Kansas Unemployment Benefit Year

Amount and Duration of Unemployment Benefits in. Those benefits include a combination of unemployment insurance programs including additional weeks of benefits extended benefits and a supplemental weekly payment.

Kansas Ks Dol Enhanced Unemployment Benefit Programs Fpuc Peuc And Pua September 2021 Extension News And Updates Aving To Invest

Kansas Ks Dol Enhanced Unemployment Benefit Programs Fpuc Peuc And Pua September 2021 Extension News And Updates Aving To Invest

What does it mean to exhaust state unemployment benefits.

Kansas unemployment benefit year. A person exhausts regular unemployment benefits when he or she either 1 draws all available benefits that could be paid or 2 reaches the end of the benefit year and is not monetarily eligible for a new benefit year. State Income Tax Range. The fix will be a long and slow process itll take more than two years.

Kansas City 913 596-3500 Topeka 785 575-1460 Wichita 316 383-9947 Toll-Free 800 292-6333. The Benefit Year begins when your claim is effective. In Kansas as in most states the base period is the earliest four of the five complete calendar quarters before you filed your benefits claim.

6The Kansas Department of Labor took a step forward in its effort to modernize the unemployment insurance system state officials announced Tuesday. At least 45 percent but less that 6. A tough Covid anniversary for the unemployed.

The American Rescue Plan a 19 trillion Covid relief bill waived. Your claim is good for one year starting with this date. Virtually all states look at your recent work history and earnings during a one-year base period to determine your eligibility for unemployment.

Payouts range from 118 to 474 per week. The seasonally adjusted three-month average unemployment rate in Kansas at the time your claim is effective. State Taxes on Unemployment Benefits.

KSNW The Kansas Department of Labor is moving forward to modernize the states over 40-year-old Unemployment Insurance system. Unemployed workers can receive up to a maximum of 79 - 86 weeks of unemployment compensation depending on location the unemployment rate in your state extended unemployment benefits and eligibility. Kansas taxes unemployment benefits.

31 on taxable income from 2501 to 15000 for single filers and from 5001 to 30000. The benefit year end. Congress created two new unemployment benefits programs in its.

The benefit year is a one-year period 52 consecutive weeks commencing on the Sunday immediately preceding the day in which a valid claim is filed. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. During the benefit year a claimant may not receive more than the total benefit amount established when the claim was filed while on regular unemployment exclusive of any available extended benefits.

You can continue collecting Kansas unemployment benefits for anywhere between 16 and 26 weeks. Less than 45 percent up to 16 weeks available. The Kansas Department of Labor is taking a big step in modernizing its 40-year-old computer system.

When does my Benefit Year begin. KAKE - As part of the American Rescue Plan enacted by Congress earlier this month taxpayers on unemployment will not need to pay taxes on up to 10200 in unemployment benefits received last year. A request for a proposal went out last week.

The Pandemic Emergency Unemployment Compensation PEUC program the Pandemic Unemployment Assistance PUA program and the Federal Pandemic Unemployment Compensation FPUC program which were. 2 days agoOVERLAND PARK Kan. They will soon reach the end of their benefit year.

The maximum weekly unemployment benefits payment amount varies by state. The amount of time varies based on Kansas unemployment rates and other factors and in some cases it is possible to file a Kansas unemployment extension for additional compensation. For example unemployed people in Washington State can receive up to 624 weekly in unemployment payments with a minimum of 148 as of 2013.

Millions of workers filed for unemployment benefits in March 2020 as the Covid pandemic upended the labor market.

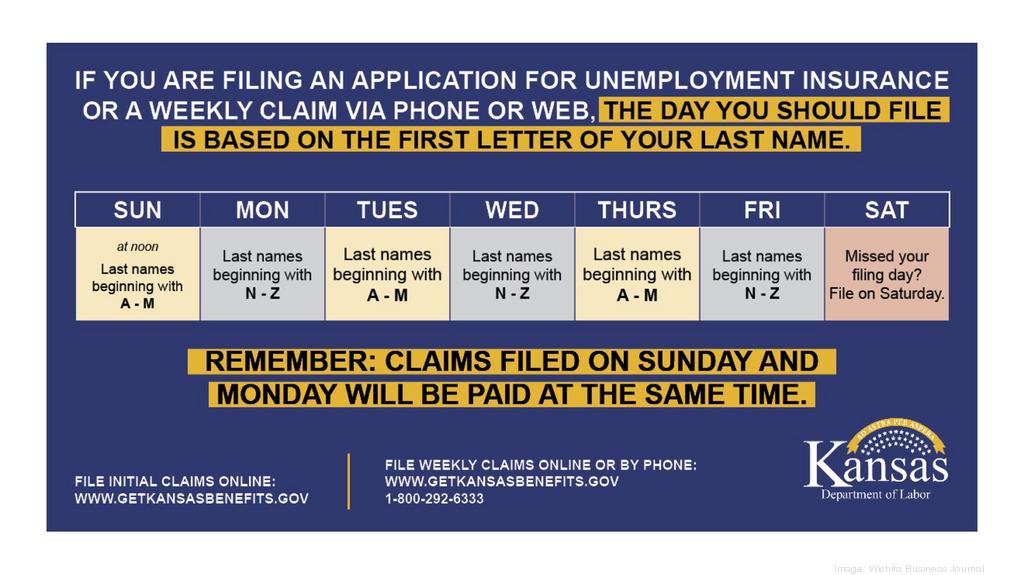

Unemployed Kansans Should Now File Weekly Claims On Certain Days Of The Week Based On Last Name Wichita Business Journal

Unemployed Kansans Should Now File Weekly Claims On Certain Days Of The Week Based On Last Name Wichita Business Journal

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Federal Unemployment Extension Filing News Tiers Update Unemployment Unemployment Rate Us Unemployment

Federal Unemployment Extension Filing News Tiers Update Unemployment Unemployment Rate Us Unemployment

Kansas Ks Dol Enhanced Unemployment Benefit Programs Fpuc Peuc And Pua September 2021 Extension News And Updates Aving To Invest

Kansas Ks Dol Enhanced Unemployment Benefit Programs Fpuc Peuc And Pua September 2021 Extension News And Updates Aving To Invest

Federal Unemployment Benefits Extension Now Available

Here S Where To Go Now That Kansas Unemployment Website Is Back

Here S Where To Go Now That Kansas Unemployment Website Is Back

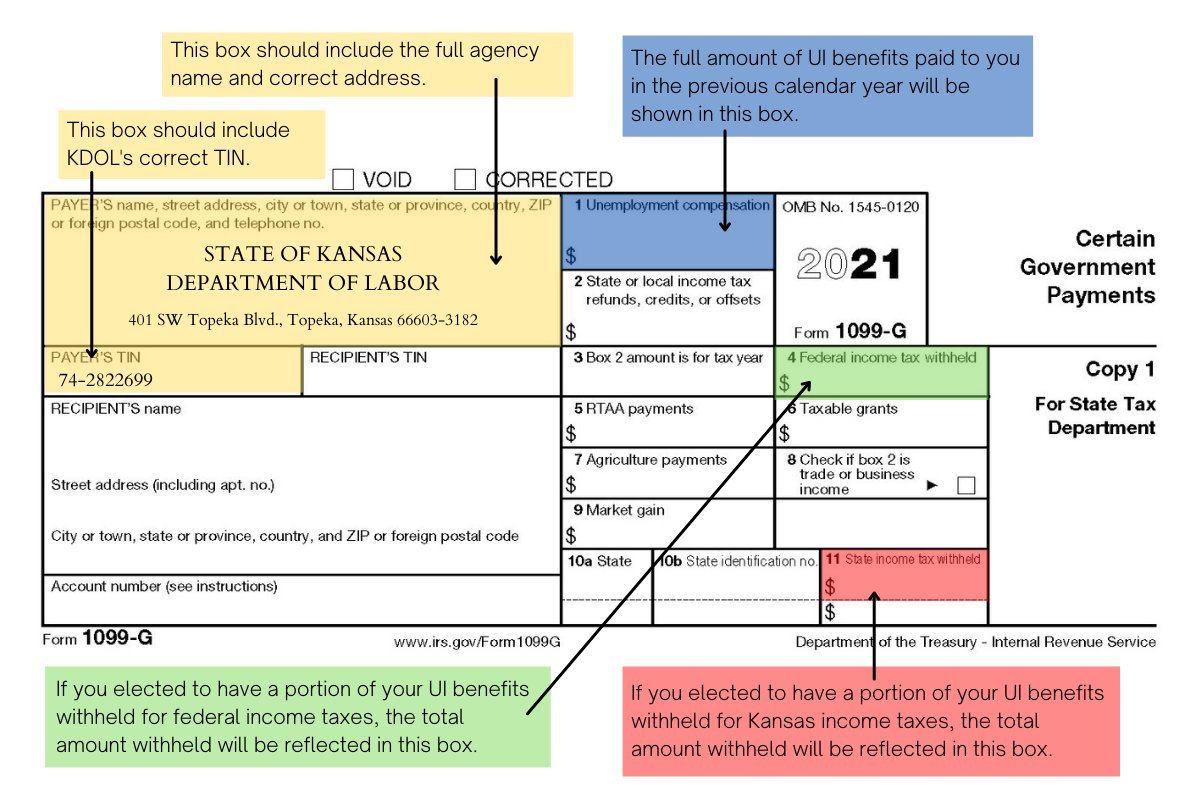

Kansas Department Of Labor On Twitter If You Have Received A 1099 G Form In The Mail Make Sure The Following Information Is Correct Kdol S Address Kdol S Tin Total Unemployment

Kansas Department Of Labor On Twitter If You Have Received A 1099 G Form In The Mail Make Sure The Following Information Is Correct Kdol S Address Kdol S Tin Total Unemployment

Home Benefits Kansas Department Of Labor

Home Benefits Kansas Department Of Labor

Kansas Department Of Labor Initiates New Weekly Claims Filing System

Kansas Department Of Labor Initiates New Weekly Claims Filing System

Home Benefits Kansas Department Of Labor

Home Benefits Kansas Department Of Labor

Claims And Benefits Employer Handbook Employers Kdol

Claims And Benefits Employer Handbook Employers Kdol

Kansas Department Of Labor Launches New Unemployment Call Back Option Ksnt News

Kansas Department Of Labor Launches New Unemployment Call Back Option Ksnt News

Though The Second National Bank Was Headquartered In Philadelphia It Had Branches In Alabama Missouri And Maine Education High School Education Bank Branch

Though The Second National Bank Was Headquartered In Philadelphia It Had Branches In Alabama Missouri And Maine Education High School Education Bank Branch

Employer Tax Rates Employers Kdol

Employer Tax Rates Employers Kdol

Kansas Confirms 26 Week Unemployment Expansion Is Operative

Kansas Confirms 26 Week Unemployment Expansion Is Operative

Kdol Shares Information And Answers To Questions About The Continued Assistance Act

Kdol Shares Information And Answers To Questions About The Continued Assistance Act

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Post a Comment for "Kansas Unemployment Benefit Year"