What Is Kentucky Unemployment Tax Rate

State tax wont necessarily amount to much though depending on the respective tax rate. Hundreds of unemployed Kentucky residents in June waiting for help with unemployment claims.

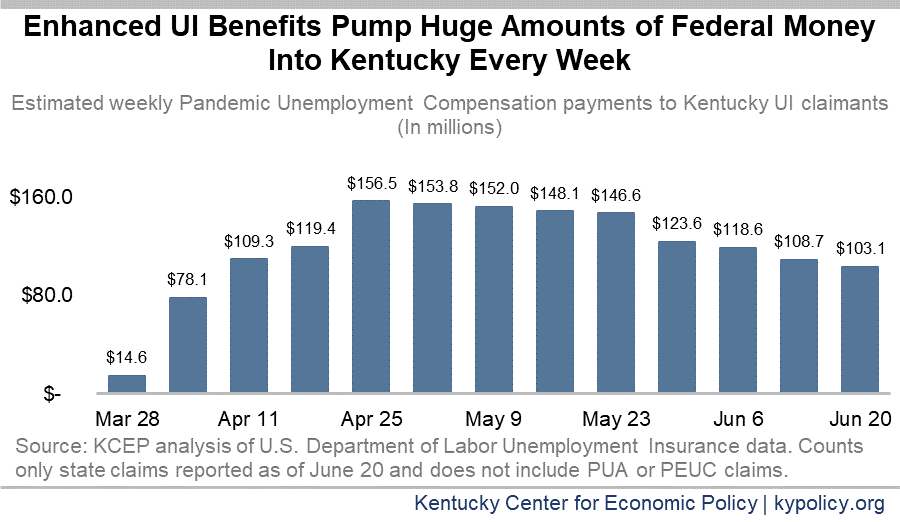

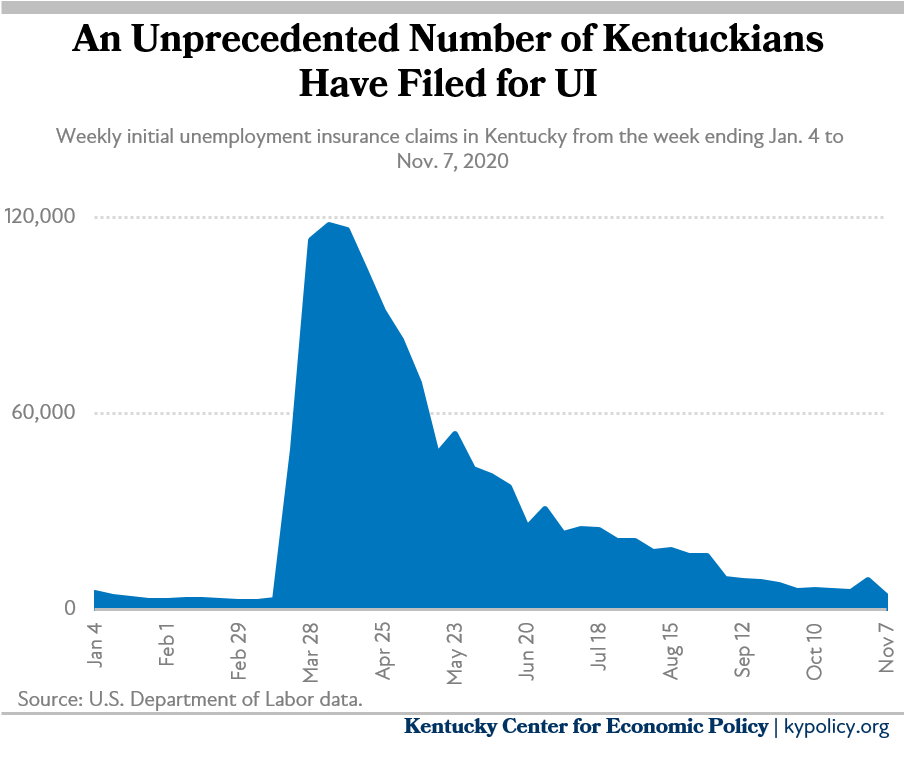

Letting Enhanced Unemployment Insurance Benefits Expire In A Month Would Harm Families And Weaken Kentucky S Economy Kentucky Center For Economic Policy

Letting Enhanced Unemployment Insurance Benefits Expire In A Month Would Harm Families And Weaken Kentucky S Economy Kentucky Center For Economic Policy

National Unemployment Rate Kentucky Unemployment Rate Kentucky Unemployed.

What is kentucky unemployment tax rate. Due to this change tax rates will range from 030 to 900. This will reduce your FUTA contribution rate to 060 600 - 540. This class receives a 1000 exemption but is otherwise subject to the tax with rates beginning at 4 for amounts greater than the 1000 exemption and increasing to a top rate of 16 for the amount of the inheritance above 200000.

For this and other information and assistance please visit the Kentucky Career Center website at wwwkcckygov. Notably Kentucky has the highest maximum marginal tax bracket in the United States. Kentucky collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Rates are to range from 100 to 350 for positive-rated employers and from 750 to 1000 for negative-rated employers. This allows rates to return to 2020 levels providing relief to all experience-rated employers. Unlike the Federal Income Tax Kentuckys state income tax does not provide couples filing jointly with expanded income tax brackets.

The wage base is 10800 for 2020 and rates range from 10 to 100. In recent years it has approached and then exceeded 10000. For example taxpayers in Colorado pay a flat 463 on income which would include jobless benefits.

For 2019 unemployment tax rates are to range from 03 percent to 24 percent for positive-rated employers and from 65 percent to 9 percent for negative-rated employers. Effective January 1 2021 unemployment tax rates for experience-rated employers are to be determined with Schedule E. Starting in 2021 Proposition 208 approved by.

The FUTA taxable wage base remains at 7000 per worker. A provision in the 19 trillion American Rescue Plan could save jobless Americans between 1000 and. If youre a new employer youll pay a flat rate of 27.

45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers. That amount known as the taxable wage base increases slightly every year in Kentucky. Unemployment tax rates are to be the same as in 2019 Kentuckys unemployment-taxable wage base is to be 10800 in 2020 up from 10500 in 2019 a spokeswoman for the state Office of Unemployment Insurance said Oct.

You will be taxed at the regular rate for any federal unemployment benefits above 10200. You can take the tax break if you have an adjusted gross income of less than 150000. Additionally HB 413 will decrease the 2021 unemployment taxable wage base from 11100 to 10800.

The new-employer tax rate will remain at 270 for 2021. The state UI tax rate for new employers also is subject to change from one year to the next. Not everone is as lucky as you are information Kentucky s Unemployment Rate commonwealth of kentucky unemployment wage limit 2018 NomicsNotes from NumberNomics State Wage Base Chart Kentucky All in e Labor Law Poster join the nasdaq munity today and free instant access to portfolios stock ratings real time alerts.

60 February 2021. The Kentucky Division of Unemployment Insurance announced that unemployment tax rates are set to increase for 2021. In recent years however the rate has been stable at 27.

Kentucky State Unemployment Insurance SUI As an employer youre responsible for paying state unemployment insurance which covers those unemployed through no fault of their own. The tax rate is five 5 percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141019. Here is a list of the non-construction new employer tax.

Important Notice Regarding UI system against fraudulent claims. A full-year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the year or is a full-year nonresident files Form 740-NP. You can learn more about how the Kentucky income tax compares to other.

Provide civilian labor force estimates unemployment rates by county affirmative action statistics industry unemployment estimates and average weekly wages. Commonwealth Of Kentucky Unemployment Wage Limit 2018. Kentucky employers are eligible to claim the full FUTA credit of 540 when filing your 2019 IRS 940 Forms in January 2020.

52 rows SUI tax rate by state.

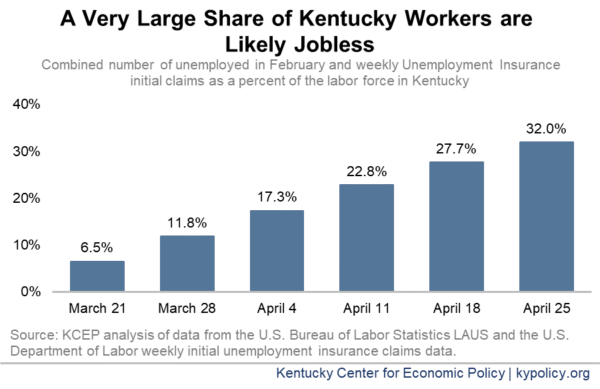

Nearly One In Three Kentucky Workers May Be Out Of A Job Kentucky Center For Economic Policy

Nearly One In Three Kentucky Workers May Be Out Of A Job Kentucky Center For Economic Policy

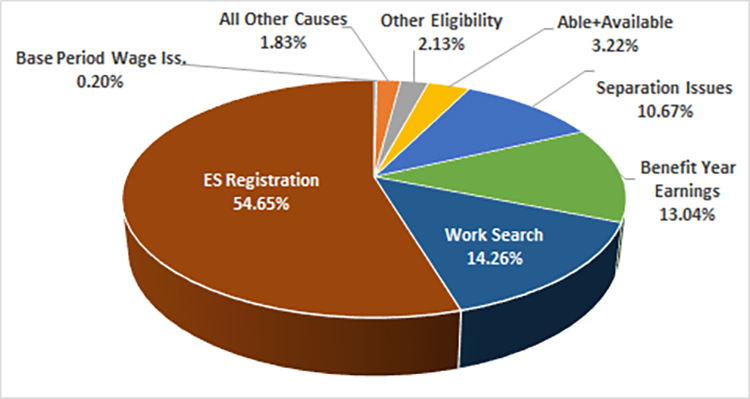

Kentucky Must Remove The Roadblocks To Unemployment Insurance Our Most Important Economic Stabilizer Kentucky Center For Economic Policy

Kentucky Must Remove The Roadblocks To Unemployment Insurance Our Most Important Economic Stabilizer Kentucky Center For Economic Policy

Colin Gordon Unemployment Rate Iowa Counties Since 2006 Unemployment Rate Unemployment Iowa

Colin Gordon Unemployment Rate Iowa Counties Since 2006 Unemployment Rate Unemployment Iowa

Governor Commits To Dedicating Cares Act Funding To Unemployment Insurance Trust Fund As Businesses Face Increased Taxes The Bottom Line

Governor Commits To Dedicating Cares Act Funding To Unemployment Insurance Trust Fund As Businesses Face Increased Taxes The Bottom Line

The Best And Worst States To Be Unemployed Kentucky Travel Best Places To Retire Kentucky Horse Farms

The Best And Worst States To Be Unemployed Kentucky Travel Best Places To Retire Kentucky Horse Farms

Kentucky Makes Changes To Unemployment Insurance Rules In Response To Coronavirus Greater Louisville Inc

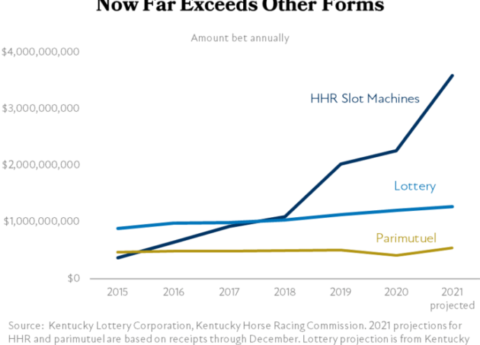

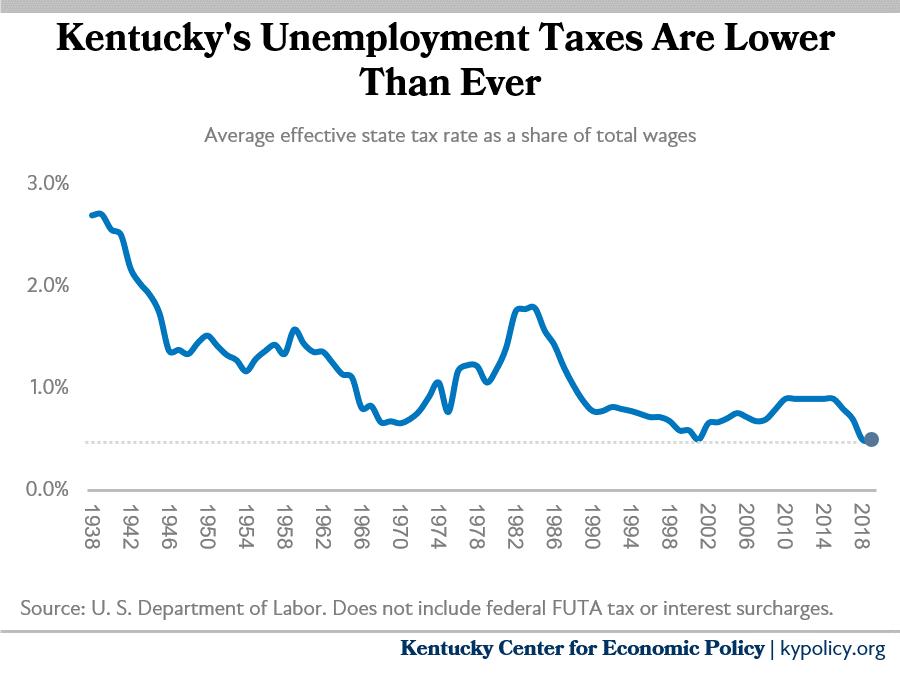

Kentucky S Inadequate And Outdated Unemployment Insurance Taxes Need To Be Modernized Kentucky Center For Economic Policy

Kentucky S Inadequate And Outdated Unemployment Insurance Taxes Need To Be Modernized Kentucky Center For Economic Policy

Nearly One In Three Kentucky Workers May Be Out Of A Job Kentucky Center For Economic Policy

Nearly One In Three Kentucky Workers May Be Out Of A Job Kentucky Center For Economic Policy

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

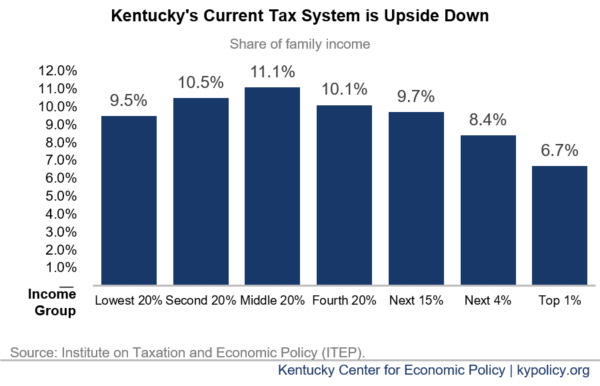

Tax Plan Would Fix Kentucky S Budget Challenges By Addressing Upside Down Tax Code Kentucky Center For Economic Policy

Tax Plan Would Fix Kentucky S Budget Challenges By Addressing Upside Down Tax Code Kentucky Center For Economic Policy

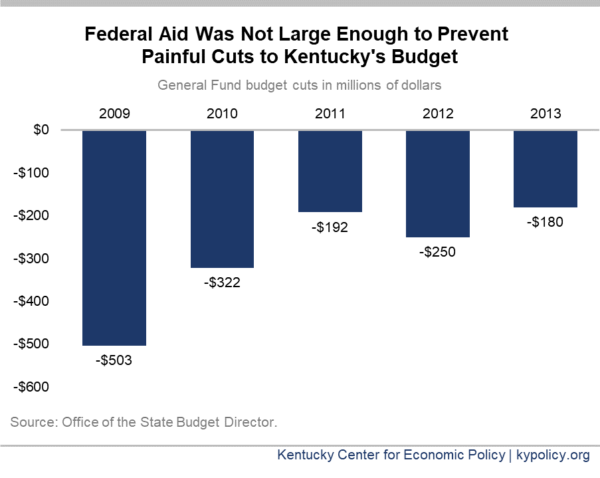

Lessons From The Great Recession Kentucky And Other States Need More Federal Relief Kentucky Center For Economic Policy

Lessons From The Great Recession Kentucky And Other States Need More Federal Relief Kentucky Center For Economic Policy

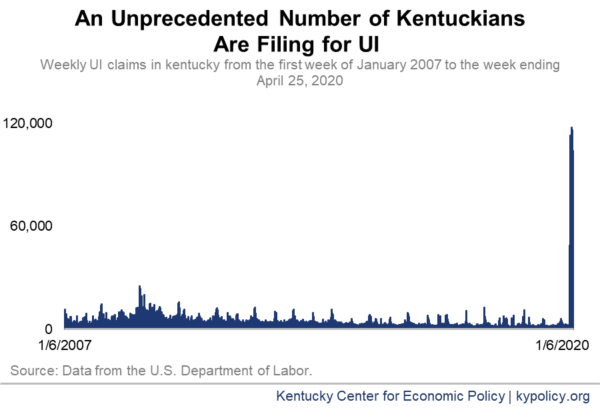

Covid 19 Crisis Demonstrates Need For State Improvements To Unemployment Insurance In Kentucky Kentucky Center For Economic Policy

Covid 19 Crisis Demonstrates Need For State Improvements To Unemployment Insurance In Kentucky Kentucky Center For Economic Policy

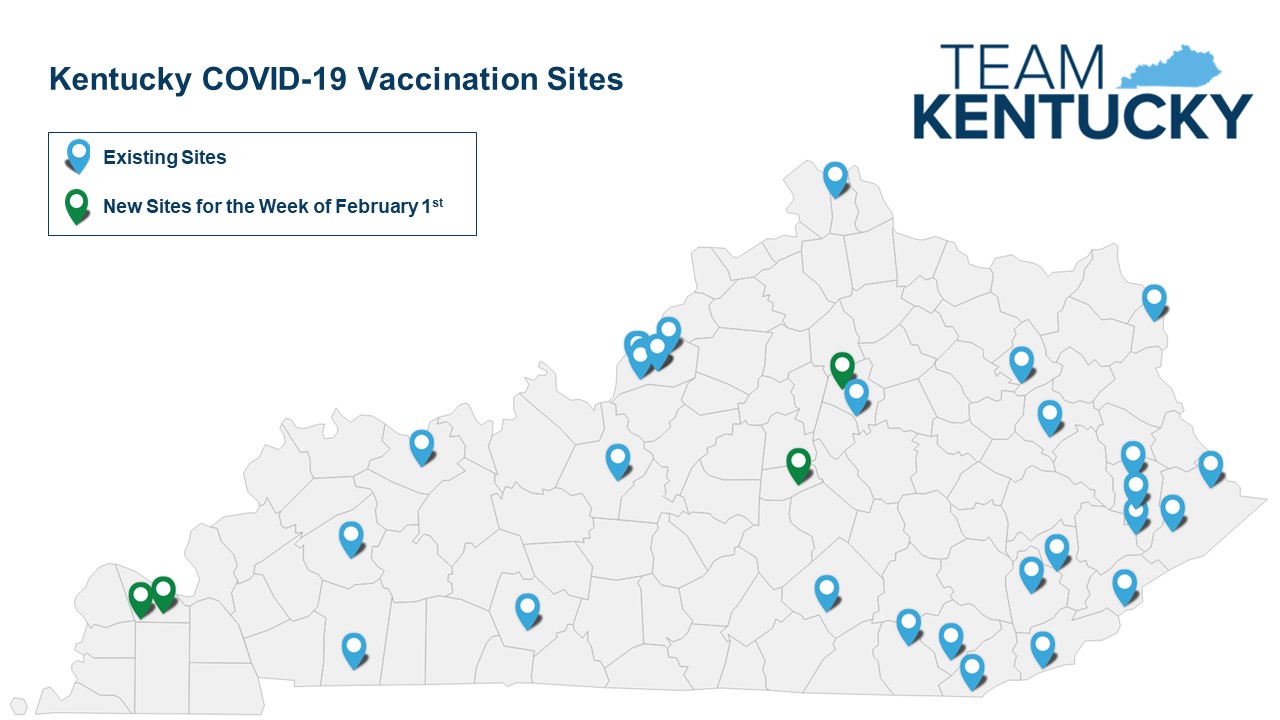

Four New Regional Vaccine Sites Announced Website To Help Eligible Kentuckians Find A Vaccine Marshall County Daily Com

Four New Regional Vaccine Sites Announced Website To Help Eligible Kentuckians Find A Vaccine Marshall County Daily Com

Gov Beshear Offered Self Quarantine Unemployment Now State Is Backtracking And Billing 89 3 Wfpl News Louisville

Gov Beshear Offered Self Quarantine Unemployment Now State Is Backtracking And Billing 89 3 Wfpl News Louisville

Unemployment Insurance Used Longer In Kentucky Than National Average Lane Report Kentucky Business Economic News

Unemployment Insurance Used Longer In Kentucky Than National Average Lane Report Kentucky Business Economic News

Unemployment Insurance How It Works And How To Apply Wku Public Radio

Unemployment Insurance How It Works And How To Apply Wku Public Radio

Kentucky U S Department Of Labor

Kentucky U S Department Of Labor

Kentucky Makes Changes To Unemployment Insurance Rules In Response To Coronavirus Greater Louisville Inc

Kentucky Career Center What You Need To Know

Kentucky Career Center What You Need To Know

Post a Comment for "What Is Kentucky Unemployment Tax Rate"