Does Unemployment Income Count Toward Medicaid Eligibility

The redetermination process is meant to ensure the senior Medicaid beneficiary still meets the eligibility criteria such as income. If your family income is too much for Medicaid.

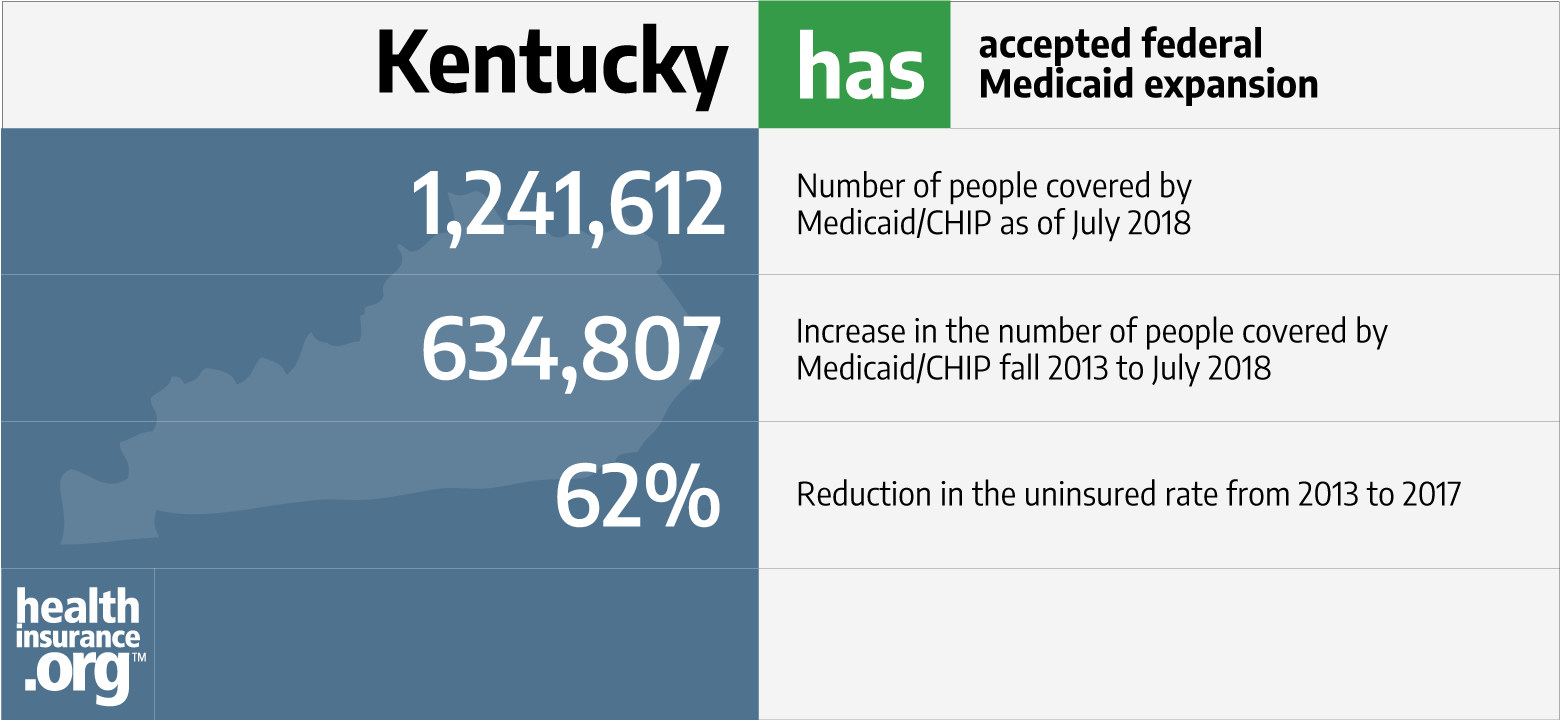

Kentucky And The Aca S Medicaid Expansion Healthinsurance Org

Kentucky And The Aca S Medicaid Expansion Healthinsurance Org

For Medicaid the additional 600 per week of PUC is not countable and should be excluded in determining eligibility but other UI benefits are counted.

Does unemployment income count toward medicaid eligibility. Yes income and assets have to be verified again for redetermination which after initial acceptance into the Medicaid program is generally every 12 months. 20 rows The Marketplace counts estimated income of all household members. Applying for Medicaid services involves an evaluation of your income and assets.

A person on SSI is required to apply for and accept UI and any other benefit to which they may be entitled. The law also made a change that could impact you if you collected unemployment in 2020. MedicaidMO HealthNetPart 1 Regular Rules.

The HealthCaregov website says calculating your adjusted gross income gives you a good estimate. States have flexibility for treatment of income under TANF. The income numbers you have to crunch come from your whole familys income.

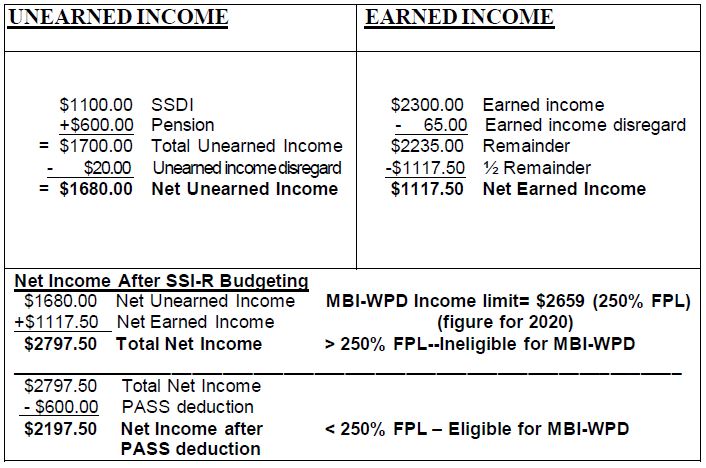

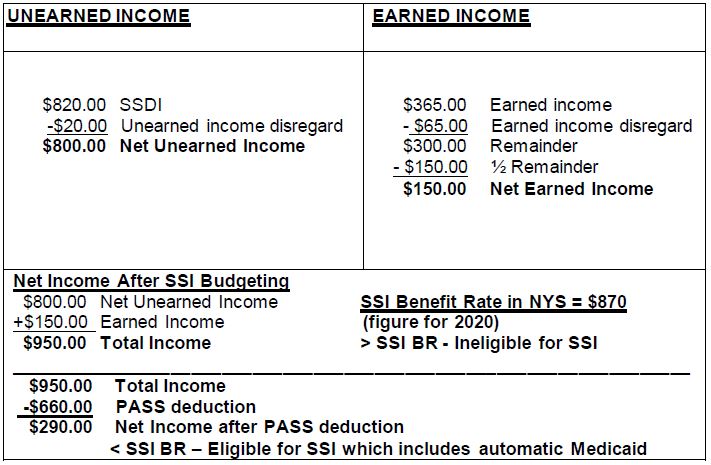

The act expressly excludes this additional payment but not the base unemployment compensation from counting toward income in Medicaid and CHIP. UI benefits are considered unearned income and will reduce SSI accordingly. Unemployment benefits could increase an individuals income to such a degree that aid through these programs is either reduced or eliminated entirely.

Given the fact that the ACA sought to align income eligibility its a bit of a head scratcher as to why the CARES act exempted the. Will my Unemployment Insurance Benefit UIB count as income for purposes of Medicaid eligibility. If youre unemployed but your spouse works you have to count that toward your state income limits.

But the 600 a week in extra federal. Another perverse complication is that the unemployment benefits those 328 million people are applying for actually count towards the income for Medicaid qualification. If individuals are receiving the weekly 600 in PUC they should include it on their applications for Marketplace coverage.

Examples include a personal needs allowance for the Medicaid participant private health insurance premiums spousal allowance also referred to as a Monthly Maintenance Needs Allowance and care costs. You do not have to include this income when applying for Medicaid. At present vulnerable workers who become unemployed can receive 600 in additional federal income for 16 weeks.

Unfortunately this does not apply to eligibility for premium tax credits or cost-sharing subsidies in the Marketplace. Although income received through UIB is typically countable income for purposes of Medicaid budgeting some eligible individuals who are collecting UIB received an additional weekly compensation payment of 600. Most states count the full amount of UI but some states are excluding the.

This federal unemployment compensation is included in income eligibility. If youre unemployed you may be able to get an affordable health insurance plan through the Marketplace with savings based on your income and household size. However it will be counted as income in determining eligibility for financial assistance through the Marketplace.

These limits are determined by each state but federal policy establishes what types of income and assets are counted or exempt for retirees. Unemployment payments count as income and so do withdrawals from a 401k or IRA account. Common Types of Social Security Benefits The Social Security Administration SSA manages various benefits programs that pay cash allotments to.

You may also qualify for free or low-cost coverage through Medicaid or the Childrens Health Insurance Program CHIP. This is known as the Pandemic Unemployment Compensation. It is important to note that the additional 600 weekly assistance will not count as income for Medicaid eligibility.

Additionally if you receive the 300 weekly FPUC benefit the money wont count toward your income when determining your eligibility for Medicaid or the Childrens Health Insurance Program. For those already receiving UI the full benefit amount counts as unearned income for SNAP at application. Any money that you have left 12 months after receiving these payments will count as a resource.

The funds which no longer count towards Medicaids income eligibility can only be used for very restrictive purposes. Types of non-taxable include may include child support gifts veterans benefits insurance proceeds beneficiary payments AFDC payments injury payments relocation pay TANF payments workers compensation federal income tax refunds and SSI payments. If a SSI beneficiary receives enough unearned income from UI their SSI payment will be suspended.

A Retroactive Change to 2020 Unemployment Benefits. Both the one-time stimulus check up to 1200 for single adults 2400 for married couples 500 for children under age 17 and the weekly 600 Pandemic Unemployment Compensation checks do not count as income on your Medicaid application.

Unemployment Impacts Eligibility In Medicaid Expansion States

Unemployment Impacts Eligibility In Medicaid Expansion States

Http Www Insureoklahoma Org Workarea Linkit Aspx Linkidentifier Id Itemid 4818 Libid 4840

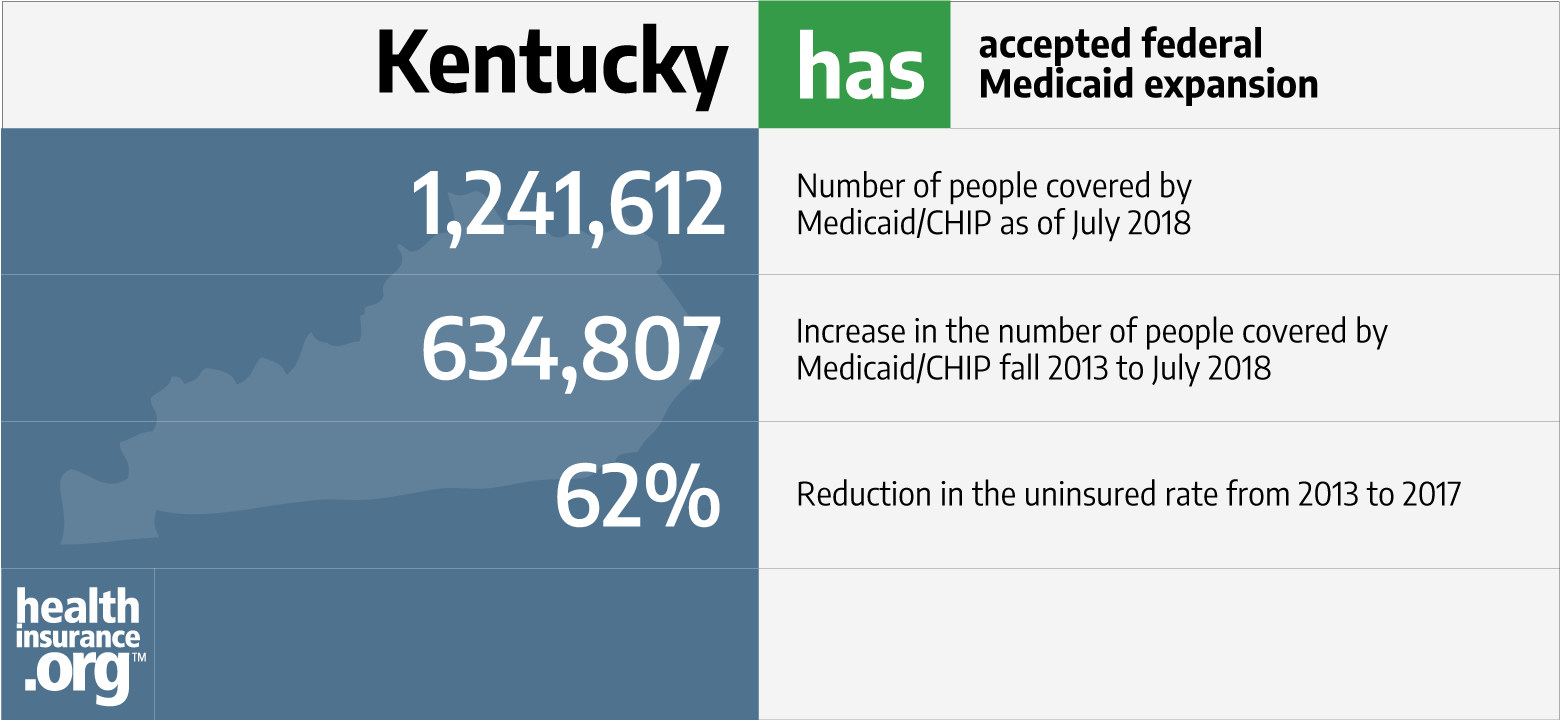

Medicaid And Chip Eligibility Enrollment Renewal And Cost Sharing Policies As Of January 2017 Looking Ahead 8957 Kff

Medicaid And Chip Eligibility Enrollment Renewal And Cost Sharing Policies As Of January 2017 Looking Ahead 8957 Kff

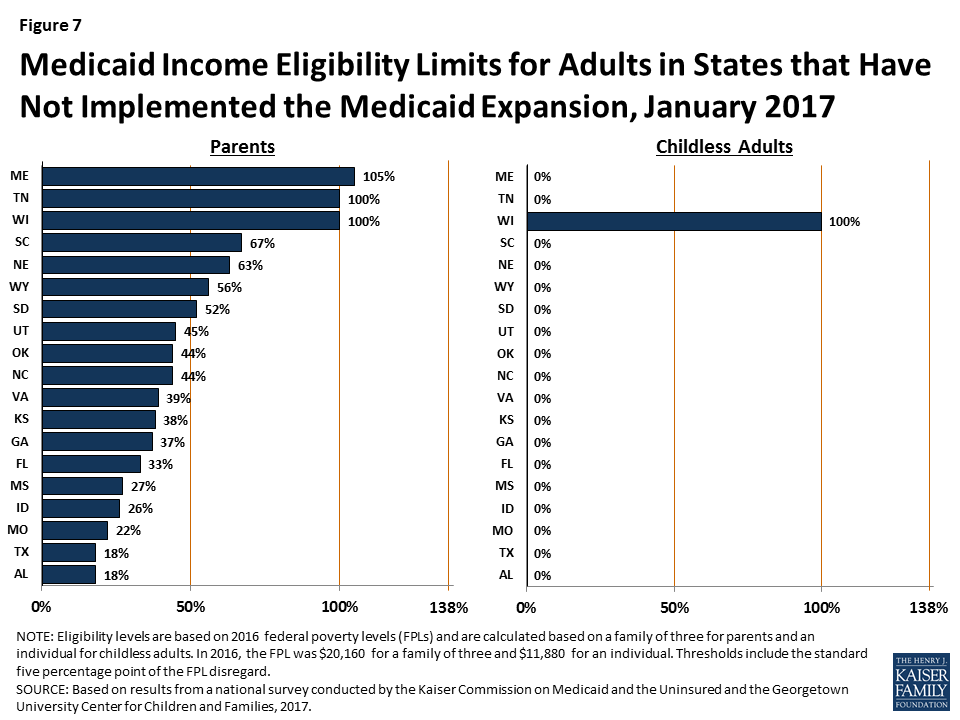

Texas And The Aca S Medicaid Expansion Healthinsurance Org

Texas And The Aca S Medicaid Expansion Healthinsurance Org

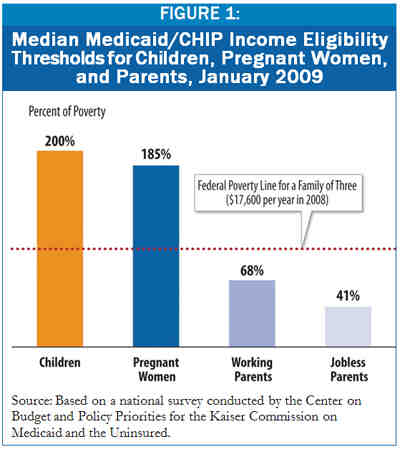

Medicaid And Chip Eligibility Is Protected For Jobless Families That Receive Boost In Unemployment Benefits Center On Budget And Policy Priorities

Medicaid And Chip Eligibility Is Protected For Jobless Families That Receive Boost In Unemployment Benefits Center On Budget And Policy Priorities

What Do I Do If I Lose My Job Based Health Insurance

What Do I Do If I Lose My Job Based Health Insurance

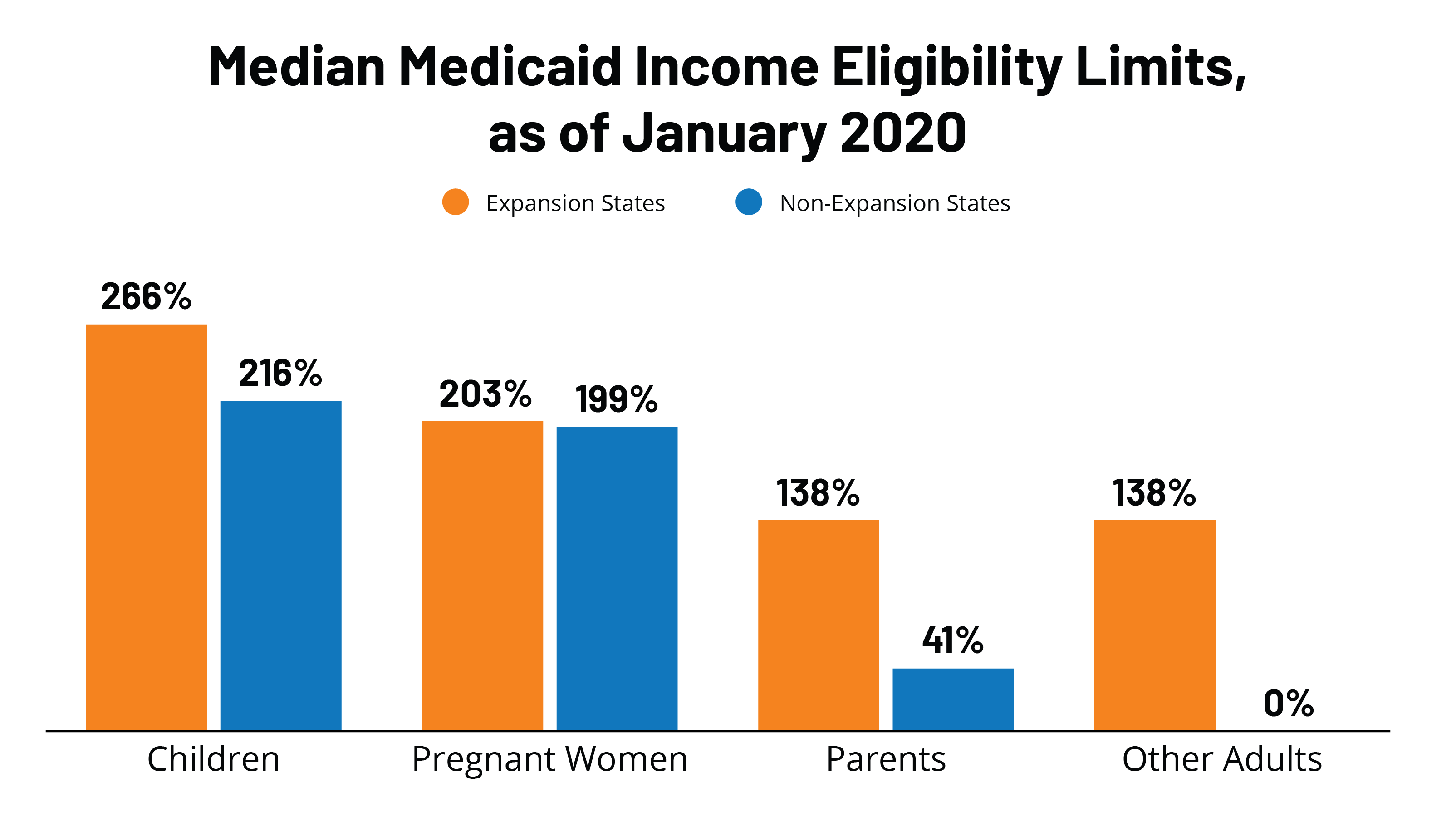

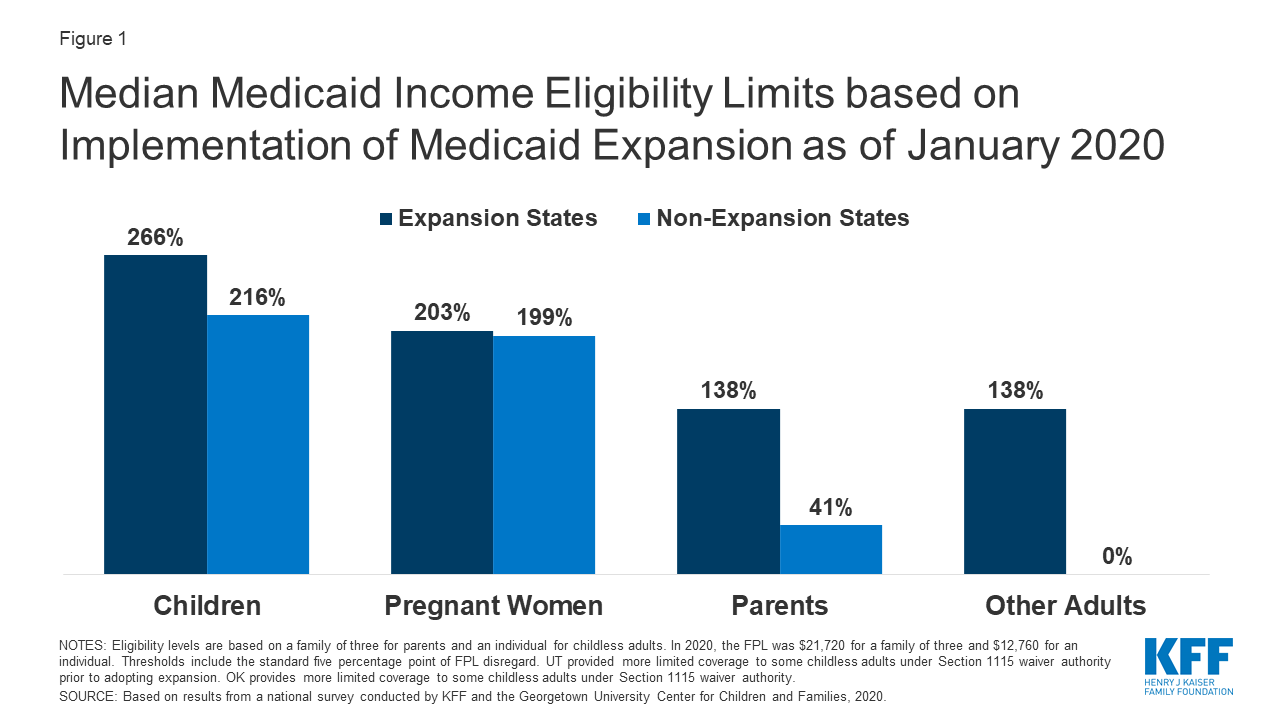

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Kff

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Kff

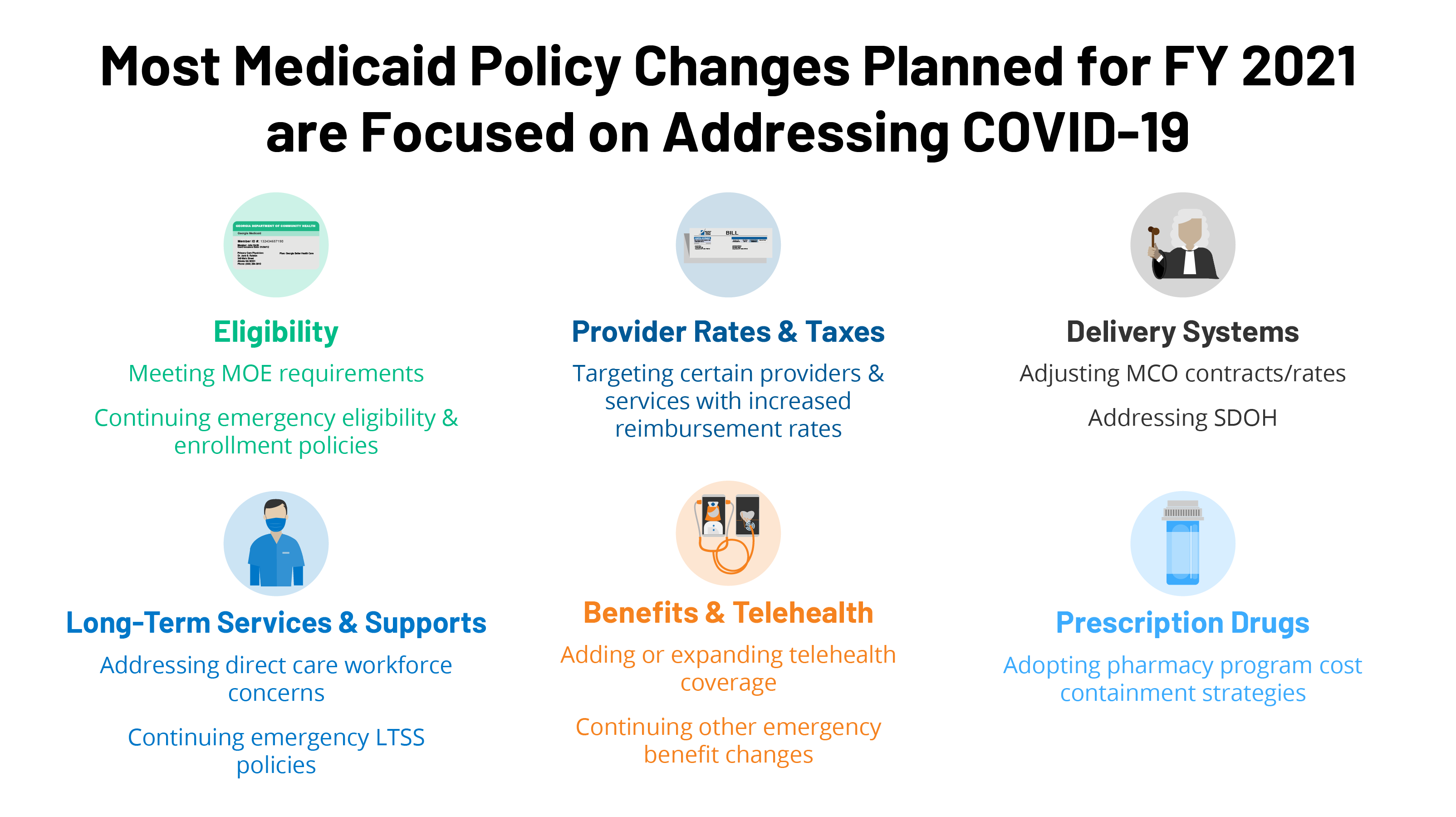

State Medicaid Programs Respond To Meet Covid 19 Challenges Eligibility And Enrollment 9554 Kff

State Medicaid Programs Respond To Meet Covid 19 Challenges Eligibility And Enrollment 9554 Kff

Food Stamps And Medicaid Utah Those On Unemployment Starting To See End To Their Snap Medicaid Benefits

Food Stamps And Medicaid Utah Those On Unemployment Starting To See End To Their Snap Medicaid Benefits

Key Facts Determining Household Size For Medicaid And The Children S Health Insurance Program Beyond The Basics

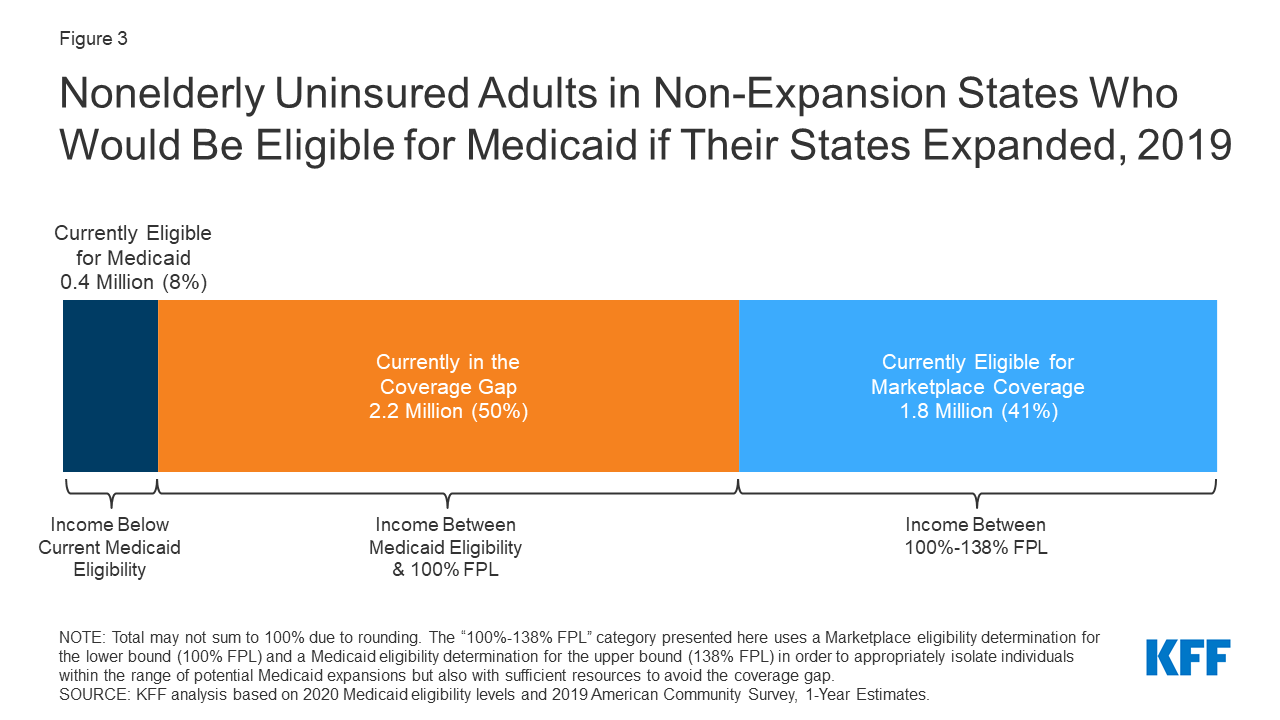

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

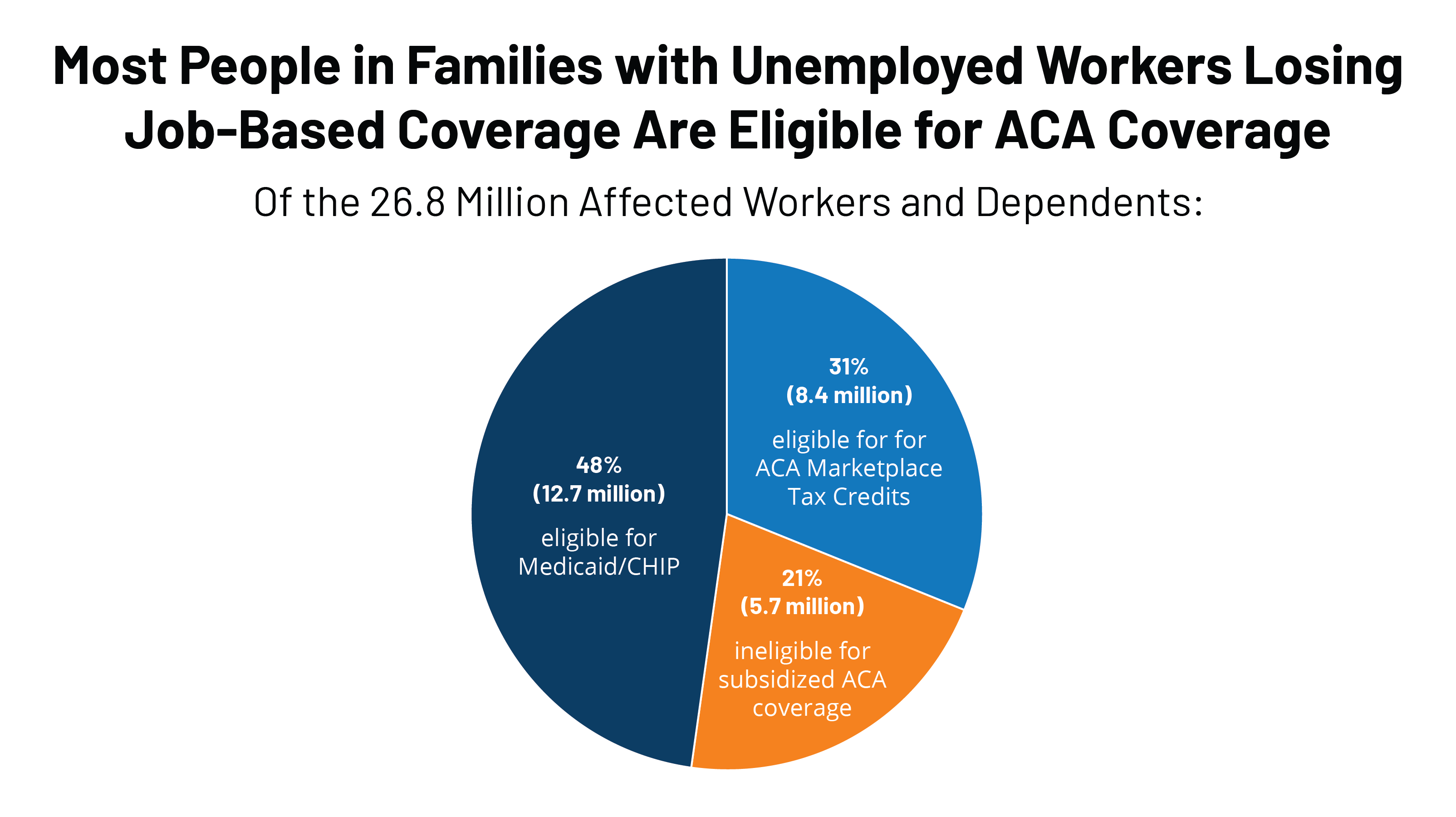

Eligibility For Aca Health Coverage Following Job Loss Kff

Eligibility For Aca Health Coverage Following Job Loss Kff

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Kff

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Kff

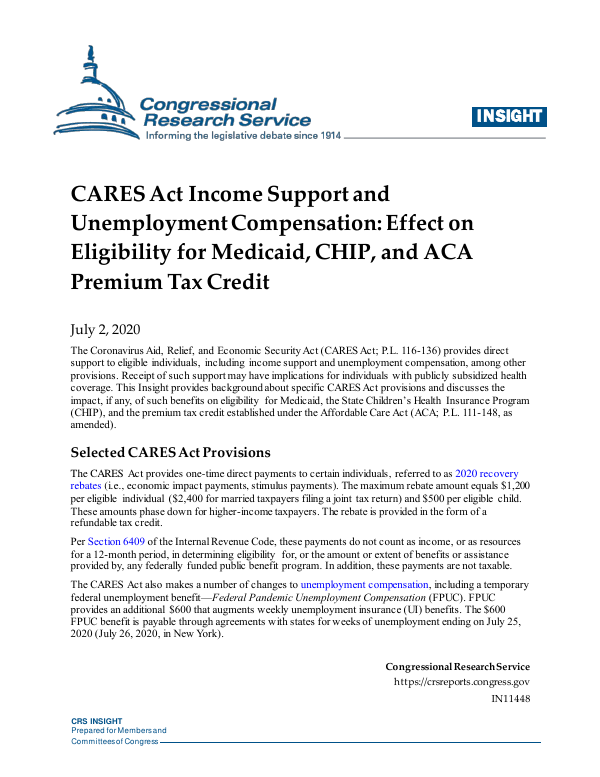

Cares Act Income Support And Unemployment Compensation Effect On Eligibility For Medicaid Chip And Aca Premium Tax Credit Everycrsreport Com

Cares Act Income Support And Unemployment Compensation Effect On Eligibility For Medicaid Chip And Aca Premium Tax Credit Everycrsreport Com

New Claims By Opponents Of Medicaid Expansion Rest On Faulty Analysis Center On Budget And Policy Priorities

New Claims By Opponents Of Medicaid Expansion Rest On Faulty Analysis Center On Budget And Policy Priorities

New Claims By Opponents Of Medicaid Expansion Rest On Faulty Analysis Center On Budget And Policy Priorities

New Claims By Opponents Of Medicaid Expansion Rest On Faulty Analysis Center On Budget And Policy Priorities

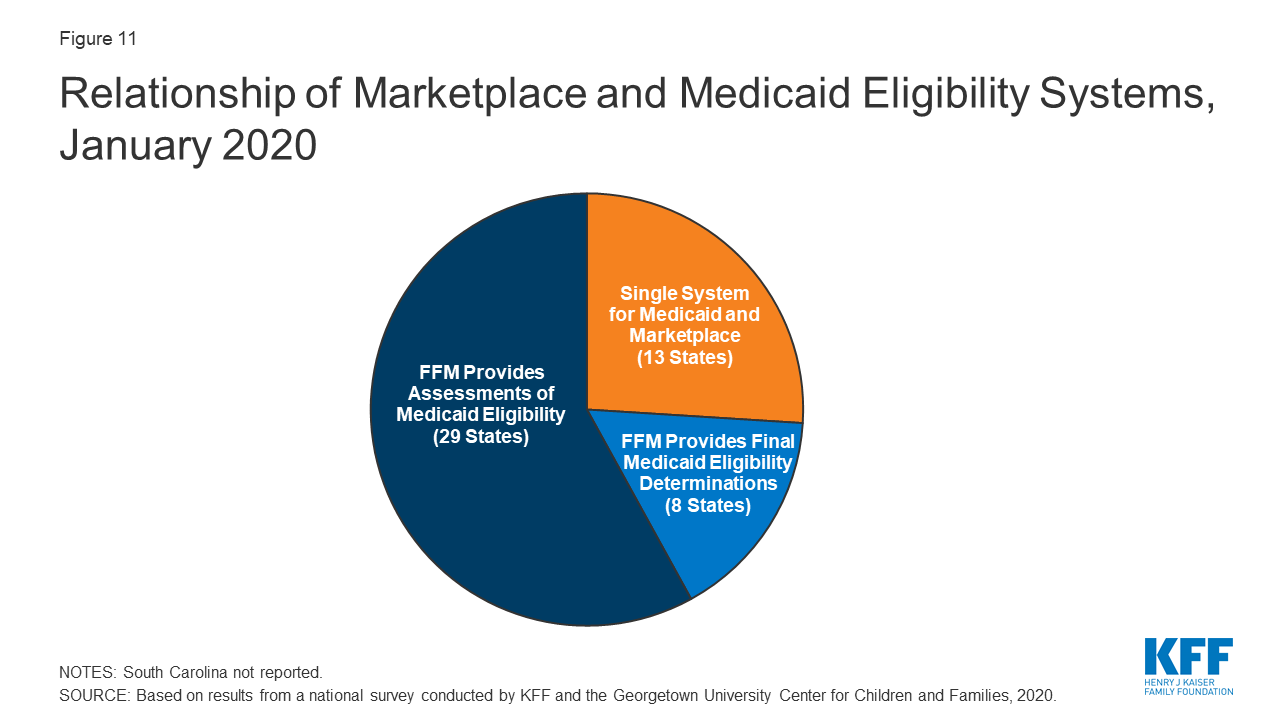

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Enrollment And Renewal Processes 9428 Kff

Medicaid And Chip Eligibility Enrollment And Cost Sharing Policies As Of January 2020 Findings From A 50 State Survey Enrollment And Renewal Processes 9428 Kff

Post a Comment for "Does Unemployment Income Count Toward Medicaid Eligibility"