Unemployment Not Taxable Senate Bill

Senate Democrats agreed to lower additional unemployment aid to 300 per week from 400 but extended the payments through Sept. An act to amend the tax law in relation to excluding from state income tax unemployment compensation benefits PURPOSE.

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

This legislation would permit the same exclusion from tax for 2020 for qualified taxpayers to.

Unemployment not taxable senate bill. Karen Keiser D-Des Moines and several others pushes the unemployment insurance tax increases back from taking effect in 2021 to 2025 including. After passing both the state senate and house Gov. They also included a.

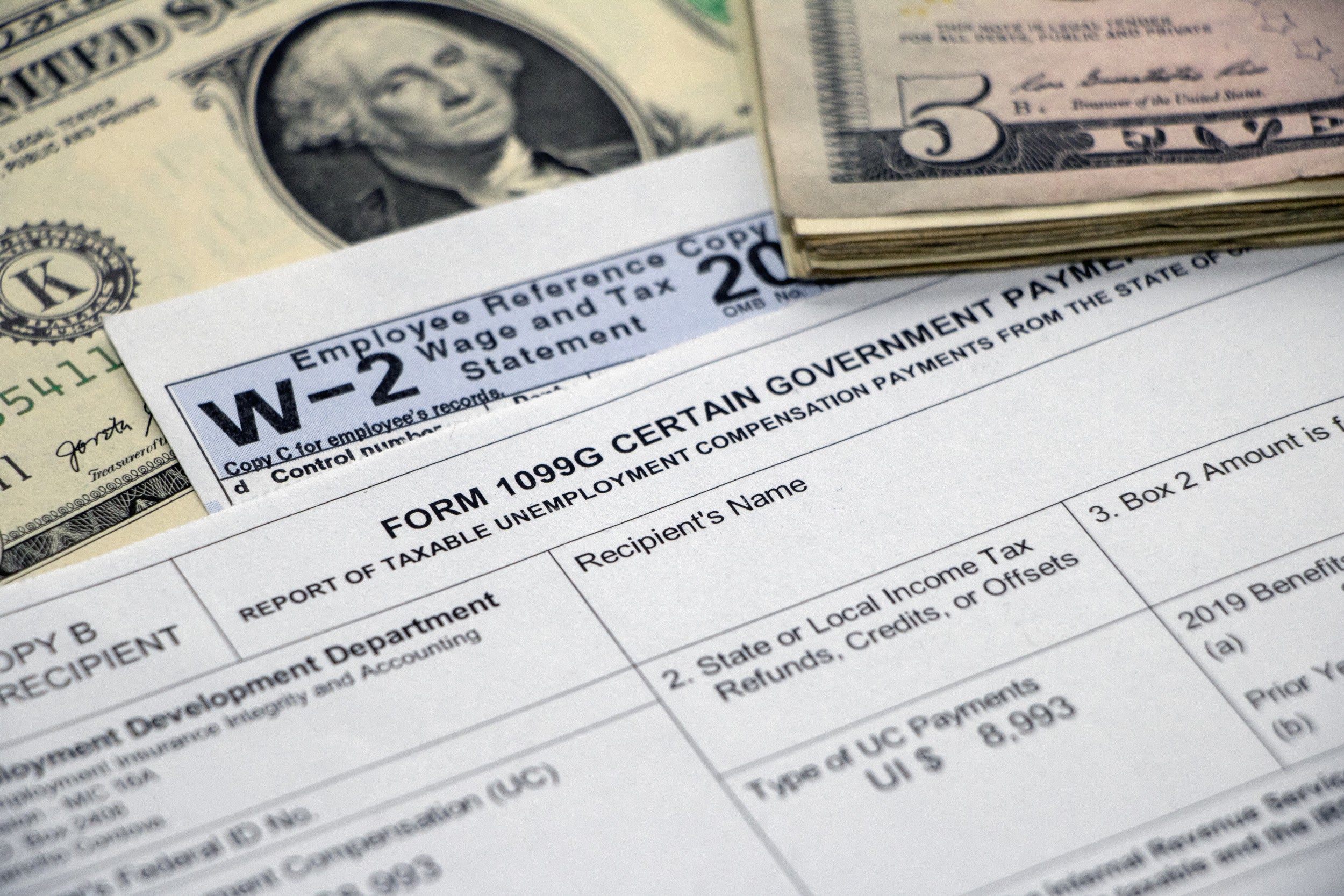

Those who paid taxes on those benefits already could be in. Section 9042 of the Senate bill allows for taxpayers who have an adjusted gross income AGI of 150000 or less for the 2020 tax year to exclude 10200 from. For the past several months Inslee has hinted that action on unemployment taxes was on the way as part of a broader effort to provide relief for businesses most impacted by COVID.

This bill would amend subsection c of section 612 of the tax is. FELDER TITLE OF BILL. 25 by state Sen.

Senate Bill S5125A has been in a budget committee for weeks in Albany. Tax changes part of a financial relief. That works out to 600 per week of benefits for 17 weeks.

On Saturday the Senate passed a version of the Covid bill that included a provision to waive taxes on the first 10200 in unemployment insurance. Remove state income tax requirement on unemployment benefits received in 2020. Senator James Tedisco is sponsoring a bipartisan bill to follow the federal example.

A bipartisan bill introduced in the state Senate Senate Bill S5125A would exclude from state taxes the first 10200 in unemployment payments received. The bill also allows people to get their first 10200 in unemployment benefits free of federal taxes. The bill also allows people to get their first 10200 in unemployment benefits free of federal taxes.

The law waives federal income taxes on up to 10200 in unemployment insurance benefits for people who earn under 150000 a year potentially. The 19 trillion American Rescue Plan signed into law last week by President Joe Biden created a change in the tax code that is rare in its timing taking effect after 557 million Americans have already filed their taxes and in its magnitude allowing tens of millions of Americans to deduct the first 10200 they collected in unemployment benefits last year. Tedisco is a co-sponsor of that bill.

Dick Durbin D-Ill and Rep. Jay Inlsee is expected to sign the bill into law later this week perhaps as early as Thursday February 4. On Friday as the deal in the Senate was coming together Sens.

Cindy Axne D-Iowa introduced a bill on Tuesday that would waive taxes on the first 10200 in unemployment benefits that individuals received last year. The amendment was actually a bill filed on Feb. If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

Section 9042 of the Senate bill allows for taxpayers who have an adjusted gross income AGI of 150000 or less for the 2020 taxable year to exclude 10200 from gross income or in the case of a joint return up to 20400 if each spouse received unemployment compensation. ALBANY NY NEWS10 Not every state taxes unemployment but now that. S5125 - Sponsor Memo.

Ron Wyden D-Ore and Bernie Sanders I-Vt pushed to add a measure that would exempt the first 10200 of unemployment benefits earned in 2020 from tax bills this season. That bill calls for the first 10200 of unemployment income to be excluded from taxation. Those who paid taxes on those benefits already could be in.

The bill the Coronavirus Unemployment Benefits Tax Relief Act introduced by Senator Dick Durbin D-Illinois and Representative Cindy Axne D-Iowa is intended to stave off a. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on. Senate Bill 5061 which was sponsored by Sen.

Consumer Alert Unemployment Recipients Could See Big Tax Bill Wjar

Consumer Alert Unemployment Recipients Could See Big Tax Bill Wjar

Unemployment Benefits 2020 How To Claim The New Tax Reduction As Com

Unemployment Benefits 2020 How To Claim The New Tax Reduction As Com

Consumer Alert Unemployment Recipients Could See Big Tax Bill Wjar

Consumer Alert Unemployment Recipients Could See Big Tax Bill Wjar

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

How The Tax Rebate In The Senate S Bill Compares To Other Proposals Itep

How The Tax Rebate In The Senate S Bill Compares To Other Proposals Itep

Felder Demands Tax Relief Again Ny State Senate

Felder Demands Tax Relief Again Ny State Senate

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

First 100 Exempting The Unemployed From Surprise Tax Bills The American Prospect

First 100 Exempting The Unemployed From Surprise Tax Bills The American Prospect

Https Www Finance Senate Gov Download Unemployment Compensation

Consumer Alert Unemployment Recipients Could See Big Tax Bill Wjar

Consumer Alert Unemployment Recipients Could See Big Tax Bill Wjar

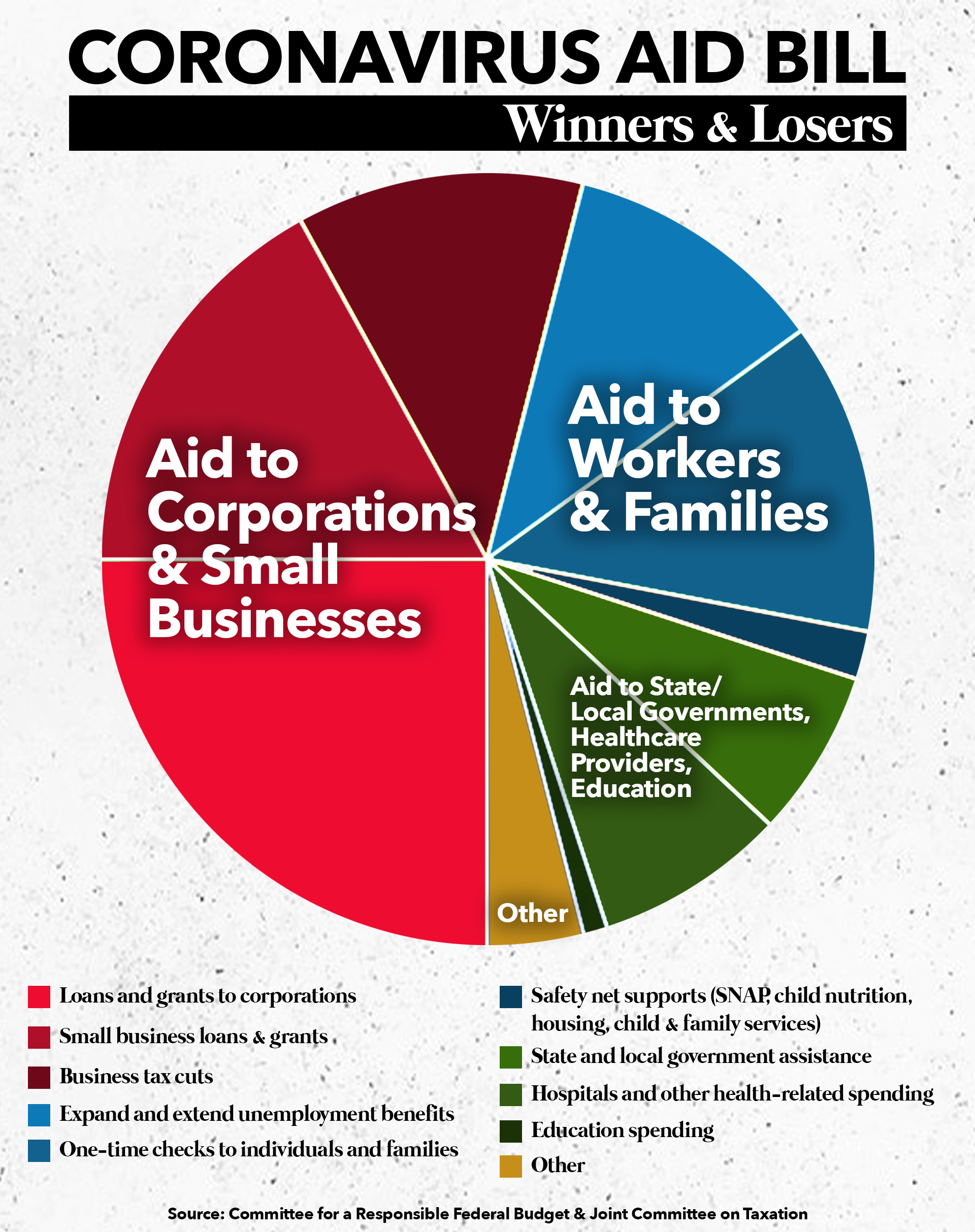

Summary Of Major Tax Provisions In The Senate And House Coronavirus Stimulus Bills Americans For Tax Fairness

Summary Of Major Tax Provisions In The Senate And House Coronavirus Stimulus Bills Americans For Tax Fairness

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Covid Bill Provides Tax Waiver On Up To 10 200 Of Unemployment Benefits

Covid Stimulus Update Democrats Reach Deal On Unemployment Aid

Covid Stimulus Update Democrats Reach Deal On Unemployment Aid

Post a Comment for "Unemployment Not Taxable Senate Bill"