Unemployment Mn Independent Contractor

FOX 9 - Minnesota is among the first states to start making unemployment payments to those who are self-employed independent contractors and others eligible that normally wouldnt. As a result of the CARES Act for the first time ever independent contractors can be entitled to unemployment benefits.

When Independent Contractors Get Unemployment Benefits What It Means For Employers

When Independent Contractors Get Unemployment Benefits What It Means For Employers

The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

Unemployment mn independent contractor. Welcome to the Minnesota Unemployment Insurance UI Program This is the official website of the Minnesota Unemployment Insurance Program administered by the Department of Employment and Economic Development DEED. UI benefits provide a temporary partial wage replacement to workers who become unemployed through no fault of their own. Minnesota Unemployment Insurance Unemployment Insurance.

If you made 24340 or less on your last tax return you get 234 per week. This will ensure we can review your eligibility for. We will let you know if we need more information from you.

They calculate your base amount from your net income on your last tax return. He appealed that decision. Covered employment versus noncovered employment Independent contractors Workers compensation.

Independent contractors receive a Form 1099 for taxes while employees receive a Form W-2. But like with everything else during the COVID-19. We will review your account automatically in the coming months.

COVID-19 Information for employers. However Congress has passed the Coronavirus Aid Response and Economic Security Act. You are a member of a partnership that carries on a trade or business A partnership is the relationship between two or more people or business entities who join to carry on a trade or business.

Under the new program called Pandemic Unemployment Assistance the following workers also qualify. This is the official resource for information about Minnesota Unemployment Insurance UI benefits. If you are self-employed or an independent contractor make sure to follow our special step-by-step instructions on how to apply if you are self-employed.

Construction industryindependent contractor registration Nine-factor test for independent contractors Unemployment insurance. Except for the construction industry Minnesota applies the common-law criteria for determining if an individual is an employee or independent contractor for unemployment compensation purposes MN. If you are self-employed or an independent contractor you get a 1099 tax form.

If you have become unemployed or had your hours greatly reduced complete the Application Process we will determine whether or not you are eligible. To qualify you must certify that. Neither independent contractors nor their clients or customers pay state or federal unemployment taxes.

FOX 9 - Those who are self-employed or independent contractors are encouraged to sign up for the states unemployment insurance. Please do not submit an appeal or raise an issue to request relief of charges due to COVID-19. After Roulo stopped providing services for Key Lakes Companies an unemployment law judge ULJ determined that Roulo was an independent contractor and therefore not eligible for unemployment benefits.

You can see an estimate of your regular unemployment benefits using the MN Unemployment Insurance Benefits Estimator. The Pandemic Unemployment Assistance PUA program provides weekly benefit payments for those who are not eligible for regular or extended unemployment benefits in Minnesota or any other state. Self-employed workers and contractors are typically not eligible for unemployment benefits.

Self-employed individuals which includes independent contractors and gig economy workers. An independent contractor on the other hand is a worker who is not an employee and independently contracts with an individual or business to provide a good or perform a service. Workers compensation liability of contractors.

The Minnesota Court of Appeals determined whether Roulo was an independent contractor or employee. People without sufficient work history most states require at least 6 months of work to qualify for normal unemployment insurance.

Misclassifying Employees As Independent Contractors Can Land You In Jail Felhaber Larson

Misclassifying Employees As Independent Contractors Can Land You In Jail Felhaber Larson

Free Independent Contractor Agreement Templates Pdf Word Eforms

Free Independent Contractor Agreement Templates Pdf Word Eforms

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

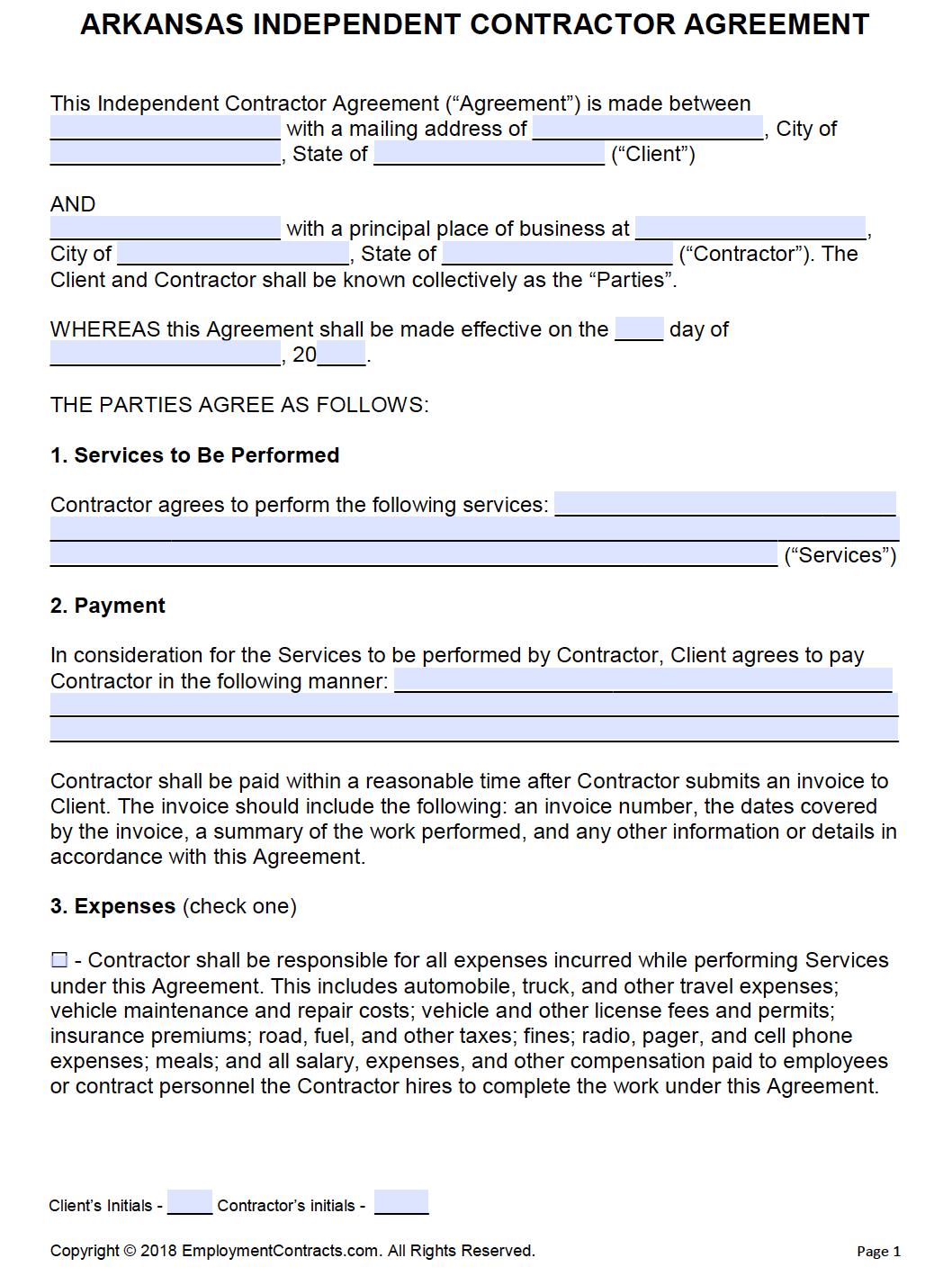

Free Arkansas Independent Contractor Agreement Pdf Word

Free Arkansas Independent Contractor Agreement Pdf Word

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

Unemployment Verification Letter Sample Awesome 9 10 Letter Unemployment Verification Dannybarrantes Temp Letter Templates Letter Of Employment Letter Sample

Unemployment Verification Letter Sample Awesome 9 10 Letter Unemployment Verification Dannybarrantes Temp Letter Templates Letter Of Employment Letter Sample

Can Independent Contractors Collect Unemployment

Can Independent Contractors Collect Unemployment

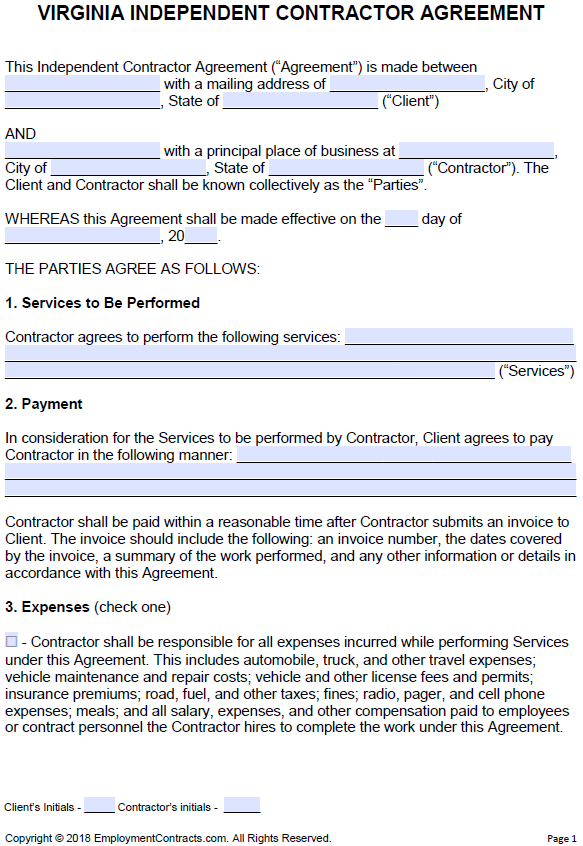

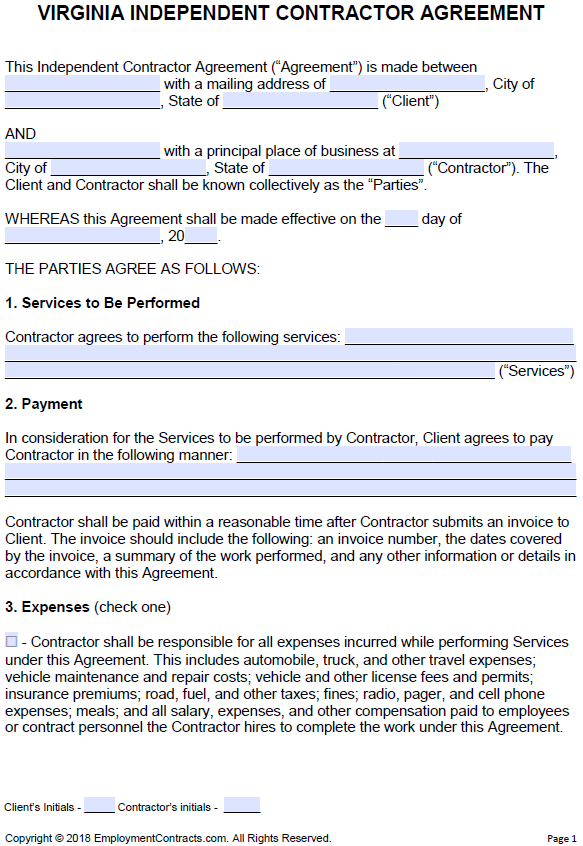

Free Virginia Independent Contractor Agreement Pdf Word

Free Virginia Independent Contractor Agreement Pdf Word

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

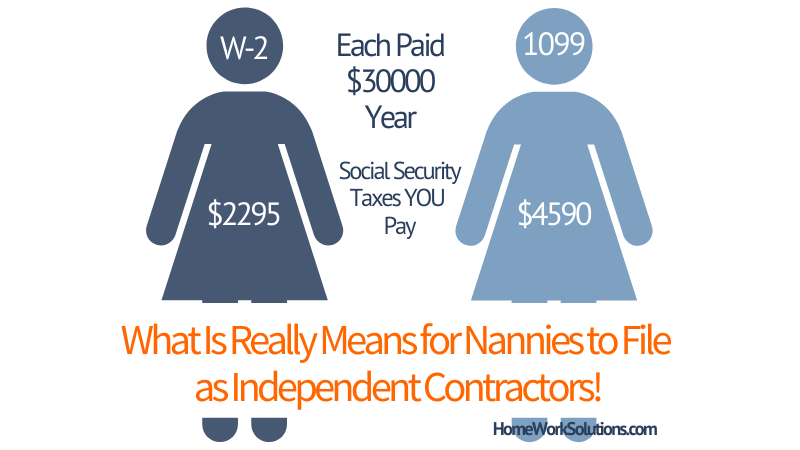

How Does A Nanny File Taxes As An Independent Contractor

How Does A Nanny File Taxes As An Independent Contractor

Independent Contractor Certification Form

Independent Contractor Certification Form

Consultant Independent Contractor Agreements Legal Books Nolo

Consultant Independent Contractor Agreements Legal Books Nolo

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

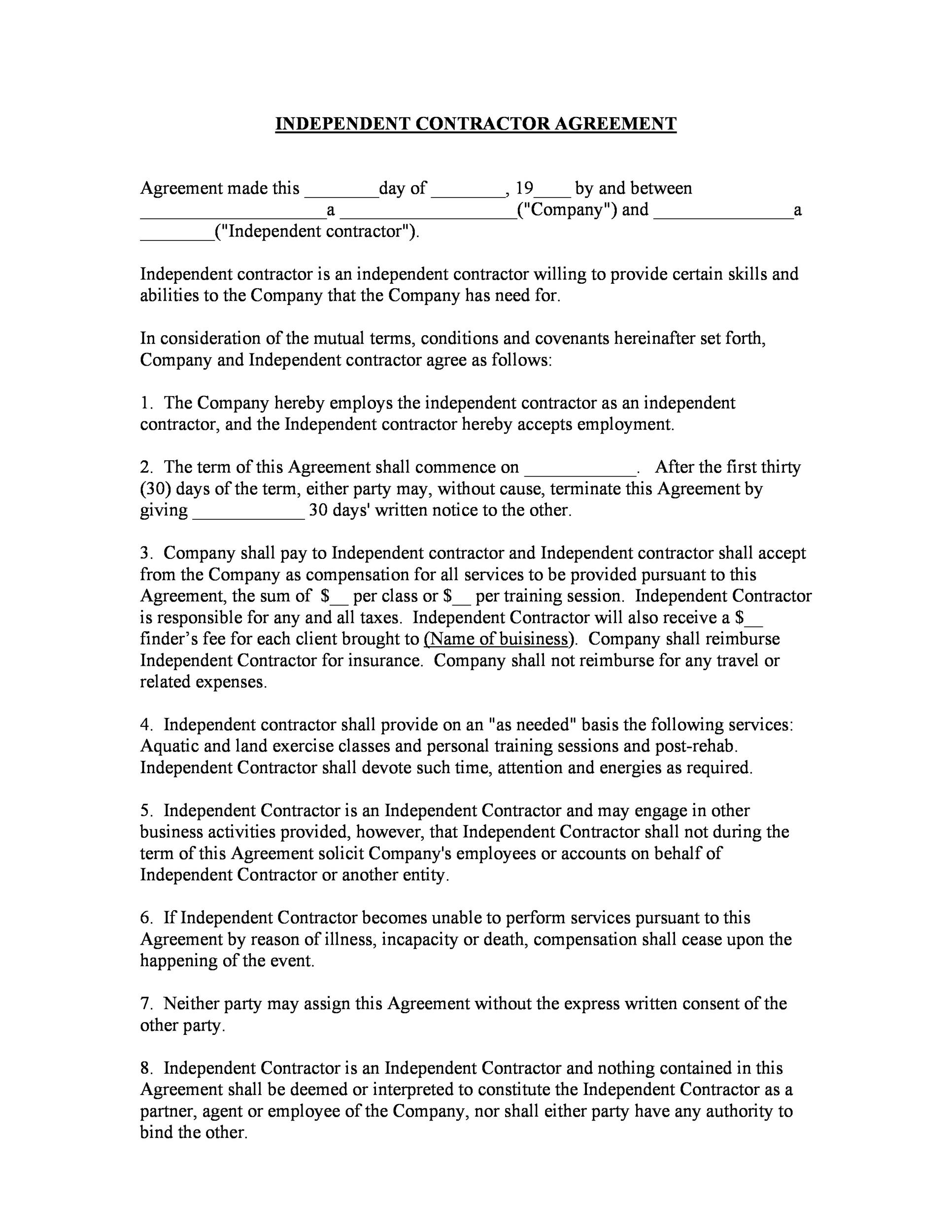

Contractor Contract Sample Free Printable Documents Contractor Contract Contract Template Contractors

Contractor Contract Sample Free Printable Documents Contractor Contract Contract Template Contractors

Free Minnesota Independent Contractor Agreement Word Pdf Eforms

Can The Same Person Be An Employee And An Independent Contractor

Can The Same Person Be An Employee And An Independent Contractor

Free Ohio Independent Contractor Agreement Pdf Word

Free Ohio Independent Contractor Agreement Pdf Word

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

Post a Comment for "Unemployment Mn Independent Contractor"