How Is Unemployment Rate Calculated Ky

Calculate the FUTA Unemployment Tax which is 60 of the first 7000 of each employees taxable income. Kentuckys Office of Employment and Trainings OET website features a weekly unemployment benefits calculator that uses quarterly income date earned during a base year to provide a projection for potential unemployment benefit amounts.

Credit Report Sample Credit Card Application Form Credit Card Application Credit Repair

Credit Report Sample Credit Card Application Form Credit Card Application Credit Repair

Different states have different rules and rates for UI taxes.

How is unemployment rate calculated ky. Additionally HB 413 will decrease the 2021 unemployment taxable wage base from 11100 to 10800. Effective July 1 2020 the minimum rate is 39 and the maximum rate is 569 per week regardless of how high the wages are. In that release Kentuckys statewide unemployment rate and employment levels are adjusted to observe statistical trends by removing seasonal influences such as weather changes harvests holidays and.

Unemployment is measured through the Current Population Survey conducted monthly by the Bureau of Labor Statistics. Only citizens who are in the. You will receive a maximum of 415 each week.

This allows rates to return to 2020 levels providing relief to all experience-rated employers. You may receive benefits for a maximum of 26 weeks. According to the BLS current population survey CPS the unemployment rate for Kentucky fell 01 percentage points in February 2021 to 52The state unemployment rate was 10 percentage points lower than the national rate for the month.

April 20 2020 Annual unemployment rates decreased in 62 Kentucky counties in 2019 compared to 2018 rose in 39 counties and stayed the same in 19 counties according to the Kentucky Center for Statistics KYSTATS an agency within the Kentucky Education and Workforce Development Cabinet. Provide civilian labor force estimates unemployment rates by county affirmative action statistics industry unemployment estimates and average weekly wages. A worker must be older than age 16 and have been able and available to work full-time in the last four weeks to be considered unemployed by BLS standards.

2020 Contribution Rates will continue to be reduced by an additional 0075 for the SCUF assessment. New companies usually face a. Kentuckys seasonally adjusted unemployment rate was released on March 26 2020 and can be viewed at httpskentuckygovPagesActivity-streamaspxnEducationCabinetprId402.

In Kentucky state UI tax is just one of several taxes that employers must pay. Your Contribution Rate Notice should display a UI Rate based on your calculated Reserve Ratio an Adjusted UI Rate from the SCUF assessment reduction and a SCUF Rate. For this and other information and assistance please visit the Kentucky Career Center website at wwwkcckygov.

2020 to calculate total unemployment. The unemployment rate formula is the number of unemployed workers divided by the available civilian labor force at that time. The median property tax rate in Kentucky is 829 per 100000 of assessed home value.

For further details refer unemployment benefits article. Note that if you pay state unemployment taxes in full and on time you are eligible for a tax credit of up to 54 which brings your effective FUTA tax rate to 06. The minimum amount is 39.

If you are eligible to receive unemployment your weekly benefit rate in Kentucky will be 11923 of your total wages during the base period. The basic benefit calculation is easy it is 11923 of your base period wages. The new-employer tax rate will remain at 270 for 2021.

Keep in mind that the projected amount can change due to factors such as dependents and deductible income. You will have to verify with your states unemployment office to see what the highest payout for your state is. Unfortunately theres no easy way to calculate exactly how much money youll receive through unemployment benefits or for how long youll be able to collect those benefits unless your state has an online unemployment calculator.

Only employers are responsible for paying the FUTA tax not employees. The unemployment rate in Kentucky peaked in April 2020 at 169 and is now 117 percentage points lower. In times of very high unemployment additional weeks of benefits may be available.

However below are some factors which may affect how you would expect the calculation to work. Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes. The UI tax funds unemployment compensation programs for eligible employees.

This calculator uses the average weekly state benefit amount reported by the Department of Labor from Jan. Unemployment is computed and one half of what your weekly pay was at the time of the discharge up to your states maximum benefit. For more information go to the Kentucky State Tax Guide for.

Due to this change tax rates will range from 030 to 900. States assign your business a SUTA tax rate based on industry and history of former employees filing for unemployment benefits.

Unemployment Benefits Comparison By State Fileunemployment Org

Unemployment Benefits Comparison By State Fileunemployment Org

Tuesday Tip How To Calculate Your Debt To Income Ratio Consumer Credit Debt To Income Ratio Paying Off Credit Cards Credit Counseling

Tuesday Tip How To Calculate Your Debt To Income Ratio Consumer Credit Debt To Income Ratio Paying Off Credit Cards Credit Counseling

Our Simple And Easy To Use Calculators Are Provided To Assist Your Buying Decision Whether Obtaining A Pre Ap Preapproved Mortgage Mortgage Mortgage Brokers

Our Simple And Easy To Use Calculators Are Provided To Assist Your Buying Decision Whether Obtaining A Pre Ap Preapproved Mortgage Mortgage Mortgage Brokers

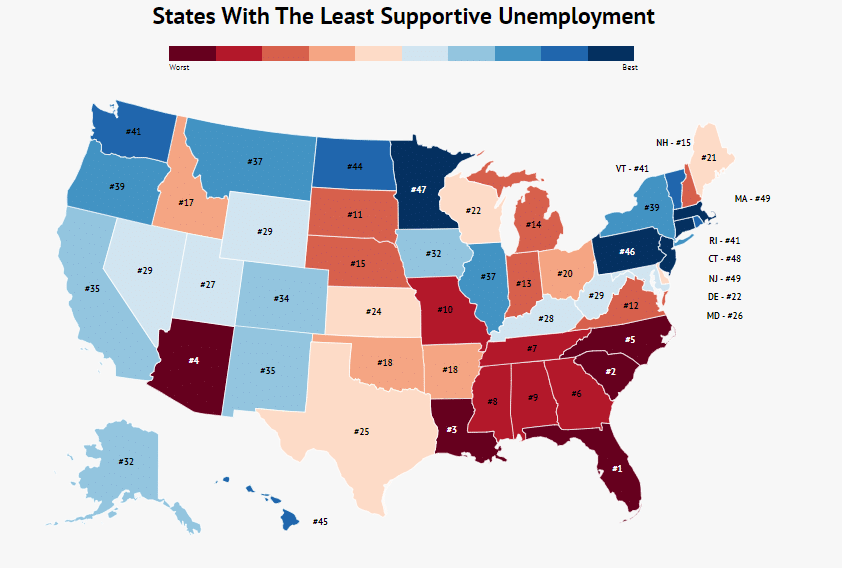

Here Are The States With The Least Supportive Unemployment Systems Zippia

Here Are The States With The Least Supportive Unemployment Systems Zippia

Mortgage Calculator Mortgage Loan Originator Free Online Web Tool For You Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Loan Originator

Mortgage Calculator Mortgage Loan Originator Free Online Web Tool For You Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Loan Originator

Account Suspended Good Credit Improve Credit Improve Credit Score

Account Suspended Good Credit Improve Credit Improve Credit Score

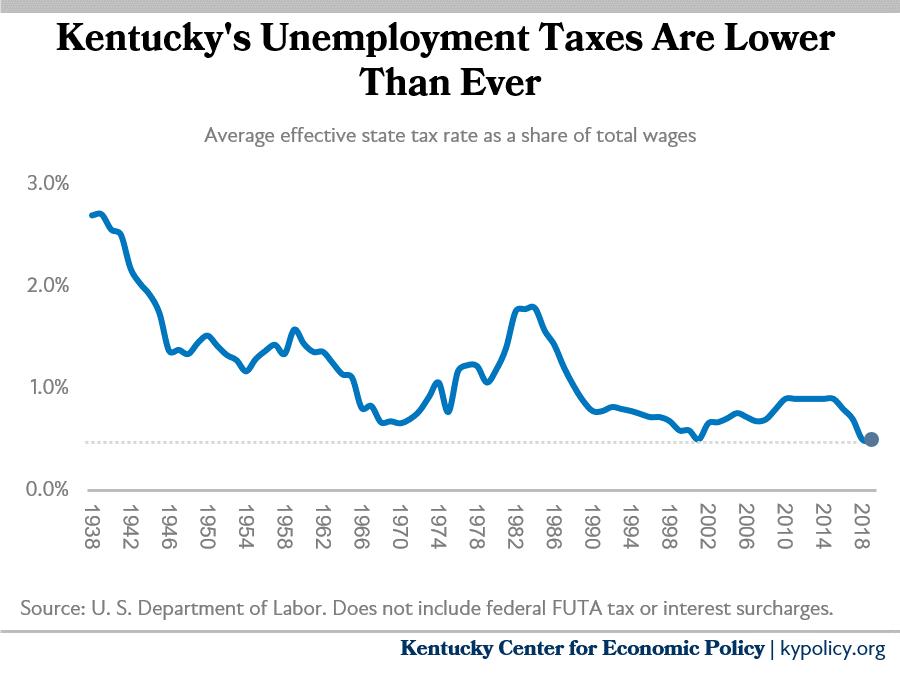

Kentucky S Inadequate And Outdated Unemployment Insurance Taxes Need To Be Modernized Kentucky Center For Economic Policy

Kentucky S Inadequate And Outdated Unemployment Insurance Taxes Need To Be Modernized Kentucky Center For Economic Policy

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

How Much To Save In Bi Weekly Loan Payment Http Www Mortgagefit Com Calculators Biweeklypayment Saveinteres Current Mortgage Rates Mortgage Payment Finance

How Much To Save In Bi Weekly Loan Payment Http Www Mortgagefit Com Calculators Biweeklypayment Saveinteres Current Mortgage Rates Mortgage Payment Finance

What Is Ess Features Of An Employee Self Service Portal Self Service Employee Self

What Is Ess Features Of An Employee Self Service Portal Self Service Employee Self

Unemployment Rate In Lexington Fayette Ky Msa Lexi421urn Fred St Louis Fed

Unemployment Rate In Lexington Fayette Ky Msa Lexi421urn Fred St Louis Fed

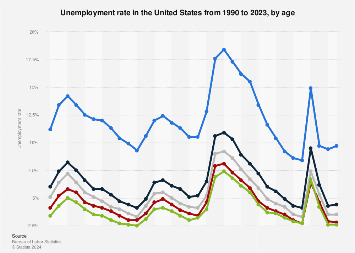

U S Unemployment Rate By Age Statista

U S Unemployment Rate By Age Statista

Unemployment Rate In Lexington Fayette Ky Msa Lexi421urn Fred St Louis Fed

Unemployment Rate In Lexington Fayette Ky Msa Lexi421urn Fred St Louis Fed

Unemployment Rate In Lexington Fayette Ky Msa Lexi421urn Fred St Louis Fed

Unemployment Rate In Lexington Fayette Ky Msa Lexi421urn Fred St Louis Fed

Different Types Of Kentucky Home Loans Home Buying Process Home Mortgage Home Buying

Different Types Of Kentucky Home Loans Home Buying Process Home Mortgage Home Buying

These 5 States Have The Worst Unemployment Rates

22 New Fannie Mae Homes In Kentucky Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Amortization

22 New Fannie Mae Homes In Kentucky Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Amortization

Save Enough Money To Make A Down Payment More Info Could Be Found At The Image Url Loan Lenders Mortgage Companies How To Get Money

Save Enough Money To Make A Down Payment More Info Could Be Found At The Image Url Loan Lenders Mortgage Companies How To Get Money

Fha Streamline Refinance The Most Popular Mortgage Of 2012 Fha Streamline Fha Streamline Refinance Streamline

Fha Streamline Refinance The Most Popular Mortgage Of 2012 Fha Streamline Fha Streamline Refinance Streamline

Post a Comment for "How Is Unemployment Rate Calculated Ky"