Unemployment Tax Form Alabama

10 hours agoMost people on unemployment last year didnt have state income taxes taken out potentially leaving them with a bill when those taxes come. The Form 1099-G details how much unemployment compensation claimants received during the calendar.

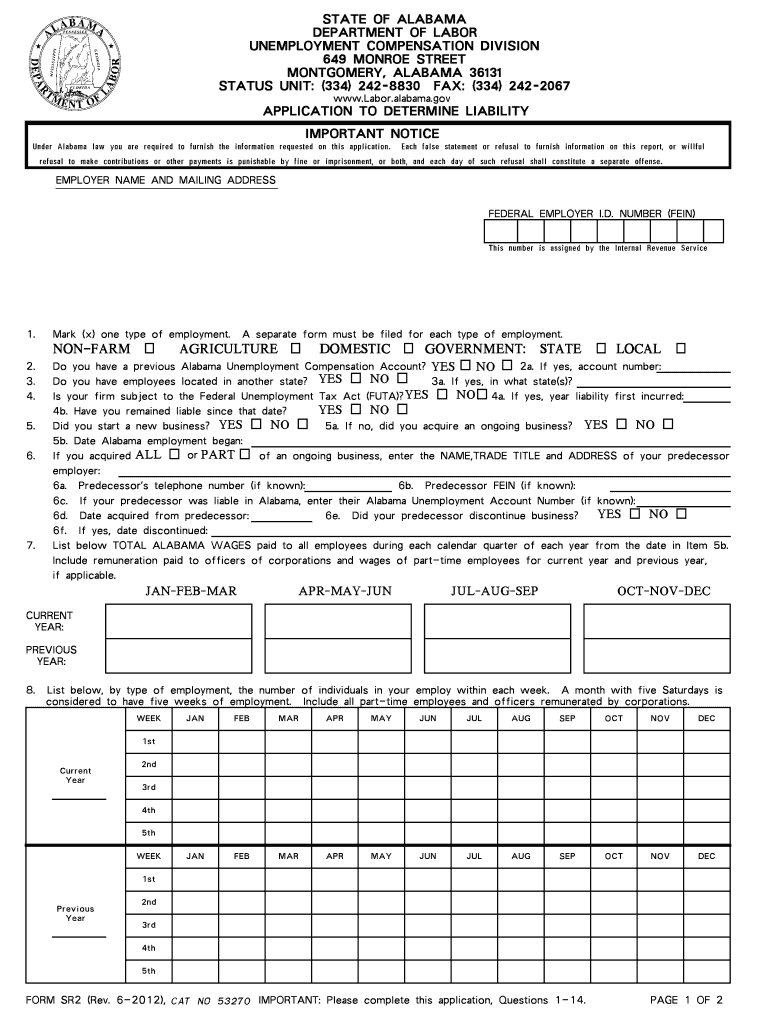

Fillable Online Dir Alabama Sr2 For Alabama Unemployment Form Fax Email Print Pdffiller

Fillable Online Dir Alabama Sr2 For Alabama Unemployment Form Fax Email Print Pdffiller

Alabamas Unemployment Compensation Benefit Rights and Responsibilities Handbook explains the program and answers any questions.

Unemployment tax form alabama. Need To Know - 2020 1099-G 2020 1099-Gs are now available for download. Unemployment insurance taxes due April 30. See SUI Taxable Wages.

Delinquent after May 1. Use the information below to access employer related services and information. Beginning in 2018 foreign income to the extent such income is exempt from federal income tax pursuant to section 26 USC 911.

Unemployment compensation has its own line Line 7 on Schedule 1 which accompanies your 1040 tax return. Unemployment Compensation - This box includes the dollar amount paid in benefits to you during the calendar year. For Pandemic Unemployment Assistance PUA.

Once registered youll be issued an unemployment compensation UC account number. The first quarterly tax payment for unemployment insurance taxes is due April 30 and delinquent after May 1. Alabama Department of Labor Unemployment Insurance Program.

Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on Line 25b. Alabama does not tax unemployment benefits. That means you have to include the funds received on.

The SUI tax rates are based on one of four tax rate schedules established by law. The information on the 1099-G tax form is provided as follows. In addition the first 25000 received from an employer as severance pay unemployment compensation and the like.

You can register for an account with ADOL either online or on paper. Forms To view a complete listing of forms for individual income tax please visit the forms page. Ahead of receiving your first unemployment compensation payment the Alabama Department of Labor requires recipients to select tax withholdings.

FOR IMMEDIATE RELEASE. For regular UI Benefits Rights and Responsibilities please click here. If you have received unemployment income at any point during the year you will be required to complete and return IRS Form 1099-G.

Whether you are starting a new business or an existing employer the Alabama Department of Labor will help you find the resources and information that you need to succeed. 28 rows You can open an Alabama Unemployment Tax account by completing an application. Employers should have been able to download their 2021 unemployment insurance rate via the Alabama Department of Labor website in either the first or.

These documents WERE MAILED TO THE ADDRESS OF RECORD BY FEBRUARY 1 2021 as is required by law. Adjustments - This box includes cash payments and income tax refunds used to pay back overpaid benefits. Income tax intercepts for recoup outstanding overpayments.

However 1099-Gs are available online hereTo verify andor update your mailing address please visit our Claimant Portal. As an Alabama employer subject to UI tax your small business must establish an Alabama UI tax account with the Alabama Department of Labor ADOL. Alabama defines wages for state unemployment insurance SUI tax purposes as every form of compensation paid for personal services.

Beginning January 1 1998 all tuition benefits received from the Alabama Prepaid Affordable College Tuition PACT program. Filing Form A-3 Annual Reconciliation of Alabama Income Tax Withheld is a two-step process. January 14 2020 Unemployment Compensation Tax Forms Are Now Available Online MONTGOMERY - Alabamians who received unemployment compensation benefits in 2019 can now view and download their form 1099-G online at wwwlaboralabamagov.

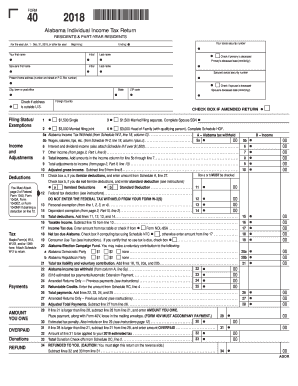

Submission of employee W-2 information andor 1099s with Alabama income tax withheld and submission of Form A-3 the annual reconciliation of the monthlyquarterly taxes withheld and remitted to. This document will accurately summarize your unemployment compensation and ensure that you are taxed appropriately. Forms Search Order Forms Most Popular Forms Form 40 Form 40 Booklet Form 40A Form 40A Booklet Form 40NR Form 40NR Booklet Form.

Rate increased for all employers. Need To Know - Claims Eligibility Working for cash or received a 1099. State Taxes on Unemployment Benefits.

You may search by form number title of the form division tax category andor year. Alabama 529 Savings Plan. Certain types of payments are specifically excluded.

You can collected Form 1099-G by calling your local unemployment office or contacting the IRS directly. It is not to be used for responding to the Tax Division on a Form Ben-8B Notice of Benefit Charges. 1467 rows Access forms form instructions and worksheets for each tax division.

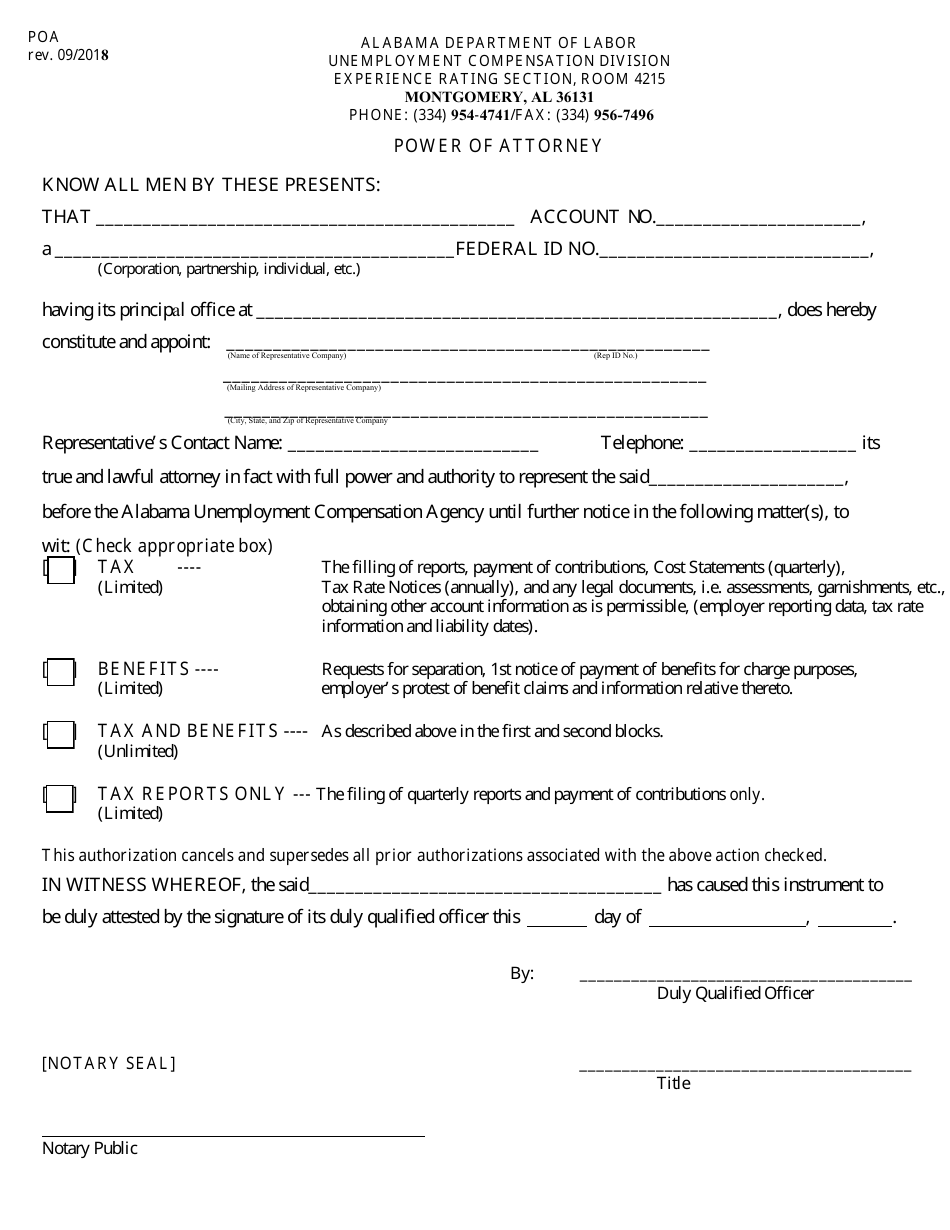

Form Poa Download Fillable Pdf Or Fill Online Power Of Attorney Alabama Templateroller

Form Poa Download Fillable Pdf Or Fill Online Power Of Attorney Alabama Templateroller

Alabama Department Of Labor News

Alabama Department Of Labor News

Unemployment Tax Forms Now Available Alabama News

Unemployment Tax Forms Now Available Alabama News

Steps To Login For Alabama Unemployment Benefits Applications In United States Application Gov

Steps To Login For Alabama Unemployment Benefits Applications In United States Application Gov

Alabama Department Of Labor Workers Compensation

Alabama Department Of Labor Workers Compensation

Steps To Login For Alabama Unemployment Benefits Applications In United States Application Gov

Steps To Login For Alabama Unemployment Benefits Applications In United States Application Gov

Fillable Online To Download A Tax Form And Instructions Home Decatur Alabama Fax Email Print Pdffiller

Fillable Online To Download A Tax Form And Instructions Home Decatur Alabama Fax Email Print Pdffiller

Alabama Form Uc Cr4 Pdf Fill Online Printable Fillable Blank Pdffiller

Alabama Form Uc Cr4 Pdf Fill Online Printable Fillable Blank Pdffiller

2012 2021 Form Al Sr 2 Fill Online Printable Fillable Blank Pdffiller

2012 2021 Form Al Sr 2 Fill Online Printable Fillable Blank Pdffiller

Https Labor Alabama Gov Docs Pressreleases Uc 2015 1099 Forms 1 8 16 Pdf

3 12 154 Unemployment Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

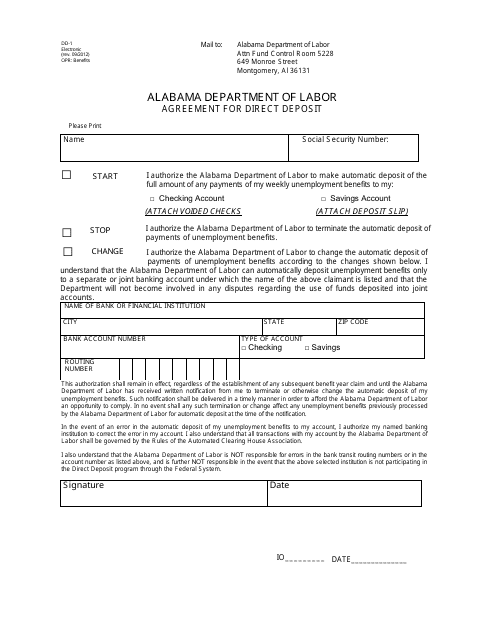

Form Dd 1 Download Printable Pdf Or Fill Online Agreement For Direct Deposit Alabama Templateroller

Form Dd 1 Download Printable Pdf Or Fill Online Agreement For Direct Deposit Alabama Templateroller

Steps To Login For Alabama Unemployment Benefits Applications In United States Application Gov

Steps To Login For Alabama Unemployment Benefits Applications In United States Application Gov

Irs Form 1099 G Software 79 Print 289 Efile 1099 G Software

Irs Form 1099 G Software 79 Print 289 Efile 1099 G Software

Alabama Tax Forms And Instructions For 2020 Form 40

Alabama Tax Forms And Instructions For 2020 Form 40

Post a Comment for "Unemployment Tax Form Alabama"