How Does Unemployment Work In Indiana For Employers

Some states that border each other have entered into agreements related to allowing an employee who lives in one state but works in a neighboring state to have their withholding tax paid to the work. You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers.

The more employee claims that an employer has had to pay out the higher the tax rate.

How does unemployment work in indiana for employers. Your responsibility for unemployment benefits begins when you hire an employee not when you terminate employment. Employers must pay this tax if they have at least one employee on their payroll for 20 calendar weeks or if they have paid employees at least 1500 in a calendar quarter. FREQUENTLY ASKED QUESTIONS for COVID-19 work-related issues.

The higher tax rate offers employers an incentive for avoiding laying off workers and cutting positions since avoiding these actions will keep their unemployment insurance rates lower. If an employer raises an issue of failure to accept suitable employment the state unemployment insurance agency must provide the claimant with an opportunity to provide his or her side of the story and to rebut any evidence provided to the state before making a final determination. These taxes fund your states unemployment insurance program.

State Unemployment Tax Act SUTA Indiana Code Title 22 Article 4. Indiana Unemployment Job Seekers Work-Based Learning and Apprenticeship Career Training and Adult Education Jobs for Americas Graduates JAG Employer Services Veteran Services. Its important to know that only employers pay this tax and it doesnt come from your paycheck.

Similarly Indiana is interpreting unemployment laws as broadly as possible to cover citizens out of work because of COVID-19. The weekly benefit rate is subject to a minimum of 50 and a maximum of 390. See below for liability rules.

Employers are required to either pay SUTA contributions or reimburse the state for benefit payments. State unemployment insurance rates vary for employers based on their history. Please use our Quick Links or access one of the images below for additional information.

If you are eligible to receive unemployment the weekly benefit rate in Indiana is 47 of your average weekly wage to come up with your average weekly wage divide your total wages during the base period by 52. As an Indiana employer your small business must open a state unemployment account with the Indiana Department of Workforce Development DWD. Both the state unemployment tax and withholding tax should generally be paid to the employees work state but there are exceptions.

When you hire new employees report them to your state. When an employee files for unemployment benefits your states unemployment office will begin the process of determining the events surrounding their loss of employment as well as their eligibility for unemployment. Please note that Unemployment Insurance is available to Hoosiers whose employment has been interrupted or ended due to COVID-19 you should file for UI and your claim.

This coverage includes paying unemployment insurance benefits to employees who file their unemployment claims late. These payments are deposited into the Indiana Unemployment Benefit Trust Fund. If I lay people off due to COVID-19 will it affect my Merit rate tax rate next year.

Employers fund the unemployment insurance program through unemployment tax which is not withheld from employee wages. Typically youll receive a up to a 54 credit for paying state unemployment taxes. The FUTA rate is 60 percent of the first 7000 of each employees wages for the year.

Some employers choose to participate in state unemployment programs which means their FUTA rate drops to 06 percent or 42 per employee. Contributory employers are not charged for separations between March 13 2020 and 10312020. In Indiana these funds come from a tax that employers must paycalled unemployment taxesthat are collected by the state and paid out to workers who have lost their job.

If the worker is determined to be ineligible then nothing will happen to you as the business owner. Unemployment Insurance is a collaborative federal-state program financed through mandatory employer payments into two separate trusts one administered by the United States Department of Labor USDOL and one administered by the State Workforce Agency which in Indiana is the Department of Workforce Development DWD. You must pay federal and state unemployment taxes for each employee you have.

Register as a new employer Maintain unemployment insurance account information Review account status information Submit quarterly. You must register during the first calendar quarter that your business is liable to pay UI premiums taxes. Money received from employers is used solely for the payment of unemployment benefits to qualifying claimants.

Federal Unemployment Tax Act FUTA This is an employer-only tax that is 6 on the first 7000 each employee earns per calendar year which means the maximum amount youll have to pay per employee is 420 per year. Through the Uplink Employer Self Service System you have access to on-line services 24 hours a day 7 days a week. Indiana Unemployment Insurance.

Updated April 1 2021. Businesses have to pay a federal unemployment tax FUTA for each employee. Employers interact with DWD through the UPLINK Employer.

You may receive benefits for a maximum of 26 weeks. Uplink allows you to do the following on-line. The state unemployment rate varies by state.

What Makes Indiana An Affordable Place To Live Our Robust Economy For Starters Budgeting Help Wanted Higher Education

What Makes Indiana An Affordable Place To Live Our Robust Economy For Starters Budgeting Help Wanted Higher Education

Indiana Unemployment Faqs Martinsville Chamber Of Commerce

Indiana Unemployment Faqs Martinsville Chamber Of Commerce

Pin On State Federal Labor Law Posters

Pin On State Federal Labor Law Posters

Here S What Unemployed Hoosiers Should Know About The American Rescue Plan

Here S What Unemployed Hoosiers Should Know About The American Rescue Plan

Dwd Unemployment For Individuals Faqs

Reverse Job Fair For Job Seekers With Disabilitiesemployindy

Reverse Job Fair For Job Seekers With Disabilitiesemployindy

Indiana Mandatory Employment Posters

Indiana Mandatory Employment Posters

Factory Closing Notice Used Car Lots Studebaker Car Lot

Factory Closing Notice Used Car Lots Studebaker Car Lot

How To File For Unemployment Benefits Indiana Youtube

How To File For Unemployment Benefits Indiana Youtube

Free Indiana Indiana Iosha Poster Labor Law Poster 2021

Free Indiana Indiana Iosha Poster Labor Law Poster 2021

Unemployment Workone Southeast

Dwd Pandemic Unemployment Assistance

Claimant Self Service Tutorial Filing A New Claim Youtube

Claimant Self Service Tutorial Filing A New Claim Youtube

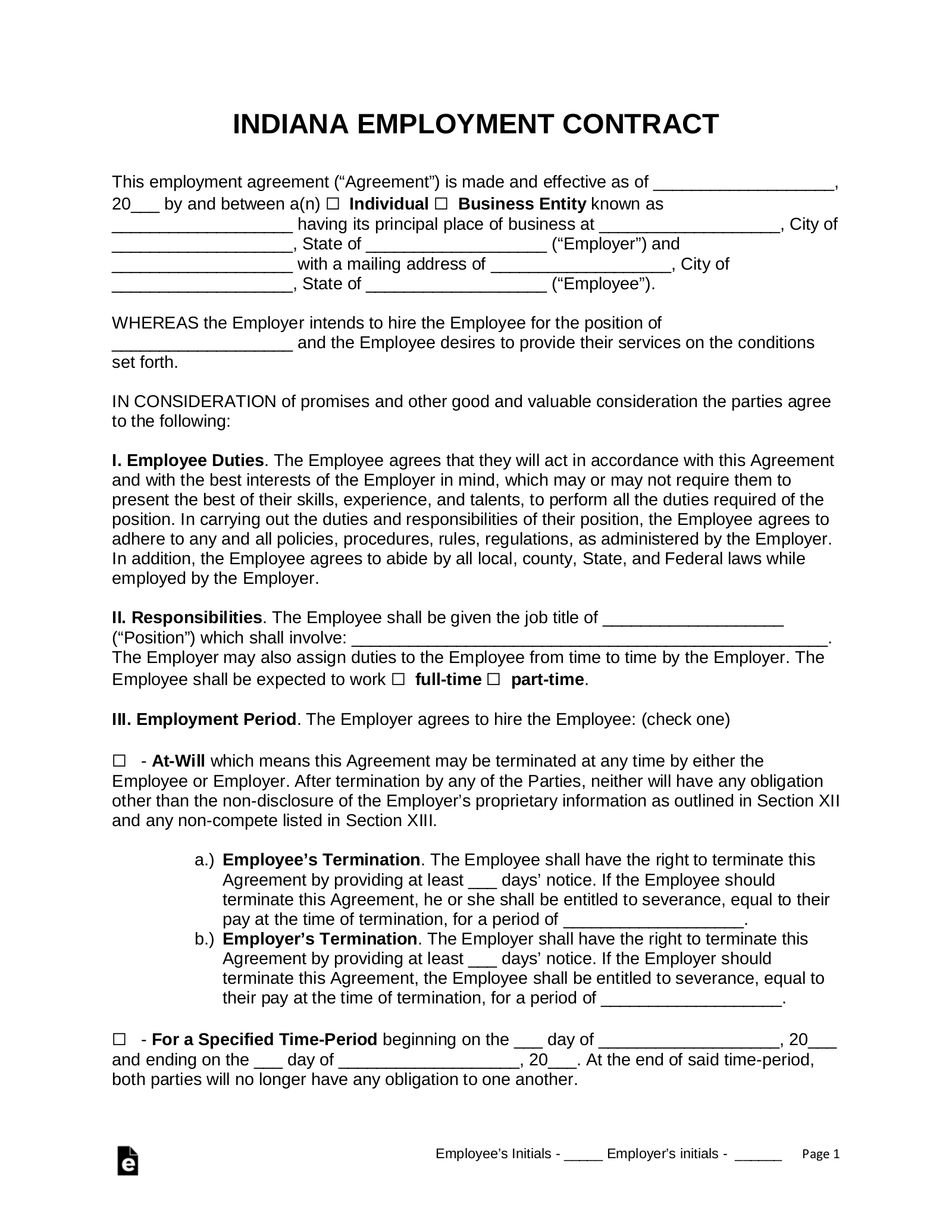

Free Indiana Employment Contract Templates Pdf Word Eforms

Free Indiana Employment Contract Templates Pdf Word Eforms

Free Indiana Minimum Wage Labor Law Poster 2021

Free Indiana Minimum Wage Labor Law Poster 2021

Indiana Unemployment Insurance Faqs Indiana Dental Association

Indiana Unemployment Insurance Faqs Indiana Dental Association

Http Www Iuoe103 Com Uploads Uploadedfiles Docs Claimant Handbook Pdf

Post a Comment for "How Does Unemployment Work In Indiana For Employers"