Does Ohio Have Partial Unemployment

In Ohio for example unemployment benefits are usually limited to 20 to 26 weeks. 6 Does a taxpayer have additional time to file a refund claim.

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

You do NOT have to be totally unemployed.

Does ohio have partial unemployment. How will SharedWork Ohio benefits affect my income taxes. However in no case may the weekly benefit amount exceed the states annually established maximum levels based on the number of allowable dependents claimed. Under a SharedWork Ohio plan the participating employer reduces affected employees hours in a uniform manner.

51 rows It is possible to work part time and still receive unemployment. In some cases all of it. Your weekly benefit amount is computed at one-half of your average weekly wage during your base period.

Alabama does not tax unemployment benefits. In New York your benefits are typically limited to 26 times your full weekly rate. Is there still an earnings cutoff for partial unemployment benefits.

Unemployment benefits will be available for eligible individuals who are requested by a medical professional local health authority or employer to be isolated or quarantined as a consequence. Ohio doesnt have local unemployment offices but you can visit your countys OhioMeansJobs center for help finding a job. Partial unemployment provisions help those who may be working but are still experiencing a loss of work.

The 17 million Ohioans who collected unemployment in 2020 will get a nice chunk of the taxes they paid on it back. Each state has its own formula for calculating unemployment benefits including partial benefits. May be entitled to receive for one week of total unemployment.

The participating employee works the reduced hours each week and the Ohio Department of Job and Family Services ODJFS provides eligible individuals an unemployment insurance benefit proportionate to their reduced hours. An executive order issued by Governor DeWine expands flexibility for Ohioans to receive unemployment benefits during Ohios emergency declaration period. Also you must have worked at least 20 weeks and earned at least an average weekly wage of 269 in the past 4 or.

If your hours are cut you may still be eligible for what is called partial unemployment compensation. In other words you wont be eligible if full-time work is available but you have chosen to work part time for personal reasons. Please call 877 644-6562 or your assigned processing center.

If you earn more than 504 in weekly gross pay the amount of money earned before taxes and deductions are taken out excluding earnings from self-employment you will not be eligible for unemployment or pandemic benefits for that week no matter how few hours you worked. In California benefits usually last between 12 to 26 weeks depending on your earnings during the base period. I applied for unemployment but I havent heard anything.

197 the statute of limitations for a refund claim set to expire between March 9 2020 and the end of the Governors COVID-19 emergency declaration or July 30 2020 whichever is earlier is tolled during that time. To have Ohio unemployment eligibility you must meet the following criteria. This may occur a lot.

However if your hours are reduced by more than 50 percent you may be able to receive total or partial unemployment benefits. In addition the first 25000 received from an employer as severance pay unemployment compensation and the like. While you can only collect a portion of your benefits it can provide a supplemental income.

For more information on these rules see Eligibility for Partial Unemployment. Ohio is one of the states that allows partial unemployment but you have to meet the minimum requirements of the Department of Jobs and Family Services DJFS to participate. I just filed a claim but then got rehired.

But dont file your tax returns just yet local accountants and state officials say. How to Calculate Partial Benefits. State Taxes on Unemployment Benefits.

Any unemployment benefits including SharedWork Ohio benefits are subject to federal income tax. And if you already filed the IRS is still working on a. You are either totally or partially unemployed when you file your claim.

Pursuant to uncodified section 22 of Am. If you are totally unemployed it means you have no income or earnings due to you during the week you apply for unemployment.

Coronavirus Unemployment Questions When Does The 600 Check Arrive News The Columbus Dispatch Columbus Oh

Coronavirus Unemployment Questions When Does The 600 Check Arrive News The Columbus Dispatch Columbus Oh

Ohiojfs On Twitter Unemployment Tip Do Not Reopen Claim Application For Unemployment Faq S Visit Https T Co M9geahtrmo Inthistogetherohio Everyclaimisimportant Covid19 Https T Co Plh2gdbalr

Ohiojfs On Twitter Unemployment Tip Do Not Reopen Claim Application For Unemployment Faq S Visit Https T Co M9geahtrmo Inthistogetherohio Everyclaimisimportant Covid19 Https T Co Plh2gdbalr

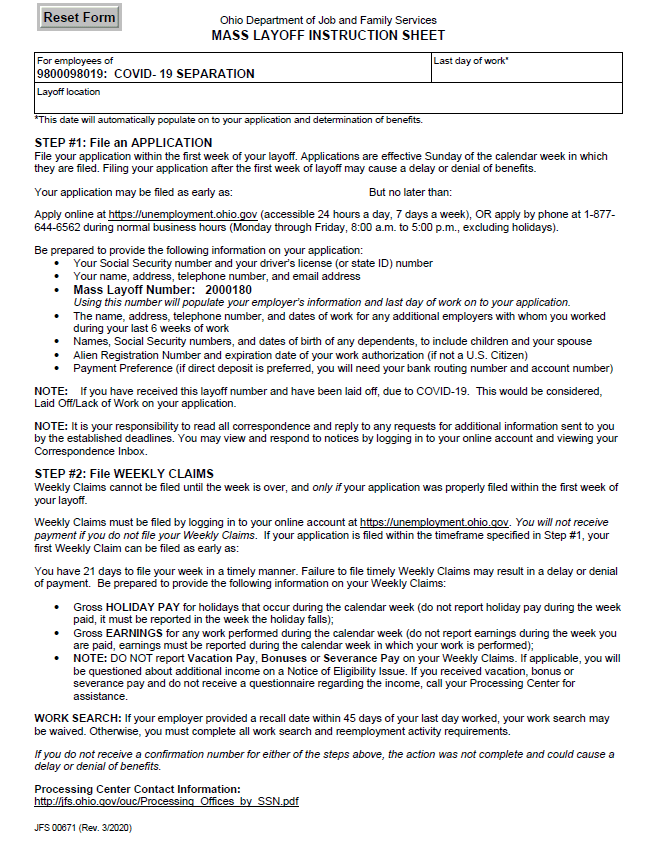

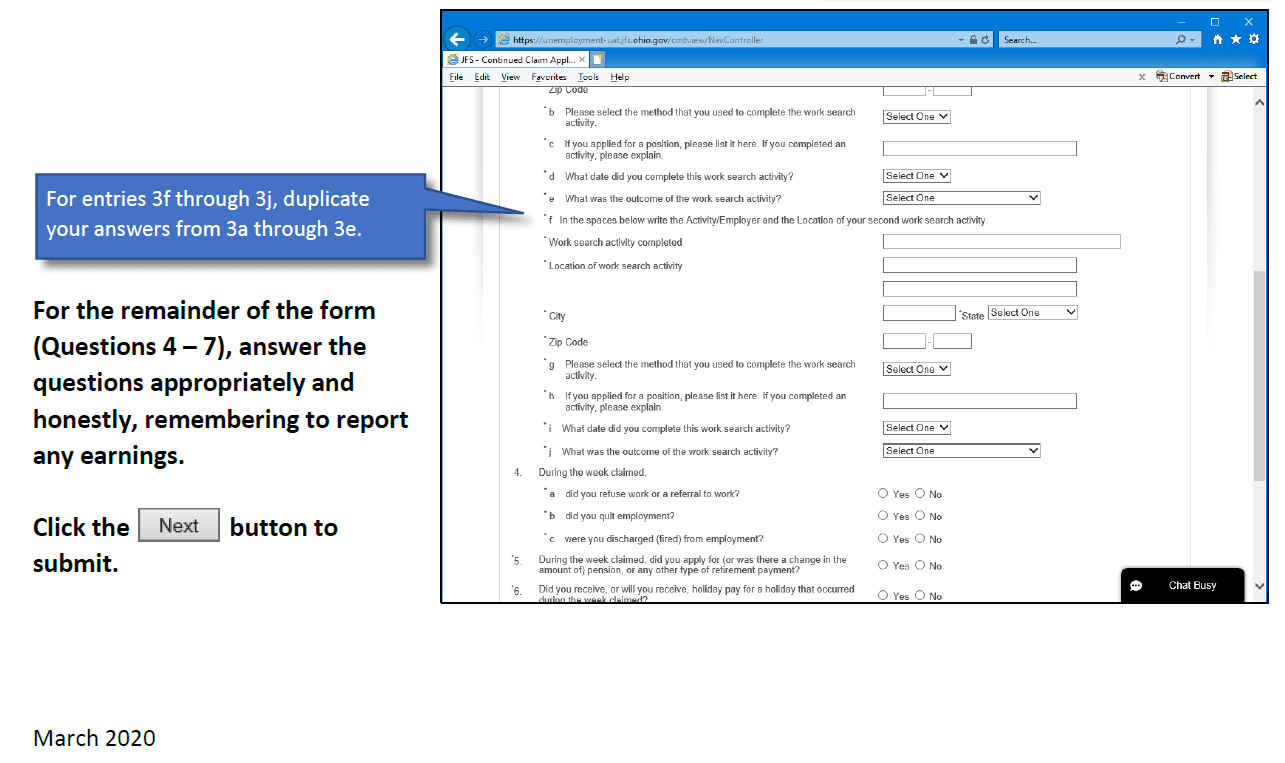

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Www Ohioattorneygeneral Gov Files Administrative Appeals Decision 2013 10 30 Cuyahoga Cleveland Clinic Foundation

Scam Targets Ohioans Who Receive Or Have Received Pandemic Unemployment Assistance The Statehouse News Bureau

Scam Targets Ohioans Who Receive Or Have Received Pandemic Unemployment Assistance The Statehouse News Bureau

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Https Ccao Org Wp Content Uploads Hdbkchap070 1994 Pdf

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

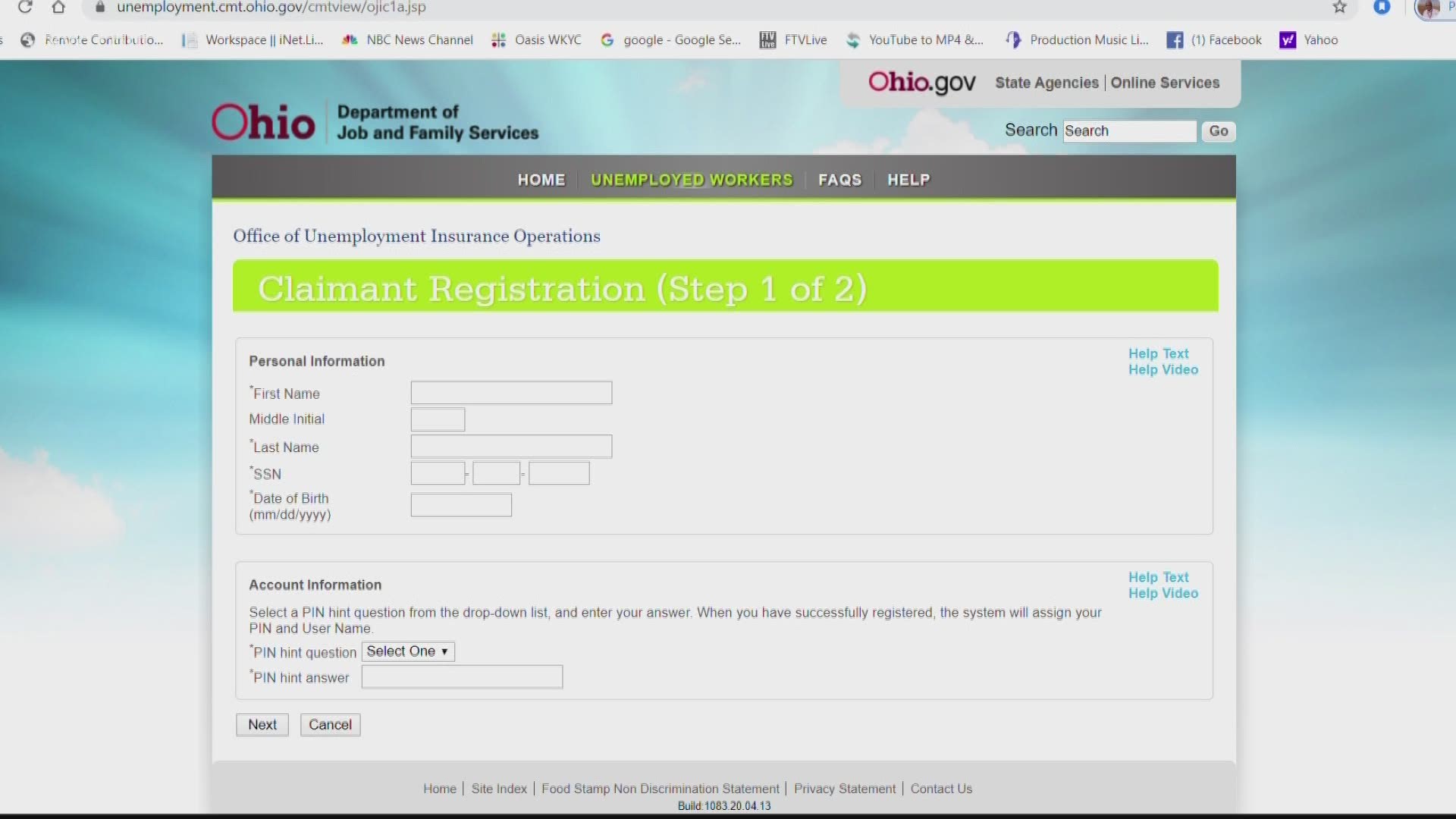

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Apply For Unemployment Benefits Online In Ohio Youtube

Https Marketing Sedgwick Com Acton Ct 4952 P 023b Bct Ct12 0 1 D Sid Tv2 3abejyl3qts

Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids

Debunking Myths About Covid 19 Relief S Unemployment Insurance On Steroids

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Unemployment Changes In Ohio Due To Covid 19 Equality Ohio

Answers To Qualifying For Unemployment The 300 Payments And Disputed Ohio Claims That S Rich Q A Cleveland Com

Answers To Qualifying For Unemployment The 300 Payments And Disputed Ohio Claims That S Rich Q A Cleveland Com

Ohio S Unemployment Data Shows Only Half Of 1 11 Million Who Filed Have Received Benefits Weareiowa Com

Ohio S Unemployment Data Shows Only Half Of 1 11 Million Who Filed Have Received Benefits Weareiowa Com

Post a Comment for "Does Ohio Have Partial Unemployment"