Are Gig Workers Entitled To Unemployment Benefits

Although gig workers and other independent contractors have access to some federal coronavirus emergency relief they typically arent entitled to unemployment compensation and other benefits. Gig economy workers such as Uber and app-based delivery drivers would be allowed to claim unemployment benefits under a 2 trillion package awaiting final congressional.

Unemployment Recipients Aren T Getting Support They Re Eligible For Report Finds Marketplace

Unemployment Recipients Aren T Getting Support They Re Eligible For Report Finds Marketplace

Self-employed contract and gig workers must submit their 2019 IRS 1040 Schedule C F or SE prior to December 26 2020 by fax or mail.

Are gig workers entitled to unemployment benefits. In an unusual move Congress included ride-hail drivers like Bazian in the 2 trillion pandemic relief bill approved last month. The Court of Appeals determined that THESE gig workers at least ARE entitled to collect unemployment benefits. But with it they are entitled to the same unemployment compensation that traditional employees receive plus the same additional 600 a week that traditional employees are receiving from the federal government.

In yet another wrinkle California is. Some gig workers may be scratching their heads at what for many has become a roundabout process to get unemployment benefits. Historically gig workers like Julie have not been eligible for unemployment benefits.

2 days agoSteady the leading income intelligence platform for 1099 gig and hourly workers will assist states in verifying workers income to get unemployment benefits out more efficiently. Non-traditional applicants who are eligible will qualify for a base weekly benefit amount of 207 plus the additional 600 Federal Pandemic Unemployment Compensation FPUC payment per week. She said The majority of workers in the app-enabled gig economy come from this economically vulnerable demographic.

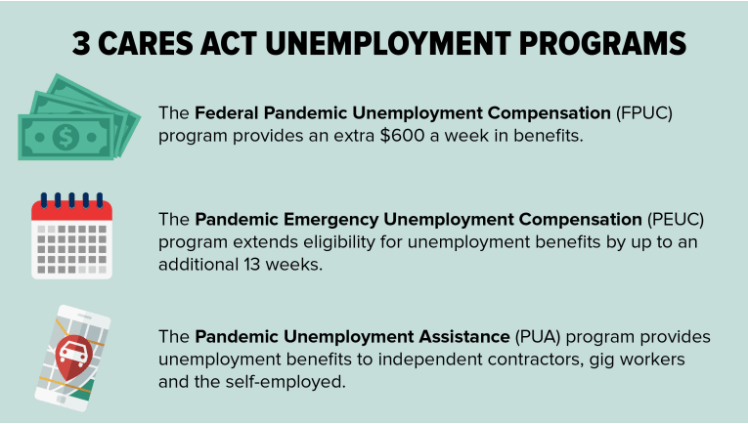

New unemployment programs created during the pandemic including Pandemic Unemployment Assistance for gig worker and those not traditionally eligible Pandemic Emergency Unemployment Compensation. Self-employed workers independent contractors gig economy workers and people who have not worked long enough to qualify for the other types of unemployment assistance may still qualify for PUA if they are otherwise able to work and available for work within the meaning of the applicable state law and certify that they are unemployed partially unemployed or unable or unavailable to work. Without this rideshare drivers and other gig workers would have no hope of receiving any aid through the unemployment system.

So-called gig workers whose work has been affected by the virus are. NEW YORK Reuters - US. The decision was written by Chief Judge DiFiore.

In addition to employees who have traditionally been eligible to collect unemployment insurance compensation the CARES Act extends benefits to workers who have not qualified for unemployment benefits in the past including independent contractors self-employed and gig workers and the long-term unemployed who have exhausted their benefits. But in March the federal CARES Act extended Pandemic Unemployment Assistance to independent contractors such. On March 26 2020 the New York Court of Appeals issued an opinion holding Postmates food delivery drivers and potentially thousands of other gig or app-based workers are employees and not self-employed independent contractors thus entitling them to.

Many workers who were approved for Pandemic Unemployment Assistance PUA the federal expanded unemployment benefits for gig workers independent contractors and the self-employed were.

Self Employed Other Newly Eligible Workers Can Apply For Unemployment On Monday 600 Federal Payments Also Begin Semca

Self Employed Other Newly Eligible Workers Can Apply For Unemployment On Monday 600 Federal Payments Also Begin Semca

Unemployment Benefits For Self Employed Gig Economy And Other Workers Launched Wwlp

Unemployment Benefits For Self Employed Gig Economy And Other Workers Launched Wwlp

Gig Workers Now Eligible To Apply For Unemployment Benefits Cbs Chicago

Gig Workers Now Eligible To Apply For Unemployment Benefits Cbs Chicago

New York Revises Process For Gig Workers Self Employed To Get Jobless Benefits Local News Auburnpub Com

New York Revises Process For Gig Workers Self Employed To Get Jobless Benefits Local News Auburnpub Com

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Labor And Economic Opportunity Can A Person Work Part Time And Still Collect Ui Benefits

Dol Clarifies Cares Act Unemployment Benefits Sbc Magazine

Dol Clarifies Cares Act Unemployment Benefits Sbc Magazine

Ct Receives 38 000 Unemployment Claims From Self Employed And Gig Workers But Benefit Payments Will Take A While Longer

Ct Receives 38 000 Unemployment Claims From Self Employed And Gig Workers But Benefit Payments Will Take A While Longer

California Expands Unemployment Insurance Self Employed Part Time And Gig Workers Eligible Coronavirus Resources Coastalview Com

California Expands Unemployment Insurance Self Employed Part Time And Gig Workers Eligible Coronavirus Resources Coastalview Com

Https Www Everycrsreport Com Reports R45478 Html

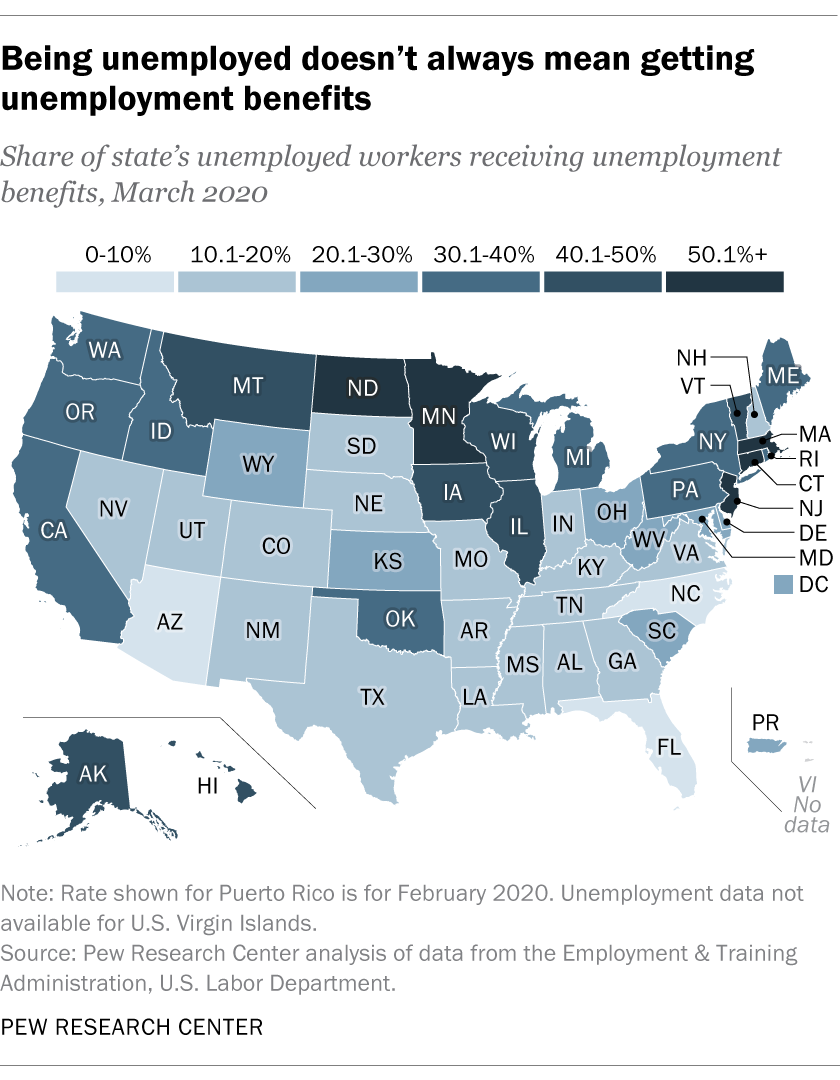

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

Gig Workers Would Get Unemployment Safety Net In Rescue Package Michigan Radio

Gig Workers Would Get Unemployment Safety Net In Rescue Package Michigan Radio

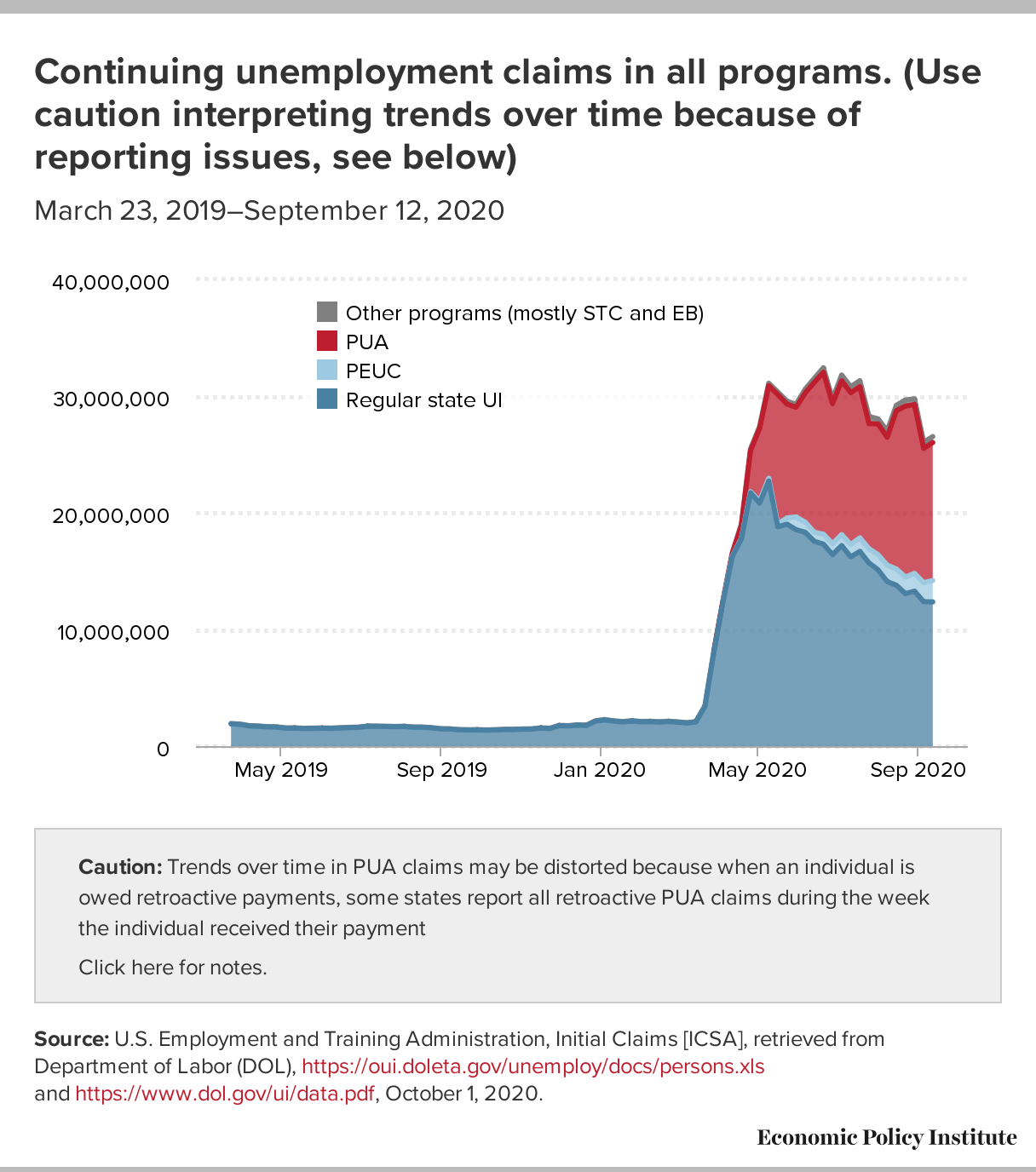

With Millions Of Workers Receiving Unemployment Benefits And No End In Sight For The Covid 19 Pandemic Congress Must Act Economic Policy Institute

With Millions Of Workers Receiving Unemployment Benefits And No End In Sight For The Covid 19 Pandemic Congress Must Act Economic Policy Institute

The Requirements For Unemployment Have Changed Here S What You Need To Know Williamsburg Yorktown Daily

The Requirements For Unemployment Have Changed Here S What You Need To Know Williamsburg Yorktown Daily

The Coronavirus Recession Exposes How U S Labor Laws Fail Gig Workers And Independent Contractors Equitable Growth

The Coronavirus Recession Exposes How U S Labor Laws Fail Gig Workers And Independent Contractors Equitable Growth

Millions Of Gig Workers Depend On New Unemployment Program But Fear It Ll End Soon Georgia Public Broadcasting

Millions Of Gig Workers Depend On New Unemployment Program But Fear It Ll End Soon Georgia Public Broadcasting

Ct Receives 38 000 Unemployment Claims From Self Employed And Gig Workers But Benefit Payments Will Take A While Longer

Ct Receives 38 000 Unemployment Claims From Self Employed And Gig Workers But Benefit Payments Will Take A While Longer

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

Enhanced Unemployment Benefits During The Coronavirus Crisis Smartasset

![]() Workers Describe A Painful Wait For Unemployment Benefits During Coronavirus Shutdowns Wamu

Workers Describe A Painful Wait For Unemployment Benefits During Coronavirus Shutdowns Wamu

Post a Comment for "Are Gig Workers Entitled To Unemployment Benefits"