Vt State Unemployment Tax Rate

2021 Income Tax Withholding Instructions Tables and Charts. The current taxable wage base and.

Weekly Unemployment Claims Level Off Vermont Business Magazine

Weekly Unemployment Claims Level Off Vermont Business Magazine

133 State Street Montpelier VT 05602 Temporarily Closed to the Public.

Vt state unemployment tax rate. The 1099-G is a tax form for Certain Government Payments. Provided the state does not have any outstanding Title XII loans payment of state unemployment taxes in a timely manner reduces the federal unemployment tax rate from 60 to 6 so it is important to pay your state unemployment taxes on time. More than 22000 employers remit state unemployment taxes to the Department of Labor on a quarterly basis.

10 hours agoThe claims back in 2009 pushed the states Unemployment Insurance Trust Fund into deficit and required the state to borrow money from the federal government to cover claims. All Vermont employers who have to pay Unemployment Insurance UI on their employees MUST file a quarterly wage and contribution report. Every January we send a 1099-G form to people who received unemployment benefits during the prior calendar year.

The money for unemployment benefits is solely funded by employers by paying taxes into the unemployment insurance trust fund. 2020 VT Rate Schedules. The purpose of unemployment insurance benefits is to provide short term replacement of lost wages to individuals who lose their jobs through no fault of their own.

The Vermont Standard Deductions increases an average of 160. That would translate into incremental state taxes of 841 on 10200 in. The 2021 rates range from 04 to 54 on the first 14100 in wages paid to each employee in a calendar year.

For tax year 2020 it is 12500 for Married Filing Jointly or Qualifying Widow er 6250 for Single or Married Filing Separately 9400 for Head of Household and an additional 1050 for individuals 65 and older andor blind. The gross wages paid. 2019 VT Rate Schedules.

Vermont offers a state credit equal to 36 of the federal EITC. The Vermont Legislature would need to pass a law linking up to the 2021 federal tax laws to have this program expansion flow through to the Vermont credit. Annual tax rate schedule calculations are set each July based on the recent history of the UI program and the local economy.

Regular UI and Pandemic Unemployment Assistance PUA 1099-Gs include additional 600 added to weekly benefits from April 4 - July 25. New Federal Exclusion of Unemployment Compensation. Starting in 2021 Proposition 208 approved by.

Here is a list of the non-construction new employer tax. Vermont Department of Taxes PO Box 1779 Montpelier VT 05601-1779. If mailing your return with a payment mail to.

Our office hours are 745 am. Residents with 150000 in taxable income pay a marginal state tax rate of 825 percent. Vermont State Unemployment Insurance As an employer in Vermont you have to pay unemployment insurance to the state.

In Vermont the state UI tax rate for most new employers also known as the standard beginning tax rate has been fixed at 1 since 2004. Most recently it has been approaching 17000. Right now see data below Vermont has 2069 million in its Trust Fund and saw the fund decrease by a net of 31 million last week.

What is a 1099-G. The amount due is based on. These taxes are deposited into Vermonts UI Trust Fund to pay UI benefits to eligible claimants.

On an annual basis the department and IRS conduct a cross match to ensure that employers are paying both taxes. Similar to this year workers can elect to calculate their TY21 credit using the higher of 2019 or 2021 wages. To 430 pm Monday through Friday.

However its always possible that rate could change. The tax rate that has been assigned to the employer. Some states have higher rates though.

Vermont has a mandatory electronic filing requirement for all employers. Additional 1099-G forms will also be received for Lost Wage Assistance LWA Vermont Short-Term Supplemental VSTS benefits and the one-time payment of 1200 issued by the State on April 20. WCAX - Theres a federal tax break for Vermonters who received unemployment checks in 2020 but Montpelier still needs to decide if youll get a break on your state taxes.

Vermont Department of Taxes Issuing 1099-Gs for Economic Recovery Grants and Taxable Refunds. 45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers. Unemployment Insurance has been in existence since 1939.

If youre a new employer congratulations on getting started rates range from 1 to 48 depending on your industry. Hawaii for example has a top tax rate of 11New York and Minnesota have top rates of 882 and 985 respectivelyHowever a lower marginal tax rate. If you received unemployment benefits during 2020 youll need the information to file your taxes.

2020 VT Tax Tables. 52 rows SUI tax rate by state. Vermont Department of Taxes 133 State Street 1st Floor Montpelier VT 05633-1401.

Submit Your Payment by Mail.

Economic Impact Of Coronavirus Outbreak On Vermont Housing Vhfa Org Vermont Housing Finance Agency

Economic Impact Of Coronavirus Outbreak On Vermont Housing Vhfa Org Vermont Housing Finance Agency

Weekly Unemployment Claims Still Edging Up Vermont Business Magazine

Weekly Unemployment Claims Still Edging Up Vermont Business Magazine

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

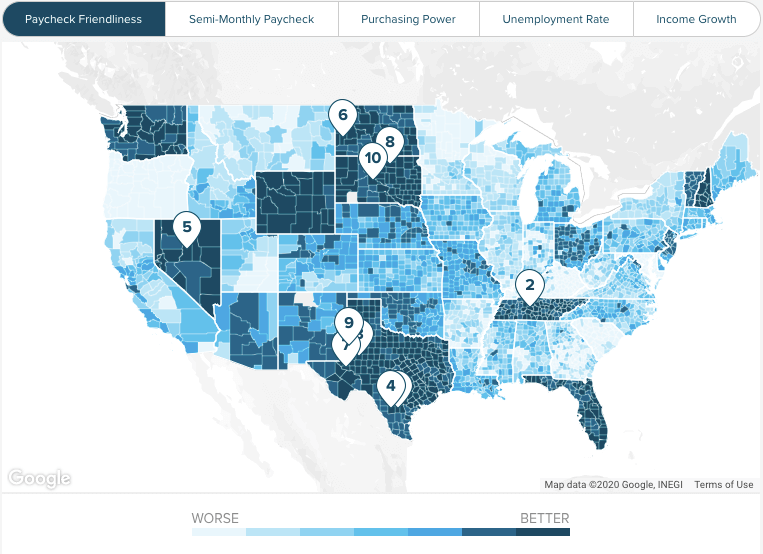

Vermont Paycheck Calculator Smartasset

Vermont Paycheck Calculator Smartasset

Weekly Unemployment Claims Keep Falling Now Under 800 Vermont Business Magazine

Weekly Unemployment Claims Keep Falling Now Under 800 Vermont Business Magazine

Weekly Unemployment Claims Continue To Rise Vermont Business Magazine

Weekly Unemployment Claims Continue To Rise Vermont Business Magazine

Weekly Unemployment Claims Continue To Slide Now Under 1000 Vermont Business Magazine

Weekly Unemployment Claims Continue To Slide Now Under 1000 Vermont Business Magazine

Labor Head Vt Unemployment Rate Doesn T Show Full Covid 19 Impact

Labor Head Vt Unemployment Rate Doesn T Show Full Covid 19 Impact

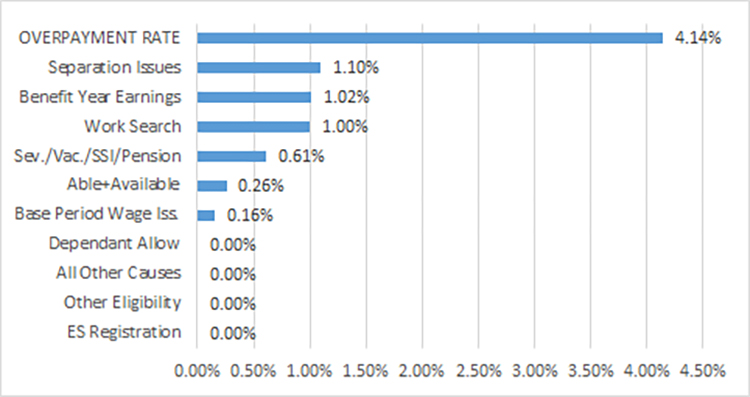

Vermont U S Department Of Labor

Vermont U S Department Of Labor

Vermont U S Department Of Labor

Vermont U S Department Of Labor

Weekly Unemployment Claims Level Off Vermont Business Magazine

Weekly Unemployment Claims Level Off Vermont Business Magazine

Complete And E File Your 2020 2021 Vermont State Tax Return

Complete And E File Your 2020 2021 Vermont State Tax Return

Https Www Bostonfed Org Media Documents Workingpapers Pdf 2020 Cpp20200709 Pdf

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Https Labor Vermont Gov Sites Labor Files Doc Library B 11claimant 20handbook 202019 Pdf

Weekly Unemployment Claims Continue To Slide Now Under 1000 Vermont Business Magazine

Weekly Unemployment Claims Continue To Slide Now Under 1000 Vermont Business Magazine

Filing Season Updates Department Of Taxes

Filing Season Updates Department Of Taxes

Vermont Lowers Unemployment Taxes And Increases Benefits 501 C Agencies Trust

Vermont Lowers Unemployment Taxes And Increases Benefits 501 C Agencies Trust

Https Labor Vermont Gov Sites Labor Files Doc Library Employer 20manual 20december 202019 Pdf

Post a Comment for "Vt State Unemployment Tax Rate"