Ohio State Unemployment Tax Rate

That you have been using to certify for weekly benefits to get your 1099G from the states site. The primary purpose of the mutualized account is to maintain the Unemployment Insurance Trust Fund at a safe level and recover the costs of unemployment benefits that are not chargeable to individual employers.

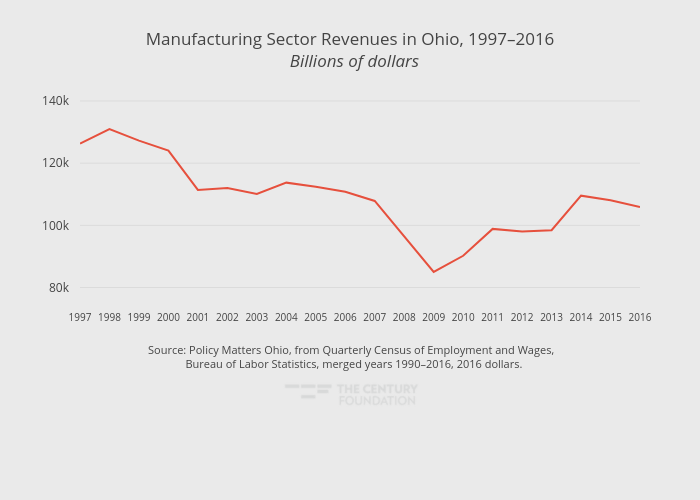

Manufacturing A High Wage Ohio

Manufacturing A High Wage Ohio

1 day agoThe governors announcement come as Ohio received some good economic news.

Ohio state unemployment tax rate. March 2021 Ohio Substate Unemployment Data. Wage Base and Tax Rates. The new-employer tax rate is to be 270 for 2021 unchanged from 2020.

7797 1980 of excess over 10500. The 2020 SUI taxable wage base reverts to 9000 down from 9500 for 2018 and 2019. 2599 990 of excess over 5250.

These resources are for individual taxpayers looking to obtain information on filing and paying Ohio income taxes completing the ID confirmation quiz and other services provided by the Department. Enter your 1099G in FederalWages IncomeUnemployment. 93763 3465 of excess over 42100.

For calendar year 2021 the mutualized tax rate will be 05. The Ohio Department of Taxation will help you find answers to questions about Ohio income taxes including who needs to file a return how and when to file finding the right tax forms and information about Ohios sales tax holiday. 31414 2969 of excess over 21100.

Ranking of counties by unemployment rate produced by the Local Area Unemployment Statistics LAUS program. Here is a list of the non-construction new employer tax. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees.

Reports are available for the State of Ohio and the six regions of the JobsOhio Network. To check on your refund pay your taxes or file online visit TaxOhiogov. 18291 2476 of excess over 15800.

UI tax is paid on each employees wages up to a maximum annual amount. Report it by calling toll-free. New employers in the construction industry are to be assessed a rate of 580 in 2021 also unchanged from 2020.

Interest Rates Tax Rates and. Starting in 2021 Proposition 208 approved by. Through the State Unemployment Tax Act SUTA states levy a payroll tax on employers to fund the majority of their unemployment benefit programs.

Unemployment taxes contributions must be paid on the first 9000 of an employees wages per year. Find Ohio public school district income tax information for all addresses in the State of Ohio. That amount known as the taxable wage base has been stable at 9000 in Ohio since the year 2000.

However its always possible the amount could change. 45 on 327263 and over of taxable income for married joint filers and 163632 and over for single filers. Employers with questions can call 614 466-2319.

The state UI tax rate for new employers also known as the standard beginning tax rate can change from one year to the next. The taxable wage base for calendar years 2018 and 2019 is 9500. The taxable wage base for calendar year 2020 and subsequent years is 9000.

Alaska New Jersey and Pennsylvania collect. Ohios unemployment taxable wage base will remain at 9000 for 2021. New employers except for those in the construction industry will continue to pay at 27.

Ohio State Single Filer Personal Income Tax Rates and Thresholds in 2021. The Ohio 2020 state unemployment insurance SUI tax rates will range from 03 to 94 up from the 2019 range of 03 to 92. The states gross domestic product at 5 growth also outpaced the national rate.

This applies to money you get through your state-administered unemployment program and the additional 600 weekly stipend some people are receiving. The taxable wage base may change from year to year. Payments for the first quarter of 2020 will be due April 30.

Or you might need to go to your states unemployment website and use the password etc. 52 rows SUI tax rate by state. Ohios unemployment rate for February was 5 which was better than the national rate of 62.

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

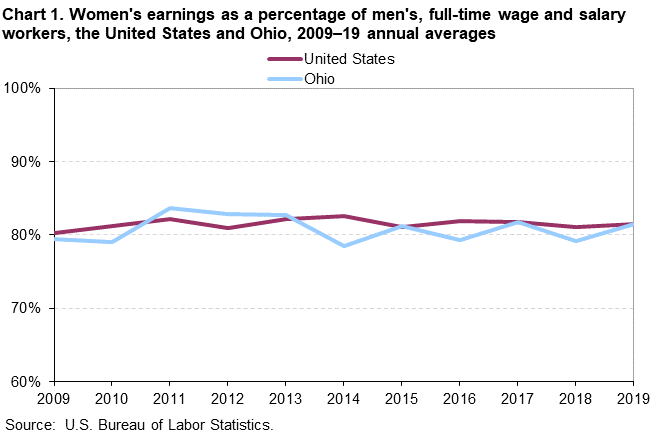

Women S Earnings In Ohio 2019 Midwest Information Office U S Bureau Of Labor Statistics

Women S Earnings In Ohio 2019 Midwest Information Office U S Bureau Of Labor Statistics

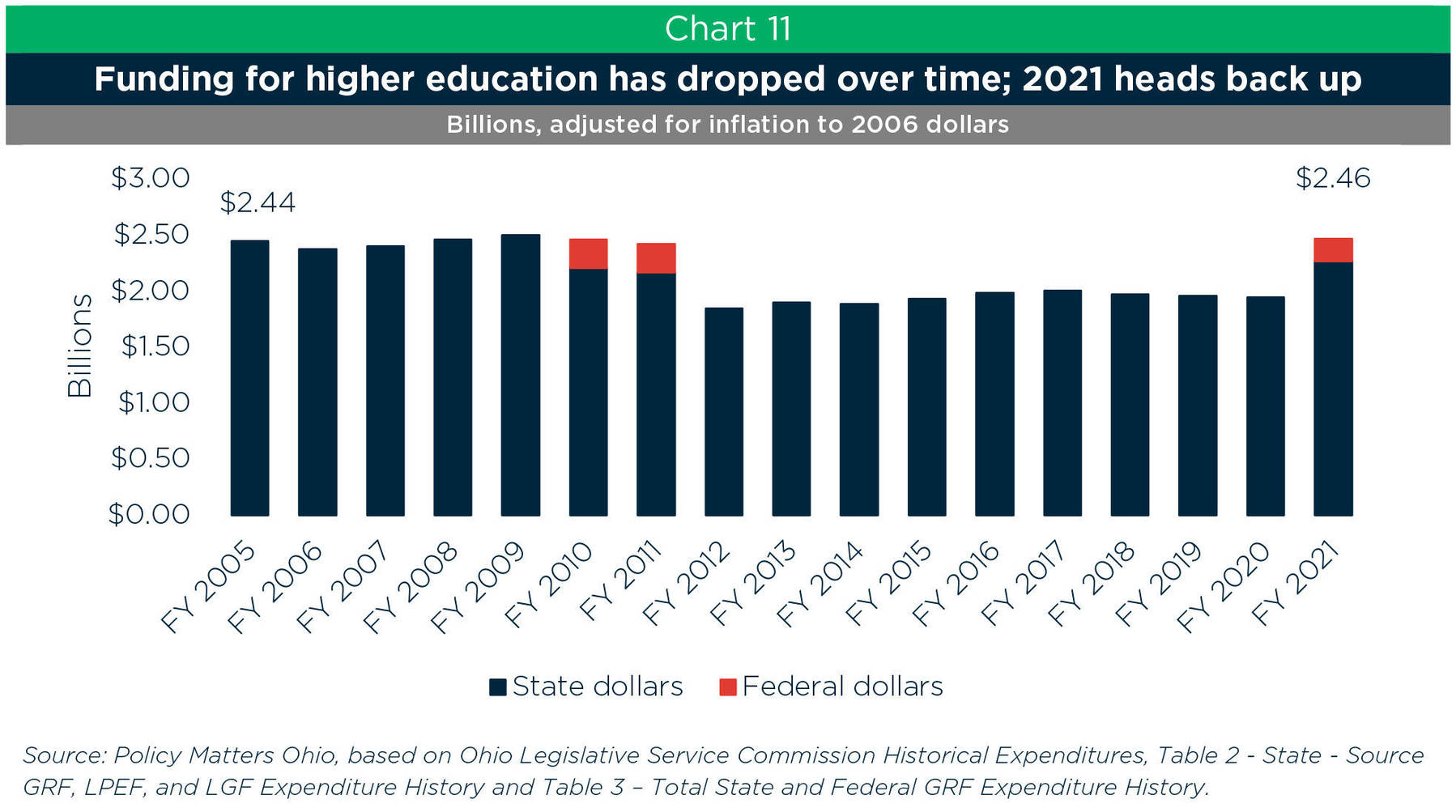

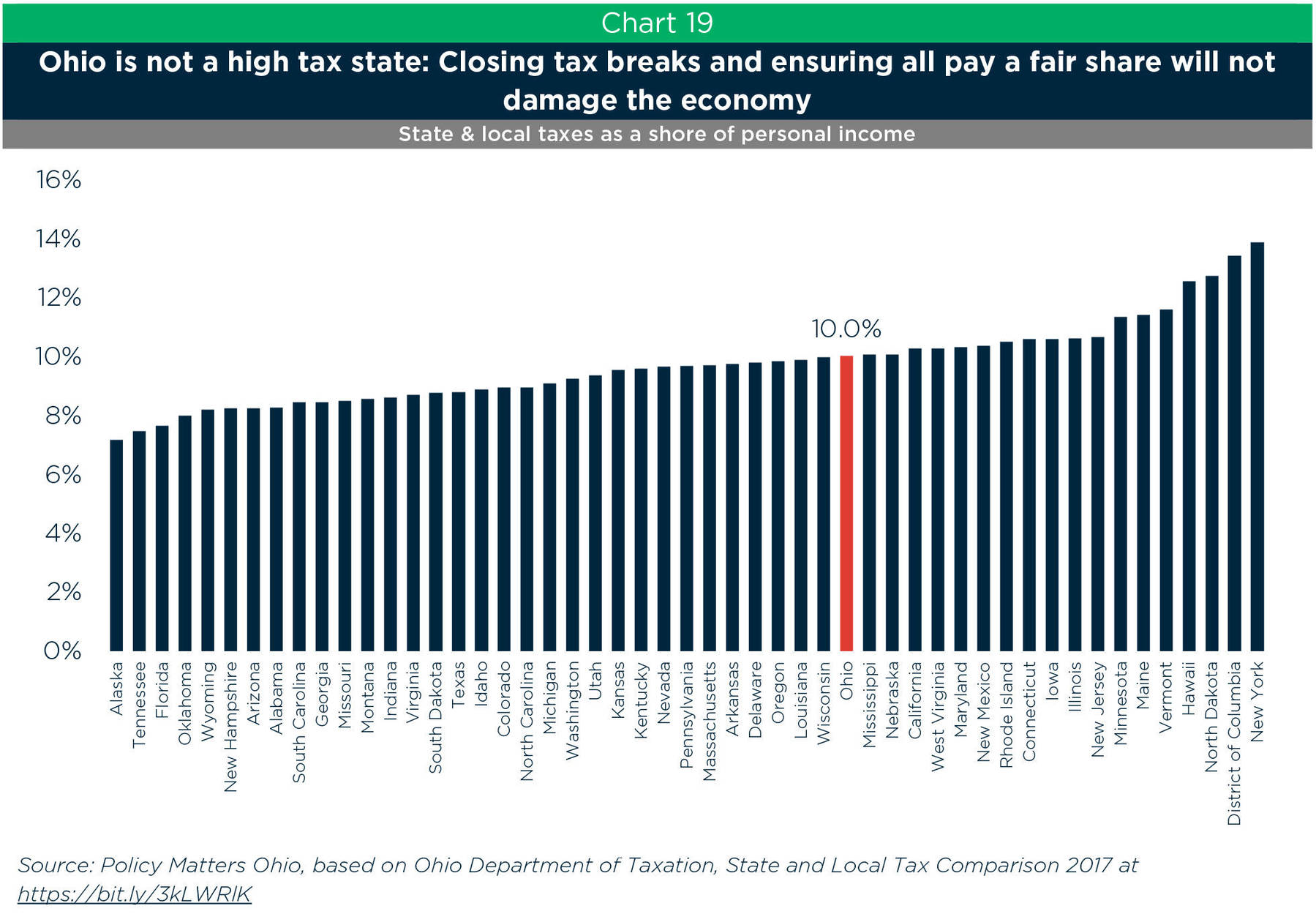

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

Beyond Unemployment The Full Labor Market Picture Of Ohio Mercatus Center

Beyond Unemployment The Full Labor Market Picture Of Ohio Mercatus Center

Unemployment Fraud Reports Running Rampant In Central Ohio

Unemployment Fraud Reports Running Rampant In Central Ohio

Ohio S Unemployment Rates By County Ohio Manufacturers Association

Ohio S Unemployment Rates By County Ohio Manufacturers Association

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

The Ohio 2022 2023 State Budget

Sui Sit Employment Taxes Explained Emptech Com

Sui Sit Employment Taxes Explained Emptech Com

Ohio Unemployment Help Wkyc Com

Ohio Unemployment Help Wkyc Com

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

How Severely Will Covid 19 Impact Sui Tax Rates

How Severely Will Covid 19 Impact Sui Tax Rates

Ohio Hospital Association Ohio Hospital Association

Ohio Hospital Association Ohio Hospital Association

Post a Comment for "Ohio State Unemployment Tax Rate"