Nys Unemployment W2 For 2020

More than 59 billion in unemployment was paid to nearly 4 million New Yorkers from March 2020 when the pandemic started to the end of the year an. 2 days agoWENY - Although the IRS is not taxing the first 10200 of unemployment benefits New York State is not doing the same.

1099 G Tax Form Department Of Labor

1099 G Tax Form Department Of Labor

New York will still tax the unemployment benefits New Yorkers received in 2020 despite changes on the federal level according to State Budget Director Rob Mujica.

Nys unemployment w2 for 2020. It provided an additional 600 per week in unemployment compensation per recipient through July 2020. The American Rescue Plan approved by Congress and. Log in to your NYGov ID account.

Visit the Department of Labors website. Log in with your NYGOV ID then click on Unemployment Services and ViewPrint your 1099GYou can also request a copy by completing and mailing the Request for 1099G form. Hello cbhay99 For NYS unemployment you should have received a 1099G.

The 1099-G will show the amount of unemployment benefits received during 2020. Numerous lawmakers have been pushing the state to change its own laws due to the pandemic saying it is unfair to New Yorkers who lost their jobs when New York went on pause. 9 That extra 600 is also taxable after the first 10200.

Tax credits put money back in your pocket. If you received unemployment compensation in 2020 including any income taxes withheld visit the New York State Department of Labors website for Form 1099-G. 2 You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10.

Recipients must report this information along with information from other income tax forms such as Form W-2 on their 2020 federal and New York income tax returns. 2 days agoNew York State will continue to fully tax unemployment benefits despite a federal exemption on the first 10200 received by some workers who lost their jobs last year due to the pandemic. More than 4 million New Yorkers more than 20 of the states population filed for unemployment in 2020 and will have to pay taxes this year.

The 10200 of tax relief provided in this bill would cover 17 weeks of that 600 per week benefit. Brian Galle a professor at Georgetown Law School analyzed the impact for The Century Foundation a progressive think tank looking at the nearly 580 billion dollars in unemployment benefits sent to more than 40 million Americans in 2020. To access your form online log in to labornygovsignin click Unemployment Services select 2020 from the dropdown menu and click ViewPrint Your 1099-G If you do not have an online account with NYS DOL you may call 1-888-209-8124 to request 1099.

If you need a copy of your 1099G you can view and print your 1099G for calendar year 2013 on the NYS Department of Labor website. Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020 is exempt from. Taxpayers with an adjusted gross income of less than 150000 will not pay federal income taxes on the first 10200 received for unemployment benefits in 2020.

Select Unemployment Services and ViewPrint 1099-G. Those who qualified for unemployment benefits in 2020 and already filed their taxes may be entitled to get some money back. ALBANY NY NEWS10 Not every state taxes unemployment but now that the federal government says the first 10200 of benefits will be tax-free New York is.

This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2020 as well as any adjustments or tax withholding made to your benefits. The empire state will still tax peoples 2020 unemployment benefits in full. External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites.

The CARES Act passed by Congress in March 2020 provided an additional 600 in unemployment benefits through the end of July. This form does not include unemployment compensation. Individuals filing form 1040-NR.

NBC New Yorks Lynda Baquero reports. The Statement for Recipients of Certain Government Payments 1099-G tax forms are now available for New Yorkers who received unemployment benefits in calendar year 2020. The Cuomo Administration confirmed the decision Wednesday.

The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein. If you live in New York and received unemployment payments in 2020 youll have to pay state income taxes on all of them. Delaware just recently exempted UI benefits from state taxes and Arkansas is weighing a similar proposal.

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

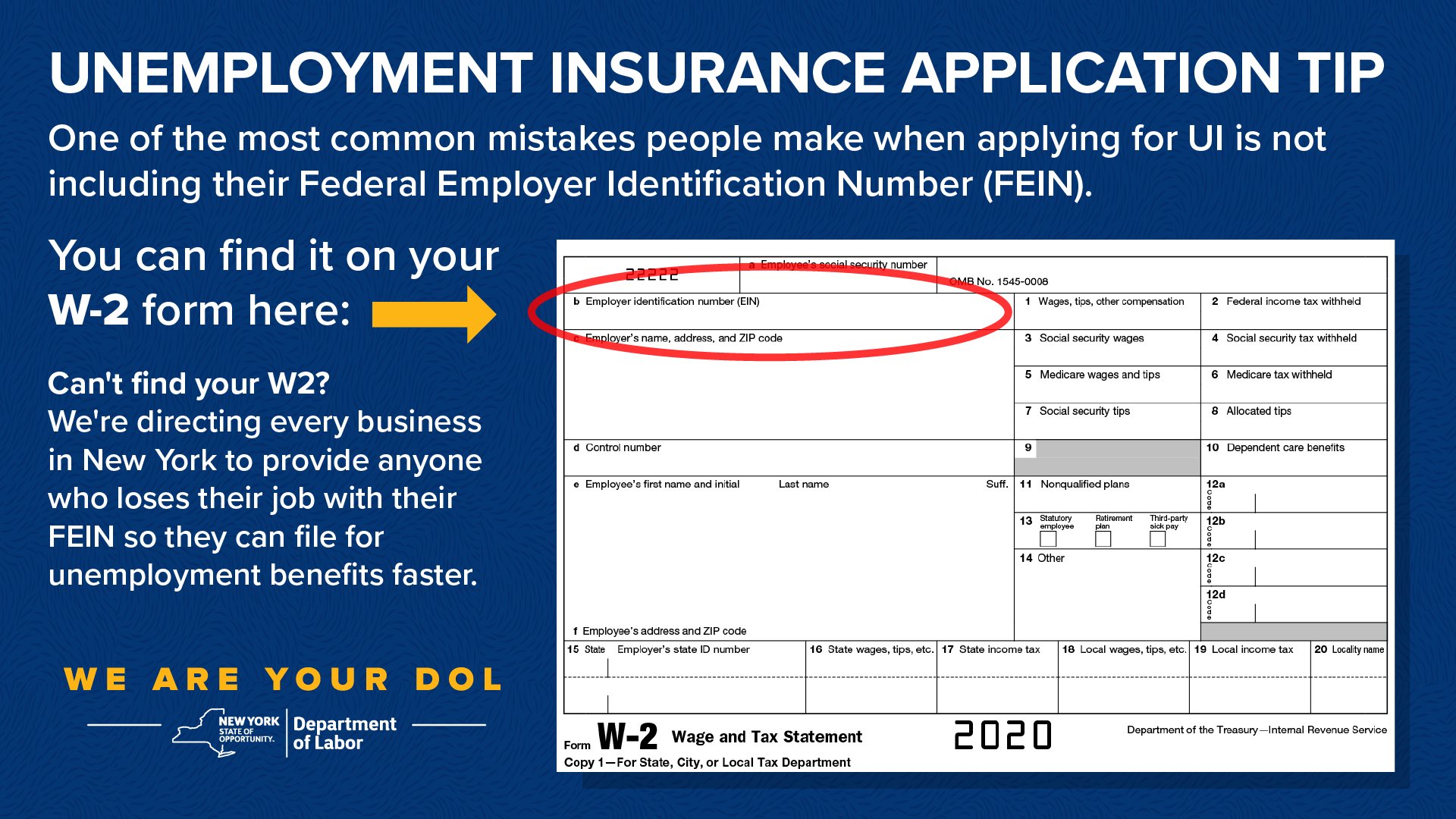

Nys Department Of Labor On Twitter Reminder The Number One Reason New Yorkers Applications Are Incomplete Is Because They Are Missing Federal Employer Identification Numbers Fein Here S Where You Can Find The

Nys Department Of Labor On Twitter Reminder The Number One Reason New Yorkers Applications Are Incomplete Is Because They Are Missing Federal Employer Identification Numbers Fein Here S Where You Can Find The

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

Ill Fated Blitz Call Provides Defining Moment In New York Jets Worst Season Ever Nfl Ne In 2020 Nfl News Live Football Streaming Nfl

Ill Fated Blitz Call Provides Defining Moment In New York Jets Worst Season Ever Nfl Ne In 2020 Nfl News Live Football Streaming Nfl

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

What To Watch For When Filing 2020 Tax Returns The Blade

What To Watch For When Filing 2020 Tax Returns The Blade

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

D 11 Passport Form How To Expedite A Passport Passport Application Form Passport Form Passport Application

D 11 Passport Form How To Expedite A Passport Passport Application Form Passport Form Passport Application

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Two Websites To Get Your W2 Form Online For 2020 2021

Two Websites To Get Your W2 Form Online For 2020 2021

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

2020 Form W2s New Guidance Issued By Irs Nstp

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Post a Comment for "Nys Unemployment W2 For 2020"