Vt Unemployment For Part Time Employees

Unemployment Insurance has been in existence since 1939. The current maximum is 513 per week.

Https Labor Vermont Gov Sites Labor Files Doc Library B 11claimant 20handbook 202019 Pdf

Please refer to Section 3 Base Periods for more details.

Vt unemployment for part time employees. Must register for work unless you have been specifically exempted. You are required to certify that you are unemployed on a weekly basis to receive these benefits. When you register for a Vermont business tax account be sure to answer the.

Vermont Department of Labor 5 Green Mountain Drive PO. In order to be eligible for unemployment compensation an individual. Before you Open for Business.

A 18 years of age or older for all of a calendar quarter. Box 488 Montpelier 05601-0488. Once you become totally or partially unemployed the time to establish a new claim is during the first week you work less than 35 hours.

Employers with previous employees may be subject to a different rate. Department of Labor offices are currently closed due to COVID-19Please contact the Department by phone. You must register for an employer withholding account.

Eligibility for Unemployment When You Work Part-Time Expanded unemployment benefits are available for laid-off workers due to the coronavirus pandemic. Under the new rules you can work up to 7 days per week without losing full unemployment benefits for that week if you work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment. If you are eligible to receive unemployment your weekly benefit rate is your total wages in the two highest paid quarters of the base period divided by 45.

If an employee is under the age of 18 during any part of a calendar quarter he or she should not be included in the calculation for uncovered employees on the HC-1. As used in this chapter. Vermont Department of Labor 5 Green Mountain Drive PO.

Health Care Fund Contribution Assessment. Must be available for full-time work on all shifts and during all the hours work claimant is qualified for is normally performed. Box 488 Montpelier 05601-0488.

To be eligible for unemployment benefits in Vermont you must meet the following requirements. If your small business has employees working in Vermont youll need to pay Vermont unemployment insurance UI tax. Eligible workers will receive supplemental payments and extra weeks of unemployment compensation.

See Vermont State Unemployment Benefits. Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes. State Unemployment Tax Rate In Vermont the new employer SUI state unemployment insurance for most employers is 1 percent on the first 14100 of wages for each employee.

10502 10502. 1 Employee means an individual who is. B employed full-time or part-time.

You ordinarily may receive benefits for a. An individual who is 18 years or older during any part of a calendar quarter employed full-time or part-time and reported by the employer for purposes of unemployment compensation. Must be totally or partially unemployed.

Amount and Duration of Unemployment Benefits in Vermont. The UI tax funds unemployment compensation programs for eligible employees. The purpose of unemployment insurance benefits is to provide short term replacement of lost wages to individuals who lose their jobs through no fault of their own.

Department of Labor offices are currently closed due to COVID-19Please contact the Department by phone. C reported by an employer for purposes of complying with Vermont unemployment compensation law pursuant to 21 VSA. If you plan on hiring employees to work in your business you must withhold Vermont state income tax from each employees paycheck and remit the tax to the Vermont Department of Taxes.

Have been separated from employment through no fault of your own or have had your hours reduced. If you become unemployed and have worked in Vermont in the past 18 months you may be eli- gible to receive unemployment insurance benefits. Under certain circumstances Vermont residents may be eligible for unemployment benefits while they search for another job.

If you previously worked only at a part-time job the unemployment office may require you to only look for new part-time jobs and to accept any part-time work that is. In Vermont state UI tax is just one of several taxes that employers must pay. The money for unemployment benefits is solely funded by employers by paying taxes into the unemployment insurance trust fund.

With this change your benefits will not be reduced for each day you engage in.

Additional And Extended Benefits Department Of Labor

Additional And Extended Benefits Department Of Labor

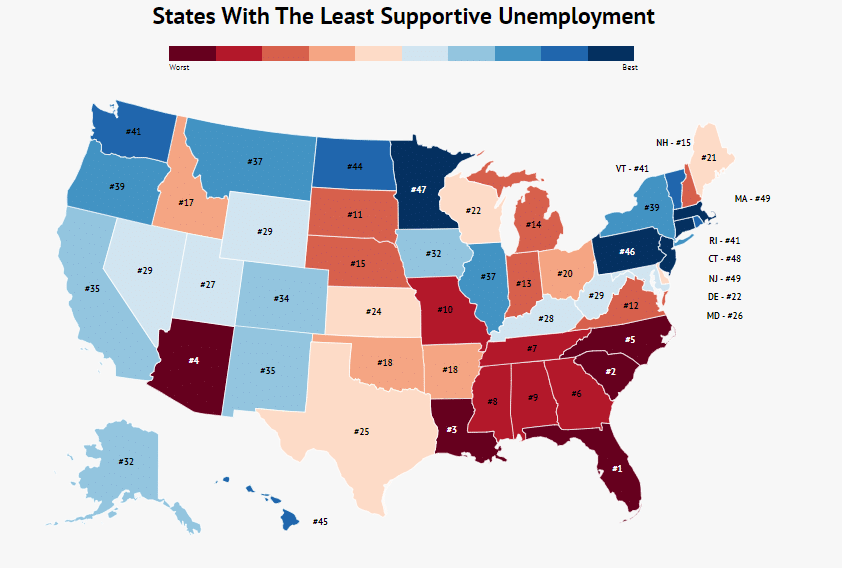

Here Are The States With The Least Supportive Unemployment Systems Zippia

Here Are The States With The Least Supportive Unemployment Systems Zippia

![]() Unemployment Benefits In Response To Covid 19 Coronavirus Vtlawhelp Org

Unemployment Benefits In Response To Covid 19 Coronavirus Vtlawhelp Org

The Life Expectancy Gap Between The Longest Living And Shortest Living County Of Each State Visualized Information Visualization Life Expectancy U S States

The Life Expectancy Gap Between The Longest Living And Shortest Living County Of Each State Visualized Information Visualization Life Expectancy U S States

Valley News Laid Off Workers In Twin States Struggle To Access Unemployment Safety Net

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

Weekly Unemployment Claims Level Off Vermont Business Magazine

Weekly Unemployment Claims Level Off Vermont Business Magazine

Weekly Unemployment Claims Still Edging Up Vermont Business Magazine

Weekly Unemployment Claims Still Edging Up Vermont Business Magazine

Weekly Unemployment Claims Still Edging Up Vermont Business Magazine

Weekly Unemployment Claims Still Edging Up Vermont Business Magazine

How Unemployment Benefits Are Calculated By State Bench Accounting

How Unemployment Benefits Are Calculated By State Bench Accounting

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

Nearly Half Of States Could Not Cover Unemployment Insurance In A Recession Marketplace

Nearly Half Of States Could Not Cover Unemployment Insurance In A Recession Marketplace

Weekly Unemployment Claims Level Off Vermont Business Magazine

Weekly Unemployment Claims Level Off Vermont Business Magazine

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Podcast Vermont S Unemployment Claims Spike Explained Vtdigger

Podcast Vermont S Unemployment Claims Spike Explained Vtdigger

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

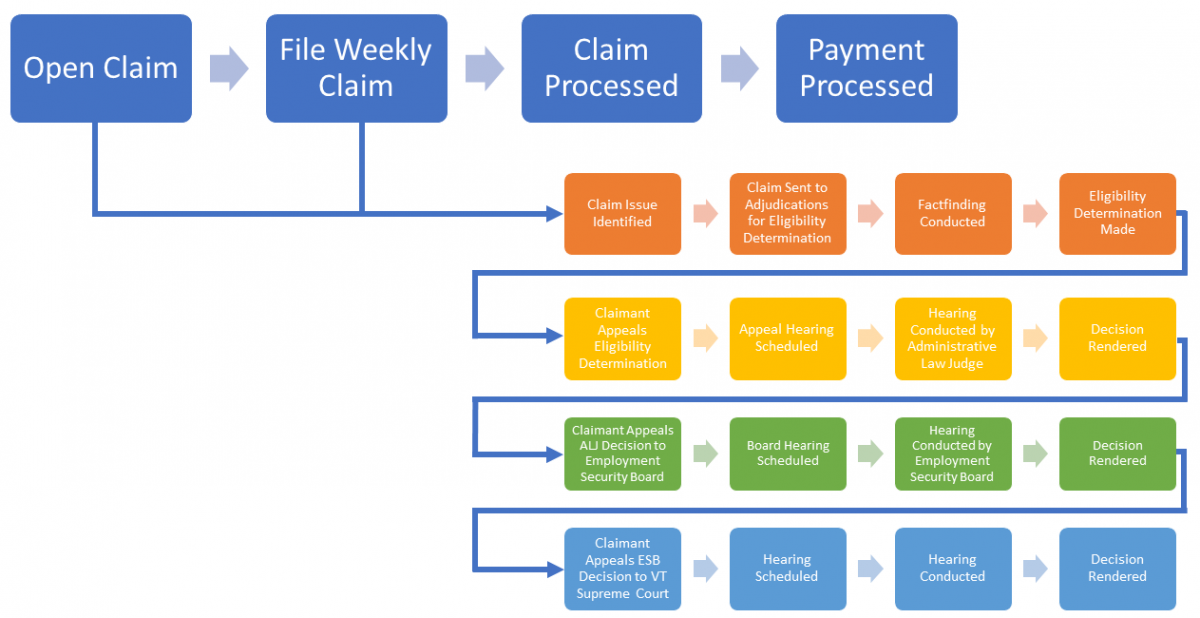

Appealing Ui Claim Determinations Department Of Labor

Appealing Ui Claim Determinations Department Of Labor

Coronavirus Layoffs Overwhelm Vermont Unemployment Center Off Message

Coronavirus Layoffs Overwhelm Vermont Unemployment Center Off Message

Post a Comment for "Vt Unemployment For Part Time Employees"