Is The 600 Unemployment Taxable In Nj

The silver lining is that unemployment benefits are still taxed significantly less than regular wages because youre not responsible for withholding Social Security or Medicare taxes. This includes regular Unemployment Insurance Pandemic Unemployment Assistance benefit extensions 600 and 300 weekly Federal Pandemic Unemployment Compensation payments and 300 FEMA Lost Wages Assistance payments.

Unemployment compensation and temporary disability including family leave insurance benefits received from the State of New Jersey or as third-party sick pay are not taxable.

Is the 600 unemployment taxable in nj. That is taxable as well The IRS notes unemployment compensation is taxable and must be reported on a 2020 federal income tax return. Provides an additional 300 per week to all PUA and regular Unemployment Insurance recipients from January 2 2021 through September 4 2021. The way the exemption works is the first 10200 of unemployment insurance will not be taxable.

How can I get PUA. If someone received 20000 of benefits in 2020 they will only be taxed on 9800 of it. Are unemployment disability payments or family leave insurance taxable for New Jersey Income Tax purposes.

You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. Yes the extra 600 that the unemployed can receive as part of the expanded federal benefits is taxed by the federal government. It provided an additional 600 per week in unemployment compensation per recipient through July 2020.

Pandemic Emergency Unemployment Compensation. Indiana and Wisconsin make partial exemptions according to the Tax Foundation an independent tax policy nonprofit. Total Taxable Wages are all taxable wages reported to the New Jersey Department of Labor by all employers as of March 31st of the current calendar year with respect to their employment during the preceding calendar year.

New Jersey does not tax unemployment benefits but the federal government does. Most states tax UI benefits as well. 259 on up to 54544 of taxable.

If you collected unemployment benefits in New Jersey this year the state wont be collecting income taxes on that money. State Income Tax Range. Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes.

Retroactive to the week ending April 4 2020. New Jersey does not tax unemployment benefits but the state did not give workers the opportunity to withhold federal taxes on expanded benefits. You may also have been eligible for 600 per week on top of regular benefits retroactive to the week ending April 4 2020 through July 25 2020.

But withholding is voluntary. State Taxes on Unemployment Benefits. Unemployment benefits are not taxable for New Jersey.

Unemployment benefits are subject to federal income taxes. If you earned 18240 and received the extra 600 in COVID unemployment benefits for six months 3600 it will be subject to federal income tax but it will not reduce your Social Security. However the federal government will be collecting income taxes.

Do not include these amounts on your New Jersey return. Provides an additional 13 weeks of Unemployment. Balance of Unemployment Trust Fund is the balance in the Fund as of March 31st of the current year.

You must be negatively impacted by the coronavirus emergency to. Of the 40 states that tax income only five California New Jersey Oregon Pennsylvania and Virginia fully exempt UI benefits. PUA recipients are also eligible for an extra 600 per week also taxable.

I know 500-600 extra per week. To help offset your future tax liability you may voluntarily choose to have 10 percent of your weekly Unemployment Insurance benefits withheld and sent to. The 600 per week is retroactive to the week ending April 4 2020 and ends the week of July 25 2020.

Arizona taxes unemployment compensation to the same extent as it is taxed under federal law. Without the option to withhold taxes from the 600 payments workers could be are looking at a federal tax. If you didnt elect to have federal taxes withheld you can go to your unemployment.

Unemployment benefits are not taxable for New Jersey. Yes the extra 600 that the unemployed can receive as part of the expanded federal benefits is taxed by the federal government. 9 That extra 600 is also taxable after the first 10200.

Pandemic Unemployment Compensation. Provides an additional 600 per week on top of regular benefits to all recipients of Unemployment Insurance. Federal Pandemic Unemployment Compensation.

Nj Unemployment 1099g Emailed No Federal Taxes Withheld On 300 600 Pau Unemployment Id Theft Youtube

Nj Unemployment 1099g Emailed No Federal Taxes Withheld On 300 600 Pau Unemployment Id Theft Youtube

New Jersey Nj Dol Division Of Unemployment Insurance 300 Fpuc Peuc And Pua News September 2021 Extension Updates Aving To Invest

New Jersey Nj Dol Division Of Unemployment Insurance 300 Fpuc Peuc And Pua News September 2021 Extension Updates Aving To Invest

Nj Unemployment 1099g Emailed No Federal Taxes Withheld On 300 600 Pau Unemployment Id Theft Youtube

Nj Unemployment 1099g Emailed No Federal Taxes Withheld On 300 600 Pau Unemployment Id Theft Youtube

Http Www Sprinklerfitters696 Org Ulwsiteresources Ualocal696 Resources File Covid 19 Tax Implications Nj Unemployment 6 2020 Pdf

Is Unemployment Taxable Unemployment Portal

Is Unemployment Taxable Unemployment Portal

New Jersey Nj Tax Rate H R Block

New Jersey Nj Tax Rate H R Block

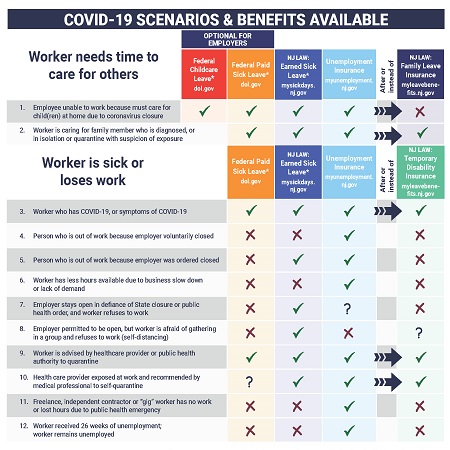

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Division Of Unemployment Insurance Nj Workers Frequently Asked Questions During The Coronavirus Emergency

Is Covid 19 Financial Relief Taxable

Is Covid 19 Financial Relief Taxable

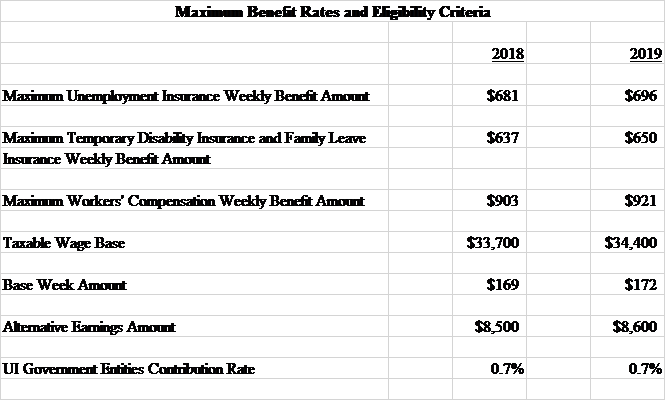

Njdol Maximum Benefit Rates For Unemployment Temporary Disability Family Leave And Workers Comp Rise In 2019 Insider Nj

Njdol Maximum Benefit Rates For Unemployment Temporary Disability Family Leave And Workers Comp Rise In 2019 Insider Nj

Coronavirus Update N J Unemployed Getting 600 Checks Whyy

Coronavirus Update N J Unemployed Getting 600 Checks Whyy

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

New Jersey Nj Dol Division Of Unemployment Insurance 300 Fpuc Peuc And Pua News September 2021 Extension Updates Aving To Invest

New Jersey Nj Dol Division Of Unemployment Insurance 300 Fpuc Peuc And Pua News September 2021 Extension Updates Aving To Invest

Extra 300 Fpuc Unemployment Compensation Covid Stimulus Relief Slow Rollout Out By States Aving To Invest

Extra 300 Fpuc Unemployment Compensation Covid Stimulus Relief Slow Rollout Out By States Aving To Invest

Is The 600 Unemployment Benefit Taxable Njmoneyhelp Com

Is The 600 Unemployment Benefit Taxable Njmoneyhelp Com

Faqs Nj Unemployment Guidance Njbia New Jersey Business Industry Association

Faqs Nj Unemployment Guidance Njbia New Jersey Business Industry Association

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

New Jersey Nj Dol Division Of Unemployment Insurance 300 Fpuc Peuc And Pua News September 2021 Extension Updates Aving To Invest

New Jersey Nj Dol Division Of Unemployment Insurance 300 Fpuc Peuc And Pua News September 2021 Extension Updates Aving To Invest

Post a Comment for "Is The 600 Unemployment Taxable In Nj"