Can You File For Unemployment If You Are Self Employed In Ny

31 2021 you need to provide proof of prior employment including self-employment in order to receive federal unemployment benefits. Freelance self-employed and gig workers are now eligible for unemployment benefits but many say the filing process is confusing and difficult.

See Form DTF-215 Recordkeeping Suggestions for Self-employed Persons for examples of the documentation the Tax Department will and will not accept in support of your claim.

Can you file for unemployment if you are self employed in ny. But coronavirus legislation has changed that at least temporarily. Yes you can claim both credits however it may be limited. The minimum benefit rate is 50 of.

With the recent introduction of new unemployment and relief benefits for self-employed professionals though your eligibility may change. However the federal government created new provisions that allow 1099 earners to tap into unemployment benefits during the ongoing COVID-19 pandemic. Currently most self-employed individuals and independent contractors working in New York State are not authorized to obtain unemployment insurance benefits.

You qualify if you are self-employed a 1099 filer or independent contractor that was affected by COVID-19. For instance with new plans like disaster relief funds and other unemployment aid becoming available you. You qualify if you are seeking part.

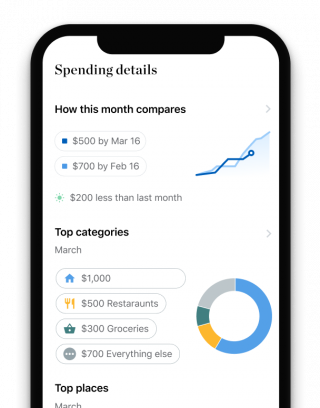

The amount you recieve is based on your previous income and may vary based on where you live and your benefit guidelines. However self-employed individuals and independent contractors may be eligible for benefits under PUA. You will not be eligible for PUA if you can telework or if you are.

The FFCRA provides two self-employed tax credits to help cover the cost of taking time off due to COVID-19. Normally self-employed and 1099 earners such as sole independent contractors freelancers gig workers and sole proprietors do not qualify for unemployment benefits. Form 8829 if you are claiming business use of your home.

You must include documentation that supports the basis for your calculations. Pandemic Unemployment Assistance is a new federal program that is part of the Coronavirus Aid Relief and Economic Security CARES Act that provides extended eligibility for individuals who have traditionally been ineligible for Unemployment Insurance benefits eg self. As of Jan.

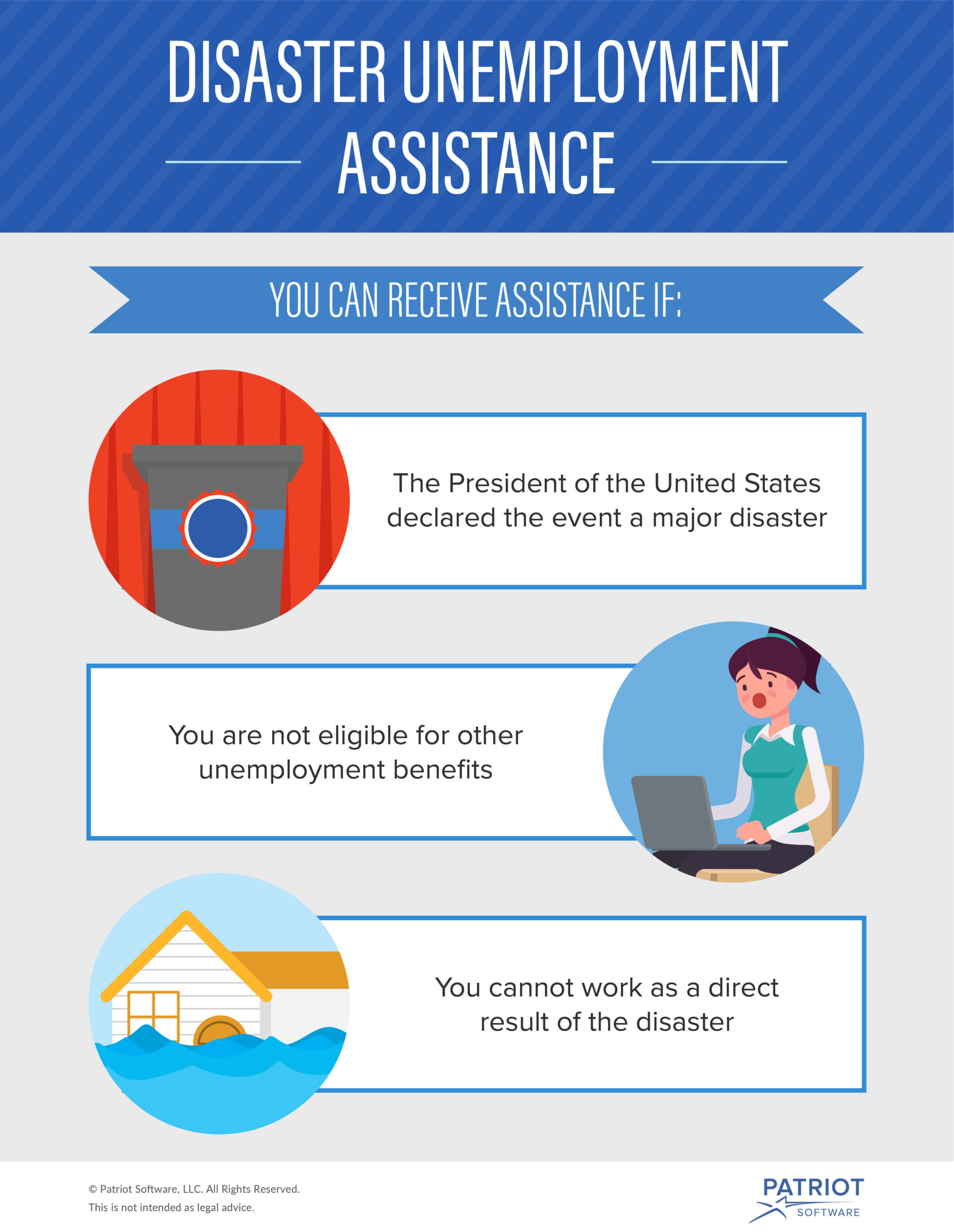

You may be eligible for unemployment benefits if. Currently most self-employed individuals and independent contractors working in New York State are not authorized to obtain unemployment insurance benefits. However self-employed individuals and independent contractors may be eligible for benefits under PUA.

If you are not traditionally eligible for unemployment benefits self-employed independent contractors farmers workers with limited work history and others and are unable to work as a direct result of the coronavirus public health emergency you may now be eligible through Pandemic Unemployment Assistance PUA. If you are self-employed an independent contractor or a farmer you may now be eligible and can file for benefits online. You are a part-time worker freelancer gig-worker or independent contractor sole proprietor or single-member LLC.

PUA is available for individuals who would. If you are not traditionally eligible for unemployment benefits self-employed independent contractors farmers workers with limited work history and others and are unable to work as a direct result of the coronavirus public health emergency you may now be eligible through Pandemic Unemployment Assistance PUA. Traditionally self-employed professionals are ineligible for unemployment benefits because they generally do not make contributions to the unemployment taxes that these benefits come from.

The New York State Department of Labor is. While most of the text in these laws apply to businesses with employees it also applies to self-employed individuals. Provide unemployment benefits to self-employed workers who dont traditionally qualify.

Keeping documentation about your previous income and wages as a freelancer independent contractor or self-employed worker is important and will help you when filing for unemployment. You have lost work due to reasons relating to the coronavirus pandemic. Being self-employed usually means you cant get unemployment benefits when your business income dips or dries up.

Under the relief law people who are self-employed including independent contractors and gig workers and not eligible for regular unemployment insurance can still receive unemployment benefits if they are unable to work or are working reduced hours due to the coronavirus.

How To Apply For Unemployment As An Independent Contractor Money

How To Apply For Unemployment As An Independent Contractor Money

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Free Unemployment Verification Letter Sample With Benefits Plus In Proof Of Unemployment Letter Template Business Letter Template Lettering Letter Templates

Free Unemployment Verification Letter Sample With Benefits Plus In Proof Of Unemployment Letter Template Business Letter Template Lettering Letter Templates

Unemployment Insurance Benefits For Self Employed Contractors And Farmers Department Of Labor

Unemployment Insurance Benefits For Self Employed Contractors And Farmers Department Of Labor

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Self Employed Unemployment Insurance Can Business Owners File

Self Employed Unemployment Insurance Can Business Owners File

Meeting Illustrators Innovative Meeting Ideas In Nyc Imagethink How To Memorize Things Creative Thinking Visual Learners

Meeting Illustrators Innovative Meeting Ideas In Nyc Imagethink How To Memorize Things Creative Thinking Visual Learners

Never Worked Resume Sample Job Resume Examples Resume Examples Sample Resume Templates

Never Worked Resume Sample Job Resume Examples Resume Examples Sample Resume Templates

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Free Unemployment Verification Letter Sample With Benefits Plus In Proof Of Unemployment Letter Template Business Letter Template Lettering Letter Templates

Free Unemployment Verification Letter Sample With Benefits Plus In Proof Of Unemployment Letter Template Business Letter Template Lettering Letter Templates

26 Cover Letter Sample Pdf Cover Letter Sample Pdf Job Application Letter Format Pdf Save Co Job Cover Letter Writing A Cover Letter Cover Letter For Resume

26 Cover Letter Sample Pdf Cover Letter Sample Pdf Job Application Letter Format Pdf Save Co Job Cover Letter Writing A Cover Letter Cover Letter For Resume

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Self Employed How To Claim 600 Week Unemployment Youtube

Self Employed How To Claim 600 Week Unemployment Youtube

Skin In The Game By Nassim Nicholas Taleb 9780425284643 Penguinrandomhouse Com Books Philosophy Books Nassim Nicholas Taleb Good Books

Skin In The Game By Nassim Nicholas Taleb 9780425284643 Penguinrandomhouse Com Books Philosophy Books Nassim Nicholas Taleb Good Books

Can I Get Unemployment If I M Self Employed Credit Karma

Can I Get Unemployment If I M Self Employed Credit Karma

How To File For Unemployment Benefits If You Re Self Employed Youtube

How To File For Unemployment Benefits If You Re Self Employed Youtube

Affidavit Letter Of Support Example New Sample Affidavit Of Support 8 Examples In Pdf Support Letter Teacher Letter Of Recommendation Business Letter Template

Affidavit Letter Of Support Example New Sample Affidavit Of Support 8 Examples In Pdf Support Letter Teacher Letter Of Recommendation Business Letter Template

Post a Comment for "Can You File For Unemployment If You Are Self Employed In Ny"