Unemployment Fraud Penalties Texas

1 Financial institution means a bank trust company insurance company credit union building and loan association savings and loan association investment trust investment company or any other organization held out to the public as. Shapiro expect further prosecutions as a result of this fraud.

Notorious Killers Named In Edd Fraud Incalifornia Jails Prisons Khou Com

Notorious Killers Named In Edd Fraud Incalifornia Jails Prisons Khou Com

Falsely claiming UI benefits is considered to be Unemployment fraud and can lead to serious penalties and consequences.

Unemployment fraud penalties texas. TWC established a Fraud Hotline 800-252-3642 for individuals who wish. By Brian New June 30 2020 at 439 pm. Texas Workforce Commission overpaid 32 million to 46000 unemployed workers.

If you are a claimant who was overpaid or received excess benefits then you are legally required to pay back. Unemployment benefits are taxable income reportable to the Internal Revenue Service IRS under federal law. TEXAS UNEMPLOYMENT COMPENSATION ACT.

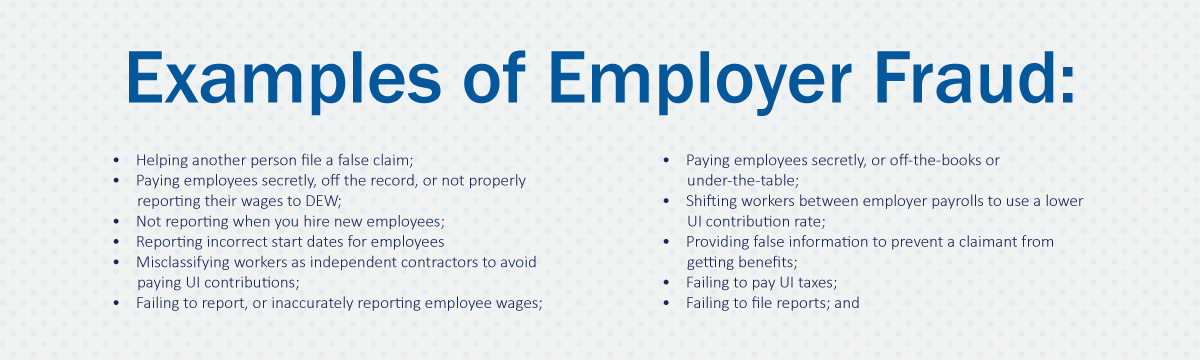

People who commit unemployment fraud in Texas may face both civil and criminal penalties. The penalties vary by state but usually involve fines ranging from 100 to 500 and jail time ranging from 90 days to up to five years for each offense. Fraud is a willful act or course of deception or an intentional concealment omission or perversion of truth with the intent to obtain a material benefit or service for that person or another person for which the person may not be eligible.

Individuals found to have committed fraud are assessed penalties RCW 5020070 are required to repay the amount identified as overpaid RCW 5020190 and are subject to possible state or federal criminal prosecution. What is unemployment imposter fraud. And 10 years probation and 10000 fine for the Theft of Unemployment benefits.

Gamez on Monday originally said. If TWC finds unemployment fraud in a case the person has to give back the benefits and pay a 15 penalty. Penalties may include fines of up to 4000 or imprisonment of up to one year or both forfeiture of benefits received and the right to benefits that remain in the claimants benefit year.

Now it wants that money back Those with over-payments determined as. 8 years prison and 10000 fine for the Social Security fraud. You must report all unemployment benefits you receive to the IRS on your federal tax return.

What are the penalties for unemployment fraud. FRAUDULENTLY OBTAINING BENEFITS OR OTHER PAYMENT. Oftentimes a civil penalty involves a fine.

A A person commits an offense if to obtain or increase a benefit or other payment either for the person or another person under this subtitle the unemployment compensation law of. Western Pennsylvania COVID-19 Fraud Task Forces Toll Free Hotline. On the other hand a criminal penalty can include fines probation incarceration and more.

Following a punishment hearing a jury sentenced Hall to the following to run concurrently. If you believe you have been a target or victim of coronavirus-related fraud please report it to the Task Force at. The penalties can range from monetary fines penalty weeks of unemployment to serving a prison term.

The Texas Workforce Commission is authorized by the Texas Labor Code to investigate allegations of fraud waste and program abuse involving TWC programs. Claimants who commit unemployment fraud must pay back benefits they were not entitled to receive plus a 15 percent penalty on benefits they fraudulently received. OFFENSES PENALTIES AND SANCTIONS.

Texas Unemployment Office Catches 738 Identity Theft Fraud Claims. In addition to the repayment that you need to settle you might need to pay a fine as well. Unemployment fraud is a crime and if you defraud the state of large sums of unemployment benefits or are a repeat unemployment fraud offender you may face criminal charges.

Criminal penalties may involve incarceration probation fines. If you are convicted of unemployment benefit fraud you can face civil and criminal penalties. Civil penalties usually involve fines.

If you are receiving benefits you may have federal income taxes withheld from your unemployment benefit payments.

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

What Is Unemployment Insurance Fraud

What Is Unemployment Insurance Fraud

Illinois Ides Unemployment Fraud Task Force Comprised Of Attorney General Irs Formed Abc7 Chicago

Illinois Ides Unemployment Fraud Task Force Comprised Of Attorney General Irs Formed Abc7 Chicago

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

What Is Food Stamp Fraud Investigation Punishment Video Lesson Transcript Study Com

What Is Food Stamp Fraud Investigation Punishment Video Lesson Transcript Study Com

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

What Is Unemployment Fraud Craighead Law Firm

What Is Unemployment Fraud Craighead Law Firm

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Pua Unemployment Il How To Report Fraud To Illinois Dept Of Employment Security As Fake Claims Spike Abc7 Chicago

Pua Unemployment Il How To Report Fraud To Illinois Dept Of Employment Security As Fake Claims Spike Abc7 Chicago

Unemployment Fraud State Seeks No Criminal Charges In 99 8 Of Cases

Unemployment Fraud State Seeks No Criminal Charges In 99 8 Of Cases

Unemployment Fraud More Illinois Residents Receiving Unemployment Benefits From Different States Despite Not Applying For Them Abc7 Chicago

Unemployment Fraud More Illinois Residents Receiving Unemployment Benefits From Different States Despite Not Applying For Them Abc7 Chicago

10 People Facing Felony Charges Related To Unemployment Insurance Fraud

10 People Facing Felony Charges Related To Unemployment Insurance Fraud

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Unemployment Insurance Fraud Sc Department Of Employment And Workforce

Http Covid19 Thomas And Company Com Wp Content Uploads 2020 08 Thomas Rise In Fraud 2020v2 1 Pdf

Post a Comment for "Unemployment Fraud Penalties Texas"