Delaware State Unemployment Tax Rate 2021

Use the Delaware paycheck calculators to see the taxes on your paycheck. Personal Income Tax Forms current Personal Income Tax Forms prior years Paper Tax Forms.

Congress Wants To Waive Taxes On Unemployment Some States May Not

Congress Wants To Waive Taxes On Unemployment Some States May Not

The state began a phased reopening of businesses in May 2020 and economic activity has picked up.

Delaware state unemployment tax rate 2021. - Governor John Carney on Monday signed House Bill 65 which provides unemployment tax relief for Delawareans and businesses affected by the COVID-19 crisis. The First State has a progressive income tax system with income tax rates similar to the national average. 8 th 2021 Governor John Carney signed House Bill 65 which waives 2020 state income tax on unemployment benefits collected by Delawareans who lost a job or income over the course of the year.

Under the measure HB. 65 tax for new employers are the same for 2021 as in 2020. However its always possible that amount could change.

Phone Directory Locations Directory Public Meetings Voting Elections Transparency Delaware Marketplace. State median of 52. Click here for important information for tax filers taking.

Wage Base and Tax Rates. The state UI tax rate for new employers also is subject to change from one year to the next. Here is a list of the non-construction new employer tax.

As an employer youre responsible for paying state unemployment insurance which covers those unemployed through no fault of their own. 17 hours agoDOVER April 9 2021 The Delaware Division of Public Health DPH is providing an update on the most recent statistics related to coronavirus disease 2019 COVID-19 in Delaware as of 6 pm. Get the latest information on Division of Unemployment Insurance response to COVID-19 including Frequently Asked Questions.

Delaware state income tax rate table for the 2020 - 2021 filing season has seven income tax brackets with DE tax rates of 0 22 39 48 52 555 and 66 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. The legislation - sponsored by Representative Ed Osienski and Senator Jack Walsh - waives 2020 state income tax on unemployment benefits collected by Delawareans who lost a job or income over the. The Delaware income tax has six tax brackets with a maximum marginal income tax of 660 as of 2021.

The tax an employer pays depends on the size of the employers taxable payroll the employers unemployment insurance tax rate and the taxable wage base. If youre a new employer youll pay a flat rate of 18. A total of 97784 positive cases of COVID-19 among Delaware residents have been reported to DPH since March 18 2020.

Form 200ES Delaware Estimated Income Tax Voucher 2021 Select Quarter using Installment Due dropdown. 20 rows State unemployment tax assessment SUTA is based on a percentage of the taxable. Compared to individual corporate sales and property taxes unemployment insurance UI taxes are less widely understood but they have important implications for a states business climate.

52 rows SUI tax rate by state. Delaware Personal Tax Forms. Mail to State of Delaware Division of Revenue PO BOX 830 Wilmington DE 19899-0830.

For 2021 the standard tax rate for new employers is 18 and the rate for new construction employers is 23. Thursday April 8 2021. Detailed Delaware state income tax rates and brackets are available on this page.

Employment has rebounded 643 from the trough as of February ahead of the 576 US. The seven-day average of new positive cases. Unemployment Insurance Tax.

The unemployment-taxable wage base is 16500. The taxable wage base is 18500 and the minimum and maximum tax rates. Even with the rebound in employment Delawares unemployment rate of 63 as of February is above the US.

Delaware Business Tax Forms. Todays map is the final in our series examining each of the five major components of the 2021 State Business Tax Climate Index. However the Fitch.

According to the Division of Unemployment Insurance thousands of businesses will benefit from the freeze. UI tax is paid on each employees wages up to a maximum annual amount. Delawares unemployment tax rates for experienced employers in 2021 range from 03 to 82.

That amount known as the taxable wage base has held steady in recent years at 18500. Delaware State Code State Regulations Business First Steps. Form 200ESi Delaware Estimated Income Tax Voucher.

The wage base in Delaware is 16500 for 2021 and rates range from 03 to 82. Those paying the new employer tax rate of 18 will save an estimated 264 per employee in 2021. A states performance on the UI tax component accounts for 94.

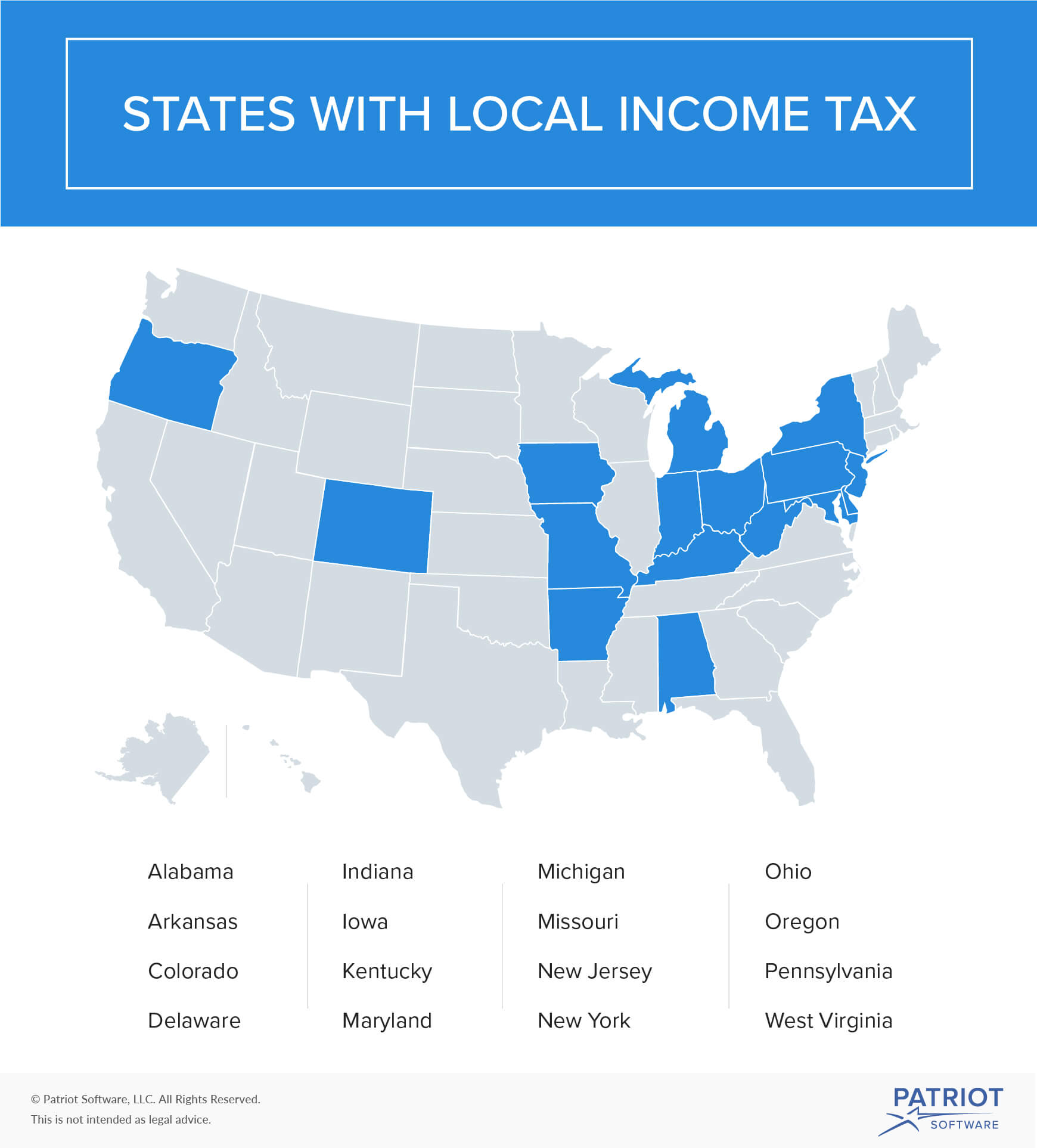

What Is Local Income Tax Types States With Local Income Tax More

What Is Local Income Tax Types States With Local Income Tax More

Delaware Paycheck Calculator Smartasset

Delaware Paycheck Calculator Smartasset

Home Delaware Department Of Labor

Home Delaware Department Of Labor

Historical Delaware Tax Policy Information Ballotpedia

Historical Delaware Tax Policy Information Ballotpedia

Unemployment Trust Fund Reforms Fall Short Cbia

Unemployment Trust Fund Reforms Fall Short Cbia

Delaware Senate Passes Unemployment Tax Relief Wboc Tv

Delaware Senate Passes Unemployment Tax Relief Wboc Tv

Amazon Com De Labor Law Poster 2021 Edition State Federal And Osha Compliant Laminated Poster Delaware English Prints Office Products

Amazon Com De Labor Law Poster 2021 Edition State Federal And Osha Compliant Laminated Poster Delaware English Prints Office Products

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

Ranking State Unemployment Insurance Taxes Hawaii Free Press

Ranking State Unemployment Insurance Taxes Hawaii Free Press

Delaware Weekly Unemployment Claims Fall To Lowest Pandemic Level Dbt

Delaware Weekly Unemployment Claims Fall To Lowest Pandemic Level Dbt

Unemployment Line Goes Online State Of Delaware News

Unemployment Line Goes Online State Of Delaware News

Bipartisan Bill Would Waive State Tax On 2020 Unemployment Benefits Town Square Delaware Live

Bipartisan Bill Would Waive State Tax On 2020 Unemployment Benefits Town Square Delaware Live

2021 State Unemployment Insurance Tax Climate Index 501 C Services

2021 State Unemployment Insurance Tax Climate Index 501 C Services

Dscc Daily Delaware State Chamber Of Commerce Wilmington De 19899

Dscc Daily Delaware State Chamber Of Commerce Wilmington De 19899

Legislation Calls For No Tax On Jobless Checks While Holding The Line On Contributions To Unemployment Fund Delaware Business Now

Legislation Calls For No Tax On Jobless Checks While Holding The Line On Contributions To Unemployment Fund Delaware Business Now

Pandemic Jobless Claim Payouts In Delaware Total 1 1 Billion Delaware Business Now

Pandemic Jobless Claim Payouts In Delaware Total 1 1 Billion Delaware Business Now

Delaware Income Tax 1099g Information Delaware Department Of Labor

Delaware Income Tax 1099g Information Delaware Department Of Labor

Post a Comment for "Delaware State Unemployment Tax Rate 2021"