Stimulus Unemployment Not Taxable

Lets back up. Unemployment income exemption Stimulus It has been nearly a month since Governor Hogan signed the bill to make MD unemployment non-taxable and nothing has changed in TurboTax.

Over 50 Of Americans Don T Know Their Stimulus Checks Won T Be Taxed Forbes Advisor

Over 50 Of Americans Don T Know Their Stimulus Checks Won T Be Taxed Forbes Advisor

President Joe Biden signed the American Rescue Plan Act of 2021 on Thursday.

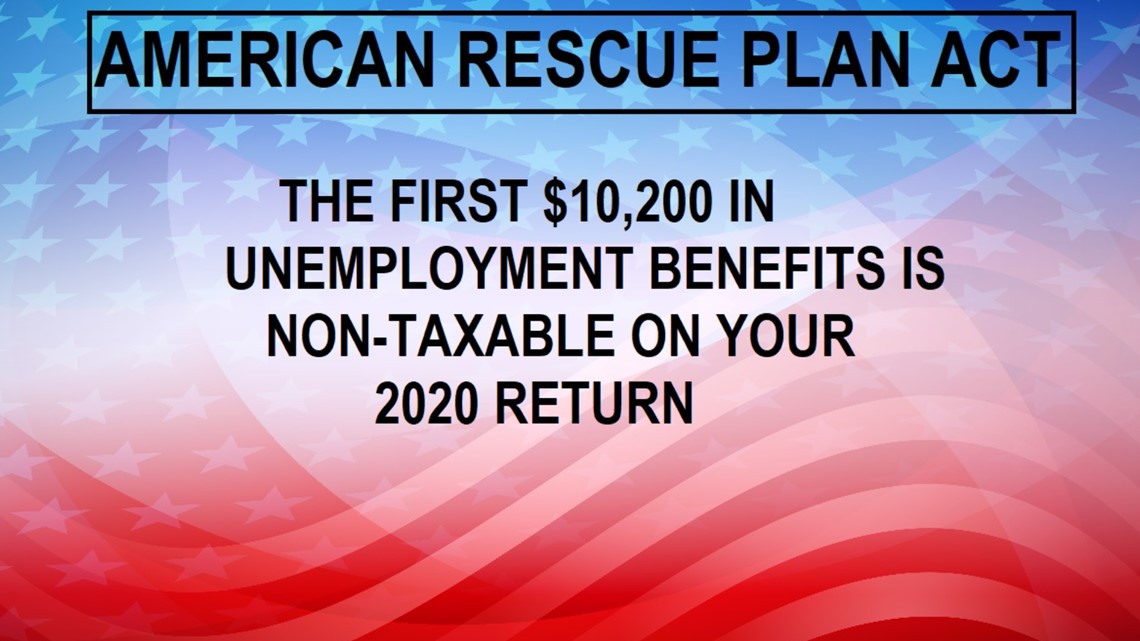

Stimulus unemployment not taxable. Stimulus check update. Posted Mar 11 2021 The new COVID relief bill makes some. The way the exemption works is the first 10200 of unemployment insurance will not be taxable.

A new relief provision lets jobless workers off the hook on taxes for unemployment benefits. But what if youve already paid them and filed your 2020 return. But this isnt widely understood.

1 day agoThe Internal Revenue Service is telling people not to file amended returns after the recent stimulus packages tax break on the first 10200 of unemployment benefits. The first 10200 of unemployment compensation will be shielded from taxes for households with incomes under 150000 in 2020. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable.

It depends on the type of benefit. You wont have to pay federal tax on first 10K of unemployment benefits under new bill Updated Mar 12 2021. If someone received 20000 of benefits in 2020 they will only be taxed on 9800 of it.

The American Rescue Plan allowed taxpayers to exclude up to 10200 in unemployment benefits from their Adjusted Gross Income AGI. If you chose to withhold. The two rounds of direct stimulus payments that were sent to millions of Americans are tax-free.

A payment also will not affect income for purposes of determining eligibility for federal government assistance or benefit programs Source. The new stimulus package called the American Rescue Plan Act of 2021 makes tax-free a big chunk of unemployment benefits people received last year. It seems likely that MANY people will need to file for an extension or file an amended return.

Unemployment benefits are generally treated as income for tax purposes. The American Relief Plan provides a small measure of relief. The stimulus payment or economic impact payment as the IRS calls it is technically a tax credit.

The 19 trillion Covid relief bill gives a federal tax break on up to 10200 of unemployment. If you filed your 2020 taxes already and you got unemployment income in 2020 chances are youre going to get money back from the IRS. If you received unemployment compensation during the year you must include it in gross income.

Unfortunately the answer is yes and that can seem like Uncle Sam kicking you when youre already down. A new tax break in the American Rescue Plan Act makes the first 10200 of unemployment benefits received in 2020 non-taxable for households with incomes under 150000. However with the new stimulus bill up to 10200 in last years unemployment payments can be exempt from taxes if your adjusted gross income AGI is less than 150000 according to new.

Its not a stimulus payment let me explain. Refer to this Post Release Changes to Forms article for information about the new exclusion of up to 10200 of unemployment compensation. Heres how it works.

To determine if your unemployment is taxable see Are Payments I Receive for Being Unemployed Taxable. IRSgov Tax Tips Not your average tax credit. The stimulus package signed into law on Thursday by President Joe Biden extends unemployment benefits for millions of American workers who are.

These states wont allow federal tax break for those who got unemployment benefits April 06 2021 at 1222 pm EDT By Debbie Lord Cox Media Group National Content Desk Under the American Rescue Plan those who received federal unemployment benefits in 2020 will receive a 10200 tax break when they file a federal income tax.

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Unemployment Answers To Your Tax Related Questions Fox43 Com

Stimulus Unemployment Answers To Your Tax Related Questions Fox43 Com

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

New Stimulus Bill Offers Tax Break On Unemployment Payments Whec Com

Stimulus Checks Unemployment In Taxes What You Need To Know 13wmaz Com

Stimulus Checks Unemployment In Taxes What You Need To Know 13wmaz Com

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Collecting Unemployment Take These Steps To Avoid A Tax Bill Next Year

Most Unemployment Benefits No Longer Taxable Income Tom Copeland S Taking Care Of Business

Most Unemployment Benefits No Longer Taxable Income Tom Copeland S Taking Care Of Business

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Stimulus Bill Unemployment Benefits How A New Tax Break Could Save You Money Cnet

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Is Unemployment Taxable Unemployment Portal

Is Unemployment Taxable Unemployment Portal

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Unemployment Recipients May Be Surprised Come April 15 Memphis Local Sports Business Food News Daily Memphian

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Post a Comment for "Stimulus Unemployment Not Taxable"