State Unemployment For Remote Workers

Remote employees who temporarily or permanently lose their job freelancers independent contractors and freelance workers will all be eligible for the extra 600 provided they meet the following eligibility requirements. If an alternative work assignment is not feasible or the employee declines the employer must allow the employee to use any accrued leave or seek unemployment benefits.

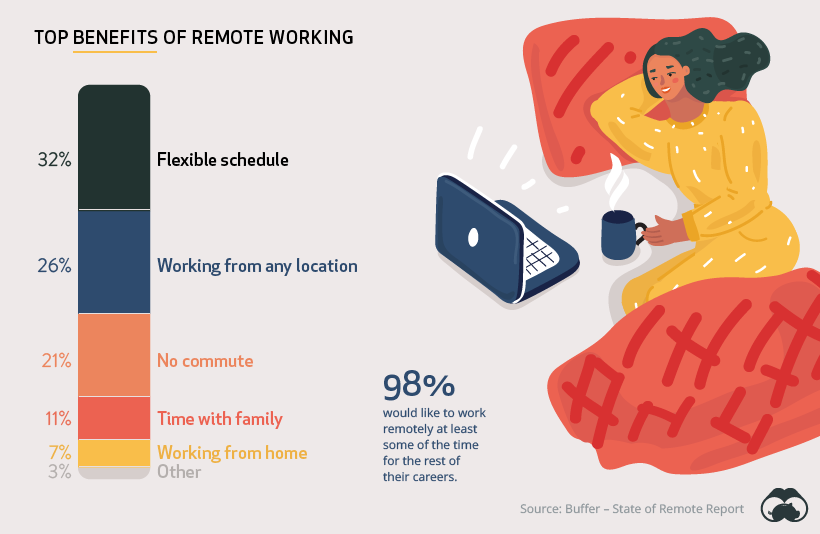

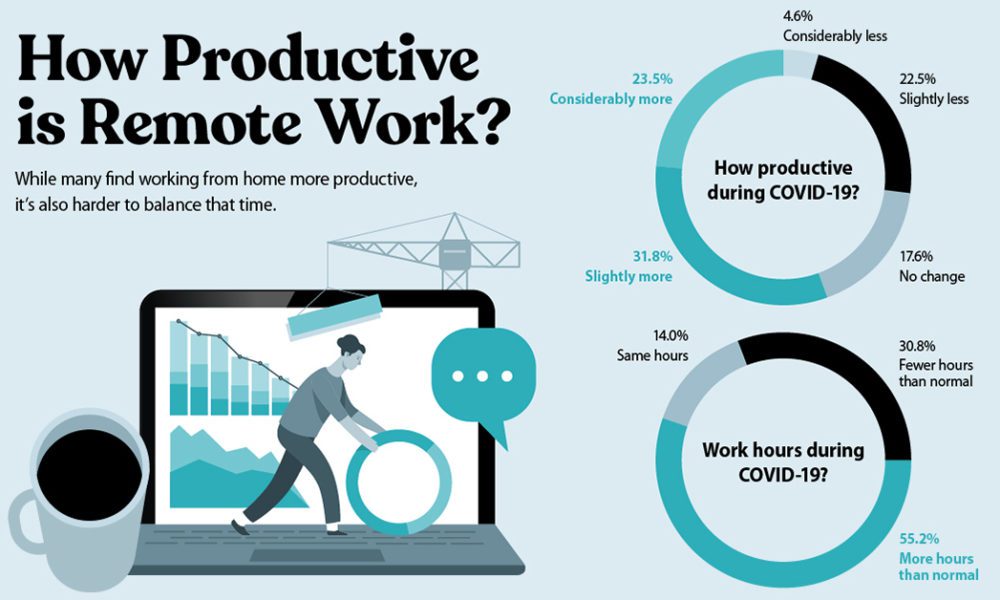

How People And Companies Feel About Working Remotely Visual Capitalist

How People And Companies Feel About Working Remotely Visual Capitalist

However job search requirements are currently optional until the Pandemic State of Emergency is lifted.

State unemployment for remote workers. The employer must offer high-risk employees alternative work assignments including telework alternative or remote work locations if feasible and social distancing measures. Whether an employer is subject to a particular state or local law often depends on how many employees the employer has within that state or locality. Be aware that some states set limits on how long you can collect unemployment benefits after relocating so the time period you can receive benefits may be shorter if you move.

Unemployment income is only taxable to the state where you are living in at the time when you receive it. If the company you work for is in one state and you live and work remotely from another state do you claim unemployment benefits from the state in which the company is located or from the state of your residence. Remote Employees in Your State.

On top of state unemployment benefits eligible workers can earn an additional 600 per week for the next 13 weeks. Out-of-State Remote Workers. If your remote employees are located in the same state as your business location you can follow the same state laws for income taxes and employment taxes.

Confused about state withholding for remote work and unemployment insurance. Workers including remote workers can become hurt or sick on the job in numerous ways. If that happens you contact the office that handles unemployment claims in the state where you moved.

I just had to set up a new state for a remote workers and I pay into that states unemployment. Melrose is one of approximately 70000 Granite State workers receiving the extra 600 in weekly federal unemployment payments the last of which are scheduled to be paid this week unless. People Getting Unemployment Will Have to Look for Work Again The Virginian-Pilot reported Tuesday that the weekly job search is a requirement of state and federal law.

Employees who work in a state outside of Washington may be. Unemployment insurance Remote employees who work outside of Washington are not covered by Washington unemployment insurance unless there is a reciprocal coverage arrangement in place with that state. Generally where federal state and local.

As a result most states require you to buy workers compensation insurance. But you do need to check on income taxes in the localities where remote employees work. You will pay unemployment taxes to Georgia based on that employees wages.

You need to purchase workers compensation in the state where the employee works. You may answer no to the job search questions on your weekly claim. For remote workers employed by an out-of-state business a state where the employee is working generally requires that the employer register for and pay the unemployment insurance.

Download the full publication Remote workforce unexpected state tax implications for employees employers The takeaway Most states shelter-in-place orders and the tax relief tied to them are for specific periods of time. Employees who work in a state outside of Washington may be covered by a similar program in the state in which they work. Figuring out where to file your initial claim however can get tricky in todays telecommuting.

Usually people receiving unemployment benefits are required to look for work and document their search. When an employer is in one state and the remote worker is in another compliance with various state employment and tax laws can be complicated. Employers need to determine which state and local employment laws may apply to their remote employees in addition to applicable federal laws.

In such cases employers should consult with legal counsel and a tax advisor to determine which laws apply to the remote worker. Your filing was correct and you do not file a Maryland return this year either.

Three Warning Signs That Your Remote Employees Are Starting To Crack Under The Stress Of Working From Home

Three Warning Signs That Your Remote Employees Are Starting To Crack Under The Stress Of Working From Home

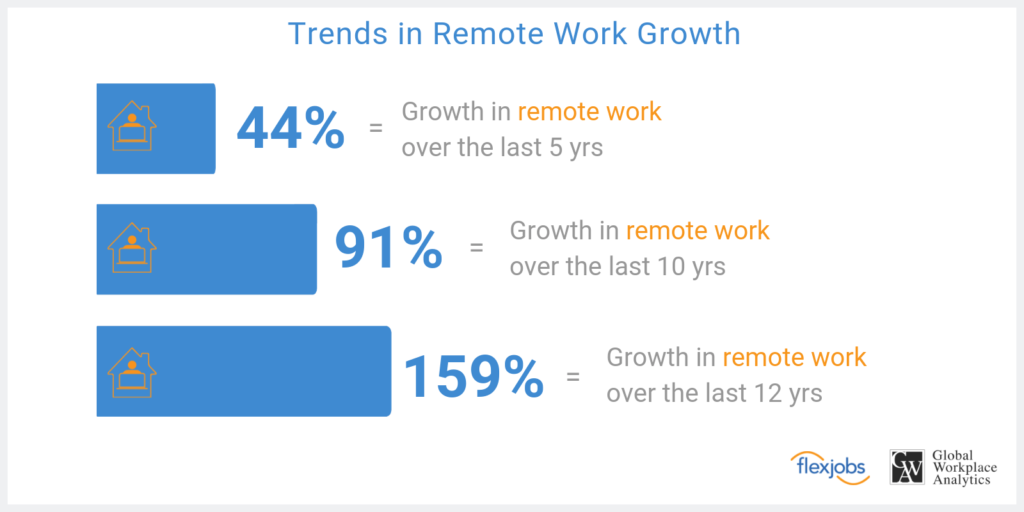

159 Increase In Remote Work Since 2005 Flexjobs Global Workplace Analytics Report

159 Increase In Remote Work Since 2005 Flexjobs Global Workplace Analytics Report

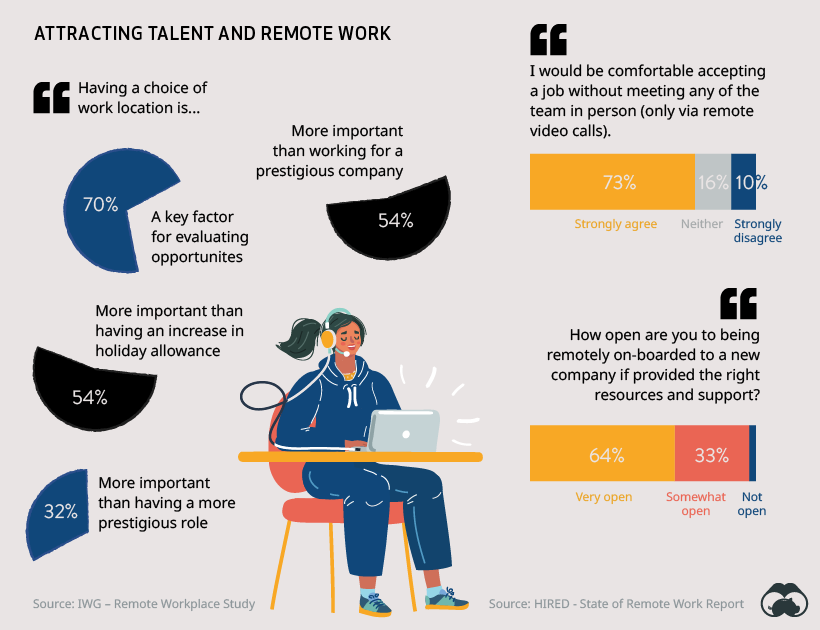

This Is The Future Of Remote Work In 2021

This Is The Future Of Remote Work In 2021

How People And Companies Feel About Working Remotely Visual Capitalist

How People And Companies Feel About Working Remotely Visual Capitalist

How People And Companies Feel About Working Remotely Visual Capitalist

How People And Companies Feel About Working Remotely Visual Capitalist

Legit Data Entry Jobs From Home Work At Home 2020 Data Entry Jobs Working From Home Work From Home Jobs

Legit Data Entry Jobs From Home Work At Home 2020 Data Entry Jobs Working From Home Work From Home Jobs

Remote Workers May Be Subject To Local Wage Sick Leave Ordinances Hrwatchdog

Remote Workers May Be Subject To Local Wage Sick Leave Ordinances Hrwatchdog

Pin On Official Hawaii Unemployment Group

Pin On Official Hawaii Unemployment Group

How To Apply For Unemployment Benefits Unemployment How To Apply Collecting Unemployment

How To Apply For Unemployment Benefits Unemployment How To Apply Collecting Unemployment

159 Increase In Remote Work Since 2005 Flexjobs Global Workplace Analytics Report

159 Increase In Remote Work Since 2005 Flexjobs Global Workplace Analytics Report

How To Trust Your Remote Employees Infographic Small Business Trends Employee Infographic Remote Workers Remote Work

How To Trust Your Remote Employees Infographic Small Business Trends Employee Infographic Remote Workers Remote Work

6 Tips For Managing Remote Employees How To Maintain Productivity And Engagement

6 Tips For Managing Remote Employees How To Maintain Productivity And Engagement

How To Grow As An Engineer Working Remotely Remote Work Engineering Remote Workers

How To Grow As An Engineer Working Remotely Remote Work Engineering Remote Workers

The Future Of Remote Work According To Startups

The Future Of Remote Work According To Startups

Maine Remote Work Resources Virtual Vocations

Maine Remote Work Resources Virtual Vocations

Leading Remote Workers The Coronavirus Impact On Effective Management

Leading Remote Workers The Coronavirus Impact On Effective Management

Maine Remote Work Resources Virtual Vocations

Maine Remote Work Resources Virtual Vocations

The New Normal Isn T Remote Work It S Better

The New Normal Isn T Remote Work It S Better

Rural Online Initiative Connecting Rural Communities To Remote Work Remote Work Virtual Assistant Services Work Opportunities

Rural Online Initiative Connecting Rural Communities To Remote Work Remote Work Virtual Assistant Services Work Opportunities

Post a Comment for "State Unemployment For Remote Workers"