Unemployment Missouri Tax Form

The Division of Employment Security administers the Unemployment Insurance benefit and tax system in Missouri. The Division uses the Unemployment Tax Registration to determine whether an entity is liable for unemployment tax as a new or successor employer.

Https Labor Mo Gov Sites Labor Files Pubs Forms Modes 2699 9 Pdf

Download Adobe Acrobat Reader.

Unemployment missouri tax form. Contact A Claims Center. Form 1099-G details how much unemployment benefits a claimant received during the calendar year as well as information about taxes withheld from their benefits. DES is aware that the US Department of Labor has issued new guidance to states regarding the expansion of eligibility for workers who declined work due to pandemic safety concerns.

State Income Tax Range. Include the taxable portion of unemployment compensation on MO-PTS Line 1. The form must be completed even if the entity is not liable so that the Division can follow up at a time when liability may have been achieved or eliminate the entity from further follow-ups.

Individual workers wages are recorded on the DES wage record files and retained for five quarters to be used for determining monetary benefit entitlement should a worker file a claim for unemployment. 15 on taxable income of 107 or more. State Taxes on Unemployment Benefits.

At this time Missouri does not have any requirement or authority for the taxpayer to add back the excluded unemployment compensation from the Federal return. Having trouble viewing a form. It is not a bill and you should not send any type of payment in response to the form.

Since it is included in the Missouri Adjusted Gross Income MO-PTS Line 1. Report the exempt portion of unemployment income not already included in MO-PTS Line 1 on MO-PTS Line 3. Unemployment benefits including this additional 300 per week payment are subject to federal and state income taxes.

Heres a link to it on the IRS website if you are filing on paper. You need to file an Unemployment Compensation Exclusion form when you do your taxes Oware said. On Line 7 and 8 of the form you include how much unemployment insurance you and your spouse received and add those numbers up.

The IRS recommends using that form to fill out the Form 1040 the standard tax worksheet. 31821 - Missouri individual income tax return begins with the federal adjusted gross income on the federal return. OF EMPLOYMENT SECURITY UNEMPLOYMENT INSURANCE TAX 573-751-1995 QUARTERLY CONTRIBUTION AND WAGE REPORT File online at uinteractlabormogov 1.

The Division of Workforce Development provides support to unemployed workers in finding a new job and advancing their career. The 1099-G tax form details all unemployment benefits a claimant received during the calendar year as well as information about taxes withheld. 54 on more than 8584.

If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment. To search for archived forms from a previous tax year choose a year in the drop down menu. Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block.

Employers that are liable for Missouri unemployment tax contributions must provide the Division of Employment Security DES information on the wages of their covered employees each quarter. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return. Division of Workforce Development.

Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b. The amount on Form 1099-G is a report of income you received from the Missouri Department of Revenue. Report the total unemployment compensation received on MO-PTC Line 2.

Unemployment compensation is fully taxed in Missouri. Wed 01082020 Jefferson City MO - Missourians who received unemployment benefits in 2019 can now view and download their 1099-G tax form online at uinteractlabormogov. Division of Employment Security PO.

Missouri Department of Revenue. EMPLOYER NAME AND ADDRESS 14FEDERALID NUMBER _____ If mailing return this page with remittance to. The American Rescue Plan a 19 trillion Covid relief bill waived.

If a professional preparer handles your taxes you should give this form to the preparer along with your other tax information such as W-2 forms. To search type in a keyword andor choose a category. The total number is the amount of unemployment compensation excluded from your income Spencer PlattGetty Images FILE.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200.

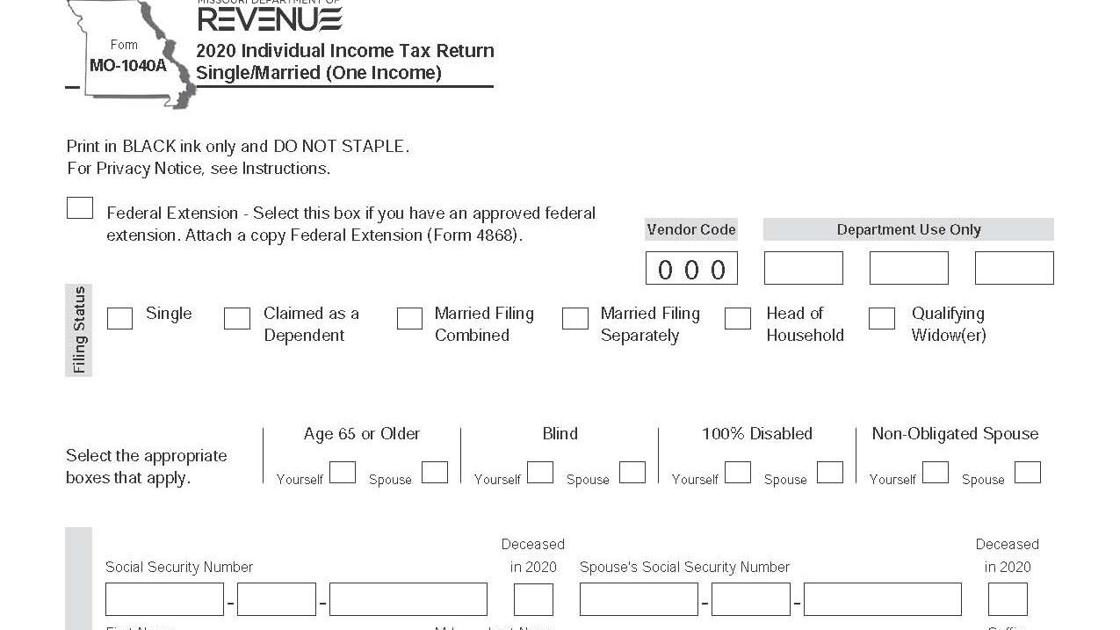

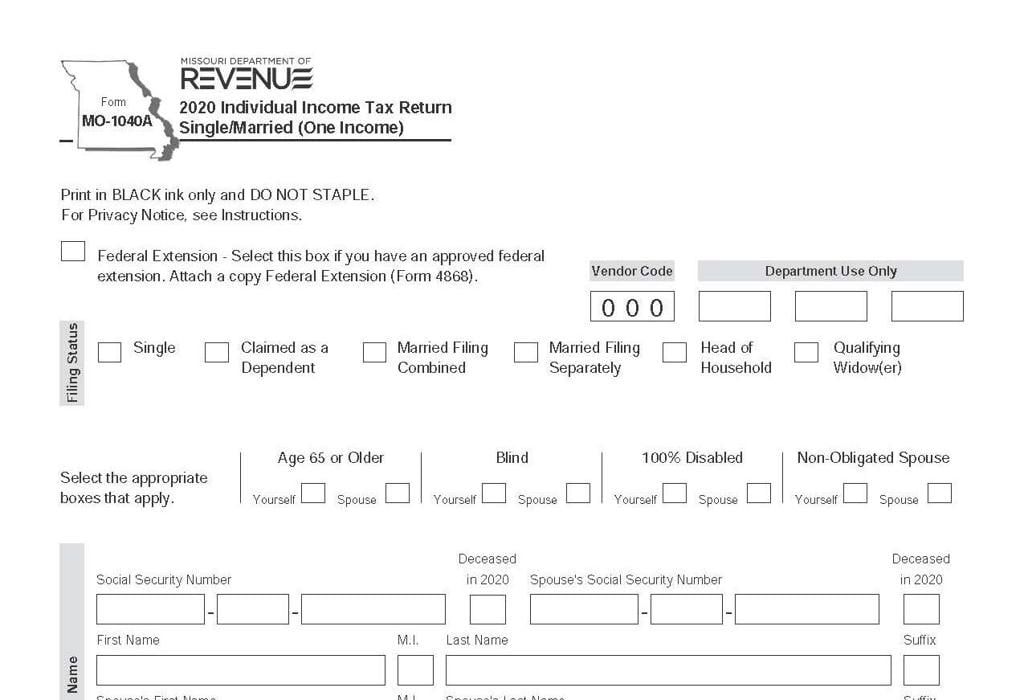

Missouri Stops Printing Income Tax Forms In Bid To Go Online Only Politics Stltoday Com

Missouri Stops Printing Income Tax Forms In Bid To Go Online Only Politics Stltoday Com

Form 8615 Tax For Certain Children With Unearned Income

Form 8615 Tax For Certain Children With Unearned Income

Missouri Stops Printing Income Tax Forms In Bid To Go Online Only Politics Stltoday Com

Missouri Stops Printing Income Tax Forms In Bid To Go Online Only Politics Stltoday Com

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

Fill Free Fillable Forms For The State Of Missouri

Fill Free Fillable Forms For The State Of Missouri

Https Dor Mo Gov Forms 2643t Pdf

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back Tax Credits For People Who Work

401 K Plans Are Employer Sponsored Retirement Plans Where Employees Can Choose How Much They Contribute Compare The Type How To Plan Retirement Planning Type

401 K Plans Are Employer Sponsored Retirement Plans Where Employees Can Choose How Much They Contribute Compare The Type How To Plan Retirement Planning Type

Rotunda Of The Second Floor Of Missouri State Capitol Description From Asergeev Com I Searched For This On Bing Com Capitol Building Missouri State Missouri

Rotunda Of The Second Floor Of Missouri State Capitol Description From Asergeev Com I Searched For This On Bing Com Capitol Building Missouri State Missouri

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

Fill Free Fillable Forms For The State Of Missouri

Fill Free Fillable Forms For The State Of Missouri

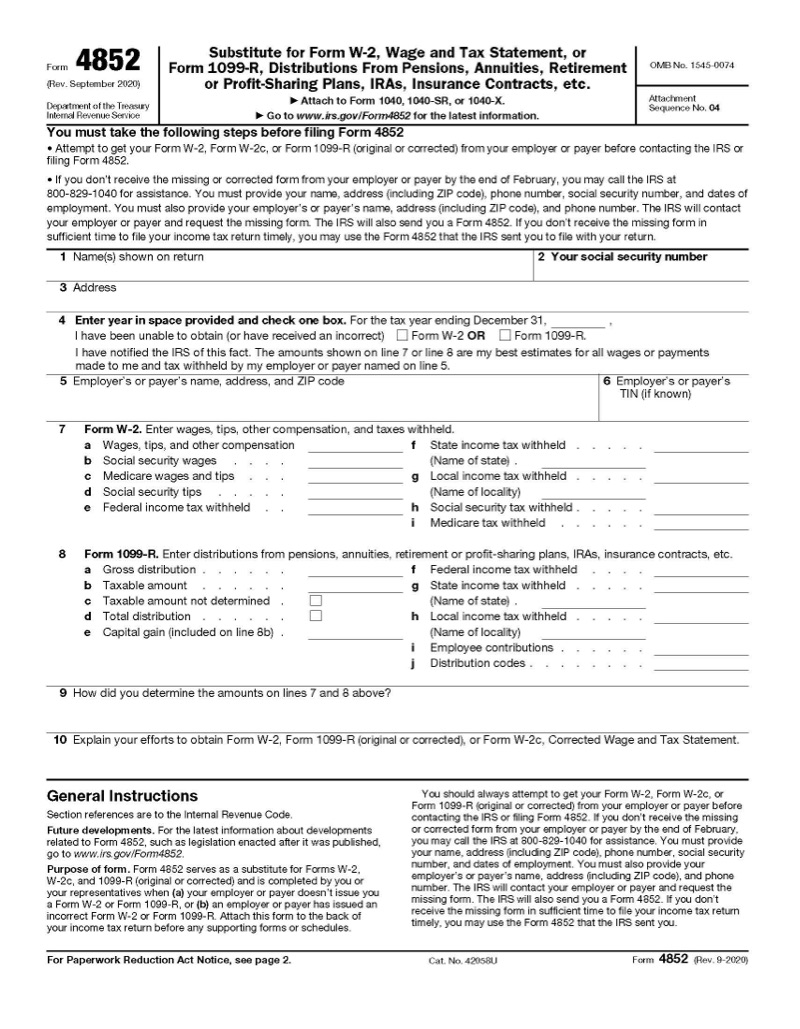

Form 4852 Substitute For Missing Forms W 2 And 1099 R

Form 4852 Substitute For Missing Forms W 2 And 1099 R

Tax Form 1099 G Available Online For Missourians Who Claimed Unemployment Benefits Government And Politics Dailyjournalonline Com

Tax Form 1099 G Available Online For Missourians Who Claimed Unemployment Benefits Government And Politics Dailyjournalonline Com

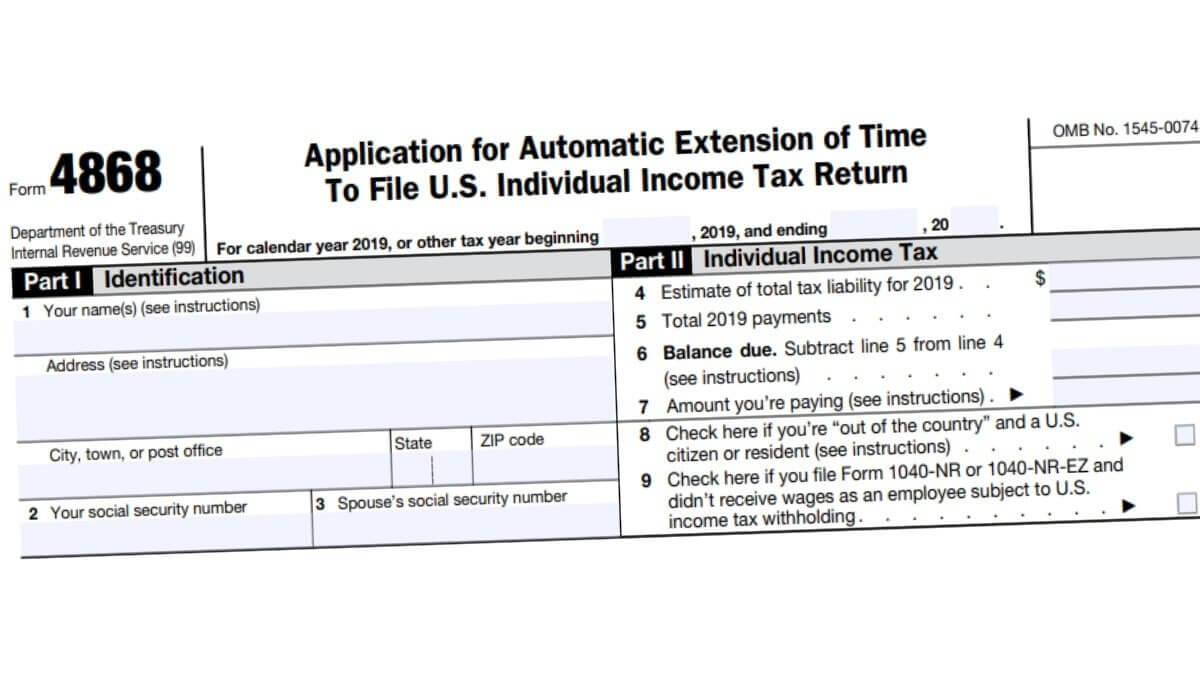

4868 Form 2021 Irs Forms Zrivo

4868 Form 2021 Irs Forms Zrivo

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Missouri Unemployment Tax Registration Fill Online Printable Fillable Blank Pdffiller

Missouri Unemployment Tax Registration Fill Online Printable Fillable Blank Pdffiller

Post a Comment for "Unemployment Missouri Tax Form"