Do You Have To Claim Less Than $600

If you had earnings from other g. Yes if you are required to file a tax return you have to report ALL income whatever the amount including self-employment income under 600.

How I Created A 30 000 Per Year Pet Sitting Business For Less Than 600 Pet Sitting Business Pet Sitting Dog Walking Business

How I Created A 30 000 Per Year Pet Sitting Business For Less Than 600 Pet Sitting Business Pet Sitting Dog Walking Business

Due to the lack of a Form 1099 from Uber TurboTax wont be able to import your income automatically.

Do you have to claim less than $600. Estate tax also called the death. Sweepstakes sponsors must report prizes worth 600 or more to the IRS. Note that the 600 is a threshold below which a payer is not required to issue a form 1099-MISC but the recipient of.

Youll receive a copy of the 1099 and the IRS will receive a copy as well. Its only that Doordash isnt required to send you a 1099 form if you made less than 600. For example in 2020 if you earned less than 600 from a side gig the payer doesnt have to send you a 1099 form but you still have to report the earnings.

You can deduct certain expenses from self-employment income. You are required to report and pay taxes on any income you receive. Form 1099-MISC is required to be issued to independent contractors or the self-employed who have been paid 600 or more.

You are not required to file if your total SE self-employment income is less than 600 and that is all the income you have to report. This is a common misconception for many beginner freelancers or independent contractors that can get you into a lot of trouble with the IRS. Its included in taxable income whether a 1099-MISC was issued or not.

Theres a way to claim the missing funds. Instead youll want to manually enter your income from Ubers Tax Summary by following these steps. IF I had a job that i made LESS THAN 600 DO I HAVE TO claim that.

This rule is for companies and payors who hire nonemployees only. According to the IRS it is a widespread misconception that wages under 600 arent taxed or do not have to be reported. Sweepstakes sponsors are required to submit a 1099 form for prizes and awards that are not for services such as winnings on TV or radio shows if those prizes are valued above 600.

Do I have to pay taxes if I made less than 600 with Doordash. This rule can make things a little confusing for the taxpayer though since logic can easily lead you to conclude that you dont have to file taxes if you dont receive a form. If those earnings are all the taxable income you had for the year you wouldnt need to file a tax return at all.

The 600 Rule The 600 rule applies to the business paying you money not to you. The reason that this gets confusing for individual taxpayers is that the threshold for required reporting from the payor is 600. Form 706 estate tax return In addition to regular income tax a second kind of tax can be levied against certain estates.

If that was your only income and you were a Form W-2 employee then no you would not be required to file. If you were paid less than 600 for your services an amount that doesnt trigger a 1099-MISC youre still responsible for reporting the income. The taxpayer who receives the income is required to report the income regardless of the amount even if the amount is less than 600.

If you have other income or are filing a return regardless of your income level then yes you must claim all income. Payments of 600 or more for services performed for your business by people not treated as your employees such as fees to subcontractors attorneys accountants or directors. The IRS requires that if a business remits 600 or more to you during the tax year it must issue you a Form 1099-MISC for that amount.

While it is true that companies paying independent or self-employed contractors are not required to supply them with a 1099-NEC for jobs less than 600 this has no bearing on whether you report this income to the IRS. Favorite Answer 1099s are required to be sent out if you make 600 or more during the year. Self-employed taxpayers and those who work as independent contractors typically report their miscellaneous income on Schedule C of IRS Form 1040.

Use allowable deductions to trim your tax bill Business expenses reduce the amount of taxable income lowering your tax bill. That said a business can still send out a 1099 to a. No you dont have to file a Form 1099-MISC for non-employee compensation less than 600.

1 Casinos and gambling institutions are required to withhold taxes on winnings above 600. The 600 threshold is not related to whether you have to pay taxes. If you were left out of those earlier payments or you received less than.

If you didnt receive a 1099 from UberLyft this year it may mean that you made less than 20000 gross and less than 200 trips. You must file Form 1099-MISC if any of the following situations apply. Some may be wondering why they havent received their 1200 or 600 checks.

But the 600 rule. In other words if. Form 1041 is only required if the estate generates more than 600 in annual gross income.

The 600 rule often gives payees the wrong impression that they dont have to report their own 1099 earnings if they make less than 600. Income is income no matter the amount. If the income was from self-employment or as an independent contractor received cash no taxes.

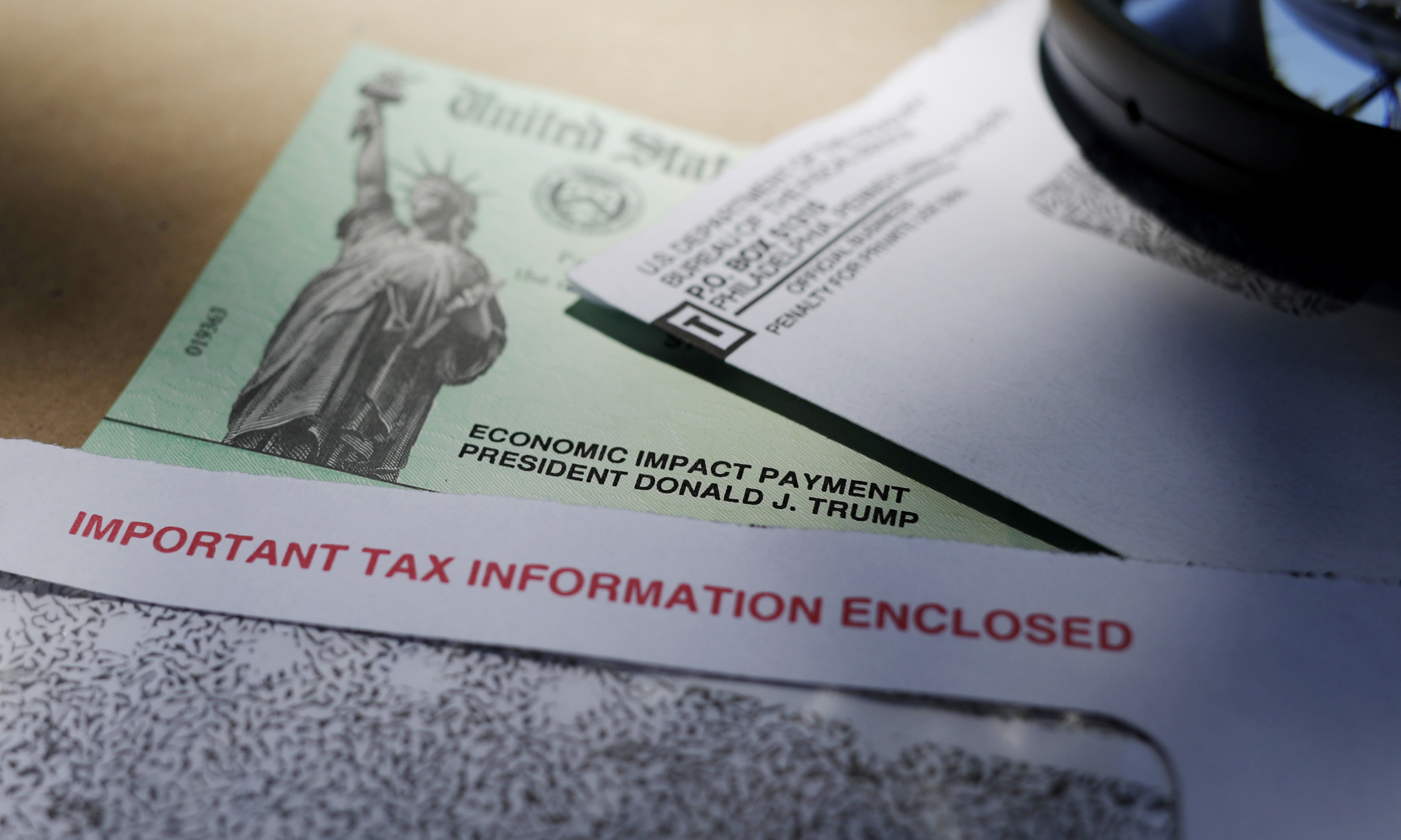

What Do You Do If You Have Not Received Your 600 Stimulus Check Yet The Irs Offers Some Tips Kiro 7 News Seattle

What Do You Do If You Have Not Received Your 600 Stimulus Check Yet The Irs Offers Some Tips Kiro 7 News Seattle

600 Stimulus Check Didn T Get A Payment Or The Full Amount 9news Com

600 Stimulus Check Didn T Get A Payment Or The Full Amount 9news Com

Shipping Company Breaks 600 Tv Denies Claims Loses Millions Revenge Stories Inspirational Life Lessons Shipping Company

Shipping Company Breaks 600 Tv Denies Claims Loses Millions Revenge Stories Inspirational Life Lessons Shipping Company

2nd Stimulus Check 600 Payments Have Started Going Out Mnuchin Says Syracuse Com

2nd Stimulus Check 600 Payments Have Started Going Out Mnuchin Says Syracuse Com

Here S Who Qualifies For A 600 Stimulus Check With The New Covid 19 Relief Package

Here S Who Qualifies For A 600 Stimulus Check With The New Covid 19 Relief Package

Do You Have To File A 1099 Under 600

Do You Have To File A 1099 Under 600

California Oks 600 Stimulus Check And Small Business Aid Los Angeles Times

California Oks 600 Stimulus Check And Small Business Aid Los Angeles Times

Ask The Taxgirl Reporting Income Under 600

Ask The Taxgirl Reporting Income Under 600

Want Your Third Stimulus Check Sooner Try These Things Before It S Approved Cnet

Want Your Third Stimulus Check Sooner Try These Things Before It S Approved Cnet

Irs Says All 600 Stimulus Payments From December Bill Have Been Sent

Will You Get A 600 Tax Refund If You Didn T Get Your Stimulus Check It S Not That Simple Personal Finance Tulsaworld Com

Will You Get A 600 Tax Refund If You Didn T Get Your Stimulus Check It S Not That Simple Personal Finance Tulsaworld Com

600 Stimulus Check For Californians Qualifications And When Your Payment Could Arrive Cnet

600 Stimulus Check For Californians Qualifications And When Your Payment Could Arrive Cnet

What Dependents Qualify For An Additional 600 Stimulus Check Kare11 Com

What Dependents Qualify For An Additional 600 Stimulus Check Kare11 Com

Dead People May Still Get 600 Stimulus Checks

Dead People May Still Get 600 Stimulus Checks

Dependents And Stimulus Checks Everything New And Different You Should Know Even If Your Check Came Cnet

Dependents And Stimulus Checks Everything New And Different You Should Know Even If Your Check Came Cnet

Best Mirrorless Camera Under 600 Guide For 2021 Sony Camera Mirrorless Camera Best Digital Camera

Best Mirrorless Camera Under 600 Guide For 2021 Sony Camera Mirrorless Camera Best Digital Camera

Now S The Time To Claim Your Missing Stimulus Money On Your 2020 Tax Refund Here S How In 2021 Tax Refund Filing Taxes Tax Credits

Now S The Time To Claim Your Missing Stimulus Money On Your 2020 Tax Refund Here S How In 2021 Tax Refund Filing Taxes Tax Credits

Third Stimulus Checks Are In The Mail Is Your Payment Amount Correct Filing Taxes Adopting A Child Cnet

Third Stimulus Checks Are In The Mail Is Your Payment Amount Correct Filing Taxes Adopting A Child Cnet

Post a Comment for "Do You Have To Claim Less Than $600"