When Can Ohio Self Employed File Unemployment

TOLEDO Ohio Self-employed and part-time workers in Ohio can now apply for unemployment through the federal stimulus package state officials said Wednesday. The programs effective date is Jan.

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

December will see several changes to Ohios unemployment benefits.

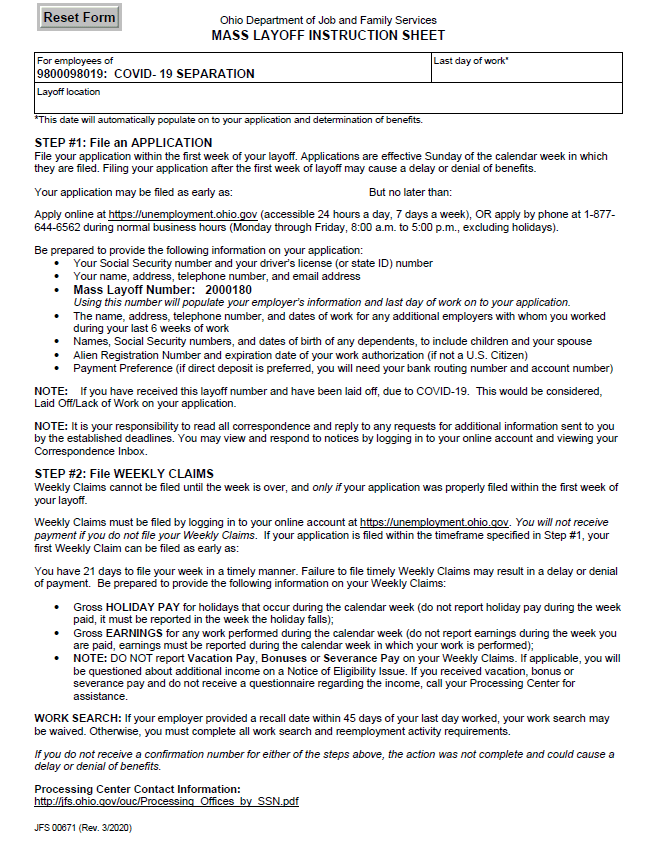

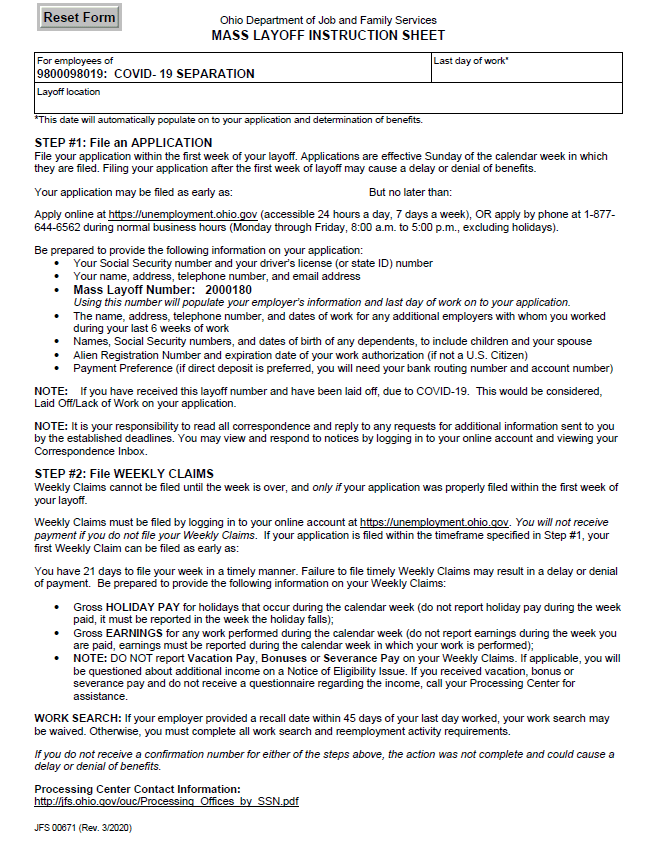

When can ohio self employed file unemployment. Expanded Eligibility Resource Hub The new federal Pandemic Unemployment Assistance or PUA program provides benefits for many individuals ineligible for state unemployment benefits including self-employed workers 1099 tax filer. Government information which is restricted to authorized users ONLY. Ohio for instance announced its program wont be ready until mid-May and many more states are telling workers to keep checking back for more information.

Generally unemployment benefits are taxable. Starting on Friday April 24 Ohioans who are unemployed as a result of the coronavirus COVID-19 pandemic but who dont qualify for regular unemployment benefits can begin pre-registering for Pandemic Unemployment Assistance PUA a new federal program that covers many more categories of workers. The CARES Act allows states to pay unemployment benefits to self-employed people for up to 39 weeks.

The additional 600-per-week Federal Pandemic Unemployment Compensation program ends on July 31 2020 though the date can vary by state. The program offers up to 39 weeks of benefits to many who traditionally have not qualified for unemployment benefits including self-employed individuals 1099. Are my unemployment benefits taxable.

050 COLUMBUS - After weeks of waiting self-employed workers can apply for unemployment approved by the federal stimulus package. The Pandemic Unemployment Assistance PUA program was made to help workers who wouldnt otherwise qualify for unemployment insurance like self-employed and freelance workers. OHIO Self-employed part-time workers and independent contractors filing 1099 forms for taxes will be able to begin the process to apply for unemployment benefits Friday the Ohio Department of.

As of December 27 2020 an additional 300 in unemployment benefits will be added to current state benefits. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19. Unemployment checks in Ohio normally amount to no more than half the lost weekly income topping out at 480 for a single person or 647 for someone with at least three dependents.

Under the relief law people who are self-employed including independent contractors and gig workers and not eligible for regular unemployment insurance can still receive unemployment benefits if they are unable to work or are working reduced hours due to the coronavirus. Unauthorized access use misuse or modification of this computer system or of the data contained herein or in transit tofrom this system constitutes a violation of Title 18 United States Code Section 1030 and may subject the individual to Criminal and Civil penalties pursuant to. This system may contain US.

6 2021 at the latest. Apply for Unemployment Now Employee 1099 Employee Employer. You have to apply for unemployment through your state to get the 300 per week which is now payable until Sept.

See the Ohio Department of Job and Family Services ODJFS unemployment tool to estimate the amount of money you could get based on your old wages. PUA Login false Coronavirus and Unemployment Insurance Benefits. How long you can receive unemployment benefits will depend on your work history.

If you live in Ohio and have lost your job you may be able to get cash assistance through Ohios unemployment program. Ohio Department of Job and Family Services started accepting. The Ohio Department of Job and Family Services on Tuesday started emailing roughly 208000 workers who pre-registered for the program through.

Report it by calling toll-free. The Federal Pandemic Unemployment Compensation FPUC program - FPUC will provide an additional 600 per week to existing benefit amounts.

Ohio Contacted Two Dozen Unemployment Claimants Who Viewed Leaked Personal Data Found No Evidence Of Widespread Compromise Cleveland Com

Ohio Contacted Two Dozen Unemployment Claimants Who Viewed Leaked Personal Data Found No Evidence Of Widespread Compromise Cleveland Com

Https Jfs Ohio Gov Ouio Pdf Pua Stepbystepapplicationinstructions Pdf

Q A Your Most Common Unemployment Questions The Lima News

Q A Your Most Common Unemployment Questions The Lima News

How To Apply For Unemployment Benefits Online In Ohio Youtube

How To Apply For Unemployment Benefits Online In Ohio Youtube

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Who In Ohio Is Qualified For Coronavirus Related Jobless Benefit Wfmj Com

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Odjfs Wants Businesses To Report Employees Who Refuse To Return To Work

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

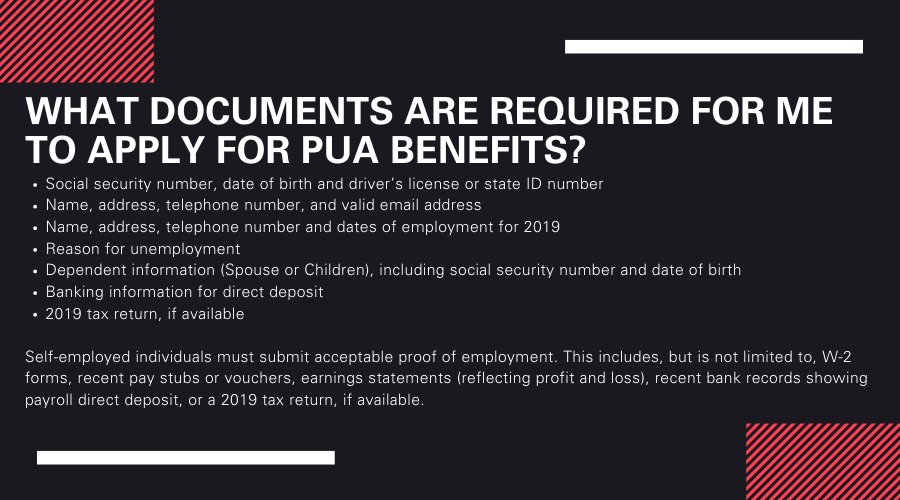

Ohiojfs On Twitter What Documents Are Required For Me To Apply For Pua Benefits For Answers To More Faq S Visit Https T Co Eummtiixu4 Inthistogetherohio Everyclaimisimportant Covid19 Https T Co 6okwzpzqdr

Ohiojfs On Twitter What Documents Are Required For Me To Apply For Pua Benefits For Answers To More Faq S Visit Https T Co Eummtiixu4 Inthistogetherohio Everyclaimisimportant Covid19 Https T Co 6okwzpzqdr

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Covid 19 Unemployment Benefits Hamilton Ryker

Covid 19 Unemployment Benefits Hamilton Ryker

Ohio Updates Pre Registration Process For Pandemic Unemployment Assistance Benefits

Ohio Updates Pre Registration Process For Pandemic Unemployment Assistance Benefits

Urgent Alert For Independent Contractors Or Self Employed Individuals Who Filed For Pandemic Unemployment Assistance Benefits In Ohio

Urgent Alert For Independent Contractors Or Self Employed Individuals Who Filed For Pandemic Unemployment Assistance Benefits In Ohio

Ohio Oh Department Of Job And Family Services Odjfs Extra 300 Fpuc Peuc Pua And Eb 2021 Unemployment Benefit Extensions News And Updates Aving To Invest

Ohio Oh Department Of Job And Family Services Odjfs Extra 300 Fpuc Peuc Pua And Eb 2021 Unemployment Benefit Extensions News And Updates Aving To Invest

Those On Pandemic Unemployment Assistance In Ohio May Have Had Personal Info Compromised Wkrc

Those On Pandemic Unemployment Assistance In Ohio May Have Had Personal Info Compromised Wkrc

Ohio Launches Online Application For Pandemic Unemployment Assistance Program

Ohio Launches Online Application For Pandemic Unemployment Assistance Program

Post a Comment for "When Can Ohio Self Employed File Unemployment"