Ohio Unemployment Tax Due Dates

July 1 - Sept. Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI.

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Please review the various options employers have to submit their quarterly reports electronically.

Ohio unemployment tax due dates. Theyve extended the due date from April 15 to May 17. The good news is that up to 10200 of those benefits received in 2020 are tax-free thanks to the American Rescue Plan Act of 2021. Beginning January 1 2018 employers are required to submit their quarterly reports electronically.

If due date falls between April 15 2020 and June 15 2020 the deadline has been extended to July 15 2020. Due to the ARPA the IRS is allowing certain taxpayers to deduct up to 10200 in unemployment benefits. Filing Season Deadline is May 17 2021 Click here for more information This page serves as an online headquarters for taxpayers looking for more information about the Ohio individual and school district income tax.

Please click here for information on when employers become liable under the Ohio Unemployment Law. 15th day of ninth 9th taxable month. In Ohio the postmark date is considered the date of filing.

3rd Quarter - The 15th day of ninth 9th taxable month. 15th day of twelfth 12th taxable month. If the due date falls on a Saturday Sunday or holiday the.

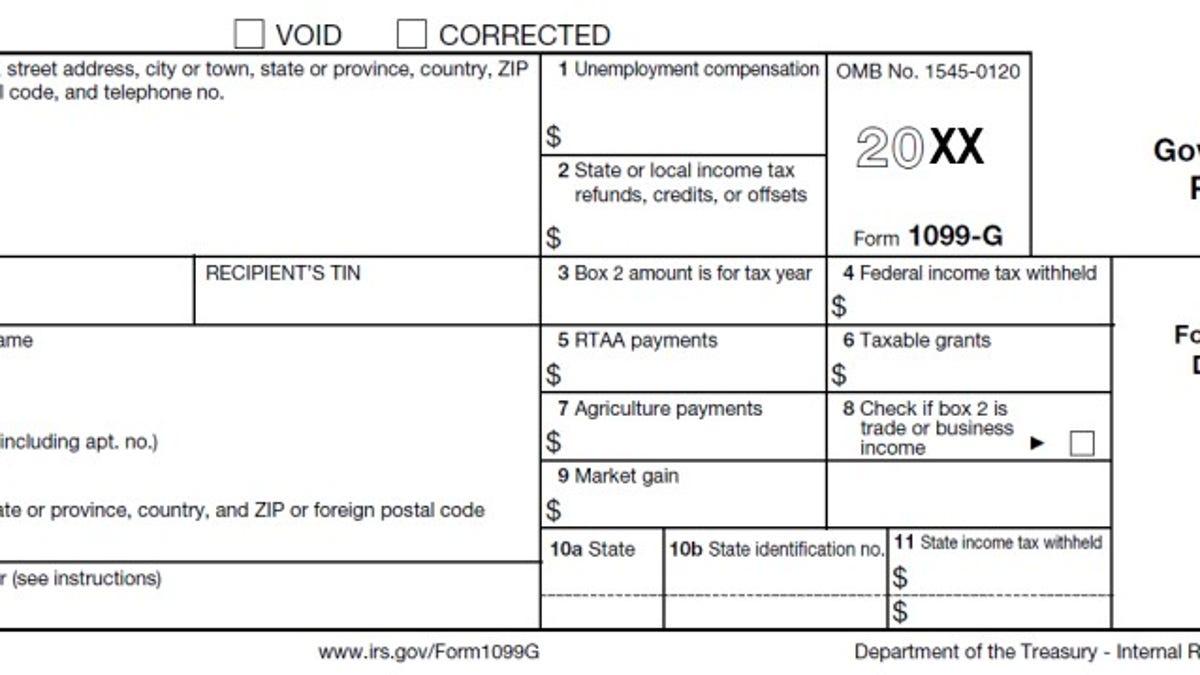

2021 State Tax Filing Guidance for Coronavirus Pandemic updated. Click here to see whats new for tax year 2020. Please visit unemploymentohiogov click on the Report Identity Theft button and complete the form so that we can investigate the claim that was filed and take appropriate actionsThis can include correcting the 1099-G form that you were sent.

The added time gives taxpayers more flexibility according to a House committee. Ohio taxes unemployment compensation to. Box 182404 Columbus Ohio 43218-2404If you report your liability at Ericohiogov you will receive a determination immediately.

They should get it ironed out in 20 to 30 days I would say. 4th Quarter - The 15th day of twelfth 12th taxable month. First quarter - April 30 Second quarter - July 31 Third quarter - October 31.

In addition the Employer Resource Information Center ERIC allows employers and third-party administrators to manage all their business related to unemployment contributions online including registering new businesses filing quarterly reports and making tax. The taxable wage base for calendar year 2000 and after is 9000. 15th day of the sixth 6th taxable month.

The AICPA has compiled the below latest developments on state tax filings related to coronavirus. If the due date falls on a weekend or holiday the quarterly report is due the next business day Quarterly Reporting Unemployment Insurance Tax 8 Methods of Filing ERIC - Employer Resource Information Center. 15th day of fourth 4th taxable month.

Due Dates 1st Quarter April 30 2nd Quarter July 31 3rd Quarter October 31 4th Quarter January 31 Note. Taxable Wage Base The Taxable Wage Base is the amount of an employees wages upon which the employer is required to pay unemployment taxes each year. A bracket adjustment of between 40 and 440 is subtracted from the amount of tax due for taxpayers with net income from 79301 to 84600.

If your unemployment compensation payments do not reflect Ohio income tax withheld you may need to make Ohio income and school district income tax estimated payments using form IT 1040ES for Ohio income tax and SD 100ES for school district income tax to avoid a balance due when you file your 2020 Ohio IT 1040 and SD 100 returns. 12921 10 am et also see 2020 State Tax Filing Guidance for Coronavirus Pandemic US. Ohio income and school district income tax estimated payments for the first and second quarter of 2020.

So you do have an extra month Grispin said. Reporting Requirements Employers are required to submit a complete Quarterly Tax Return each quarter. 2nd Quarter - The 15th day of the sixth 6th taxable month.

States are providing tax filing and payment due date relief for individuals and businesses. The taxable wage base may change from year to year. Reporting their unemployment tax liability as soon as there are one or more employees in covered employmentThis may be done at Ericohiogov or by completing the JFS 20100 Report to Determine Liability and mailing it to PO.

Due Dates Quarterly reports must be filed no later than the last day of the first month following the close of the calendar quarter being reported. That represents a lot of Americans who will find themselves grappling with taxes on their unemployment benefits when the filing season rolls around in 2021 for 2020 tax returns. The due dates for filing quarterly reports are as follows.

April 1 - June 30. Some individuals who have already filed or will soon be filing their 2020 Ohio IT 1040 and SD 100 returns due by May 17 2021. 1 - March 31.

The Internal Revenue Service is delaying the traditional tax filing deadline from April 15 to May 17. Bloomberg via Getty Images FILE.

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

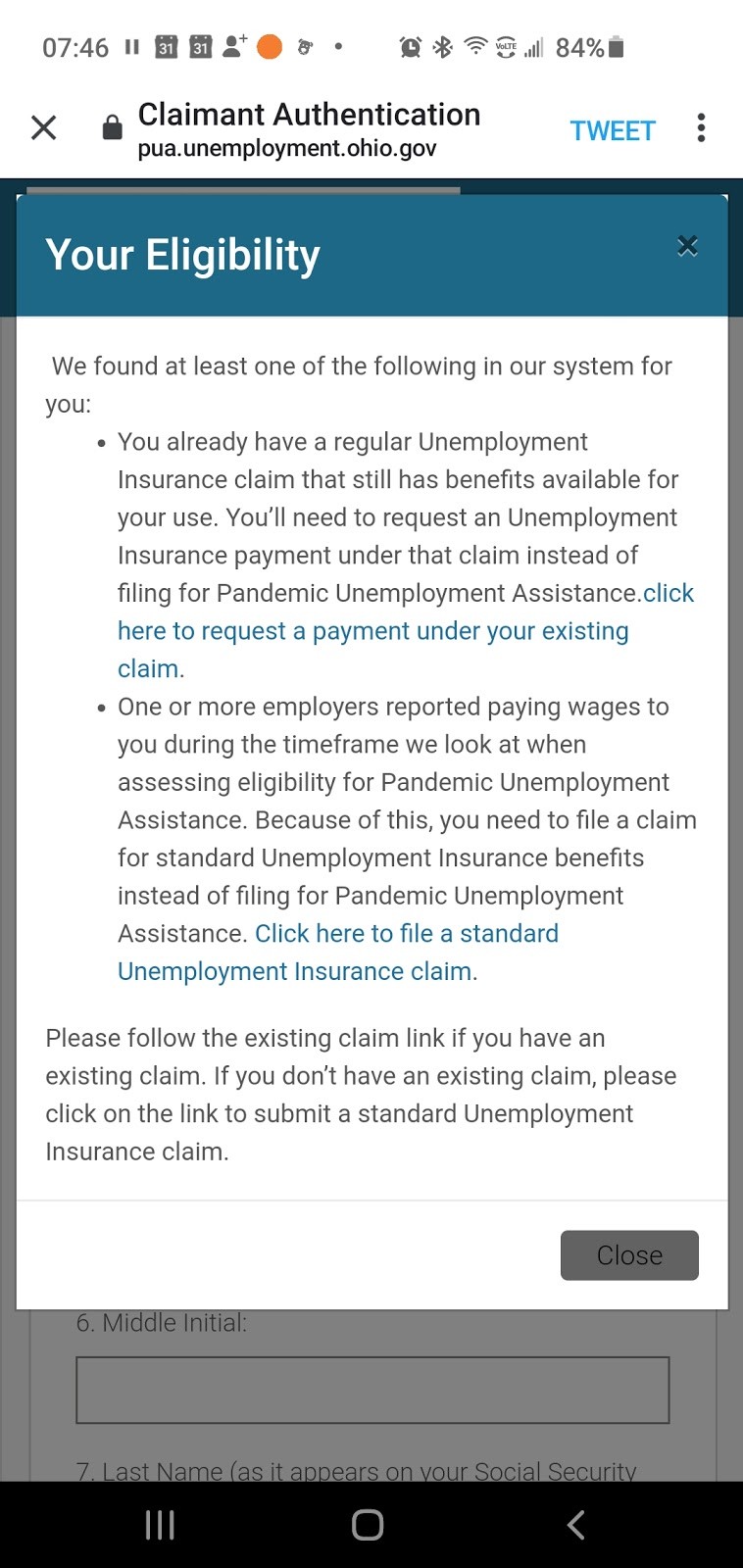

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Apply For Unemployment Benefits Online In Ohio Youtube

3 Ways To File An Ohio Unemployment Claim Wikihow

3 Ways To File An Ohio Unemployment Claim Wikihow

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Website Available For Reporting Unemployment Fraud In Ohio Wkbn Com

Website Available For Reporting Unemployment Fraud In Ohio Wkbn Com

Https Jfs Ohio Gov Ocomm Pdf 1099 Id Theft Hotline News Release Stm

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits Scene And Heard Scene S News Blog

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits Scene And Heard Scene S News Blog

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Post a Comment for "Ohio Unemployment Tax Due Dates"