Is Unemployment Considered Unearned Income

Any dividends you earn from investments like stocks and mutual funds are considered unearned income. Expenses of Obtaining Income.

Unemployment is not considered earned income but it is taxable reportable and gross income as relates to claiming him.

Is unemployment considered unearned income. Working young adults are special Kiddies. The federal tax filing deadline for individuals has been extended to May 17 2021. While unemployment benefits are taxable they arent considered earned income.

Exclusions Under Other Federal Statutes. Overview of Unearned Income Exclusions. Unemployment income is considered unearned income for kiddie tax purposes.

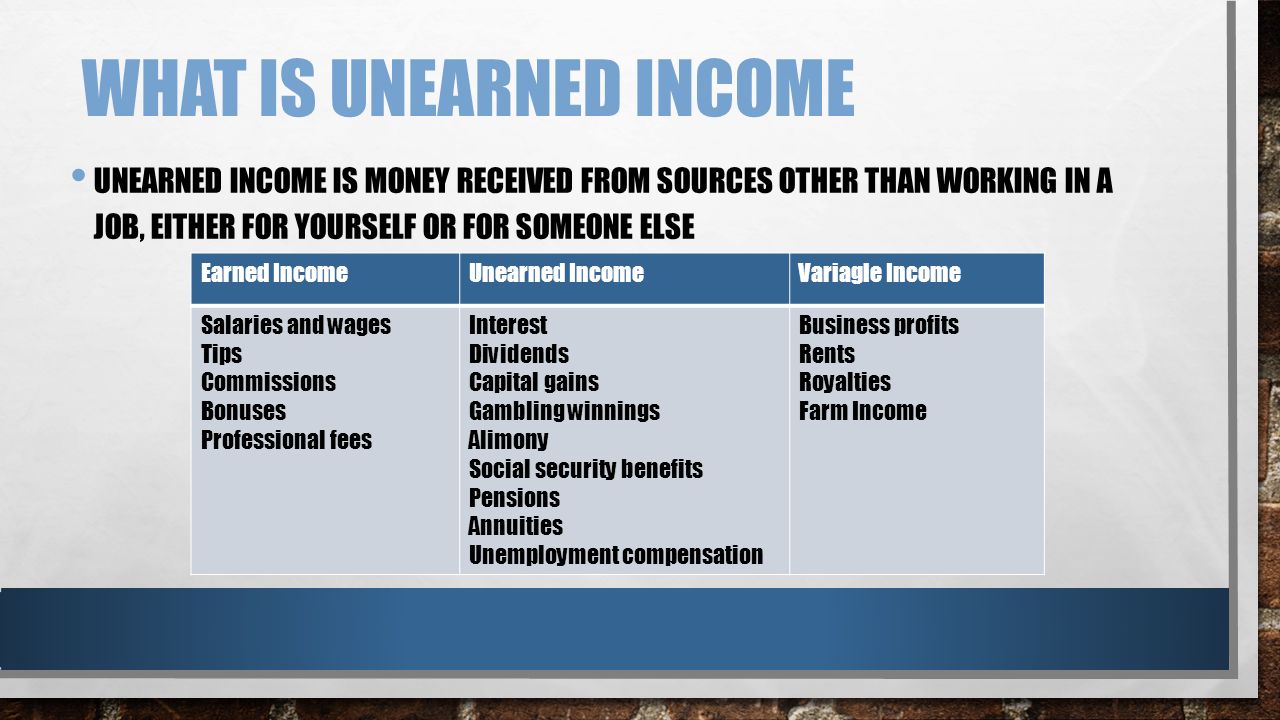

It also includes taxable social security benefits pension and annuity income taxable scholarship and fellowship grants not reported on Form W-2 unemployment. Unearned income is passive or supplemental income that might include social security benefits unemployment annuities pensions and trust funds. Unearned income includes investment-type income such as taxable interest ordinary dividends and capital gain distributions It also includes unemployment compensation taxable Social Security.

Under normal circumstances receiving unemployment would result in a reduction of both credits when you file your tax. Federal Tax Refunds and Advanced Tax Credits for SSI Income Purposes. Taxpayers who received unemployment benefits in 2020 are facing an unexpected reckoning in the 2021 filing season.

Unemployment compensation is considered unearned income. Examples of unearned income include interest from savings accounts bond. Children who are subject to the kiddie tax.

Revenue Act of 1978. Guide to Unearned Income Exclusions. Unearned income is income from investments and other sources unrelated to employment.

Unemployment income is treated the same as unearned income from investments. Yes unemployment compensation is income for purposes of the 4300 2020 limit dependent income test. CARES and COVID Tax Relief Acts Unemployment Benefits American Rescue Plan Tax-Exempt Portion of Unemployment Bogus Forms 1099-G Kiddie Tax and Unemployment States Taxation of Unemployment With the passage of the CARES Act stimulus package early in 2020.

The kiddie tax taxes the childs unearned income at the parents rate. Normally we think of unearned income as being interest dividends and capital gains but certain other types of income including unemployment benefits are considered to be unearned income. Yes Eloise will be subject to the kiddie tax because of her unemployment compensation.

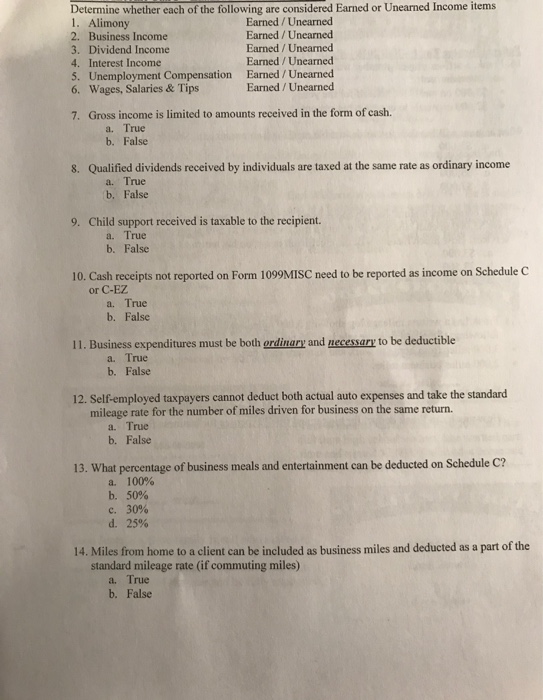

To determine if your unemployment is taxable see Are Payments I Receive for Being Unemployed Taxable. Unearned income includes taxable interest ordinary dividends capital gains including capital gain distributions rents royalties etc. Form 8615 may be required if earned income is not more than half their support Obviously the unemployment is unearned income but it is certainly not investment income.

Receiving unemployment benefits doesnt mean youre automatically ineligible for the Earned Income Credit but there are other requirements youll also need to satisfy to claim the EIC. You cannot claim him. Here is some more information about unemployment benefits of which you may be unaware.

A child who receives unemployment compensation may be subject to the kiddie tax and as a result may pay substantially higher tax than an adult receiving the same compensation. Many are just now becoming aware that income from unemployment is taxable and that. It also includes taxable interest and capital gains and even gambling and lottery winnings.

The IRS is definitely going to want you to put everything you earned whether you earned it individually through a job or unearned income via unemployment said Tagle Last year because the. The definitive non-vague answer is. Yes unemployment benefits are a form of unearned income thats taxable and reportable on federal and state returns.

ATX gives me the warning Return is for a child of age 18 and investment income exceeds 2200. You might evaluate if they should file their own return. For Form 8615 unearned income includes all taxable income other than earned income.

If you received unemployment compensation during the year you must include it in gross income.

Https Www Sccgov Org Sites Ssa About Us Debs Policy Handbooks Policy Handbook Calworks Afchap28 Pdf

8615 Filing Requirements And Ef Message 5292 Who Is Required To File Form 8615 How Do I Clear Ef Message 5292 According To Form 8615 Instructions Form 8615 Must Be Filed For Any Child Who Meets All Of The Following Conditions 1 The Child Had

8615 Filing Requirements And Ef Message 5292 Who Is Required To File Form 8615 How Do I Clear Ef Message 5292 According To Form 8615 Instructions Form 8615 Must Be Filed For Any Child Who Meets All Of The Following Conditions 1 The Child Had

2 2 Unearned Income And Payment Ppt Video Online Download

2 2 Unearned Income And Payment Ppt Video Online Download

Determining Income Type Differences With Earned Unearned Income

Determining Income Type Differences With Earned Unearned Income

Onjuno What Is Unearned Income

Onjuno What Is Unearned Income

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Chapter 2 Income Benefits And Taxes What Is

Chapter 2 Income Benefits And Taxes What Is

Onjuno What Is Unearned Income

Onjuno What Is Unearned Income

What Unearned Income Means On A Dependent S Income Tax Return Cpa Practice Advisor

What Unearned Income Means On A Dependent S Income Tax Return Cpa Practice Advisor

What S The Difference Between A Tax Return And A Refund What About Between Earned And Unearned Inc Federal Income Tax Tax Preparation Social Security Benefits

What S The Difference Between A Tax Return And A Refund What About Between Earned And Unearned Inc Federal Income Tax Tax Preparation Social Security Benefits

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Earned Income Vs Unearned Income What S The Difference Millers On Fire

Tax Rates Separating Earned Unearned Income

Tax Rates Separating Earned Unearned Income

Unearned Income And Payments Ppt Download

Unearned Income And Payments Ppt Download

What Is Unearned Income What Does Unearned Income Mean Unearned Income Meaning Explanation Youtube

What Is Unearned Income What Does Unearned Income Mean Unearned Income Meaning Explanation Youtube

Post a Comment for "Is Unemployment Considered Unearned Income"