How To Pay Ohio Unemployment Tax

If you are remitting for both Ohio and school district income taxes you must remit each payment as a separate transaction. If you have any questions or concerns about making a repayment please call 614-995-5691.

To file and pay online you can use either the ERIC system or the Ohio Business Gateway.

How to pay ohio unemployment tax. This incorporates recent federal tax changes into Ohio law effective immediately. Mail the repayment to. COLUMBUS Ohioans who received unemployment benefits in 2020 wont have to pay income taxes on the first 10200 they received.

Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. Go through the screens very carefully making sure to enter any federalstate tax you had withheld from the unemployment. Enter your 1099G in FederalWages IncomeUnemployment.

Its looking like Ohio will be addressing and likely approving in the General Assembly a conformity bill which would align Ohio with all. In Ohio theres discussion in Columbus about whether state lawmakers will follow the federal law and pass legislation next week that would also exempt 10200 in unemployment benefits on state tax returns. Specifically federal tax changes related to unemployment benefits in the federal American Rescue Plan Act ARPA of 2021 will impact some individuals who have already filed or will soon be filing their 2020 Ohio IT 1040 and SD 100 returns due by May 17 2021.

Ohio Department of Job and Family Services. To receive your Unemployment tax account number and contribution rate immediately. Unemployment checks in Ohio normally amount to no more than half the lost weekly income topping out at 480 for a single person or 647 for someone with at least three dependents.

Highlighted below are two important pieces of information to help you register your business and begin reporting. Employers with questions can call 614 466-2319. Employers also pay Federal Unemployment Tax Act FUTA taxes.

Ohio income and school district income tax estimated payments. Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis. You can file your reports and payments online or on paper.

The two sections are considered a single report for filing purposes. Alabama does not tax unemployment benefits. For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text telephones TTYs or adaptive telephone equipment.

To file on paper use Form JFS-20125 Quarterly Tax Return which contains both required sections. As of December 27 2020 an additional 300 in unemployment benefits will be added to current state benefits. How to Obtain an Employer Account Number.

A final option is to pay estimated quarterly taxes on your unemployment benefits. Payments for the first quarter of 2020 will be due April 30. The federal government uses the revenue to cover the administrative cost of state unemployment benefit programs.

18 was signed into law. But unemployment benefits are subject to Ohio income taxes. 1 day agoEliminating Ohios unemployment loan balance according to a statement from the Ohio Chamber of Commerce would stave off an employer tax increase in 2022 of more than 100 million and a subsequent 658 million in total tax increases over a three-year period that would be needed to pay.

The American Rescue Plan a 19 trillion Covid relief bill waived. Former NFL player Phillip Adams shot killed five people. Unemployment benefits are not subject to municipal income taxes in Ohio so nothing changes there the Regional Income Tax Agency confirmed.

Thirteen states arent offering a tax break on unemployment benefits received last year according to data from HR Block. Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return. This is a little more complicated but if you had been self-employed or owned your own small business you may.

State Taxes on Unemployment Benefits. STATES THAT TAX UNEMPLOYMENT BENEFITS. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b.

Ohio will use portion of COVID relief funds to pay off business unemployment insurance debt 3 hrs ago Nothing makes sense. In addition the first 25000 received from an employer as severance pay unemployment compensation and the like. If your unemployment compensation payments do not reflect Ohio income tax withheld you may need to make Ohio income and school district income tax estimated payments using form IT 1040ES for Ohio income tax and SD 100ES for school district income tax to avoid a balance due when you file your 2020 Ohio IT 1040 and SD 100 returns.

3 Ways To File An Ohio Unemployment Claim Wikihow

3 Ways To File An Ohio Unemployment Claim Wikihow

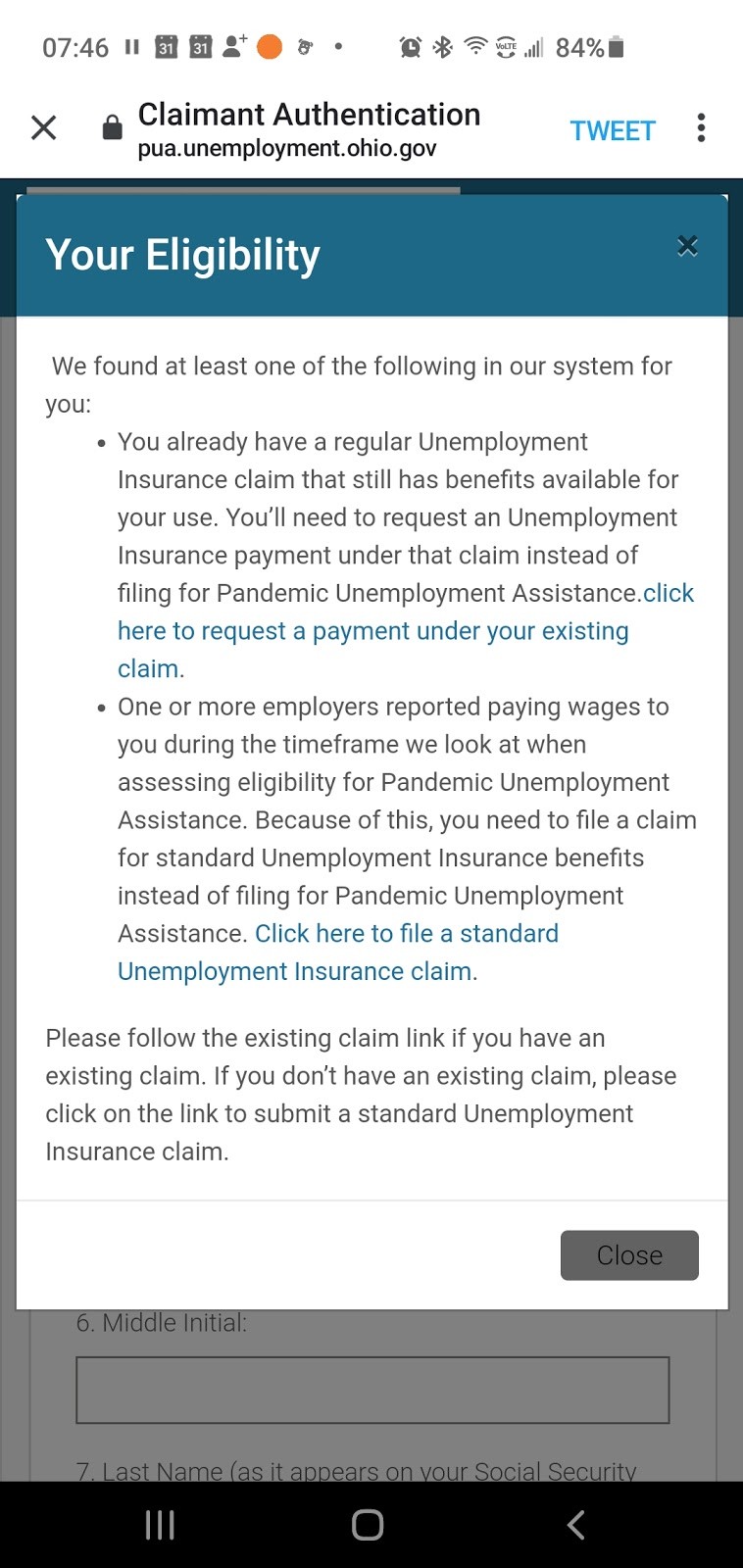

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits Scene And Heard Scene S News Blog

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits Scene And Heard Scene S News Blog

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

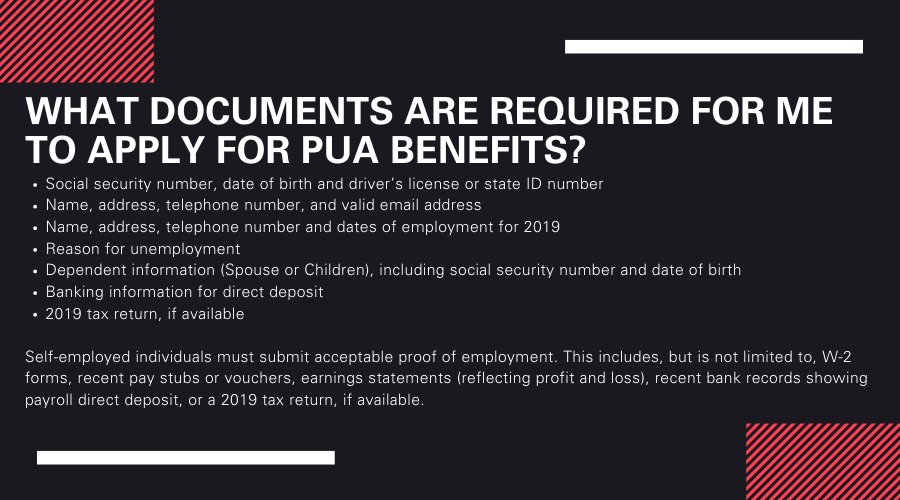

Ohiojfs On Twitter What Documents Are Required For Me To Apply For Pua Benefits For Answers To More Faq S Visit Https T Co Eummtiixu4 Inthistogetherohio Everyclaimisimportant Covid19 Https T Co 6okwzpzqdr

Ohiojfs On Twitter What Documents Are Required For Me To Apply For Pua Benefits For Answers To More Faq S Visit Https T Co Eummtiixu4 Inthistogetherohio Everyclaimisimportant Covid19 Https T Co 6okwzpzqdr

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Apply For Unemployment Benefits Online In Ohio Youtube

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Ohio Oh Department Of Job And Family Services Odjfs Extra 300 Fpuc Peuc Pua And Eb 2021 Unemployment Benefit Extensions News And Updates Aving To Invest

Ohio Oh Department Of Job And Family Services Odjfs Extra 300 Fpuc Peuc Pua And Eb 2021 Unemployment Benefit Extensions News And Updates Aving To Invest

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Post a Comment for "How To Pay Ohio Unemployment Tax"