Unemployment Compensation For Self Employed In Ca

PUA still applies to self-employed workers gig workers independent contractors and other people who dont usually qualify for unemployment insurance. However for self-employed individuals without employees whose typical profit and business expenses combined are less than 950 per week the.

Ab5 Is Law In California Now What Now What Economy California

Ab5 Is Law In California Now What Now What Economy California

The first 10200 in benefits collected in 2020 will be tax-free for households with annual incomes less than 150000.

Unemployment compensation for self employed in ca. If you are married and your spouse also received unemployment both of you can exclude 10200. Extends Pandemic Unemployment Assistance PUA and Pandemic Emergency Unemployment Compensation PEUC up to 29 weeks through September 4 2021. Provide unemployment benefits to self-employed workers who dont traditionally qualify.

The UI program pays benefits to workers who have lost their job and meet the programs eligibility requirements. Generally unemployment benefits are taxable. Claims can be filed online Sunday 5 am.

The additional 600-per-week Federal Pandemic Unemployment Compensation program ends on July 31 2020 though the date can vary by state. 3192021 Español COVID-19 Main Page COVID-19 FAQs. Continues the federal increase for all unemployment benefits which adds 300 to each week of benefits through September 4 2021.

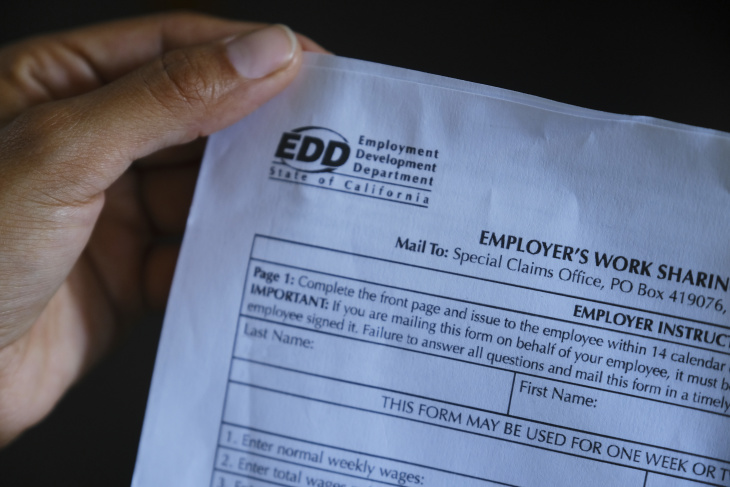

The best way to begin the process is by visiting eddcagov. Pandemic Unemployment Assistance PUA is part of the federal assistance that helps unemployed Californians who are not usually eligible for regular Unemployment Insurance UI benefits. The new American Rescue Plan Act.

Are my unemployment benefits taxable. To 10 pm Tuesday through Friday 2 am. The minimum benefit rate is 50 of the average weekly benefit amount available in your state.

To 10 pm and Saturday 2 am. The American Rescue Plan signed into law on March 11 2021 includes a provision that makes the first 10200 of unemployment nontaxable for each taxpayer who made less than 150000 in 2020. Californians can apply for unemployment benefits through the California Employment Development Department EDD.

The American Rescue Plan extends expanded unemployment benefits through September 6 2021 and includes 300 a week in extra compensation. Self-employed can now apply for unemployment in California Californians who are self-employed -- but lost their jobs because of the coronavirus shutdown --. Skip to Main Content.

The amount you recieve is based on your previous income and may vary based on where you live and your benefit guidelines. The EDD manages the Unemployment Insurance UI program for the State of California. The CARES Act allows states to pay unemployment benefits to self-employed people for up to 39 weeks.

Pandemic Unemployment Assistance PUA provides unemployment benefits to workers who were not traditionally eligible for benefits including self-employed people. Despite the new policy many are still struggling to file and receive PUA benefits. This includes business owners self-employed workers independent contractors and those with a limited.

PUA extends unemployment benefits to people who dont traditionally qualify including self-employed freelance and gig workers. Traditionally the self-employed have not been able to receive unemployment as they do not pay the government unemployment insurance. To 830 pm Monday 4 am.

Extends Pandemic Unemployment Assistance PUA and Pandemic Emergency Unemployment Compensation PEUC by 29 weeks through September 4 2021. However in light of the economic situation and shut-downs the federal government has changed the policy to include the self-employed freelancers and gig-workers. Continues the federal increase for all unemployment benefits which adds 300 to each week of benefits through September 4 2021.

If you are a business owner independent contractor or self-employed worker and only received a 1099 tax form last year you are most likely eligible for Pandemic Unemployment Assistance. Apply for Pandemic Unemployment Assistance if your work situation changed because of COVID-19 and you meet any of these requirements. Self-employed workers independent contractors gig economy workers and people who have not worked long enough to qualify for the other types of unemployment assistance may still qualify for PUA if they are otherwise able to work and available for work within the meaning of the applicable state law and certify that they are unemployed partially unemployed or unable or unavailable to work.

If you are receiving these benefits we will notify you when you can certify. This program is extended until September 6 2021 and allows individuals receiving benefits to continue collected long as the individual has not reached the maximum number of weeks. Workers currently receiving at least 1 in state unemployment benefits who earned at least 5000 in self-employment income in 2019 will be.

This new legislation.

Reemployment And Eligibility Assessment Questionnaire Assessment California Questionnaire

Reemployment And Eligibility Assessment Questionnaire Assessment California Questionnaire

Form A 1 Application For A Private Entity Certificate Of Consent To Self Insure California Form This Or That Questions

Form A 1 Application For A Private Entity Certificate Of Consent To Self Insure California Form This Or That Questions

Apportionment California The Unit Medical

Apportionment California The Unit Medical

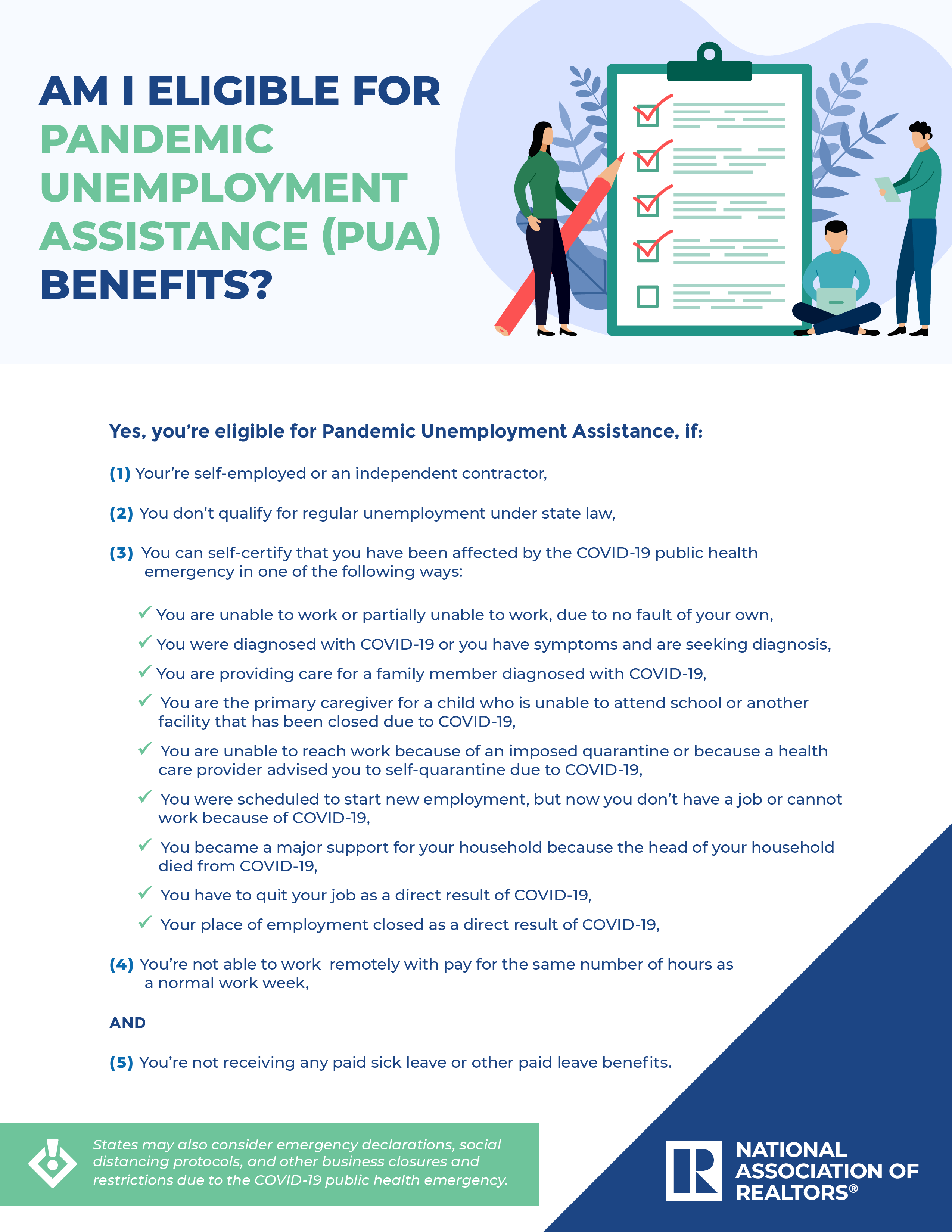

Pandemic Unemployment Assistance Pua Benefits Checklist

Pandemic Unemployment Assistance Pua Benefits Checklist

Here S Where We Stand Today Virginian Pilot The Virginian Unemployment

Here S Where We Stand Today Virginian Pilot The Virginian Unemployment

Initial Report Or Claim Report Of Labor La Violation California Initials Home Phone

Initial Report Or Claim Report Of Labor La Violation California Initials Home Phone

California Workers Struggling Through Pandemic Receive Total Of 33 5 Billion In Unemployment Benefits Cal Oes News

California Workers Struggling Through Pandemic Receive Total Of 33 5 Billion In Unemployment Benefits Cal Oes News

California Ca Edd 300 Weekly Pac Pua And Peuc September 2021 Unemployment Extensions Update And News On Payment Issues And Delayed Claims Aving To Invest

California Ca Edd 300 Weekly Pac Pua And Peuc September 2021 Unemployment Extensions Update And News On Payment Issues And Delayed Claims Aving To Invest

45 Per Week Left Her Homeless And Waiting For Relief From California S Unemployment Agency Laist

45 Per Week Left Her Homeless And Waiting For Relief From California S Unemployment Agency Laist

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Unemployment Benefits In The Covid 19 Pandemic Public Policy Institute Of California

Application For Subsequent Injuries Fund Benefits Application California Fund

Application For Subsequent Injuries Fund Benefits Application California Fund

This Is A California Form That Can Be Used For General Within Workers Comp Download This Form For Free Now California Workerscomp G Worker Form California

This Is A California Form That Can Be Used For General Within Workers Comp Download This Form For Free Now California Workerscomp G Worker Form California

The 6 Secrets About Health Insurance California Only A Handful Of People Know Health Insurance C Cheap Health Insurance Health Insurance Health Care Insurance

The 6 Secrets About Health Insurance California Only A Handful Of People Know Health Insurance C Cheap Health Insurance Health Insurance Health Care Insurance

Employment Posters California Employment Related Securities Return Temporary Employment Agencies Bolton Contract Template Caregiver Caregiver Resources

Employment Posters California Employment Related Securities Return Temporary Employment Agencies Bolton Contract Template Caregiver Caregiver Resources

Unemployment In California This Is The Best Time To Make Claims Call And Other Questions Answered About Edd Peuc And Job Opportunities Abc7 San Francisco

Unemployment In California This Is The Best Time To Make Claims Call And Other Questions Answered About Edd Peuc And Job Opportunities Abc7 San Francisco

Post a Comment for "Unemployment Compensation For Self Employed In Ca"