Ohio Unemployment Insurance Law

The maximum total number of weeks available to claim unemployment compensation in Ohio is 63 weeks. PEUC - Extension of Unemployment Benefits.

Dol Says Workers May Remain Eligible For Expanded Unemployment Benefits After Refusing Work Due To Covid 19 Safety Concerns

Dol Says Workers May Remain Eligible For Expanded Unemployment Benefits After Refusing Work Due To Covid 19 Safety Concerns

We first encourage employers to engage in dialogue with an employee who expresses reluctance to return to work about the measures that employers are taking to help employees feel safe.

Ohio unemployment insurance law. 4 to verify your eligibility for unemployment. You have at least one employee in covered employment for some portion of a day in each of 20 different weeks within either the. Highlighted below are two important pieces of information to help you register your business and begin reporting.

To pay that back would be a huge cost to Ohio businesses who are trying desperately to recover. Under Ohio law as an employer you are responsible to contact the agency as soon as you employ one or more individuals in covered employment. 117-2 that affected the calculation of adjusted gross income for taxpayers who received unemployment.

In Ohio you generally are considered a liable employer under the Ohio unemployment compensation law if you meet either of the following requirements. All hours worked from the 1 st to the 15 th of month must be paid by the 1 st of the following month. We first encourage employers to engage in dialogue with an employee who expresses reluctance to return to work about the measures that employers are taking to help employees feel safe.

1 day agoDue to the COVID pandemic Ohio is already over 14 billion in unemployment compensation debt. The American Rescue Plan Act of 2021 then increased the 24 weeks to 53 weeks. 85 6011 a 6050B and 6109 a.

Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis. If you think you may be liable or if you have questions about whether you are required to pay unemployment taxes please contact the Contribution Section at 614-466-2319 or write to us at ODJFS Contribution Section PO Box 182404 Columbus. Authority for this requirement is provided in Title III of the Social Security Act and the Internal Revenue Code of 1954 26 USC.

All hours worked from the 16 th to the end. ODJFS is required by law to ensure that unemployment benefits are issued in accordance with established eligibility requirements. 3 for statistical purposes.

ODJFS is required by law to ensure that unemployment benefits are issued in accordance with established eligibility requirements. The Ohio Department of Taxation offered guidance regarding recently enacted legislation that aligned the state with federal tax changes included in the American Rescue Plan Act of 2021 PL. 2 as a record index for processing your claim.

Report it by calling toll-free. In Ohio the Ohio Department of Job and Family Services is responsible for administering the Ohio unemployment laws and providing benefits to qualified applicants. How to Obtain an Employer Account Number.

Regular unemployment insurance from the State of Ohio is available for 26 weeks. G In accordance with section 303c3 of the Social Security Act and section 3304a17 of the Internal Revenue Code of 1954 for continuing certification of Ohio unemployment compensation laws for administrative grants and for tax credits any interest required to be paid on advances under Title XII of the Social Security Act shall be paid in a timely manner and shall not be paid directly or indirectly by an equivalent reduction in the Ohio unemployment taxes. Under Ohio law most employers are required to pay contributions for unemployment insurance.

ODJFS will use your social security number 1 to report your unemployment compensation to the Internal Revenue Service as potentially taxable income. The CARES Act initially provided an additional 13 weeks of extended PEUC benefits. Ohio Unemployment Insurance Law Compensation amounts administered by the state are determined by the amount you were earning before being laid off.

Per Section 411315 of the Ohio Revised Code an employer must pay employees at least twice per month. Each state administers a separate unemployment insurance program but all states have to follow the guidelines established by federal law. Ohio Unemployment Insurance is an option for residents who have lost employment through no fault of their own.

1 day agoCOLUMBUS OhioBoth new and ongoing unemployment claims filed in Ohio hit a two-month low last week thanks at least in part to the steadily decreasing number of. The Continued Assistance Act increased the 13 weeks to 24 weeks. The State in the form of UI assistance set by both Federal and State law.

To receive your Unemployment tax account number and contribution rate. Federal extension for unemployment compensation is available for 37 weeks. Work for such an employer is covered employment.

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Ohioans Waiting For Extended Unemployment Benefits Shouldn T Have To Wait Much Longer

Ohioans Waiting For Extended Unemployment Benefits Shouldn T Have To Wait Much Longer

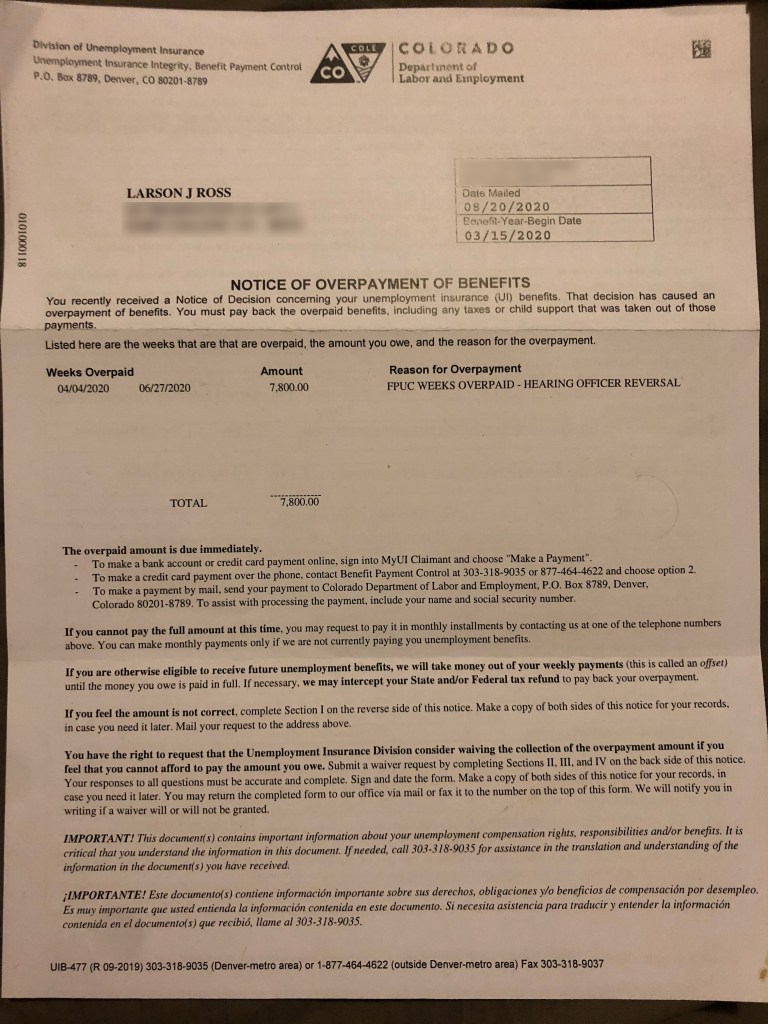

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Q A Your Most Common Unemployment Questions The Lima News

Q A Your Most Common Unemployment Questions The Lima News

Massachusetts Unemployment Insurance Benefits Pamphlet

Massachusetts Unemployment Insurance Benefits Pamphlet

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

How To Get Unemployment Benefits Even If You Quit Your Job Student Loan Hero

How To Get Unemployment Benefits Even If You Quit Your Job Student Loan Hero

Coronavirus Us Unemployment Benefits Where To Claim Phone Online As Com

Coronavirus Us Unemployment Benefits Where To Claim Phone Online As Com

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

What You Should Know About Unemployment Compensation

You Have A Secret Bank Account Heres How To Use It Social Security Benefits Social Security Disability Benefits Social Security Disability

You Have A Secret Bank Account Heres How To Use It Social Security Benefits Social Security Disability Benefits Social Security Disability

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

In Face Of Coronavirus State Policymakers Can Bolster Unemployment Compensation System

In Face Of Coronavirus State Policymakers Can Bolster Unemployment Compensation System

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

Jfs Ohio Unemployment Benefits Release Of Information

Jfs Ohio Unemployment Benefits Release Of Information

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Columbus Ohio Unemployment Compensation Livorno Arnett Co Lpa

Columbus Ohio Unemployment Compensation Livorno Arnett Co Lpa

Unemployment Insurance Faq Answered First Nonprofit Companies

Unemployment Insurance Faq Answered First Nonprofit Companies

Post a Comment for "Ohio Unemployment Insurance Law"