers are assigned a base rate until they have sufficient experience to qualify for an experience rate based tax rate. 1 day agoA bill to give Oregon employers a significant break on their unemployment insurance taxes advanced out of a House committee on a 7-0 bipartisan vote Thursday.

2021 Tax Rates and breakdown of changes for Oregon employers. The specific rate each employer will pay under the. Despite facing the highest unemployment rate in Oregons history the 2021 payroll tax schedule is a modest shift from the 2020 tax schedule with an average rate of 226 percent on the first 43800 paid to each employee.

Oregon S Nonresident Workers Article Display Content Qualityinfo

Oregon S Nonresident Workers Article Display Content Qualityinfo

Oregon Increase Unemployment Taxable Wage Base For 2020 501 C Services

Oregon Increase Unemployment Taxable Wage Base For 2020 501 C Services

Oregon Msa Venture Cap Investment Economic Indicator Investing Start Up

Oregon Msa Venture Cap Investment Economic Indicator Investing Start Up

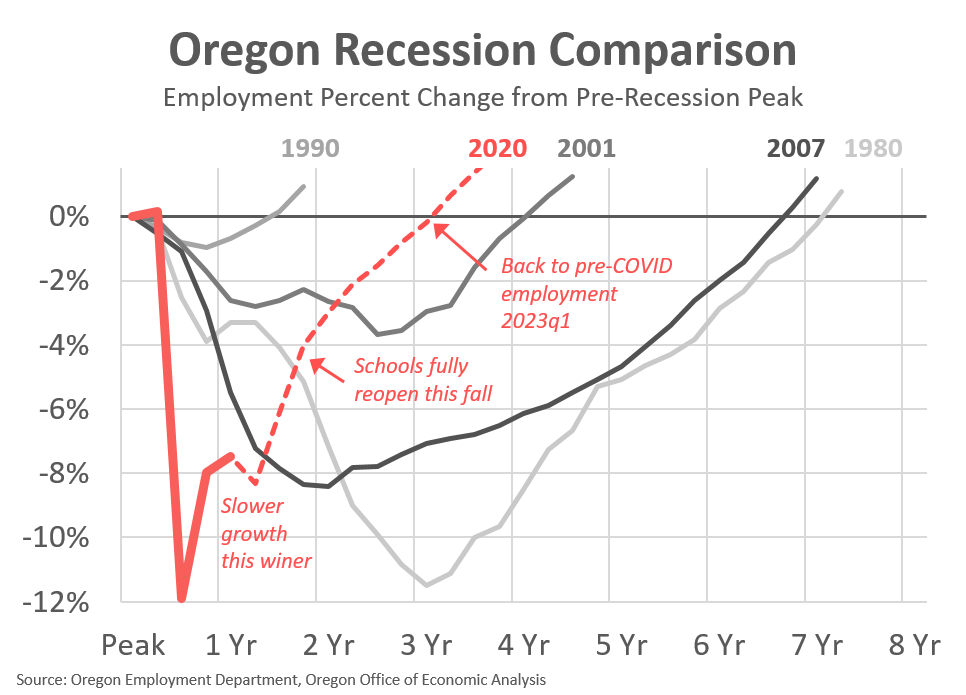

Oregon S Labor Market Recovers Unevenly Oregon Center For Public Policy

Oregon S Labor Market Recovers Unevenly Oregon Center For Public Policy

Wage Inequality In Oregon A Wide Gap Article Display Content Qualityinfo Seasonal Jobs Inequality Economic Indicator

Wage Inequality In Oregon A Wide Gap Article Display Content Qualityinfo Seasonal Jobs Inequality Economic Indicator

Millionaires Don T Need More Tax Breaks Will The Oregon Legislature Give Them More Next Week Oregon Center For Public Policy

Millionaires Don T Need More Tax Breaks Will The Oregon Legislature Give Them More Next Week Oregon Center For Public Policy

Oregon S Labor Market Recovers Unevenly Oregon Center For Public Policy

Oregon S Labor Market Recovers Unevenly Oregon Center For Public Policy

Predictions For The 2020s Oregon Office Of Economic Analysis Economic Analysis Economic Trends Predictions

Predictions For The 2020s Oregon Office Of Economic Analysis Economic Analysis Economic Trends Predictions

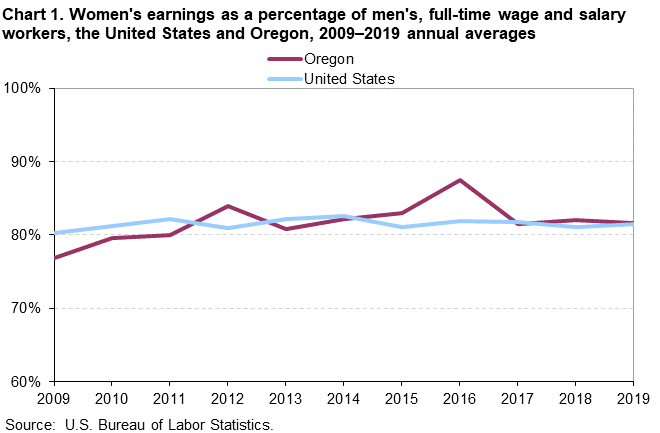

Women S Earnings In Oregon 2019 Western Information Office U S Bureau Of Labor Statistics

Women S Earnings In Oregon 2019 Western Information Office U S Bureau Of Labor Statistics

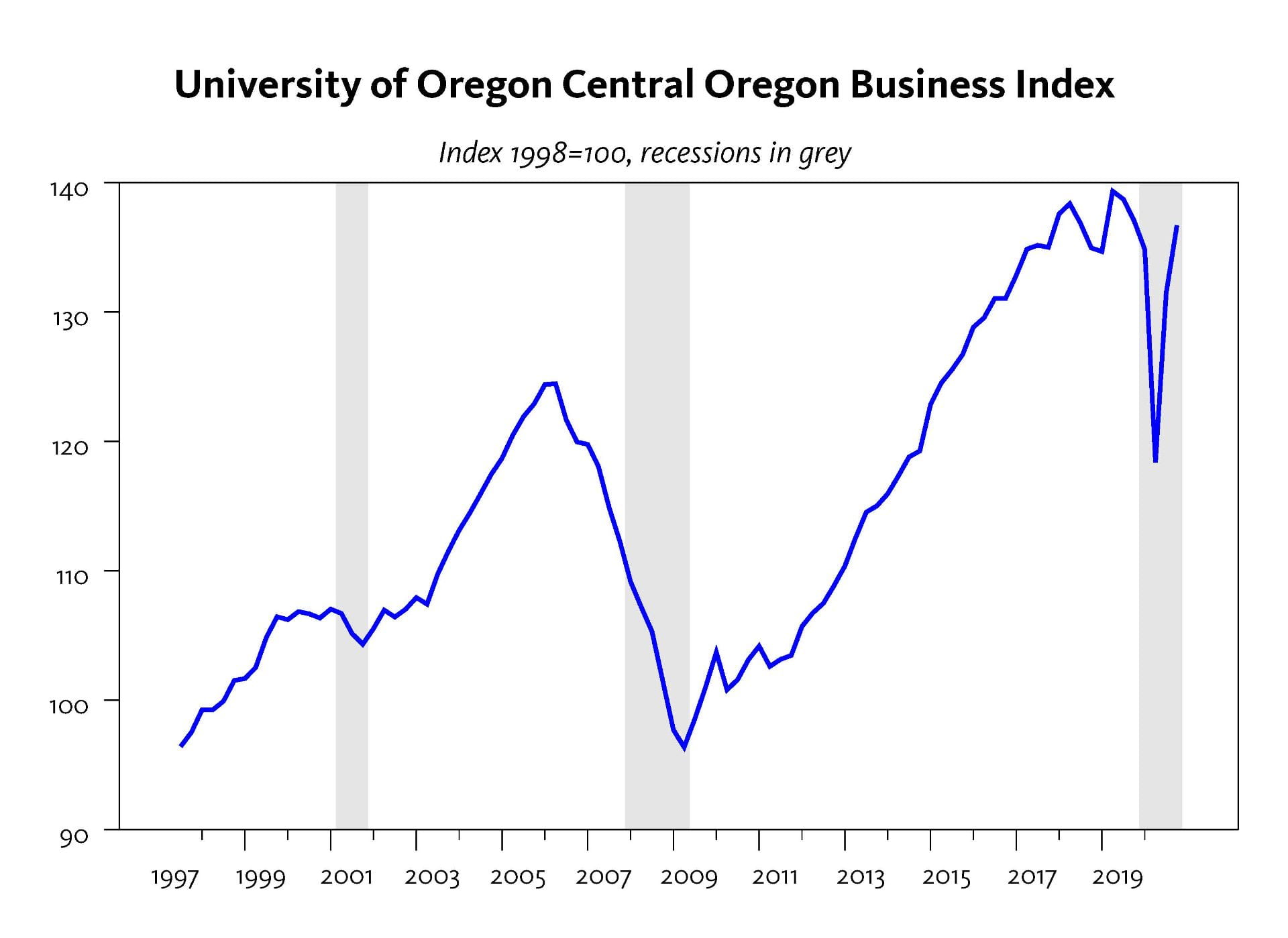

2019 21 Oregon Office Of Economic Analysis

2019 21 Oregon Office Of Economic Analysis

Oregon Enjoys Strong Economic Growth Oregon Center For Public Policy

Oregon Enjoys Strong Economic Growth Oregon Center For Public Policy

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into A Paycheck Hourly Jobs Salary

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into A Paycheck Hourly Jobs Salary

Oregon Economic And Revenue Forecast December 2019 Oregon Office Of Economic Analysis Economic Analysis Economic Indicator Rainy Day Fund

Oregon Economic And Revenue Forecast December 2019 Oregon Office Of Economic Analysis Economic Analysis Economic Indicator Rainy Day Fund

Food Insecurity In Oregon And The U S Uneven Recovery In The Midst Of Overall Development 2014 2016 Osu Extension Service

Food Insecurity In Oregon And The U S Uneven Recovery In The Midst Of Overall Development 2014 2016 Osu Extension Service

Individual Income Tax As A Proportion Of State Tax Revenue State Tax Income Tax Income

Individual Income Tax As A Proportion Of State Tax Revenue State Tax Income Tax Income

May 2020 Employment A Happy Surprise Oregon Office Of Economic Analysis Economic Analysis Employment Marketing Data

May 2020 Employment A Happy Surprise Oregon Office Of Economic Analysis Economic Analysis Employment Marketing Data

State Of Oregon Blue Book Government Finance State Government

State Of Oregon Blue Book Government Finance State Government

Post a Comment for "Unemployment Tax Rate Oregon"