Should I Claim Dependents On Unemployment Michigan

The most you can receive per week is currently 362. The Michigan Unemployment Compensa- tion Commission has defmed princi- pal support to mean that the parent claiming dependent has regu- larly contributed during his base pe-.

Taxes Due On Extra Unemployment Compensation May Reduce Eliminate Refund

Taxes Due On Extra Unemployment Compensation May Reduce Eliminate Refund

The minimum amount you will receive is 81 with a maximum of 362.

Should i claim dependents on unemployment michigan. BWUC adds 6 for each dependent you claim up to five dependents. State Income Tax Range. The tests for a qualifying child are.

The weekly benefit amount is. The employee claims her total personal and dependent exemptions for state income tax withholding purposes on line 6 of her MI-W4 form. Under the Biden Stimulus ARP package which funded another round of unemployment benefit extensions there was a late provision added that provided a tax break on unemployment insurance UI benefitsThis was added as a compromise to appease factions of the Democratic party who wanted more support for those receiving unemployment benefits.

If you are eligible to receive unemployment your weekly benefit in Michigan will be 41 of what you earned during the highest paid quarter of the base period. If your son files a 1040 Federal tax return in the Standard Deduction section he is required to disclose that someone can claim him as a dependent. You must be the main financial provider for this person.

You can also receive an allowance of 6 per week per dependent up to 30. You also get an extra 6 per week for each dependent you claim up to five dependents but your benefits cant exceed 362. If you had to pay someone to watch your child or other dependent while you looked for work you may also be able to claim the nonrefundable child and dependent care tax credit.

Check Your Entitlement Unemployment benefits in Michigan are capped at a maximum of 362 per week but your actual entitlement will depend on your previous earnings. May claim a child as dependent un- less the mother provides sole or principal support of the child. But if you do not have 10 dependents then you will have a tax bill to pay.

If you have any dependents that you are at least 50 financially responsible for youll be eligible to receive an extra 6 per dependent up to a maximum of 5 dependents. BWUC staff calculates how m uch you receive in unemployment benefits by multiply ing the highest am ount of wages paid to you in any base period quarter by 41. The Michigan unemployment department requires all benefits recipients to file a weekly claim with MARVIN the online reporting system.

A child of a taxpayer can still be a Qualifying Child QC dependent regardless of hisher income if. Also note that interest and penalties for failure to pay Michigan estimated tax on unemployment benefits received in 2020 are waived. The UIA calculates your weekly benefit amount by multiplying the wages paid in your highest base period quarter by 41.

During the coronavirus pandemic federal legislation has made UI requirements for dependents particularly college students a little less strict than they usually are. If you have 10 dependents then you simply will not get a tax refund at the end of the year. Normally the dependent can only be your spouse or your child under 25 years old.

In most states you cant claim a dependent on unemployment benefits unless that dependent is also unemployed. If you claim zero exemptions then you will have no federal income taxes taken out of your paycheck and. The employer submits a copy of the employees MI-W4 form to the Michigan Department of Treasury if she claims exemption from withholding or claims more than 10 exemptions.

Can I still claim his as a dependent even if he received unemployment. But dependents cant claim someone else as a dependent. While penalties for this vary by state and the amount of money defrauded by the claim every state requires beneficiaries to return unemployment benefits they received to which they werent entitled.

If you and your spouse file joint tax returns and one of you can be claimed as a dependent neither of you can claim any dependents. If you meet Michigan unemployment benefits eligibility you will be approved for up to 20 weeks of unemployment compensation. You are not required to claim your son as a dependent.

Claiming dependent benefits to which you are not entitled you commit unemployment fraud. For 2019 taxes the amount of credit is between 20 and 35 of allowable expenses which maxes out at 3000 for one qualifying person or dependent or 6000 for two or more qualifying persons or dependents. Amount of unemployment benefits.

This article was last updated on March 24. You may receive benefits for a maximum of 20 weeks. Dependents can usually receive unemployment insurance UI benefits provided they meet the caveats that state unemployment agencies require of anyone filing.

How your state defines a dependent can determine whether you can qualify for dependency benefits. A dependent must meet the requirements of a qualifying child or a qualifying relative in order for you to claim them on your tax return. He did not provide more than 12 his own support.

Robinson Lynda M Created Date. You can claim dependents on Form W-4 when you authorize your employer to withhold taxes from your paycheck. He is under age 19 or under 24 if a full time student for at least 5 months of the year or is totally.

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Https Www Southwestmichiganfirst Com Wp Content Uploads How To File A Claim 4 6 20 Pdf

Over 25 Million People Will Lose The 600 Unemployment Boost Next Week

Over 25 Million People Will Lose The 600 Unemployment Boost Next Week

Https Www Southwestmichiganfirst Com Wp Content Uploads How To File A Claim 4 6 20 Pdf

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

College Students Are You Getting Your Education Tax Credits The Official Blog Of Taxslayer

Ub40 Signing Off Vinyl Pussycat Records Sign Off Going To Rain News Songs

Ub40 Signing Off Vinyl Pussycat Records Sign Off Going To Rain News Songs

Stimulus Checks How Adult Dependents Can Claim Their 1 400 Payment Bankrate

Stimulus Checks How Adult Dependents Can Claim Their 1 400 Payment Bankrate

Europe Gender Development Index 2017 Human Development Index Gender And Development Human Development

Europe Gender Development Index 2017 Human Development Index Gender And Development Human Development

Unemployment Benefits And Child Tax Credit H R Block

Unemployment Benefits And Child Tax Credit H R Block

Unemployment Benefits Information For Military Spouses

Unemployment Benefits Information For Military Spouses

College Students May Now Be Eligible For Unemployment Benefits

College Students May Now Be Eligible For Unemployment Benefits

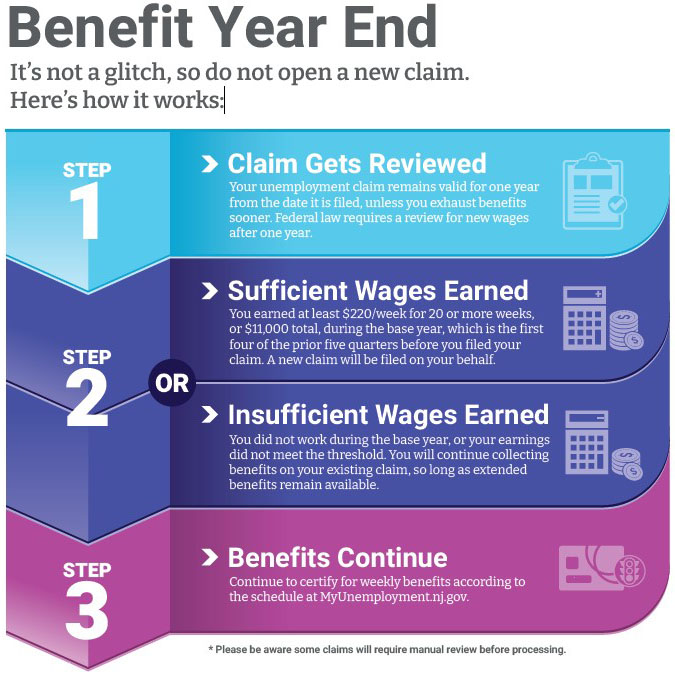

Division Of Unemployment Insurance Answers To Common Questions About Existing Claims

Division Of Unemployment Insurance Answers To Common Questions About Existing Claims

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back Tax Credits For People Who Work

Build A Family Binder In 31days Www Sweetteaandsavinggraceblog Com Family Binder Money Planner Family Organizer

Build A Family Binder In 31days Www Sweetteaandsavinggraceblog Com Family Binder Money Planner Family Organizer

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Taxes Due On Extra Unemployment Compensation May Reduce Eliminate Refund

Taxes Due On Extra Unemployment Compensation May Reduce Eliminate Refund

Are You Newly Eligible For Unemployment Insurance Here S What To Know

Are You Newly Eligible For Unemployment Insurance Here S What To Know

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Post a Comment for "Should I Claim Dependents On Unemployment Michigan"