Should You Claim Dependents On Unemployment

Dependent with unemployment. Dependents who have unearned income such as interest dividends or capital gains will generally have to file their own tax return if that income is more than 1100 for 2020 income levels are higher for dependents 65 or older or blind.

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

What Is Irs Form 1040 Income Tax Return Tax Return Income Tax

You can still claim them as a dependent on your return.

Should you claim dependents on unemployment. Are you the only person claiming them. Read the eligibility section to confirm your eligibility. Jobless parents can still claim kids as dependents.

You cannot claim any child that has been previously claimed by a spouse or co-parent on an established Unemployment Insurance claim in the past year. While you may do so as long as your child is either under age 19 if a non-student or under age 24 if a student there is a compelling reason to not claim your child as a dependent. Do you financially support them.

Claiming a Child on Taxes When Unemployed. He is under age 19 or under 24 if a full time student for at least 5 months of the year or is totally permanently disabled. Filing taxes with no income with dependents might allow you to get back money even if you havent paid any taxes.

There is the personal exemption of which you can claim one for yourself and one for your spouse. You will be asked to provide proof of dependency. Dependent and Stimulus If you were a dependent on someone elses 2019 tax return that would make you ineligible to receive the 1200 stimulus check.

You can receive additional money for each week of benefits if you qualify for a dependents allowance because you have a financially dependent spouse or child. Unemployment Dependency Benefits In some states you can have an additional amount added to your unemployment benefits based on the number of dependents you have to support. If you filed taxes in 2018 or later you can find your dependents listed on form 1040 US Individual Income Tax Return in the middle of the first page in a box labeled Dependents.

See previous sections for how such dependents. Can I still claim his as a dependent even if he received unemployment. Doing so can help cut your tax bill.

You will be asked to provide the social security number s of your spousecivil union partner and other claimed dependents. A spouse may be claimed as a dependent if. A child of a taxpayer can still be a Qualifying Child QC dependent regardless of hisher income if.

You can be a dependent on someone elses return and still get Unemployment. As well as the dependent exemption which you can claim for each qualifying child and qualifying relative. If you and your spousecivil union partner are both unemployed only one may claim Dependency Benefits.

The taxpayer must have provided more than half the persons support for the year and the qualifying relative cant be claimed as a dependent by any. You are legally married You must be married at least 90 days during the time you earned your Base Period wages or the term of the marriage was within the Base Period wages earned. Most states that supplement unemployment benefits for claimants with dependents typically only provide small weekly stipends in addition to traditional unemployment benefits -- 25 per child in Massachusetts Illinois and 10 per child in Maine for example -- and limit the number of.

Illinois unemployment benefits are based on your previous salary during the 15 to 18 months before you filed for benefits. Your dependent may be required to file a tax return if their income is within the IRS filing requirementsTo determine if your dependent is required to file a return use our FILEucator Tax ToolOnce you answer a few simple questions about your dependents situation you will find out if your dependent needs to file a tax return. Yes youre eligible for unemployment.

You must provide more than half of your relatives total support each year. A child brings in more allowance than a spouse but you may have to prove your relationship to the child to. The Recovery Rebate Credit which you can claim as part of your 2020 tax return will recoup that missing stimulus money which totals up to 1100 for qualifying babies the 500 dependent.

If you provided more than 50 of her support you can claim her but if you do she will more than likely have a tax liability for the unemployment she collected. Your relative cannot have a gross income of more than 4300 in 2020 and be claimed by you as a dependent. This means you cant claim the same person twice once as a qualifying relative and again as a qualifying child.

The reason some states offer this is that claimants with dependents incur extra costs of living including rent and food.

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Serino Supermajority Fails New Yorkers By Declining To Offer Tax Break On Unemployment Benefits Ny State Senate

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Expert Q A About The Unemployment Provisions Of The American Rescue Plan

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

How Does Being On Unemployment Affect My Child Support Obligation In Pennsylvania Child Support Laws Child Support Laws Child Support Payments Child Support

How Does Being On Unemployment Affect My Child Support Obligation In Pennsylvania Child Support Laws Child Support Laws Child Support Payments Child Support

Https Unemployment Ohio Gov Pdf New Workers Self Service User Guide Pdf

Https Itvs Website S3 Amazonaws Com Filmmakers Resources 97155fbe 17cc 4a2d 8dff 7984800d4b36 Illinois 20coronavirus 20unemployment 20benefits 20tip 20sheet Pdf

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

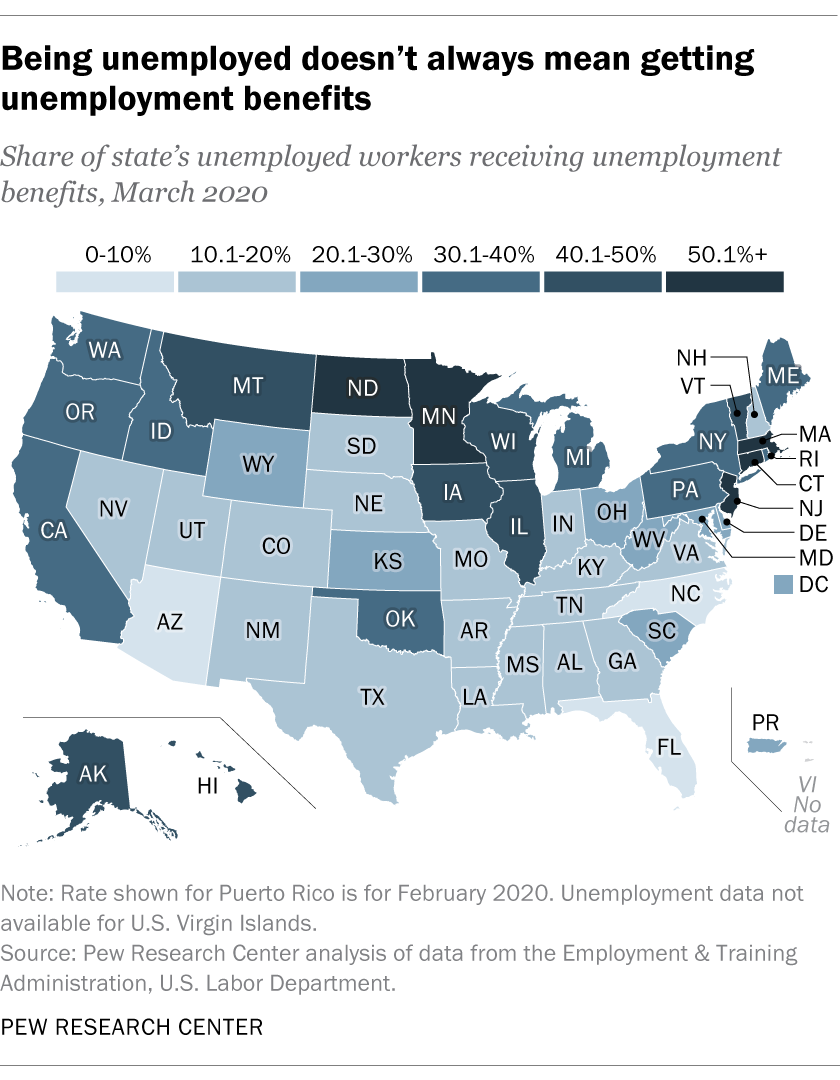

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensation D Internal Revenue Service Refund Revenue

Topic No 203 Refund Offsets For Unpaid Child Support Certain Federal And State Debts And Unemployment Compensation D Internal Revenue Service Refund Revenue

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

Scope Of Management Accounting Management Guru Tax Prep Checklist Business Tax Tax Prep

Form 10 Reconciliation Worksheet 10 Exciting Parts Of Attending Form 10 Reconciliation Works Irs Tax Forms Tax Forms Irs Taxes

Form 10 Reconciliation Worksheet 10 Exciting Parts Of Attending Form 10 Reconciliation Works Irs Tax Forms Tax Forms Irs Taxes

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

2020 Unemployment Tax Break H R Block

2020 Unemployment Tax Break H R Block

Guide To Additional Claims Ides

Guide To Additional Claims Ides

Post a Comment for "Should You Claim Dependents On Unemployment"